-

India, like other countries, has in the first instance announced many social measures to ease the pain for the needy and those below the poverty line. More resources towards implementation of MNREGA to provide employment on the rural side has been but one of them. RBI has also done its bit in ensuring enough liquidity is in the system for meeting the needs of the MSMEs and large corporates. Quantitative easing has contributed to the global markets’ exuberance. India announced a relief package of Rs20 lakh crore while the US announced assistance of $3 trillion and Europe roughly €1.2 trillion.

Disconnect between markets and economy

India Inc is not, however, impressed by the overt optimism of the stock markets. There is a sharp disconnect between the markets and the Indian economy. The managements of most companies are not really concerned with a v-shaped or u-shaped or w-shaped recovery. They seem to prefer to err on the side of caution. After experiencing the pains of lockdown, witnessed in compressed demand, reduced costs through lay-offs and salary cuts, their managements feel it is better to be prepared for any eventual uncertainties. Many industries are still reeling under the impact of the seismic earthquakes in the financial sector over the last couple of decades and recovery seems far away. While recovery is a given, it will be a slow-paced, almost snail-like recovery.

Many companies have chosen to accept a moratorium during the lockdown period and may face difficulties once the moratorium period ends. NPA proceedings, currently in abeyance, against delinquent borrowers, may also commence in the post-lockdown period. Post the lockdown, a manthan (change, shakeout) in the corporate sector is more than likely to happen. Some industries may shrink permanently while some, like digital and technology which have flourished even during the crisis, will continue to do so.

CRISIL’s analysis of the Covid-19 pandemic-led lockdown on 35 sectors, across manufacturing and services excluding financial services, reveals that nearly half of them have a sizeable and immediate revenue impact of around 15 per cent this year (see box for more details). Subodh Rai, senior director, Ratings, points out: “This sudden loss of revenue has impacted the liquidity profiles of these companies, and their ability to manage would depend on both external (sectoral demand recovery) and internal (cash buffer and leverage profiles) factors.”

-

While the first quarter was a virtual washout for most, pain in aviation, travel and tourism, hospitality, gem & jewellery is likely to linger

Most large companies have suffered both production and sales losses. Tata Steel in its reports stated that mobility restrictions severely impacted industrial activity and consumer sentiments across all geographies. Tata Steel’s production in India was down by a third. And production in Europe, despite there being no lockdown, was also low as was its South-East Asian operations. Hindustan Unilever, generally regarded as a proxy for the FMCG companies also reported a decline of 7 per cent in volumes sales. The company, which amalgamated with GSK Consumer Healthcare in a share-swap deal valued at Rs40,242 crore during the lockdown in April 2020, saw combined sales move up by just 4 per cent. Added to this was the disruption in supplies and contraction in demand during the lockdown. Bajaj Auto, across its three plants, saw shutdowns for periods ranging between 28-43 days.

The magnitude of pain is varying across industries. While the first quarter was a virtual washout for most, pain in aviation, travel and tourism, hospitality, gem & jewellery is likely to linger for a much longer time. The one which is most badly hit is realty. Heavy leverage, lack of funds to meet working capital requirements in the face of negligible demand, especially in the residential segments in urban cities, is likely to accelerate consolidation in the sector, which was anyway reeling under pressure even before Covid.

The new mantra – raise funds, be prepared for future shocks

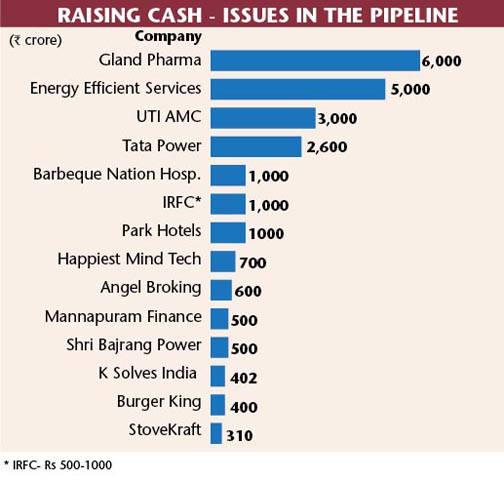

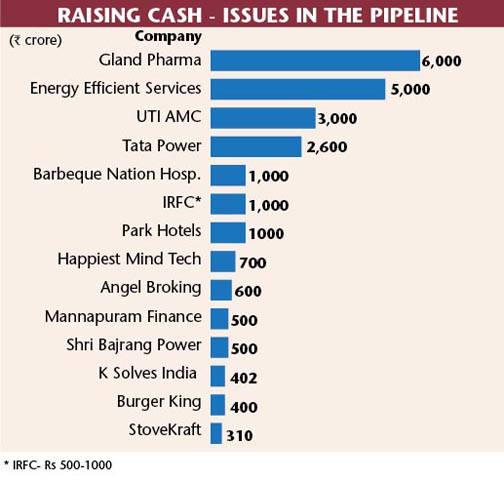

The point is that while some industries are more shaken than others, most managements of companies are in a cautious mood. Conserving cash where they have it, reducing costs, or raising money to tide over uncertain times. Raising funds by various modes, monetisation of assets, sale of asset, offering rights or QIPs, or, in the worst case borrow, are the new mantras.

