-

In five years Bandhan’s employee strength has increased from 13,000 to around 42,000

Bandhan is India’s youngest bank and is focussed on serving the needs of the unbanked and under-banked sections of society. In the last five years, it has transformed itself into a robust and granular retail banking franchise, garnering a steady volume of retail deposits. This helped inculcate a habit of financial savings among its customers and also allowed the bank to further bring down interest rates for borrowers.

After becoming a bank, Bandhan Bank spread its reach to diverse corners of India. Today, it has a presence across 34 states and union territories via its 4,559 banking outlets and 485 ATMs. Apart from its microcredit offerings, which account for 64 per cent of its portfolio, the bank has extended into several new products such as loans to micro, small and medium enterprises, gold loans and affordable housing finance.

In these five years, Bandhan’s employee strength has increased from 13,000 to around 42,000. Apart from the direct employment created by the bank, it has also helped in the creation of a multitude of indirect jobs. Not only did the bank’s 1.12 crore micro borrowers ensure their own livelihood but they also created an additional 1.12 crore jobs.

Bandhan Bank enjoys strong customer connect. “Bandhan has changed my life. I cannot imagine my life without Bandhan,” says Alpana Das, a saree seller in Tripura who has been associated with Bandhan since 2006. She has been taking loans from Bandhan to grow her stock of sarees. Currently, she owns a saree store and is running it successfully. Her son now works in a private company and her daughter is a medical student in Burdwan, West Bengal.

In the last five years the bank’s total business increased to Rs1,28,928 crore in FY20 from R27,682 crore in FY16. And deposits have grown to Rs57,082 crore from Rs12,089 crore. Similarly, profit after tax rose to Rs3,024 crore in FY20 as against Rs275 crore in FY16.

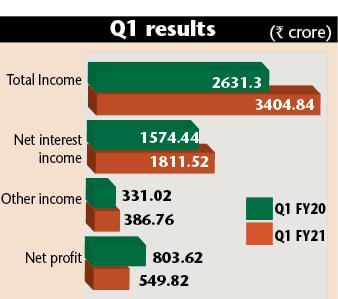

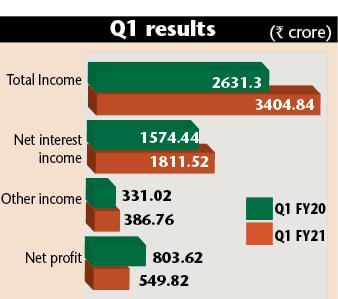

Bandhan Bank reported a 31.58 per cent drop in net profits to Rs542.82 crore in the first quarter ended in June 2021 as against Rs803.62 crore in the corresponding quarter of the previous financial year. The market cap of the bank is Rs51,095 crore with the share price hovering at Rs314. The decline of the Q1 profit was due to the lockdown. In Q1 FY21, the bank has taken accelerated/additional provisions on standard assets amounting to Rs750 crore for Covid-19 to protect the balance sheet from potential defaulters in future. This is over and above the Rs690 crore worth of provision made in the three months ended in March.

Steady increase in collections

At the time of the first lockdown in the country on 25 March, Bandhan voluntarily extended the moratorium to its entire micro-banking customer base, since the lockdown made it difficult for the bank’s field officers to reach its borrowers and vice versa. Later, there was a steady increase in collection efficiency. “The overall collection in value for the bank was at 76 per cent in June rather than the 29 per cent in April. This has also continued to steadily rise even after June and in areas where our branches are operational and there is no lockdown, our collection efficiency in micro-banking is at around 90 per cent,” says Ghosh.

-

Expanding its reach. Photo credit: Sajal Bose

In March, the Reserve Bank of India (RBI) permitted all commercial banks and NBFCs, including housing finance and microfinance institutions, to allow a three month’s moratorium on payments of loan instalments outstanding as on 1 March 2020, due to the Coronavirus lockdown. Subsequently, RBI extended the moratorium for another three months, till 31 August. But some borrowers filed a petition in the Supreme Court seeking an interest waiver for the RBI-prescribed moratorium.

The Supreme Court, on 3 September, ordered that accounts that have not been declared non-performing assets as on 31 August should not be declared NPA for two more months. The court will hear the plea related to waiving interest on instalments during the period of the loan moratorium scheme. Banks should take no action against borrowers that is coercive, ordered the court. The matter has been adjourned to 10 September.

Bandhan faced some recovery challenges in Assam in the third quarter of the last financial year due to anti-CAA protests and some anti-microfinance agitations. As soon as both the problems normalised, the collection ratio improved.

However, in the latest research report on Bandhan Bank, Goldman Sachs stated that aggressive growth in top-up loans could be perceived as risky, given potential ever-greening concerns. Reacting to that Ghosh explains: “All loans at Bandhan Bank are given after careful due diligence and assessment of a borrower’s creditworthiness and precautions are taken to ensure that a borrower doesn’t get overburdened.”

