-

Godrej: focus on green chemistry

“The acquisition of a controlling stake in Astec enabled us to leverage its leadership position in triazole-based fungicides in addition to identifying new opportunities in the agrochemical manufacturing and CDMO businesses. Keeping this in mind, our investment in the R&D centre in Rabale, Navi Mumbai, is a testament to our commitment to offering advanced solutions with a focus on green chemistry and sustainability. This move opens doors for us in the highly lucrative CDMO market, allowing us to tap into new opportunities and position ourselves as a partner of choice by offering end-to-end solutions. By slashing the time-to-market for innovative solutions we are confident that by improving product development, providing access to advanced equipment and facilities, fostering collaboration and driving innovation, the new R&D Centre will cement us at the right place in the sector at the right time,” says Nadir Godrej, chairman and managing director of Godrej Industries Ltd & chairman of Godrej Agrovet Ltd.

“The launch of the R&D Centre is a significant milestone for Astec as well as the Godrej Group in our quest to provide advanced solutions to our customers. With a focus on green chemistry and sustainability, we embark upon a journey of innovation and transformation, emphasising strategic partnerships, operational excellence, and cost leadership for our customers. With a focus on new product generation, process optimisation, scale-up, and product life-cycle management, the R&D Centre will accelerate our ambition to be an application-agnostic and trusted partner of choice for global innovator companies. We aim to help them cut down time-to-market while providing end-to-end solutions for faster scale-up. We are following a focused strategy of making significant investments to expand our capacities, product portfolio, and R&D capabilities, providing impetus to the organic growth of our CDMO portfolio, which is our key focus area for the future,” affirms Anurag Roy, Chief Executive Officer of Astec LifeSciences, which is looking to invest heavily in the next 3-4 years in achieving its set goals.

The company is aiming to clock a turnover in excess of Rs2,000 crore in the next 3-4 years, with a significant portion coming from its R&D-based innovation platform in the CDMO space. Currently, the CDMO business accounts for 26 per cent of revenue, while the enterprise business contributes 74 per cent. However, going forward, growth will be driven by innovation-led contract manufacturing.

Stellar performance

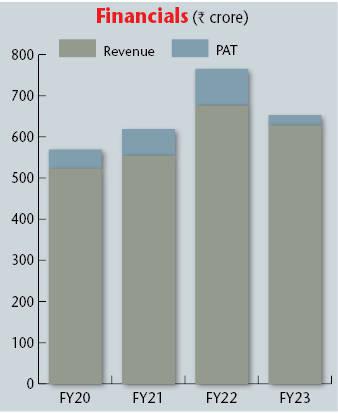

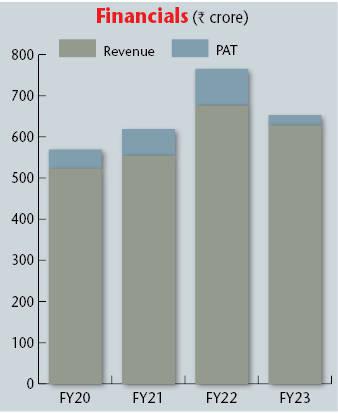

While the high-margin CDMO business gains momentum, the enterprise business has faced challenges, resulting in a decline in overall revenue from Rs676 crore in FY22 to around Rs628 crore in FY23. Nevertheless, the revenue from the CDMO business achieved 1.9x growth. Additionally, the capacity utilisation of the herbicide facility, commissioned in 2021, has increased, supporting CDMO sales growth.

-

Roy: following a focussed strategy

“Riding on the stellar performance from the previous year, the company experienced healthy growth in topline as well as profitability in the first half of FY23. This growth was driven by robust export volumes and higher sales prices compared to the previous year. However, in the second half, we faced an unforeseen dual challenge – volume headwinds and rapid correction in prices of enterprise products. This was due to high levels of channel inventories in India and key export markets, demand-supply imbalance, and subsequent price correction in key active ingredients, which impacted the Indian agrochemical sector at large. Consequently, we witnessed a drop in revenues and margin contraction,” explains Roy, who assumed the role of CEO in July 2021.

Roy, aged 49, brings over 23 years of experience working with leading pharmaceuticals, life sciences, and chemicals companies such as DSM, Dr Reddy’s Labs, BASF, and Jubilant Life Sciences. He has a proven track record of driving global profit and loss, delivering commercial and operational excellence, and leading manufacturing sites and contract manufacturing organisations (CMOs).

