-

Zaveri: carving out a differentiated space

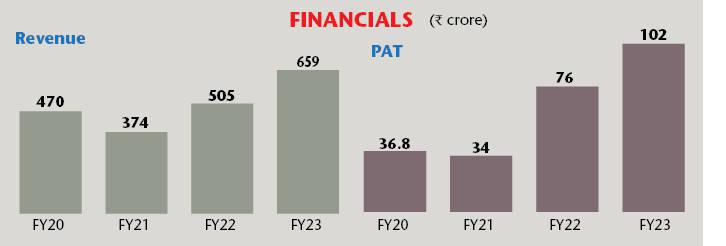

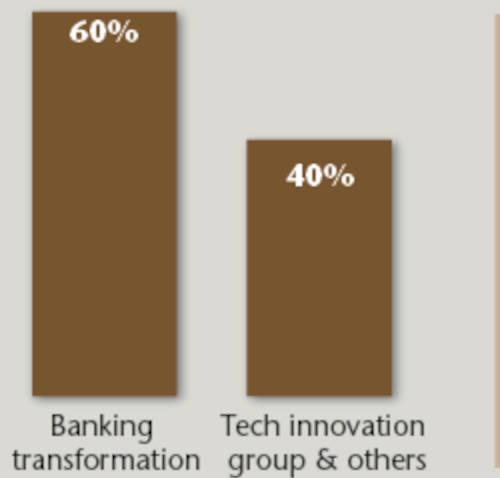

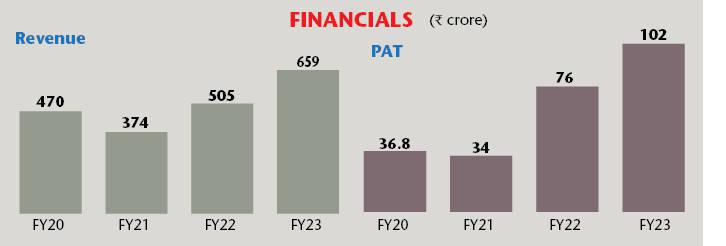

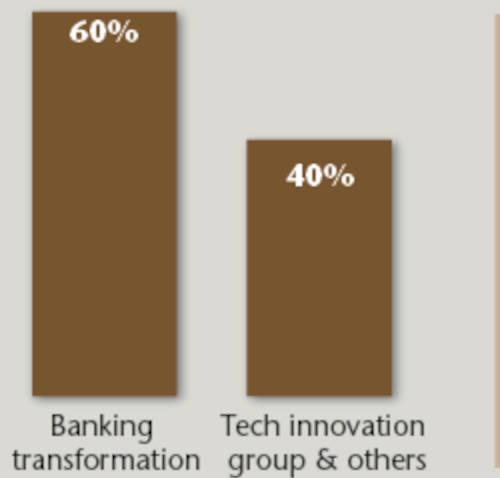

Currently, banking transformation is the primary domain for the company, accounting for approximately 60 per cent of the overall topline. In retail banking, ASL has built powerful solutions connecting every aspect of retail banking and customer touchpoints – from branches to kiosks. The company, backed by 2,000 professionals and 24 offices in 14 countries including USA, Singapore and Australia, offers an array of branch transformation solutions including Queue Management systems, Self-Service terminals, Customer Feedback systems and Digital Signage solutions to banks and now this expertise is being also leveraged by other segments such as airlines, telecom and retail outlets.

Corporate banking solutions

In wholesale banking, ASL has a streamlined corporate banking practice driven by solutions that optimise processes in transaction banking and the management of credit risks. ASL’s iCashpro+ is a web-based end-to-end digital transaction banking suite that enables banks to provide corporate internet banking innovative products/services to their corporate customers.

This is an integrated transaction banking platform that takes into account the digital transformation trend to deliver an optimal digital transaction banking solution for regional and super-regional banks. It has been benchmarked to handle 5 million transactions per hour with more than 6,000 concurrent users. Recently, the iCashpro+ transaction banking solution won the Technoviti Award for the third consecutive year.

“iCashpro+ is a next-generation transaction banking platform that provides a comprehensive solution for full-spectrum corporate banking, giving a superior and consistent client experience across customer segments in order to enhance time-to-market, acquire improved cash visibility, and cut expenses,” says Poonam Puthran, Executive Vice President, banking, ASL.

ASL recently launched AuroDigi, a next generation, digital banking engagement platform that delivers a unified experience to corporate customers, ensuring reliability, security, and configurability. AuroDigi aims to provide a customer-centric approach to deliver a seamless and personalised experience for various clients, including SME owners, CFOs of large multinational companies, bank relationship managers and business heads.

“We are delighted to introduce AuroDigi, a powerful, scalable, transparent, and user-friendly API-based platform created for banks to assist corporate clients in achieving their business goals. By utilising the customer’s prior banking behaviour and business intelligence (AI/BI) insights, AuroDigi can provide contextual banking information to corporate customers. With a cutting-edge technological stack and micro-services enabled, the platform is designed keeping the future needs of customers in mind and we are confident that it will provide a seamless experience,” says Shekhar Mullatti, President & Global Head - Banking, ASL.

