-

Rajan: too much should not be read; Photo: Sanjay Borade

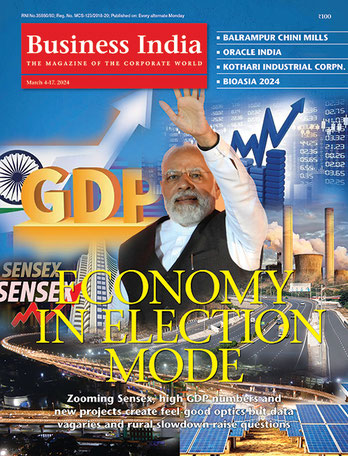

GDP grew 20.1 per cent in the April-June quarter of this financial year (FY22). This was due to the fact that in the same quarter last year, GDP had contracted by 24.4 per cent due to the first lockdown imposed last year (during the April-June period). In January-March of FY21, the GDP grew at 1.6 per cent, throwing up perhaps a more accurate picture of the economy.

Yet look at our screaming headlines. The Ministry of Statistics and Implementation, which puts out these figures, contributed to the euphoria by crowing somewhat unabashedly: “GDP at constant (2011-12) Prices in Q1 of 2021-22 is estimated at Rs32.38 lakh crore, as against Rs26.95 lakh crore in Q1 of 2020-21, showing a growth of 20.1 per cent as compared to a contraction of 24.4 per cent in Q1 2020-21.” “This is the fastest-ever growth since quarterly data was made available in the 1990s” etc. etc.

Interestingly, the industrial output for July, which threw some into raptures, was lower than the 13.6 per cent recorded in June, which too was impacted by the low base of 2020. The base effect is likely to be a factor in the August data too and IIP growth is projected to improve to 13-15 per cent for the month. However, it is from September that the true picture may emerge. This is because the base effect is likely to wane from September onward. Madan Sabnavis, Chief Economist at CARE Ratings, says, “From September onwards, the base effect will get diluted sharply as growth was positive in the two months (of last year) which followed the low-growth, lockdown period.” From now on, he feels critical part in sustaining the growth would be the expected revival in demand, especially for consumer goods.

Lockdown and aftermath

The national lockdown in March last year had seriously impacted industrial activity in April and May last year by hitting the consumption of goods and services. However, the economy had picked up some speed in September due to a revival in business activity and pent-up demand after the strict lockdown was gradually lifted. September 2000 in fact had turned out to be a month of hope.

Factory output rose 1 per cent that month. Exports returned to positive territory with shipments rising 6 per cent during the month from a year earlier. Farm exports and shipments of drugs and chemicals added to the rise. A contraction in imports moderated, resulting in a narrowing of the trade deficit. Passenger vehicle sales, a key indicator of demand, rose 26.5 per cent in September from a year ago. Retail sales too showed signs of stabilising, even though it was nearly 70 per cent below the year-ago level. In short, the animal spirits were stirring back to life. The trend continued in October as well, with factory output growing by 4.5 per cent in October.

However, in November, the factory output fell 1.6 per cent and then entered the positive territory with a 2.2 per cent growth in December. The IIP recorded a contraction of 0.6 per cent in January and 3.2 per cent in February this year. In March, it grew 24.2 per cent. For the month of April, the NSO held back the release of complete IIP data. In May 2021, IIP rose 28.6 per cent and in June, it grew 13.6 per cent.

-

Paul: building the Great Wall of herd immunity

So, the expectation is that from this month (September) onwards, the base effect has got diluted sharply and the economic picture (though it will be available only two months later in November) will be more accurate.

Consumer spending vital

But what exactly is the current economic picture? Economists like Sabnavis feels that one needs to watch out for the revival in demand. Indeed, the revival from now on will hinge largely on an improvement in demand for consumer goods. Others are more gung-ho on the state of affairs. In an article published in the September bulletin of RBI, Deputy Governor Michael Debabrata Patra says that the prospects are brightening for the economy achieving "escape velocity" from the pandemic, as the second wave of Covid wanes and preparedness for the future remains on war-alert status. Also, the trajectory of inflation is shifting down more favourably than anticipated.

