-

Anvar: focusing on innovations and customer experience

In the 1980s, ELGi began selling under its own brand name in a big way. This decade marked the rapid growth of the compressor business across both the domestic and export markets. More specifically, the ELGi brand was acquiring wide acceptance in the erstwhile USSR. In the late 1980s, ELGi’s global footprint grew significantly. While exports to the USSR, Sri Lanka, Nepal, Bangladesh, Malaysia, the Middle East, West Germany, Australia, Mauritius, and African countries continued, enquiries from new overseas markets emerged.

The last 25 years or so have been a game changer for the company as it consciously decided to focus on the compressor and automotive equipment businesses, even as other group businesses such as braking systems for trucks, pasteurisers and washers for breweries and drip irrigation systems, were shut down or divested. In 2007, however, ELGi transferred its automotive equipment business to a separate company, a wholly-owned subsidiary called ATS ELGi.

Moreover, ELGi also focused on building strong manufacturing and quality systems, with internal capabilities to develop its own technology and products. This is unlike in early years when it would heavily depend on foreign technologies for manufacturing its products. Today, it has built a strong R&D capability and most of its portfolio products and innovations are indigenously designed and developed.

The Rs1,900-crore company has earned worldwide accolades for designing customer-centric, compressed air solutions that are sustainable, and help companies achieve their productivity goals while ensuring a lower total cost of ownership. ELGi’s portfolio of 400+ products, range from oil-lubricated and oil-free rotary screw, centrifugal and reciprocating compressors, to dryers, filters, and downstream accessories.

Backed by a 2,000-odd workforce, ELGi has state-of-the-art manufacturing facilities in India, Italy and the US with high standards of quality and safety. This apart, the company has its own foundry and a pressure vessel plant to produce pressure vessels meeting global standards. Around two years ago, the company also commissioned a motor manufacturing plant at an estimated cost of around Rs18.20 crore. This supplies motors for inhouse consumption. The company has parts warehousing facilities spread over 100,000 sq ft globally.

Strategic business plan

Last year, while the company was celebrating its 60th anniversary, it started the process of rolling out its Strategic Business Plan (SBP) which is aimed at taking its revenue to $400 million by 2025-26. Besides increasing revenue, the SBP is focusing on setting goals on profitability and returns. ELGi has the ambitious aspiration to be among the top three air compressor brands across the globe. This apart, SBP will focus on backward integration; product upgrades and new products; increasing installations to grow after-market revenue; talent development & management; digital strategy; brand building; aggressive working capital management as also strategic divestment of non-core portfolios and real estate.

Currently, ELGi is ranked number seven in the world, and to accomplish its aspirational target, the company’s market-facing dimensions of strategy (where to play?) include, in addition to organic growth, business acquisitions across the world with a specific focus on India, Europe, USA, and Australia. On the value proposition dimensions of strategy (how to win?), ELGi focusses on innovations centred on energy-efficiency and quality, to be the best in the world.

“ELGi has evolved from an uncompetitive presence in multiple industries to being razor focused on building a leadership position in the global compressed air business through innovation and customer focus. The global compressed air industry is large and ELGi has a fairly low share. Thus, we expect to grow our share by building our talent, process, and technology,” states Anvar Jay Varadaraj, 35, Executive Director, ELGi, who is also the son of the current managing director.

-

“While we are proud of where we are today, we will continue to set new goals. Recently, the strategies formulated under our SBP will help the company move into the next growth phase. The SBP embeds a financial plan focused on setting goals on revenue, profitability and returns as we eagerly look to be among the top three air compressor makers going forward,” says Varadaraj, 59, managing director, ELGi.

In 2016, the company rolled out a Go-To-Market (GTM) strategy in India that Varadaraj believes, has deepened the company’s awareness of the market opportunity, created greater consideration from customers and ensured higher conversion of enquiries. “The result of this can be seen from our growth in specific products. We have rolled out similar GTM strategies in the strategic markets that we have chosen to participate in. We are confident that we will see results in these markets as well. Besides the organic GTM strategies, we have over the years, grown the business inorganically through acquisitions. We have made six acquisitions in the past eight years and except for one, all of them have enabled the company to gain the traction required in the strategic markets.”

Building vertical excellence

ELGi has also recognised the need to adopt a management philosophy that builds vertical excellence in each operating function and customer-centric horizontal excellence across the business, operations, and support functions. Over the years, the company has developed world class manufacturing and quality systems, cutting edge technological capabilities and the world’s best warranty and service solutions.

These pursuits were done in a systematic, process-oriented manner adopting principles of Total Quality Management (TQM). ELGi’s commitment to quality, coupled with TQM excellence, led ELGi to win the Deming Prize in 2019, becoming one of the first compressor manufacturers to do so in over 60 years. TQM is now part of the DNA of the company.

“The Deming prize is the recognition of the way we conduct our business – how customer-centric we are, not just in our statements but in the actual processes that we follow in the company. It’s a very detailed process of audit that is done in two phases by a team of four people in each phase, where they reach into the minute details of how our processes are working, how they are aligned to customers & employees, etc. The fact that we have been recognised as a Deming company means that our processes in every function are extremely customer-centric & employee-friendly. But I can’t make the statement that another company that is not Deming is not focused on customers. However, the fact that we are recognised as Deming means that we have that centricity in our processes,” explains Varadaraj, whose father had started by making reciprocating air compressors for a German company Pumpenfabrik GmbH on a licencing agreement.

