-

Grover: taking things coolly

At an early stage, the company announced India’s first interoperable UPI QR code system for merchants. It was the first zero MDR (merchant discount rate) payment acceptance service. Prior to this, companies charged around 0.6 per cent from merchants on every transaction. With this move, the company had announced to the world that its focus was on local kirana stores rather than consumers.

This move (considered big then and ultimately culminating in the complete abolition of MDR on offline UPI QR code transactions of merchants in 2019) actually stemmed from Grover’s own past experience of working with Grofers in the initial days as its CFO (its founder CEO was Grover’s batch mate in IIT Delhi). “We had started with the typical marketplace model, wherein we also used to pick up and drop a lot from local stores. However, at the end of every month when we used to raise the bill for our commission for getting goods from their goods sold to customers, they did not respond. It is then I realised that they did not have a margin,” he says, while adding that the gross margin of a typical kirana store is just 14-15 per cent.

“More than half of it goes to maintenance costs. How can he pay you any commission? India is not the US where a giant retailer like Walmart can assert and command big commissions from the FMCG firms for keeping and selling their products to the end users,” he further explains. And it is this basic learning which prompted Grover and his co-founder partner Shashvat Nakrani, an IIT Delhi final year dropout and a much younger partner (just 22), who also had similar ideas when he met Grover. Hailing from a Gujarati family, Nakrani started his entrepreneurial journey at the age of 19 and his early spell of experience had convinced him there was huge scope in building a business that could empower SMEs with new age fintech solutions. As co-founder, Nakrani is involved in scaling up some of the leading business verticals.

Dream debut

In statistical terms, the scale at which BharatPe has grown in less than three years, is impressive. Expanding its freebie portfolio further after the interoperable QR offering with which it started, in the second half of 2020 BharatPe launched India’s only zero rental and zero MDR card acceptance terminals – BharatSwipe. “We can afford to do it, because rental on POS machine now is an archaic system. It worked when POS machines cost Rs1 lakh. Now, this has dropped to just Rs5,000,” says Suhail Sameer (36), group president. BharatPe has deployed more than 80,000 PoS (point of sales) machines so far, which facilitate transactions of Rs1,200 crore per month. The company is now the third largest private player in the PoS industry in India.

For a less than three-year-old start-up, the pandemic year 2020, in fact, has injected that booster dose, which is difficult to imagine in a regular phase. “The business went low during the first two months in April and May last year, after the lockdown was imposed. But, after that, it recovered and later swung to a skyrocketing trajectory,” Grover points out, while adding that in the Corona affected year, BharatPe payments business has grown 5x and its lending business has grown 10x in the last 12 months.

-

Sameer: in offline, we are the largest

BharatPe now has a merchant base of over six million merchants across 100 cities. In November 2020, BharatPe had toppled Google Pay to take number three position in the UPI P2M category, with Paytm and PhonePe occupying the top slots in terms of merchants’ base. But in pure offline transactions play, it has emerged as the market leader. “For others, it means engaging merchants through online and offline. For us, it’s offline only. In offline, we are the largest despite being present in only 100 cities, whereas others are in 500 cities,” says Sameer. The company now processes over 80 million UPI transactions a month. The annualised Transaction Processed Value (TPV) is estimated at $7 billion.

One clear strength of BharatPe has been the easy financial backing of a host of marquee investors including Coatue Management, Ribbit Capital, Insight Partners, Steadview Capital, Beenext, Amplo and Sequoia Capital. The company has managed to raise close to $268 million in equity and debt till date. It had generated $108 million in the recently concluded Series D equity round at a valuation of $900 million, just a bit shy of unicorn status. The round was led by the company’s existing investor, Coatue Management. The icing on the cake is that after conclusion of this round, BharatPe returned Rs125 crore of capital to angels.

And for this, it grabbed the attention of the financial press, when it maintained in a statement that the kind of RoI it has offered to its angel investors is unprecedented as its total pay-out to 18 of its angel investors was as much as 80x – about Rs102 crore of pay-out against an initial angel stage fundraise of Rs1.9 crore. “Till date, no other Indian entrepreneur has given this kind of exponential return to his individual angels, and that too in just two years of kickstarting the business,” the statement said.