Patra says that aggregate demand is gaining firmer ground, while on the supply side, IIP and core industries mirror improvement in industrial activity and services sector indicators point towards sustained recovery. “In August, we believe that India passed a turning point which consolidates and thrives come September,” said the article. The opinions expressed in articles appearing in RBI bulletins are those of the authors and do not necessarily represent the views of the RBI. But Patra is sticking his neck out.

The fact also remains that many firms have in anticipation of a spurt in demand (both festive and otherwise) built up stocks from August onwards. Preparing for the festive season by augmenting production, businesses have also ramped up hiring which bodes well for the buying power of consumers.

The last five months of the year generally bring good tidings for consumption-driven companies as the rise in demand due to festivals boosts bottom lines. This is evident in the performance of the BSE Sensex, the FMCG index, the Consumer Durables index and the Auto index, which have given decent returns in the August-December period. The key therefore lies in personal consumption, which accounts for 57.9 per cent of the GDP, going up.

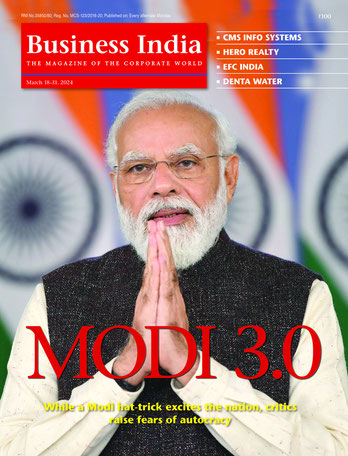

This is where policy initiatives of the Modi government over the last one year will be tested. Has the government done enough? Or does it need to do more, like putting money directly into the hands of the poor?

So far the trend has been erratic. Consumer durables output which grew by 30.1 per cent in June this year (again the base effect), was at 20.2 per cent in July, signalling a downward trend. Fitch Solutions has trimmed its 2021 India household spending forecast to 8.9 per cent from 9.1 per cent estimated in June. It says consumer spending will return to pre-pandemic levels only in 2022. Among the silent deterrents to consumer spending was retail inflation which has the potential to erode purchasing power.

Retail inflation has now remained over 5 per cent for the seventh straight month and over the RBI’s target rate of 4 per cent for the 23rd straight month. But it has cooled to 5.3 per cent in August. Economists like Patra estimate it to ease further in the coming months. Will the festive season this time, which began with Onam and ends with Diwali (sometimes stretching to Christmas), reverse the consumption trend?

-

Sanyal: no need to be exuberant

Upbeat surveys

Surveys conducted by adtech firms seem to suggest that consumers are gearing up to celebrate the festival season, planning new purchases during upcoming shopping sales for Diwali, Dussehra and Christmas. Last year, e-commerce had seized the opportunity to pull consumers onto the digital medium for both recreational and essential shopping. This year, small businesses including retailers fed by micro, small and medium enterprises are hoping to get their mojo back. Even though the fear of a third wave lingers in the background, the increasing rate of vaccination has given some hope to the businesses.

Anticipating challenge from retail stores and malls, e-commerce giants are getting their act together. Walmart-owned e-tailer Flipkart has announced its annual Big Billion Days sale 2021 in the first half of September. The dates for the event haven't been shared but Flipkart has teased some big discounts, up to 80 per cent, and launches. Smartphones, electronics, appliances, fashion goods and home products are some of the categories that will see heavy discounts. Flipkart and Amazon recently offered heavy discounts on Apple’s iPhone 12 series close to iPhone 13’s launch. Such offers are expected on brands like Vivo, Oppo and Samsung as well.

The importance of September is also evident in the behaviour of advertisers for whom timing is of essence. The second phase of the popular Indian Premier League (IPL) is starting on 19 September. The advertisers are encouraged by the timing of the T20 cricket matches as they will happen in the midst of the festive season when demand for consumer goods traditionally peaks across India.

Many brands hope to tap the IPL to boost festive sales. Companies such as Nestle, Tata Motors, Coca-Cola, Cadbury Dairy Milk and Dream11 are working on campaigns for both television and digital medium. “I expect advertisers to come back to IPL. The consumer sentiment has been upbeat, restrictions have gone down, and markets have opened up,” said Sandeep Goyal, chairman, Mogae Media, a Mumbai-based marketing and communication agency. “The environment is better than April when the league started. There’s limited ad inventory, and the demand has been bullish, so broadcaster Star might be able to command a premium as well."

