-

Gangadhar: expanding business

To differentiate himself from the plethora of new brokers and sub-brokers, Thakkar decided to take the help of technology. The first thing Thakkar did as a sub-broker was to invest in a walkie-talkie to communicate with his clients through his office and give immediate confirmation of the transactions and also gave a recap of the gist of events happening on the trade floor. (Pagers came much later in mid-90s and got extinct as quickly post the entry of mobile phones). This helped him build loyalty with his customers and also helped gain trust at a time when broking community as such was generally had earned a bad name due to the malpractices of a few.

Customers’ interest, above all, was the unwritten policy even then for the young sub-broker. The accuracy of his predictions saw clients making decent returns and in the first three months he got 300 clients who opened trading accounts. As on 30 September, he has 6.1 million investors. This is 142 per cent more than the customer base of 2.69 million in September 2020. Computer had entered the markets post-liberalisation in the 90s, also found its way to Thakkar’s office. This was used to provide fast accounting of trades even before screen-based trading started in 1994, with NSE also coming in as a new technology driven exchange.

Building reputation

As word spread about Thakkar’s research, more and more people signed up as his clients. Instant confirmation and transparency about the brokerage charges also helped him build his reputation. Angel Broking was established much later in 1996. The name was chosen to inspire confidence in clients, as Thakkar says to depict humbleness and a desire to help.

Unlike the other broking outfits which branched out in various segments including institutional broking, investment broking, private equity, housing finance, insurance, to become integrated financial companies in their own rights, Thakkar at all times, was focussed on retail customers. Even today, he is focussed on only retail investors. Whether this single-minded focus on retail is beneficial or not can be debated.

Kotak, who used his entry in to finance to build the Kotak Mahindra Bank with a market cap of Rs3.97 lakh crore. Nirmal Jain who started life with Hindustan Lever and turned to research before becoming a broker has a marketcap of nearly Rs30,000 crore from his three companies. Thakkar was, however, determined to focus on retail segment and over 26 years, has built a company with a market cap of Rs13,161 crore comparable with Motilal Oswal Financial Services at Rs13,569 crore.

Thakkar was a contrarian. During the Lehman crisis when markets world over went in a tizzy he went ahead and set up 43 new branches across India. (See Business India, The Retail Mantra, 2011) This was at a time when other broking companies were consolidating their business and cutting costs, in a bid to reduce liabilities. Funds for the expansion were utilised from the amount of Rs150 crore received from International Finance Corporation which had picked a 12.5 per cent stake in Angel Broking in 2007, valuing the company at Rs1,200 crore.

Later they picked up more on conversion of warrants to have a total holding on 18.5 per cent shares. This was probably one of the reasons for delay in raising funds from the market. Several broking houses including Motilal Oswal, Emkay, Geojit, JM Financial, Edelweiss and institutions like ICICI Securities had listed their shares on the capital market. Angel moved effortlessly from equity to commodity trading and currency trading.

-

Angel’s journey so far has been guided on a simple principle of maximising returns for existing clients. Customers have become wiser. We have to understand their needs

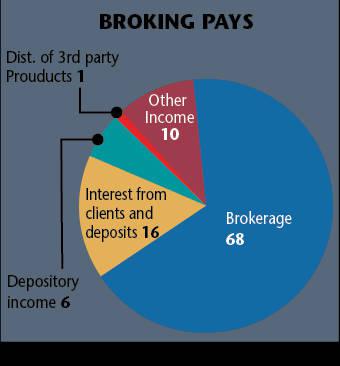

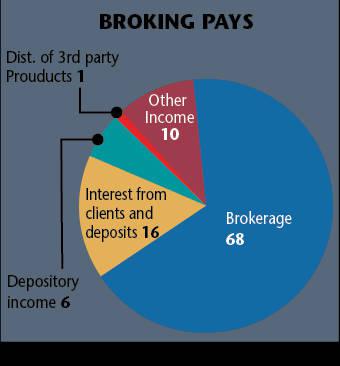

Angel Broking came out with an IPO and an offer to sell shares by promoters and IFC, during the Covid period in September 2020. The Rs10 paid up shares priced at Rs325, actually opened at a discount to the offer price on 5 October. One reason for the poor response from investors given at that point in time was the company’s heavy dependence of brokerage income which stood at nearly 70 per cent.

Given the growing competition from other brokerages, investors felt broking commission as a percentage of trading value would only go down. The company’s balance 30 per cent came from Depository, PMS and income from distribution and other services.

Thakkar, however, resolutely stuck to his focus on retail. “Even before Covid, we had already embarked on digitisation drive,” points out Thakkar. The early start helped during the retail boom which gripped the market, soon after. “There is a big change in the investors’ profile. The median age has dropped from 36 to 29. Nearly 90 per cent of investors are from Tier II and III, with 70 per cent of them being first time users.” Angel which had built a good network in Tier II and III towns benefitted vastly during FY21. “We have been investing heavily in technology and have a top technology heavy management team.” The tech team devised an online advisory platform ARQ for providing equity investment advisory services, based on alpha-generating algorithms which took into account multiple fundamental and quantitative factors. It can be accessed through the Angel Broking mobile app.