Borrow to refinance debt or keep cash for comfort and ensure that there is sufficient cash when business starts growing in the future. Early in April, Deepak Parekh, chairman HDFC, said that companies must increase capital. It is better to be overcapitalised than being overleveraged. The environment is also conducive to raising capital, both offshore as also on-shore. HDFC, which is planning to raise upto Rs40,000 crore is also looking at opportunistic growth through takeovers in the case of group companies.

-

Good companies always raise cash when it is available. It helps to tide over the rocky weather. Most are not raising for growth but to meet exigencies

Vimal Bhandari, Arka Fincap

Vimal Bhandari, vice-chairman, Arka Fincap Ltd says: “Surplus liquidity is sloshing around. Companies realise that over the next two years, uncertainty is bound to remain. Good companies always raise cash when it is available. It helps to tide over the rocky weather. Most are not raising for growth but to meet exigencies.”

Since January 2020, even as Covid hit Indian shores, companies had started raising capital in a big way. Reliance Industries was the first to monetise its telecom arm and raised funds by offering equity to several marquee investors including Facebook and other private equities (see Business India, ‘The Transformer’ dated 1-14 June). It also raised Rs54,000 crore through issue of rights. Yes Bank raised Rs15,000 crore. The bank, which after the problems in which it was enmeshed, was nursed by SBI and team to stay afloat. Aditya Birla Fashions and Investments’ rights issue which concluded on 22 July raised a little under R1,000 crore. Arvind Fashions raised Rs400 crore. The total amount raised through equity offerings, rights, IPOs and QIPs during the period of 1 January to 15 July is close to Rs92,000 crore.

SEBI, on its part, has also done its bit in facilitating raising funds through a rights issue. Following its relaxation in guidelines in November 2019, it laid a framework for raising money from shareholders and made it an easy option. As against 90 per cent subscription required earlier, only 75 per cent is required currently. Rights entitlements have to be given in demat format to allow shareholders to trade in the entitlement. The overall time to complete this has also been reduced to 32 days as against 56 days. Rights are also simpler as raising through a QIP or public issue requires the permission of the shareholders at an EGM.

“Survival may be the issue for some. For most companies, however, survival is not the issue,” says Sunil Singhania, founder Abacus Asset Management LLP. “They have a much healthier balance sheet than they had during the financial crisis of 2008. Stronger companies are fortifying themselves to ensure that post-Covid they are in a better position to grow faster.” Singhania feels that with global interest rates likely to remain low over the next few years and the US dollar likely to remain flat or become weak, US investors are looking at investing overseas.”

Cash management has become a priority and even companies which are cash rich are using cash to fortify their relations with vendors.

-

Demand has been only for the highest rated papers, which has seen many lower rated or riskier papers not getting money

Says Sanjay Agrawal, CFO, Jyothy Labs: “These are indeed tough times for every business. A good business targets market share but at Jyothy Labs, we strongly believe in the power of relationships. At the end of March 2020, despite the lockdown and constraints, we paid our suppliers in advance to enable them to meet their cash flow commitments. When the lockdown restrictions were eased, our relations with our suppliers gave us an edge as they prioritised us and enabled an immediate resumption of our operations.”

Some companies are raising capital to ensure enough liquidity and deleverage the balance sheet, as was done by Reliance Industries. “Equity for the BFSI sector is raised to strengthen the balance sheet and build a buffer to absorb shocks and leverage them when the environment improves, as is likely over the next couple of quarters,” says Karthik Srinivasan, head of financial sector ratings, ICRA.