With this unprecedented windfall coming their way, the angel investors are obviously quite elated. “Grover had given us the opportunity to exit in the first year itself. This company has simply given a brilliant performance and the scale attained by them in such a short period is quite extraordinary,” says Anuj Golecha, co-founder, VCats, one of the first angel investment firms which decided to back BharatPe in 2018.

While the top officials of BharatPe today have many points to narrate to explain the company’s acquired strength within a short period, what probably brings them the greatest satisfaction is narrating the steep uptick which has been witnessed in their loan book in the past one year. “Our loan book prior to Corona was quite low – about Rs130 crore. But after two months of dull business, we upped the ante and as businesses recovered, our loan drive got into top gear and we are closing this fiscal with around Rs1,000 crore of loan disbursement. The established NBFCs were not keen to disburse new loans after the lockdown as their primary focus turned out to be collection. We took a contrarian stand in expanding our portfolio and that worked,” explains Grover.

According to Sameer, BharatPe is decisively enhancing its lending activity to small merchants and some distinctive patterns are already visible. “Our loan size ranges from Rs10,000 to Rs7 lakh. Unsecured loans typically average Rs70,000 for nine months, while sub-Rs50,000 loans have a share of nearly 35-40 per cent in our portfolio,” says he. For every Rs1 lakh loan which is disbursed for, say, 12 months, the payback commitment to BharatPe, at nearly 2 per cent monthly interest rate, works out to be Rs1,24,000 and the collection mechanism is simple. The company collects Rs400 per day (for 310 days in the year) directly through QR transactions. “This way, it does not become a burden for the merchant. He is just paying from his everyday earning,” Grover points out.

The grand picture

With encouraging numbers defining the first leg of its journey, BharatPe now expects the growth momentum to become much stronger and has set up ambitious targets for the next two years. The company has a balance sheet which is well capitalised (according to Grover, of the Rs1,700 crore raised so far, only R500 crore has been spent and the rest is in the bank) and the top brass has drawn a target of reaching $30 billion TPV annually (as against the current figure of $9.5 billion – UPI and swipe combined) and building a loan book of $700 million with small merchants by March 2023.

To push its growth story to the next level, BharatPe plans to spread out to 300 cities with a primary focus on the southern markets and then the north. “The business is bigger in the South, as there is more awareness about technology-linked services and products,” Grover reasons. And then, to further endear itself to the merchant community (he expects 10 million merchant members by the end of 2021), adding new products and services to its lending portfolio will be a regular norm rather than exception.

According to Sameer, the company is now getting ready with two new products to be launched in the coming quarters – a gold linked secured loan in the first quarter of 2021-22 and an auto loan in the second quarter. Sometime later in this fiscal, the company also plans to introduce a ‘loan against property’ product. And on the basis of these expected moves, Sameer says, the profitability mark is well within sight.

“My asset under management (AUM) figure is Rs800 crore. This will go to Rs5,000 crore in next two years. Going by our calculation, we will become profitable when it reaches the vicinity of Rs2,500 crore,” he underlines. The company, meanwhile, launched a specific finance product for small distributors/wholesalers in February, a first of its kind, and is expecting to cobble up a loan book of Rs100 crore in the next two-three months.

Having sent its angel investors laughing all the way to the bank, the larger ambition for Grover and his team now is to ultimately emerge as a more formidable entity in the form of a bank. And, without losing any time on it, late last year, the company made its move by joining hands with Centrum Bank and submitting a joint expression of interest (EoI) to the Reserve Bank of India (RBI) to take control of the troubled Punjab & Maharashtra Co-operative Bank (PMC). There are three more bidders in the race and if the BharatPe-Centrum Bank succeeds, both of them will have equal stakes.

-

“RBI will be taking a final decision on it soon. It could mean a big jump for us, probably making us the first fintech to become a bank. If we try to do it organically, we may have to wait for ten years and build a loan book of Rs50,000 crore,” Grover says. In terms of raising further funds in the short term, there are two scenarios – regular growth plan and possible acquisition of PMC. “For our regular growth plan, we will need to further raise Rs700 crore in the form of equity in the next one year, while we plan to raise Rs3,000-4,000 crore debt in the next couple of years. However, if PMC happens, we will have to raise Rs2,000 crore shortly,” adds Grover. He currently holds 20 per cent equity after round D. Three more serious bidders are reportedly in the fray to take over the reins of PMC.