The closest to ARQ would be results generated by a fintech company Marketsmojo,com, a popular app with smart investors. The only difference is that Marketsmojo.com delivers reports based on various quantitative factors without taking into account subjective factors. In case of ARQ more than 6.7 million users have downloaded the app. Besides developing news apps multichannel delivery modes including mobiles giving multilingual instructions has gone down well and helped in increasing Angel Broking’s market share.

New platforms were devised to handle the surge in traffic and also provide customers good experience. This really helped during the Covid period as investors’ interest remained at heightened levels. The increased usage of internet helped the gen-x customers to enter the market. Going digital also allowed easy onboarding of clients without going through agents.

In the first half of FY22 the company’s shares in F&O segment increased by 3.8 times from 3.4 per cent to 12.4 per cent over the last six quarters ended 30 September, 2021. Share in cash segment during the period rose from 12.7 to 18.4 per cent. In commodity, it is currently having a market share of 28.4 per cent. This was aided by sharp growth in turnover during the same period. It is the third largest in the NSE active clients in the half year ended 30 September.

-

Tech savvy management

Following the untimely death of the company’s CEO, Angel Broking brought in Narayan Gangadhar, MS in Computer Science, a Silicon valley veteran with over two decades of experience in leadership role at Google, Microsoft, Amazon and Uber for managing the technology business. At Uber, as head of technology in San Francisco he led the company’s core infrastructure, machine learning, data platform and data science team. Uber scaled to over 400 plus cities during his tenure. His main aim was to make Angel’s products more accessible to the masses.

Gangadhar explains. “Angel’s journey so far has been guided on a simple principle of maximising returns for existing clients. Customers have become wiser. We have to understand their needs. Capture investors’ behaviour. Educate them. Make better use of machine learning. Our aim is to become an AI-driven fintech company. Our focus is transforming the company from an asset heavy model of business to asset light model with low capex requirement yoy.”

Gangadhar adds: “Ambition is far from over in broking. We aim to expand business and also increase penetration into providing investors with related products in Mutual Funds, Insurance and Loans. Technology will help us achieve it.” Gangadhar who had disrupted several businesses and also rapidly scaled others will be doing this for the first time in the broking industry.

With a view to tackling the challenge of continued compression in brokerage commissions in retail side in the face of growing competition Angel decided to change its pricing model. From a traditional brokerage house it has donned the cloak of a flat fee broking house. For clients taking delivery no commission was charged. In case of clients in F&O business a flat Rs20 per commission was charged per order. Clients were allowed to give shares as collaterals while margin funding attracted was allowed seamlessly upto a prefixed limit.

The simplified charges did not dent the income. If anything, it has increased significantly. The total income on a consolidated basis went up from under Rs200 crore in the last quarter of FY20, to Rs247 crore in the first quarter of FY22 and Rs318 crore in the second quarter ended September. While volumes have also gone up significantly it is clear that the fintech model has caught the fancy of investors.

“Angel has really transformed itself from a traditional broking house to a fintech house, through smart adoption of technology,” says Prakash Kacholia, co-founder of Emkay Global Financial Services, pointing out that being the only fintech broking house to be listed, the market has rerated Angel Broking. While Zerodha, Upstock and Groww are the other finstocks operating in this space, Angel being the first one to be listed is getting a good valuation. The shares of Angel which were around Rs388 towards end April have made a 52 weeks high at Rs1,689 during mid-session on 13 October. On this day Angel’s market cap of Rs13,465 crore was higher than Motilal Oswal’s market cap Rs13,311 crore, one of the traditional brokerage houses.

-

The company, in a bid to showcase its new identity, has devised a new logo – Angel One. Prabhakar Tiwari, the Chief Growth Officer responsible for brand building, performance marketing, sales enhancement amongst other duties, explains the reason for creating a new brand Angel One. “Broking is losing its relevance. Business is increasingly becoming a digital business.”Before Angel Broking, Tiwari worked for leading brands including Marico, PayU and Ceat. On the significant of One after Angel he says: “We aim to develop a super App for allowing our customers to buy all products including insurance, mutual fund on one platform.”

Thakkar confirms that they have applied to SEBI for starting a mutual fund. “I think there is a good market for passive funds in Tier II and III towns. ETFs have the potential of generating 13-14 per cent returns,” he says. Thakkar is not too perturbed about the market movement. Sometimes, the market goes up sometimes down. However he says, “The current bull run may continue for another 8-10 years.”

While it may be too early to make a judgement for the next decade, the markets at this point in time certainly seems to be in no hurry to cool down. However for fintech companies or brokerage houses, volumes matter, be it in a bull run or a downturn. And Angel has certainly made sure that by morphing into a fintech company – from just a digital broking house, it will continue to reap the rewards in this new model as a leading digital fintech company.