He refuted any claims that NPA would rise significantly in the next few quarters. Ghosh says: “Over 70 per cent of our borrowers are engaged in essential livelihood activities such as agriculture and allied activities, small retail, food processing and local mobility. Their businesses are mostly dependent on a local supply chain and therefore not that impacted due to the pandemic. Our previous experience with demonetisation and cyclones and floods across states has been that once the situation normalises, people start repaying.”

The report from Goldman Sachs also stated: “A strong deposit franchise would not only help Bandhan have a stable and low-cost liquidity base but also support the bank to acquire a better quality portfolio in its other businesses. In our view, this would help de-risk the business to a great degree without diluting the return ratios.”

Last year Bandhan Bank acquired Limited's stake in Gruh Finance – an affordable housing finance company. The acquisition and merger of Gruh Finance with Bandhan Bank gave Bandhan Bank a well-diversified portfolio of secured as well as unsecured assets, as well as short-term and long-term asset books. As part of the deal, Bandhan Bank had transferred 14.9 per cent stake to HDFC for merging Gruh with itself. The share exchange ratio accepted by the boards of Bandhan Bank and Gruh is 568 equity shares of a face value of Rs10 each of Bandhan Bank to be issued for every 1,000 equity shares of a face value of Rs2 each of Gruh.

-

To comply with the RBI’s licence rule Bandhan Bank further diluted the 20.9 per cent stake of the bank’s holding company

Post-merger, the shareholding of Bandhan Financial Holdings Limited (BFHL) in Bandhan Bank was reduced from 82.3 per cent to 61.0 per cent. It was a first step towards a reduction to 40 per cent as directed by the RBI, based on the norms for holding of promoters in a private sector bank. The RBI’s new licensing guidelines stipulate that Bandhan Bank’s promoter will have to reduce its stake from 82 per cent to 40 per cent within three years, to 20 per cent within 10 years and to 15 per cent within 12 years of commencing its business.

“It helped us enter the market of affordable housing finance with a sizeable portfolio from day one, and gave us an edge in this business due to the deep expertise of the team that has an experience of around three decades in this business,” says Ghosh.

Innovative product

The affordable housing segment in India is poised for growth due to the significant gap between demand and supply that exists across various Indian states. Deepak Parekh, Chairman, HDFC, stated: “Bandhan Bank and Gruh have similar core values, business ethics and are committed to financial inclusion. This merger will create one of the largest rural and semi-urban lending platforms in India.”

Recently, the bank launched a micro home loan with a ticket size of around Rs5 lakh for customers in rural areas. Such loans are ideal for rural borrowers who want to convert their mud house into a pucca house; or repair their existing house or extend it by adding a room. The micro home loan product will help these customers reduce dependence on informal syndicates and moneylenders who charge exorbitant rates of interest. “The initial feedback to this new and innovative product has been very encouraging,” the bank claims.

To comply with the RBI’s licence rule Bandhan Bank further diluted the 20.9 per cent stake of the bank’s holding company, BFHL, through a secondary market sale for Rs10,600 crore. The existing shareholders, including GIC and Temasek of Singapore, US-based PE funds Blackrock and SBI Mutual Fund, bought 337.4 million shares. With this, Bandhan Bank has reduced its stake to 40 per cent. Subsequent to this, the RBI has withdrawn the restrictions imposed on the bank.

-

Incidentally, the RBI in September 2018 had imposed restrictions on Bandhan Bank for non-compliance with its licensing condition by reducing the promoter holding to 40 per cent. Hence, the RBI barred the bank from opening new branches and also stopped the remuneration of the MD and CEO.

As a part of the bank’s ‘vision 2025’ the aspiration continues to be to expand its reach as an affordable financial institution, which provides simple, cost effective and innovative financial solutions in an inclusive and responsible manner.

Key focus areas in the next five years will be diversification of asset portfolio with modern underwriting and collection capabilities and strengthening people capabilities, including by hiring fresh talent for growth. The bank will focus on development of in-house technology, analytics and digital capabilities and consolidation of CASA (current account savings account) by developing deeper customer engagement. Bandhan will aggressively look at MSME – an important engine of the economic growth of the country. But a veteran in the sector points out that the bank needs to have more skilled banking personnel to be able to perform more efficiently as a commercial bank.

Bandhan has banking outlets in 34 states and Union Territories in the country. However, due to the heritage of the bank, the eastern region constitutes 60 per cent of its outlets. The management has the ability to strengthen its pan-India presence and roll out more products and services for its customers. Ghosh says: “The acquisition of Gruh has also helped us gain a strong footprint in west and west-central India and we will continue to ramp up our business and presence in other regions, going forward.”