According to media buyers’ estimates, Star and Disney India are charging a premium, with ad rates being raised from Rs13-14 lakh for a 10-second slot to as much as Rs18 lakh. The second half of IPL is expected to garner advertising worth Rs1,200-1,500 crore for the official broadcaster. “The last quarter is one of the biggest, and this year will be no different. We are already seeing robust signs of recovery on media spends," said Navin Khemka, chief executive officer, Mediacom South Asia. “This year, we have 30 matches of IPL as well as the T20 World Cup in the last quarter, which will help in boosting ad spends."

Sitharaman’s caution

But there is a big if. Of late, finance minister Nirmala Sitharaman has been more circumspect than other senior functionaries of the government, including her own officials, who have been talking of a V-shaped recovery. She is perhaps more aware of the damage yet another wave of the pandemic can inflict on the economy. Speaking at the centenary celebrations of Tamilnad Mercantile Bank Limited in Thoothukudi district recently, Sitharaman said that vaccination against Covid-19 infection was the only “medicine” which will allow businessmen and farmers to carry out their work, enabling growth of the economy. She also said that it was the only way to prevent a third wave.

-

Sabnavis: watch out for revival in demand

This is where the pace of the nationwide vaccination drive will matter. According to Rajesh Bhushan, Union health secretary, the vaccination drive is expected to further speed up in September as more than 240 million doses of Covid-19 vaccines are to be administered. This means that on average, 8 million shots will be administered each day, as against the corresponding figures for August which were between 5.3-5.4 million. Of these 240 million doses, approximately 200 million are likely to be of Covishield, which will be delivered by the Pune-based Serum Institute of India.

Further, in the first week of October, the supply of ZyCoV-D, the sixth and latest vaccine to receive Emergency Use Authorisation (EUA) from the Drugs Controller General of India (DCGI), will commence, while the administration of shots will begin by the end of the month. The manufacturing of two other jabs approved by the drugs regulator – those of Moderna and Johnson & Johnson respectively – is also projected to start from this month itself. As of now, the vaccination drive is completely dependent on Covishield and Covaxin, the first two vaccines which received EUA from the DCGI. Sputnik V, the third shot to be approved, has been used only in a limited capacity.

75 crore and going

The nationwide inoculation drive began on 16 January. Till last fortnight, a little more than 75 crore people have received at least one dose of vaccine across the country. The government is hopeful that the stepped up pace in September-October will turn the tide. As Sitharaman said, it will allow businessmen and farmers to carry out their work, enabling growth of the economy. Hopefully, it will also instil confidence in consumers to loosen their purse-strings.

India, however, has a population of 1.4 billion. It has so far managed to vaccinate just over 50 per cent of the population with one dose of vaccine. While this may look like a commendable achievement, the fact remains that only 18.6 crore have received two doses and can be considered fully vaccinated. A large section of the population thus remains vulnerable to the Delta variant. As Sanyal of Bandhan Bank points out, “Progress of vaccination will likely remain a key factor in ensuring medium term sustainability of recovery in economic activities.”

That is why no one is ruling out the possibility of a third wave of the pandemic. Dr V.K. Paul, a member of NITI Aayog and member/chair/or co-chair of at least five task forces assisting the government’s pandemic response, has not discounted a third wave and cautioned that the country was entering a risky period, especially with several public festivals lined up. The season of big festivals like Diwali and Dussehra is coming up in the next few months, which, if not managed well, could potentially lead to a massive spread of the illness.

“It cannot be ruled out. There is a period of the next three-four months when the vaccine is rolling up to build the Great Wall of herd immunity. We need to protect ourselves and avoid the outbreak. To me that is possible if we are all together in this show,” Dr Paul said.

-

While there has been a “reasonable recovery” on the industrial side, too much should not be read, given the low base on which the numbers have been computed and because of the supposedly skewed nature of the recovery

Restrictions if necessary

The Modi government will also have to take a call on imposing restrictions and persuading states to follow suit if the festive fervour goes out of hand. Government officials are not even sure if that is possible on a pan-India scale. “We have a risky period coming forward. There are ways to ward off the virus, in theory, in such a situation. And there are guidelines that are available to invoke restrictions in a graded manner. And they should be invoked when the time comes,” feels Dr Paul.