In September last year, ASL launched Aurobees, an innovative and integrated digitisation, fulfilment and financing platform, focused on helping small and medium enterprises (SMEs) transform their businesses for the digital economy. The platform, developed in partnership with Trejhara Solutions Ltd, enables SMEs to move their businesses online seamlessly by facilitating digital presence, webstores, and enabling them to run their businesses efficiently, seizing growth opportunities for growth in the new digital economy.

It is a subscription based, cloud-native platform that offers a highly scalable solution for digitisation and fulfilment across industries ranging from manufacturing, trading, distribution, freight forwarding, warehousing, transportation, and e-commerce. The SME platform recently entered into a partnership with BSE E-Agricultural Marketing Ltd (BEAM) to provide SMEs and corporates access to BEAM’s services.

-

“SMEs are the heart of any economy and digitisation is crucial for SMEs to stay relevant and thrive in the new digital economy. Aurobees is designed to remove complexity and cost barriers and truly empower today’s enterprise to embrace the digital economy. Aurobees’ long-term vision is closely aligned to government initiatives in its key global markets to place greater impetus on the SME sector as well as the digital economy and will go a long way towards enabling the sector to realise its digital potential,” says Rai, who joins ASL in July 2022.

With an impressive track record of over 22 years in building enterprise software businesses for global markets, Rai is a fintech industry veteran. His appointment aligns with ASL’s strategy to invest in the global expansion of its IP-led, market-leading platforms and to continually expand the depth and breadth of its offerings and provide innovative solutions to today’s industry challenges. He joined ASL from FIS, one of the world’s leading fintech companies, where he was the Group Managing Director for APAC & MEA. He holds a bachelor’s degree in computer engineering from Bhopal University and an MBA from the Indian Institute of Management.

Similarly, ASL’s SmartLender, is a platform that provides an end-to-end comprehensive credit risk management solution that boosts productivity, improves credit quality, and lowers operational risks. SmartLender is a market leader in South East Asia, serving major banks in Singapore, Malaysia, Thailand, and Vietnam.

Another platform, FXConnect, is a real-time forex branch transaction platform that allows banks and their customers to view and negotiate forex rates in real-time across products. By bridging the gap between FX treasury and core banking systems it has enabled HDFC Bank’s FX branch to offer corporate and retail customers various inward and outward product options.

Moreover, Aurionpro Market Systems offers end-to-end services, from installation to upgradation of projects for financial institutions, addressing their capital markets, treasury, risk management, and regulatory needs. ASL recently won a strategic order from one of the largest private sector banks in India, further strengthening its engagement with Murex customers.

Platform-led approach

The company, through its platform-led approach, has transformed a large group of Indian and overseas entities, including SBI, HDFC Bank, Axis Bank, Federal Bank, Kotak Mahindra Bank, IDBI Bank, India First Life Insurance, Citi Bank, Barclays, Allianz, Goldman Sachs, Etihad Airways, VFS Global, Cummins, KPMG, OCBC Bank, ADCB, Etisalat, Fox News, Nations Trust Bank, CIMB and many others.

Aurionpro Fintech is a business unit of ASL and provides digital transformation solutions for the FinTech industry. Its offerings include payment solutions, digital product engineering, outsourced technology partnerships and payment consulting. Aurionpro Fintech enables payment and FinTech companies to embrace cutting-edge technology, enhance their payment infrastructure, and optimise their operations for greater efficiency and cost savings. Aurionpro Fintech Inc, an ASL subsidiary in the US, recently won a significant order from one of the largest payment facilitators in that country. ASL is also into payment solutions through its wholly-owned subsidiary,

Aurionpro Payments Solutions Ltd which is listed on the BSE & NSE. Founded in 2021, Aurionpro Payments is a payment solution provider for B2B and B2C Payments. At present, it operates through its business entities in India, Singapore and Hong Kong. In India, it offers a streamlined and secure digital payment platform under the brand ‘AuroPay’, a technology-first payment gateway platform that enables businesses to receive payments digitally, in a fast and secure manner.

-

Rai:creating a diversified portfolio

In the Asia Pacific region, it offers its ‘AuroPayBiz’ that provides a scalable, end-to-end invoice presentment and settlement solution, simplifying the process of connecting to multiple third-party processors and global acquirers. Aurionpro Payments Singapore recently launched ‘AuropayBiz’, its unique business payments platform and has signed partnerships with global leaders Stripe Payments and FIS Worldpay.