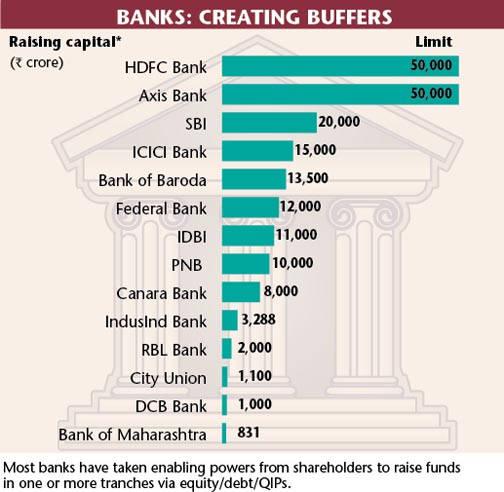

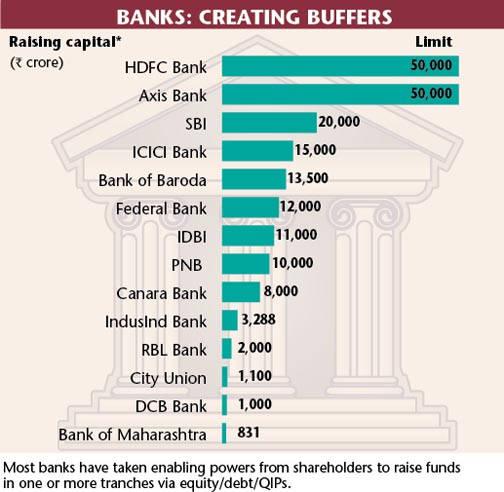

Banks & NBFCs to shore up capital

Besides industries, banks and NBFCs are also in fundraising mode. Kotak Mahindra Bank, HDFC Bank and Axis Bank have raised funds or are in the process of raising them. Several enabling resolutions are to be passed at the AGM in the coming fortnight. HDFC Bank is planning to raise Rs13,000 crore, Axis Bank Rs15,000 crore and HDFC Rs14,000 crore though the enabling resolution may be far higher. Kotak Mahindra Bank has already raised Rs7,442 crore by QIPs. SBI has its board meeting on 30 July.

PNB is raising Rs10,000 crore, PNB Housing, Rs1,700 crore. Bank of Baroda and City Union Bank are some of the others which will be joining the queue. QIPs, Follow on Public Offers and debt are the preferred ways of raising cash to meet the capital adequacy norms as also be sufficient to meet future growth demand. Yes Bank recently raised Rs15,000 crore through an FPO.

“Besides meeting enhanced working capital requirements, both banks and companies are also raising funds for takeovers. Given the high valuations offered, some companies are using shares as currency in takeovers,” says Sunil Damania, CIO, Marketsmojo.com, a fintech company providing a wealth of data on companies and markets, adding that there are good opportunities in both domestic and global markets.

-

During the lockdown, with the objective of giving relief to borrowers, RBI had allowed corporate and retail borrowers a moratorium on interest payment of loans for three months, extended by another three months to 31 August, 2020. In the case of weak borrowers, especially in the real estate sector, which was under stress, NPA recognition in these cases would be deferred till 31 August.

Adequate provisions would be required to be made. In some cases it also makes sense to raise capital available at low interest rates to pay off earlier loans. Says A. Balasubramanian, CEO, Birla Capital Asset Management Company: “No one is lending in a hurry. RBI has done its bit in asking banks to accelerate the transmission of reduced rates. But rightly or otherwise, banks remain choosy. Against such a scenario, where debtors are also pussy-footing in paying their dues, it becomes imperative to raise cash. Money has to be in rotation. Besides, companies are also looking at refinancing debt; some are looking at future growth and others to strengthen their debt-equity ratios. For asset-driven industries, refinance is the biggest advantage in these markets.”

In the case of debt, RBI had also played its part in ensuring enough liquidity in the system and enough cash is available to meet the needs of the economy. Relaxations in CPs/CDs, Long term Reverse Repo Operations and Targeted Long term Reverse Repo Operations through bonds in tenure ranging from 1-3 years really helped in reducing interest rates. RBI, on its part, also lowered repo rates by 115 basis points since the beginning of March. “RBI has done good work but the problem is that transmission has not happened to the desired level.

Demand has been only for the highest rated papers, which has seen many lower rated or riskier papers not getting money and with the lockdown we have seen lower issuances from NBFCs. Hence have seen a sharp drop of 43 per cent in CPs issued between 1 April to 15 July,” says Dharmesh Ojha, director, ITI Gilts, an Investment Trust of India group company. Ojha feels that risk aversion is very much present and only the best of the best rated companies have been able to raise funds through CPs. Ojha points out that PSU bonds have been the major issuers in this period.

It is but obvious that good money, be it equity or debt, will flow into quality assets initially. However given the huge flood of money in the global markets, it will be a matter of time before cash-givers start looking at putting money in marginally risky and thereafter more risky assets. The future is clearly uncertain. Companies like Reliance Industries have raised enough cash to make themselves cash-free. Companies like Tata Motors and Tata Steel may have enough cash to tide over the uncertain times. Tata Sons, the holding company, is anyway raising money to shore up their stake in the company and, if required, to pump in fresh money.

Certain companies like Future group may be taken over. Others may have to search for buyers. One thing is clear – there is going to be noticeable change in the corporate sector. If the pandemic lasts for a long period, some companies may well be forced to exit. Change in the post-Covid era is inevitable. Staying liquid will not always underwrite survival in difficult times but without cash, death is inevitable. Cash will at least provide a decent chance of making a comeback.