But restrictions can be a dampener on economic activity. The Central and state government will have to calibrate that very carefully.

Till now, the economy was reeling from the effects of the pandemic, with the last quarter impacted due to the second wave. In value terms, the Q1 GDP stood at Rs32,38,020 crore in April-June 2021-22, lower than Rs35,66,708 crore in the corresponding period of the 2019-20 financial year. The GDP had shrunk to Rs26,95,421 crore in April-June of 2020-21 during the nationwide lockdown. With a view to containing the second wave of the pandemic, localised and calibrated lockdowns were imposed during the first quarter of 2021-22.

RBI’s projection

The ebbing of the second wave and the movement towards normalisation of economic activity has led the RBI to retain real GDP growth projection at 9.5 per cent for 2021-22. Unveiling the bi-monthly monetary policy on 6 August, Governor Das said high-frequency indicators suggested that consumption (both private and government), investment and external demand are on the path of regaining traction. However, government data shows that consumption as well as investment in the first quarter of the current fiscal, though up from a year-ago, were lagging behind that of the first quarter in 2019-20, the period before the pandemic. That means the two key engines of growth still need to be further stimulated if growth is to be sustained through the entire year.

Indeed, the government will have to keep a close watch on private consumption, which constitutes 56 per cent of GDP, from September onwards as it is by far the single biggest engine driving the Indian economy. Economists have pointed to the not-so-good consumption trend in the first quarter numbers. While personal consumption rose by 19.3 per cent, it wasn’t just enough.

Worse, as surveys done by the Centre for Monitoring the Indian Economy (CMIE) suggest, private consumption is not likely to pick up significantly over the next 12 months because households are “in deep despondency”. That should be a matter of worry for the government whose spokesmen are painting a rosy picture and again talking of a V-shaped recovery.

Collapse and reasons

The CMIE has calculated that private consumption levels in Q1 are 12 per cent below pre-pandemic levels of 2019-20. More importantly, private consumption in 2021-22 is almost identical to private consumption in 2017-18 i.e. four years ago. That is the extent to which private consumption has collapsed over the years.

Why has the collapse happened? During the last year i.e. 2020-21, household incomes fell by 20 per cent in real terms. This, according to Mahesh Vyas, CEO of CMIE, is one explanation why private consumption remains so low. Households are poorer and, therefore, they are not spending and, consequently, there is no demand boost to the economy. Perhaps of greater concern is what the CMIE surveys suggest about the next 12 months: 41.5 per cent of households expect their incomes to worsen over this period while another 50 per cent do not expect their incomes to improve.

-

Will the PLI take the automobile sector to road to recovery?

The government’s consumption also has fallen by 4.8 per cent – something which is yet to catch attention. This is surprising, given that the Centre’s tax revenues have jumped 160 per cent from year-ago levels and even from the pre-Covid period of April-July 2019, tax revenues have grown by 156 per cent. A look at the Q1 numbers shows government expenditure in April-July is down 4.8 per cent over last year (similar to GDP data which showed a 4.8 per cent fall in general government consumption in April to June). Even over the past two years, overall Central government expenditure has crawled up by less than 3 per cent annually. The transfers from the Centre to the states have also been consistently falling over the past four years.

No revenge-buying

Before the numbers came in, the argument being trotted out unofficially by government functionaries was that post-Covid, the Indian consumer will indulge in revenge-buying of goods, India Inc will invest more in capital expenditure and a virtuous cycle of more Capex, leading to more employment and hence more consumption, will trigger growth. But as yet there is little evidence of that. Consumption is not leading from the front.

The services sector is the source of most jobs in India since it accounts for 60 per cent of the GDP. Trade, hotels, transport, communication and broadcasting that accounts for about 18 per cent of the GDP is still 30 per cent below pre-Covid levels. It is the loss of momentum in this space that is denying job opportunities and hurting consumption. A stepped up vaccination drive would have helped but the government’s laxity combined with the shortage of vaccines led to the Second Wave which hit the country during Q1.

