A vision for North-east India

The Prime Minister has announced an ambitious goal for India – to add 500 GW to the installed capacity of renewable energy sources by 2030. This is to help reduce carbon emissions of concern at the global level. This creates a grand opportunity for North Eastern Electric Power Corporation (NEEPCO) to support India’s stated mission by enhancing its installed capacity of green energy generating hydro and solar power plants. India’s nationally determined contribution statements also provide the necessary impetus to the move.

Three important facets of NEEPCO’s efforts inspire commitment to fast-track development in India’s north-east and deliver in alignment with goals set by the government of India.

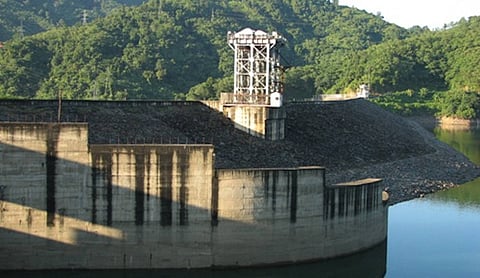

The first is about enhancing its installed capacities. NEEPCO’s present installed capacity of 2,057 MW is spread over north-eastern states. They include 1,525 MW from six hydro-power generating stations, 527 MW from three large, combined cycle gas-powered stations and a 5 MW solar plant. Its relentless efforts have secured an additional 19 large hydropower projects, totalling 17,688 MW in India’s north-east.

NEEPCO will deliver on this front through a strategically important joint venture with NHPC. All problems typically encountered in the development of every hydro project are tackled through innovative mitigation measures. These are derived from major policy interventions of the Central and the state governments.

The second facet is about the policy milieu set by the government of India that fosters hydro-power development. It treats hydro-power plants of all sizes as renewable energy sources. This goes ahead of the earlier stand that only such plants of less than 25 MW installed capacity were treated so. The government has mandated that hydro purchase obligations (HPO) within the non-solar renewable purchase obligation (RPO) basket will incentivise and accelerate hydro-power projects.

The need to cover transmission lines between hydro-power stations and nearest pooling points is mooted to be supported by government grants for infrastructure development, which includes flood moderation. Equally important is the need to rationalise transmission tariff from hydro-power plants to the delivery points in far offload centres of the country. This is to make the cost of delivered hydropower to the power distribution companies affordable. For this purpose, a targeted grant is mooted, especially for remotely located hydropower plants, on a case-to-case basis.

The third facet is about NEEPCO’s deep engagement on advocating fast-tracking time-bound single window clearances for the hydro projects. Multiple clearances from various entities of the central and state government are typically required. These, for instance, include techno-economic clearance involving various clearances from CWC, CEA, GSI, CSMRS, legal, inter-state or international clearances, security clearance and tribal affairs.

These are in addition to environmental clearance, forest clearance, wildlife clearance, as may be applicable; besides issues of land availability, NOCs from fisheries, mineral, cultural and irrigation department, etc, consent from Pollution Control Board to operate and clearances from Defence or MHA, as needed. A host of other policy enablers too have to be addressed.

NEEPCO appreciates the need to make land evacuees associated with a hydro project to overcome resistance to land acquisition for a project requiring huge tracts of land. The present dispensation is that 12 per cent free power is given by the project developer to the host state government. This is in addition to 1 per cent for the Local Area Development Fund (LADF) with matching 1 per cent contribution from the state government. Thus, the pool of fund for LADF is equivalent to 2 per cent of the power generated from the project.

However, land evacuees do not appear to view this as a direct benefit. They could therefore be offered 2 per cent free equity in the project instead of 2 per cent from the LADF. This model has worked successfully in Canada in respect of hydro-power development, where free equity is given to the land evacuees known as ‘first nations’. Several more conflicting interest groups impose additional administrative problems, as per the present model of LADF.

To avoid system leakages and pilferages, a 2 per cent equivalent equity amount is proposed to be transferred to the bank accounts of the land evacuees through Aadhar-linked Direct Benefit Transfer scheme. Actual flow of benefit is proposed to happen after commissioning of the hydropower project to ensure continued interest/ support of the land evacuees.

The free equity certificates can be given to the land evacuees at the very beginning on announcement of the project, so that apprehensions do not creep into their minds. While hydro-power is compared with other renewable sources like solar and wind, backed by Battery Energy Storage System, it will be invaluable to enable a quick ramp-up, resilient, flexible and robust system stability.

These easy to implement suggestions and policy interventions are based on real life experiences of difficulties on the ground. These few, yet critical measures can expedite focussed action on our vast hydro resources to meet our national and global commitments.