He joins Astec from Navin Fluorine International Ltd/Manchester Organics, where he served as COO – CRAMS Pharmaceuticals. In that role, he was responsible for P&L and managed and grew the global contract development and manufacturing business across the UK, Japan, USA, and India, including GMP manufacturing in India. He was responsible for building the customer base and global teams, introducing new technology and capability enhancements through in-house capabilities or CMOs to support the drug development pipelines of innovators.

Roy holds an MBA from Columbia Business School in New York, a Masters in International Business from the Indian Institute of Foreign Trade in Delhi, and a BTech in Chemical Technology (Polymers Science) from Harcourt Butler Technological Institute in Kanpur.

Roy believes that the CDMO market for chemicals in India is expected to grow at a CAGR of 12 per cent, surpassing the global rate of 10 per cent. This underlines the incredible potential of the sector which Astec aims to tap into with its recent initiatives in the CDMO market. India is becoming the preferred hub for the chemical industry, thanks to skilled technical manpower, availability of raw materials, and a strong IP regime. Astec aims to stand out with its research and infrastructure capabilities, efficient scale-up capabilities, and world-class health, safety, environment, and quality (HSEQ) standards.

R&D capabilities

“Astec has a proven track record in the agrochemicals business. With its technical competencies, the company has become a preferred supplier of technical-grade fungicides to reputable clients, including large multinational companies in domestic and export markets. Furthermore, the company’s investments in the new R&D Centre are expected to significantly enhance its R&D capabilities, enabling the development of new products and capitalising on the opportunities presented by the global shift in demand from China. Additionally, Astec’s efforts to diversify into herbicides manufacturing are expected to drive incremental revenue growth in the medium term,” states an ICRA report.

-

Astec aims to stand out with its research and infrastructure capabilities

The ICRA report also highlights that as part of its efforts to strengthen its business profile by reducing its dependence on commoditised enterprise products, where revenues and margins are relatively volatile, the company has been focussing on increasing its revenue share from the higher-margin and predictable CDMO segment.

To this end, the company ventured into herbicide manufacturing in August 2021, witnessing steady growth in the volume offtake for its herbicide products. Astec continues to invest in expanding capacities in this space. Such efforts undertaken by the company are expected to strengthen its business profile over the medium term.

“After GAVL’s majority stake purchase in Astec, the company has benefited from GAVL’s managerial and financial support. GAVL has provided financial support to Astec through ICDs (inter-corporate deposits) whenever necessary, and ICRA expects this support to continue. GAVL’s gradual increase in stake to 64.77 per cent indicates the company’s strategic importance to GAVL and the Godrej Group. Additionally, Astec benefits from the strong financial flexibility derived from being part of the Godrej Group, which provides access to capital markets and maintains healthy relationships with banks,” adds the report.

With these developments, Astec is set to establish a strong position in the market. Over the past few years, the company, which previously focused on low-margin enterprise business, has consciously expanded its high-margin CDMO business. While it is ramping up its capabilities in a big way and diversifying into herbicides and other areas from primarily being a fungicide player, it is also trying to add diversification elements to its enterprise business. All these initiatives, backed by a strong R&D foundation under the Godrej umbrella, will enable it to become a formidable player in the business, going ahead.

-

The journey, so far

Astec was originally incorporated in January 1994 by Reena Bagai and Avita Fernandes as Urshila Traders Pvt Ltd. However, their shares were later in February 1994 purchased by Ashok V Hiremath and Pratap Garud. The name of the company was changed to Astec Chemicals Pvt Ltd in August 1994 and further to Astec LifeSciences Pvt Ltd in March 2006. With effect from April 2006, the company was converted into a public limited company under the name Astec LifeSciences Ltd.

The company started its first manufacturing unit in August 1994 by acquiring a sick unit in Dombivli, Maharashtra with an installed capacity of 120 MT for the manufacture of Dicap, a pharmaceutical intermediate. It forayed into the CDMO business in 2011 by bagging contracts from reputed global players. The company went public in 2009 by raising Rs61 crore.

Hiremath who had continued to be at the helm of the company’s affairs as its managing director even after GAVL acquired the controlling stake, recently retired from his post effective 31 March 2022. However, he, having held 2 per cent stake in the company, continues to be on the board as a non-executive director.