Recognising huge opportunities in digital solutions around its current offerings, ASL has combined smart city, smart mobility and data centre offerings under a single SBU – Tech Innovation Group. The company has been at the forefront of smart cities and mobility initiatives across the globe. It works closely with governments to implement digital urban infrastructure that can help citizens realise their aspirations using a combination of disruptive technologies backed by a strong service network. “We believe that our vision of smart cities enabled, powered, and integrated by the digital future, has the ability to touch and alter the lives of countless residents by providing a safer, more convenient, and desirable environment,” says Rai.

ASL has pioneered the implementation of 3D Cities globally. The 3D city platform has the potential to change the way urban planners think about city formation, development, and administration. Urban planning stakeholders may better foresee hazards and find innovative methods to boost efficiency by using high-resolution visualisation tools and simulation scenarios.

ASL’s Digital Twin City platform provides solutions for city planning, traffic management, solar power management, facility management for utility nodes, complex infrastructure planning, disaster management, sanitation (solid waste management) and adequate water supply management.

The Centralised Project Management System (CPMS) platform is a smart management technology platform that gives real-time data insight into key aspects of project management like budget and cost management, schedule plan versus actual plan, and more.

ASL offers smart city solutions like city surveillance, smart parking, smart lighting, e-ticketing, city communication network, ICT-enabled waste management systems, variable messaging systems (outdoor & indoor) and a city app.

Among its several smart city projects, the company has been engaged in providing Centralised Project Management Solutions to the Chhattisgarh government and 3D city implementation for Jaipur. It has also provided a business intelligence platform for the government of Rajasthan (e-governance/e-districts) and city surveillance for Rajasthan, Delhi and Madhya Pradesh.

Innovative mobility solutions by the ASL team of mobility experts are redefining the future of transit systems and simplifying the lives of citizens. To this end, the company employs an open-loop methodology, which offers greater flexibility and streamlines transit ticketing, payments, fleet visibility, tracking, route planning, department management, and so on.

The company has offered digital transit solutions for One City, One Card Noida Metro where ASL’s subsidiary, Singapore based SC Soft, has implemented an NCMC RuPay CSC & QR-based AFC system and has provided all station level equipment, Backoffice, and a mobile application. In 2017, the consortium of State Bank of India, ASL and SC Soft was awarded a 10-year contract for the project, which went live in January 2019.

Transit solutions

Besides this, the company has offered transit solutions to the Nagpur, Kanpur and Kolkata metro projects; NCT City Bus project Delhi; UPSRTC interstate AFC project and the HRTC interstate AFC project.

The company was also involved in the Sacramento Light Rail Transit Project, California where the project allowed the use of EMV cards and QR code solutions for contactless ticketing. To this end, it provided EMV L1/L2 certified validators along with the AFCS Central Management System connected to LittlePay and Elavon. The project went live in June 2021 and covers all 54 stations and three lines.

-

ASL’s subsidiary, SC Soft, has partnered with SecureID to provide e-ticketing solutions for the Nigeria Railway Project. Currently, the project is operational between Abuja to Kaduna for five stations where passengers can book tickets via the mobile app and online reservation system. The project has been operational since January 2021.

For Monterey’s Salinas Bus Ticketing System in California, ASL’s subsidiary, SC Soft, has enabled the use of EMV cards and QR code solutions for contactless ticketing. The project includes EMV L1/L2 certified validators and an AFCS central management system which is connected to Littlepay and Elavon. The project went live in May 2021.

Recently, ASL’s subsidiary launched ‘tap and go’ EVM Open Loop Payment Solutions in the Maldives, in partnership with MasterCard and MTCC.

“The Indian government has announced an ambitious capex plan which will boost our businesses, particularly in the smart city and mobility segment. Mass transportation is witnessing transformation with the rapid adoption of new contactless and smart ticketing interface. The revolution in the digital payments space is complementing this transformation in the mobility segment. This has boosted the entire ecosystem of Automated Fare Collection, the smart ticketing system,” says Rai.

In recent years, ASL has also entered the fields of data centre building, consulting and hybrid cloud services. To achieve this, it has built a strong team of industry veterans, with over 20 years of experience in the field. It has also signed agreements with several customers to provide consultancy and assistance for the rollout of 100 MW data centres over the next few years.

The company will also offer consultancy services to other industry leaders regarding data centre design and implementation. It has also secured some key partnerships in the data centre segment, which will enable it to take advantage of its position in this field. ASL has been selected as a DC design consultant for a prestigious Tier IV Data Centre Project for a leading financial institution.

With all these developments in place, ASL, with its varied offerings of services and solutions, is quite strongly placed in the market. The company’s platform-led approach has been a big success and, in all likelihood, will help it maintain its growth momentum in the future. The company converges multiple technology solutions under one umbrella. It serves as a ‘one platform’ service for advanced and accelerated platform-led transformation, guiding businesses to adapt to a new paradigm in the digital world.

Over the years, the company has built a well-diversified portfolio of offerings, catering to the needs of the banking, mobility, payments, and government sectors. This will not only help the company scale up its business quickly but also establish a hedging mechanism that will keep it better placed during uncertain market conditions.