The US is home to many tech giants, who are at the receiving end of the digital service tax (DST) levied by India and other countries. So, it came as no surprise when the US trade representative (USTR) said that decisions by India, Italy and Turkey to tax local revenue of Internet giants, such as Facebook, Amazon and Google discriminates against American companies. The taxes are “inconsistent with prevailing principles of international taxation, and burden or restricts US commerce,” the office of the US Trade Representative said in a statement, but added that it won’t be taking action against the countries for now. In particular, USTR’s report points out that: “India’s DST is an outlier. It taxes numerous categories of digital service that are not leviable under other DSTs adopted around the world. This brings more US companies within the scope of the DST and makes the measure significantly more burdensome.” In June, the USTR started investigations into the moves of at least 10 countries, citing Section 301 of the US Trade Act of 1974, which allows it to retaliate for trade practices it deems unfair. It’s the same tool used to justify US tariffs on Chinese goods for alleged theft of intellectual property. Should the US decide to impose duties on imports from these countries as a retaliatory trade measure, it likely would be up to the incoming Biden administration to implement that decision – as time is running out for the current USTR to prepare tariff lists and go through a public comment period before the duties take effect. Last year, India expanded the scope of the Equalisation Levy, or DST, to the sale of goods and services in the country by overseas e-commerce firms. Responding to US allegations, the Modi government said the tax is neither discriminatory nor extra-territorial, and is consistent with India’s commitments under the World Trade Organisation and global taxation agreements. However, there was no consensus on the issue. New provision The Equalisation Levy was introduced for the first time in 2016 as 6 per cent tax on revenues earned by non-residents from online advertising and related services. The burden of this tax eventually fell on local firms advertising on these platforms. In March, the government expanded the scope of this levy to include the sale of goods and services in the country by overseas e-commerce operators. The transactions will be taxed at 2 per cent, if businesses earned more than Rs2 crore. The new provision is applicable from 1 April 2020. Globally, the rate of digital tax varies from 1.5 per cent (in Poland and Kenya) to 15 per cent (Paraguay). In Europe, the tax rate varies from 3 per cent (France, UK, Spain) to 7.5 per cent (Hungary).

-

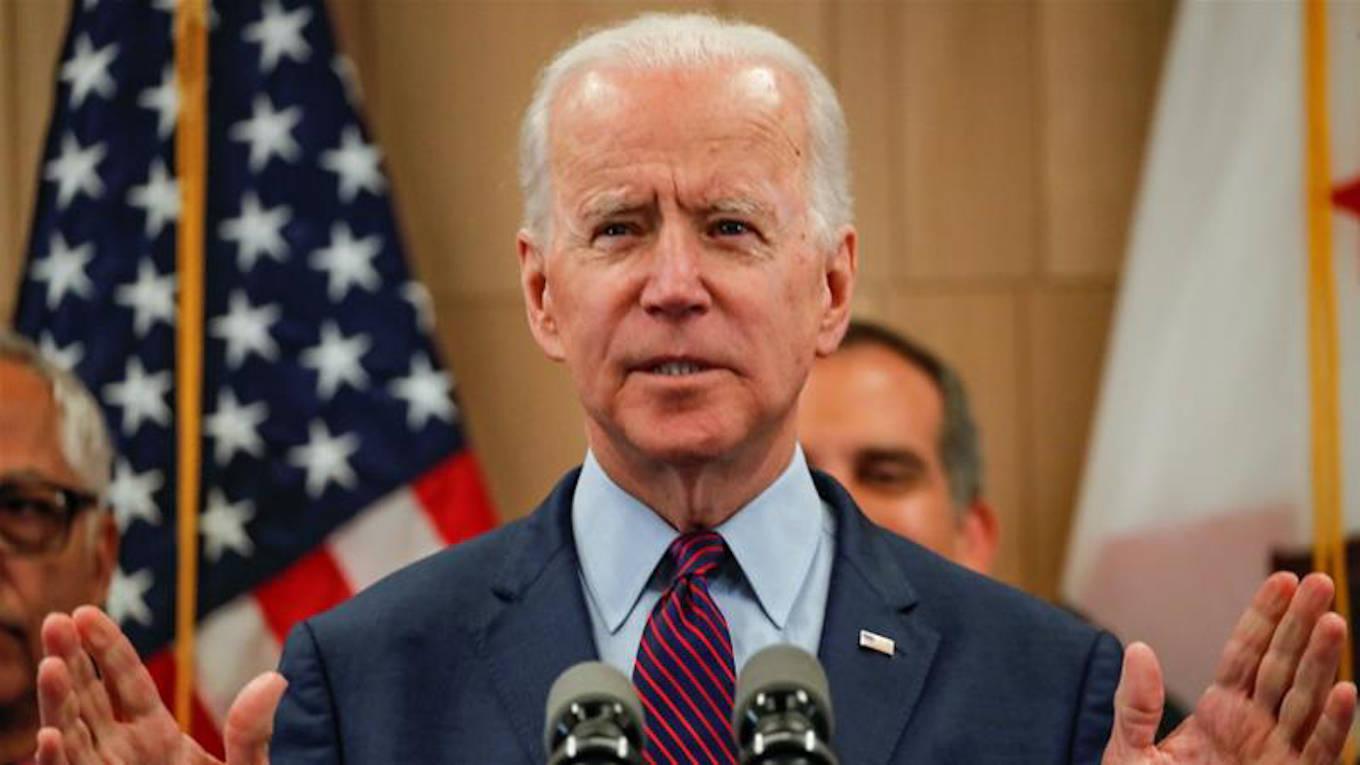

Biden: will he halt the dilly-dallying on DST?