The government now simply needs to chip, especially since there is a surprising spurt in tax collection. Dr Pronab Sen, who was India’s top official statistician, points out that if nothing else, the government needs to spur consumption by spending more on MNREGS and by transferring more to states which may spend on small irrigation and construction works that can generate jobs quickly.

However, going ahead, there are salutary signals. About 64 per cent of the 3,046 employers covered by the latest Manpower Group Employment Survey feel that employment creation will see a strong recovery in the December quarter beginning October. They are hoping for the pandemic restrictions to further ease, and demand for products and services to rise. With hiring sentiments improving, an increase in payrolls is also forecast for major sectors of the industry like services, manufacturing, finance, insurance and real estate.

Exports silver lining

Another silver lining can be seen in exports which can provide an exogenous force to trigger growth. Exports as a share of GDP have jumped up to 21.7 per cent in Q1 from around 18 per cent in the previous few years.

Also the earnings and hiring of software companies and startups attracting investments from abroad could boost housing demand in Bengaluru, Hyderabad, Chennai and Pune – the traditional IT hubs – which can in turn trigger demand for more cement and more importantly for jobs in construction. But that is still a small part of the GDP and can be vulnerable if global growth slows because of the Delta variant and our slow vaccination drive does not prevent a Third Wave.

-

Progress of vaccination will likely remain a key factor in ensuring medium term sustainability of recovery in economic activities

Indeed, the onset of the festive season, the speed of vaccine deployment and the probability of government increasing flexibility of people movement are all factor leading to optimism in India Inc. The Modi administration has also been recalibrating public policy to attain the goal of self-reliance. One of the strategies of the government is to encourage the industry to invest in new age technologies and products that will help India claim a place in global markets early on in the development of sunrise industries.

The Production Linked Incentive (PLI) scheme is one such move. As per official estimates, minimum production in India as a result of PLI schemes is expected to be over $500 billion in five years. Two more sectors were approved by the Cabinet for the scheme in September.

PLI initiatives

After clearing a PLI scheme for the textile sector with a focus on man-made fibres (MMF) and technical textiles, the Union Cabinet turned its attention to a Rs26,058 crore PLI scheme for advanced automotive technology vehicles as well as components and drones. The scheme will attract Rs42,500 crore in fresh investment in the automobile and auto components industry over five years, spurring incremental production in excess of Rs2.3 lakh crore and helping create more than 7.5 lakh jobs. Coming at a time when the industry is struggling to emerge from the twin blows of an economic slowdown and the pandemic, the scheme has been devised for both, existing automotive firms and new investors.

While this was part of the overall PLI schemes for 13 sectors announced by the government in the Union Budget 2021-22, with an outlay of Rs1.97 lakh crore, the timing was significant. The announcement came at a time when the economy was opening up. Besides, both sectors are employment-intensive.

The PLI scheme for textiles sector is important as India has a lot of catching up to do with respect to grabbing the market share in the global MMF (man-made fibre) scene. India remains a cotton player, its value chain remaining natural-fibre oriented. India needs to lift its now stagnant share of just over 4 per cent in global textiles exports if it has to sustain the livelihoods of over 45 million people who directly depend on this sector.

Textiles ministry researchers have pointed out that in the top 40 MMF lines, which alone accounted for 16 per cent (about $130 billion) of the global textiles exports of over $800 billion in 2019, India’s share was just $1 billion or less than 1 per cent; this is against a share of 4.3 per cent in global textiles exports overall. Similarly, in the fast growing technical or industrial textiles segment, India is a non-entity. In the top 10 lines in this area, India’s exports were $0.7 billion in global exports of over $80 billion. The PLI is focussed on these remarkably weak links in the textiles value chain.

-

The PLI is focussed on the weak links in the textiles value chain

Another important policy move came in the form of the long-awaited package for the telecom sector. The approved several measures to extend a lifeline to the cash-strapped sector, including a redefinition of the much-litigated concept of adjusted gross revenue (AGR) to exclude non-telecom revenue and a four-year moratorium on players’ dues to the government. Moreover, the new telecom minister Ashwini Vaishnaw allayed fears about a duopoly emerging with just two major telecom players – Bharti Airtel and Reliance Jio. He said the government was keen on ensuring that there were more players in the sector and consumers retained choices.

