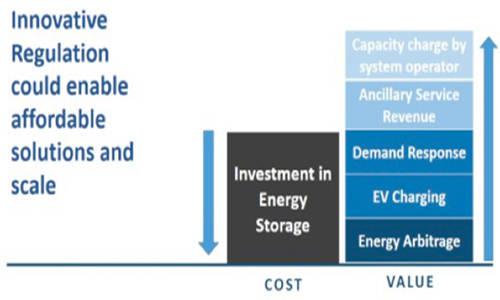

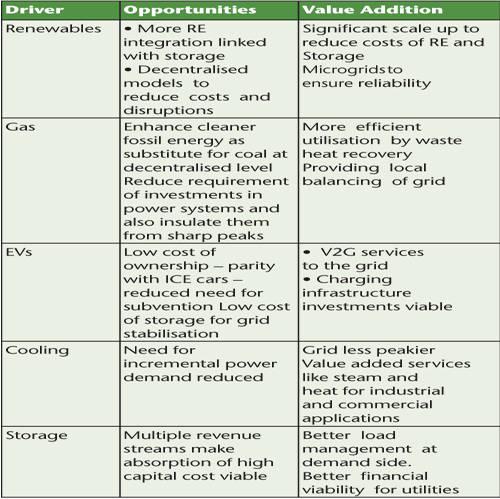

The energy sector worldwide is moving in an unprecedented direction. The standard wires & transformers business with centralised power units through large country level grids is giving way to decentralised, intermittent and dispersed systems. Estimates suggest that in 20 years, energy demand will rise by almost a quarter, due largely to population growth and urbanisation. Climate change concerns are already putting the brakes on coal, let alone only its use as baseload power. Concerns around proliferation and safety mean that nuclear power will not fill baseload gap, if any. This is likely to mean that electric mobility will become attractive, particularly to developing countries like India where energy security, savings of foreign exchange due to import substitutions and affordability are key. Solar will likely have a bigger share of new installations – which in turn could reduce demand for petrol. Digitisation of the grid will become more common to allow real time response to demand and supply management. Demand for cooling will go up as India urbanises and air-conditioners get more affordable – not to mention as climate change gets more acute. Natural gas will become a candidate for coal replacement and grid balancing. And finally, batteries will become financially and technically viable as demand increases and innovative business models develop. All this means the current way of thinking about electricity and its generation and distribution will (need to) change. Innovations in off-grid solar and wind generation, electric vehicles, battery storage and other related services are bound to develop. The market will need to find the right incentives for storage and dispatchable generation and adjust – or support – the shift from monolithic centralized systems to distributed energy resources. The concerns of climate change will make coal a less likely option for base load power and issues related to proliferation and safety would not allow nuclear power to fill in the base load gap. Even with the declining share of coal in the generation mix, the potential emissions reduction can nearly double by 2030 of what it is in 2018, which is 2.6 million tonnes. In this backdrop, the energy sector transitions that will take place are as under: • Solar power will dominate the new installations • Digitisation of the grid will become pervasive and will allow real time response to demand and supply. All of this has significant climate change benefits which if captured appropriately, can become valuable source of revenue in an otherwise nascent market. • Cooling demand, particularly in tropical countries like India, will perhaps be the single biggest driver for demand and in turn will make grid peakier as has been the case globally. Grid management will become a challenge. • Natural gas will be a candidate to replace coal for base load as well as for balancing requirements. • Battery storage, both at supply (bulk) and demand side is a technically viable solution for most of the above challenges. However, higher capital cost and technical issues remain a concern. The drivers of new energy sector are fundamentally different from the ones that have shaped the way the sector has evolved over time. The challenges indicated above will necessitate innovations in off-grid solar and wind generation, electric vehicles (EVs), battery storage, etc., more accessible and affordable. Digitisation of the sector through smart meters and smart grids, Artificial Intelligence, big data analytics, blockchain and the Internet of Things, will enable real time to optimise supply and demand disruptions to traditional business models. The energy system will therefore be fundamentally different to that of today requiring new innovative policies and regulations, financing and business models.