Brisk growth

Undoubtedly, it has been a case of extraordinary brisk growth for BharatPe in an environment where digitisation is the new flavour. And with its pointed merchant-centricity, it has probably made the most of existing and emerging opportunities, the latter triggered by the Corona crisis. But what about the possible competition which may come from the big players of the digital payment game? In terms of merchants’ volume, Paytm and PhonePe (in online and offline modes) claim to have over 15 million members.

And between them, Paytm more specifically, is now also keen to develop a merchant specific loan portfolio. Late last year in a formal note, a senior official of the company maintained one of its targets is the disbursement of loans to MSMEs to the tune of Rs1,000 crore by March 2021. Claiming to have equipped over 17 million merchant partners across the country with Paytm’s All-in-One QR, facilitating them to receive payments through Paytm wallet, bank accounts (both proprietary and third party), UPI and Rupay Cards directly into their bank accounts at 0 per cent fee, Bhavesh Gupta, CEO, Paytm Lending, had expressed his company’s intention of further deepening its engagement with merchant partners vis-a-vis specially designed credit products for them.

“With our collateral-free instant loans, we are trying to help kirana stores and other small business owners, who have been left behind by the traditional banking sector and do not have easy access to loans and credit. Going forward, we will especially focus on EDC (electronic data capture) merchants and provide higher loan amounts based on their EDC transactions,” he said. The company, however, did not respond to a specific query from Business India on their near to medium run plans to further grow the merchant credit portfolio.

-

For our regular growth plan, we will need to further raise Rs700 crore in the form of equity in the next one year, while we plan to raise Rs3,000-4,000 crore debt in the next couple of years

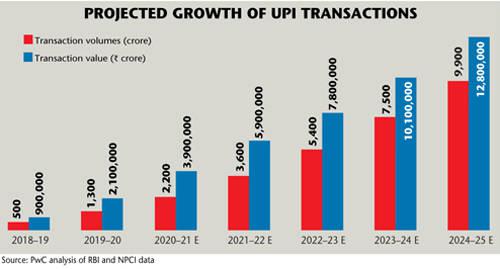

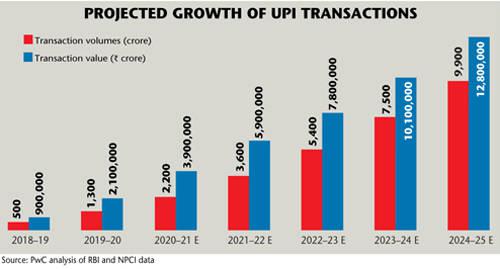

Noted domain experts like Mihir Gandhi, partner & leader (Payments Transformation), PwC India, and author of the report on the digital payment scene till 2025, however, say established players will definitely look to increase their presence in the domain. “Within the digital payment basket, the share of P2M (person to merchant) transactions is likely to reach the range of 50-60 per cent by 2025 from the current level of 40 per cent. Therefore, pushing product categories like lending to merchants could be considered a good opportunity by existing platforms, which have a large merchants base,” says he. Gandhi, however, cautions: “My estimate is that 15-18 million merchants have been on-boarded on the offline UPI platforms. It would be critical to reach a greater volume of traders in Tier III and Tier IV locations. There will be a serious cost involved in merchant acquisition going ahead. At the same time, the companies will have to ensure that the merchants who are registered with them should become more active and participative in taking advantage of their services.”

Rohit Bhayana, a noted fintech analyst and a former senior official with two leading digital payment platforms (Mobikwik & Airtel Payment Bank), feels BharatPe, with its merchant specific orientation, certainly appears to be different. “Paytm and PhonePe are bigger entities and have a formidable merchant base as part of their portfolio. But further cracking the consumer side of the business will remain their focus for the next few years. For BharatPe, however, merchant business is the core. If they get a banking licence at this stage, it could well give them a further edge in terms of engagement with the underserved merchant class. I think, a few years down the line, they would like to be compared more with well-run fintech firms or NBFCs than digital payment platforms.” So, some of those observing from close quarters seem to have already bought the theory that while trying to penetrate the gigantic 20-million retailers’ market with digital financial products, BharatPe will eventually emerge as quite a different kettle of fish.