In all, Vaishnaw announced nine structural reforms and five procedural reforms for the sector, including a fixed calendar for spectrum auctions with an extended tenure of 30 years for future spectrum allocations, and a mechanism to surrender and share spectrum. Foreign direct investment (FDI) in the sector has also been allowed up to 100 per cent under the automatic route, from the existing limit of 49 per cent. Together, these measures would pave the way for large scale investments into the sector, including for 5G technology deployment, and generate more jobs, he said.

Given the nascent and uneven nature of the recovery, the need for such continued policy support for the real economy remains strong. Though such policy moves, like the PLI, will yield concrete results only a few years later, it will create a momentum in terms of hiring and preparatory infrastructure activity which had been so far missing. One should not expect any dramatic results overnight. As Sanyal of Bandhan Bank says, “Going ahead, without any fresh headwinds as regards the Covid-19 scenario, GDP growth is expected to hover around the mid-single digit zone.” Indeed the euphoria will have to be curbed.

-

Aziz: a misleading picture

Madness in the method

The controversy about how growth should be calculated is not new. In 2015, when Central Statistics Office (CSO) introduced a new GDP series, some academics and researchers raised doubts about the new GDP estimates. The new series revised the base year from 2004-05 to 2011-12. It also employed a new methodology to estimate GDP and used new data sets to arrive at the GDP.

The CSO’s changes were in line with international norms of national income accounting like revising base years, improving methodologies and opting for better databases. But the debate intensified when, in 2018, the statistical establishment released two back-series (that is, recalibrating the GDP data for past years based on the new methodology) that contradicted each other. Several economists have questioned the official data. In 2019, the accusation that the new method overestimates GDP received a boost after Arvind Subramanian, Chief Economic Adviser between 2014 and 2018, argued that the new series overestimated GDP growth by as much as 2.5 percentage points.

Early this year there was a new twist to the debate. This one pertains to how we calculate the “growth rate” of GDP. Jahangir Aziz, who is Chief Emerging Markets Economist at J P Morgan, argued that the way India calculates its GDP growth rate paints an incorrect or misleading picture of the current state of economic growth.

As things stand in India, he wrote in an article, when we say that the Indian economy grew by 10 per cent in a particular quarter what it essentially means is that the total GDP of the country in that quarter was 10 per cent more than the total GDP produced in the same quarter a year ago. Similarly, when we say the economy contracted by 8 per cent this year what we mean to say is that the total output of the economy (as calculated by GDP) is 8 per cent less than the total output of the economy in the preceding year. This is called the year-on-year (YoY) method of arriving at the growth rate.

But this is not the only way to arrive at a growth rate. One could have compared GDP quarter-on-quarter (QoQ) – that is, compare the GDP in the current quarter with the GDP in the preceding quarter. For that matter, theoretically speaking, if the data were available, one could calculate the growth rate month-on-month (MoM) or even week-on-week.

On the face of it, the Y-o-Y method is intuitive and takes care of the seasonal variations. For example, if agricultural production is typically low during the April-May-June quarter (because it doesn’t rain as much during this period) and typically high during the July-August-September quarter, then there is little value in comparing farm productivity growth rate between these two quarters. Doing so will just throw up massive fluctuations without adding any real insight. But comparing farm output YoY – that is, July to September current year with July to September last year – provides a more robust and reasonable growth rate. It is a like-to-like comparison, thanks to the similarities in weather and farming conditions. The same argument of “seasonality” applies to other sectors of the economy as well and, as such, it makes sense to use the YoY method to arrive at the growth rate.

But Aziz has argued that there are very well-established statistical methods to take away the effect of seasonality from quarterly data. He has argued that once the data is deseasonalised, the growth rate arrived at by using the QoQ method presents a far more accurate picture of the economic growth rate. It is for this reason, he argues, that other large economies like the United States report QoQ growth rate.

Aziz worries that “the year-on-year quarterly numbers will keep rising giving the false assurance of a strengthening recovery when in reality the level of income would rise only at a grinding pace”. That is why he argues India must shift from YoY to QoQ method of calculating GDP growth rate.