Prior to this, his father was engaged in the bus body-building business in Karur, Tamil Nadu. His grandfather LRG Naidu, a first-generation entrepreneur, was into the bus transport business. In the late 1950s and early 1960s, his father along with his other uncles, decided to move out of transport business and got into manufacturing in order to capitalise on the national movement towards indigenisation. They separately set up facilities to make automotive chains, reclaim rubber, air compressor and garage equipment.

-

The company has modern manufacturing facilities for air compressors

Over the years, ELGi diversified into multiple businesses and in 1992, after Varadaraj joined the company’s board as deputy managing director, it decided to focus on air compressors and the automotive equipment business. The company is currently, the seventh largest air compressor maker in the word and aims to be among the top three makers in the next few years. In his quest to take the company to that level, Varadaraj has also been joined by his son, Anvar Jay Varadaraj.

Anvar started with ELGi in 2015, when he established ELGi’s marketing and communications function and activities to build the ELGi brand and support the company’s ‘CK2’ aspirations. He moved to Charlotte, North Carolina, in 2018 to establish ELGi’s North American marketing division. He continues to mentor ELGi’s marketing organisations while supporting the company’s strategic, long-term goals.

Following undergraduate degrees in Economics and Philosophy at the University of Michigan, Ann Arbor, Anvar began his professional career at Target Corporation in Minneapolis. In 2013, he pursued his MBA at Cornell University specialising in marketing and brand management.

While the company continued its journey, in 2013, after gaining a granular understanding of the global opportunity, the management defined the aspiration more specifically with a timeline. The aspiration was to become number two in the world in air compressors by the year 2027. This was titled CK2 or Conquer K2, the second tallest mountain in the world and the most difficult to climb and it symbolised their intended journey.

However, since then multiple events transpired, both internally and externally, which required the company to recalibrate the specificity of its aspirations. Internally, many of the company’s global initiatives took longer to gain traction. Externally, there have been mergers and acquisitions, amongst its global competitors and that changed the structure of the global market. In 2019, the number two (Ingersoll Rand’s industrial segment; revenue stood at around $3.32 billion) and the number three (Gardner Denver; revenue: around $2.69) players merged to form the new number 2 at a much higher revenue level. Most importantly, the gap between the number one player (Atlas Copco; Compressor technique segment revenue: around $5 billion) and the number two player was almost 70 per cent and that was where ELGi had seen the opportunity to become number two.

Growing market

All these global players are also key competitors of ELGi in the Indian compressor market which was pegged at around $2 billion in 2019 and it is projected to advance at a CAGR of 6.2 per cent during 2020–30. The growing automotive sector in India is expected to drive the demand for compressors. Additionally, the manufacturing sector in India is also gaining some momentum.

-

ELGi is the 7th largest air compressor player in the world

“Though we have recalibrated our aspiration, CK2 remains a strong rallying point within the organisation. We will continue to view this as our directional guide – to be among the top three players in the air compressor business worldwide. Since such internal and external influences will warrant periodic recalibration, we will define the sales and market position metrics at short intervals. Considering the current impact of the pandemic, we are working towards defining the medium-term revenue target and the timelines for the same,” says Varadaraj.

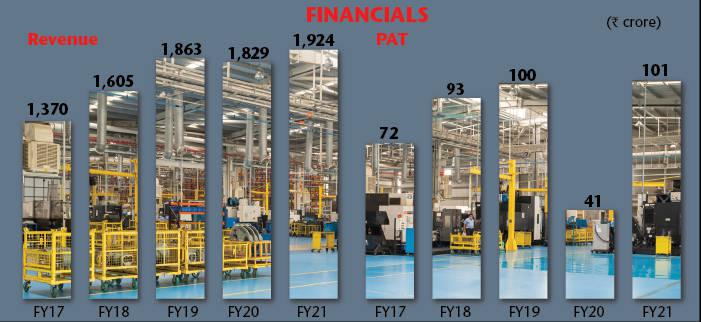

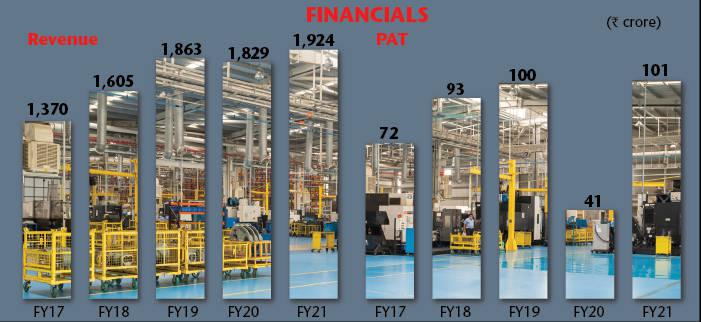

During the last financial year of FY21 despite all the Covid-related challenges, the company has shown a great deal of resilience as its revenue grew by around five per cent to Rs1,924 crore from Rs1,829 in FY20. However, the company pulled off a remarkable performance in terms of profitability, as PAT more than doubled to Rs101 crore from Rs42.60 crore in the previous year. The stock prices have surge over 65 per cent to around Rs208 in the last one year.

“The year, 2020-21 was unique in many ways and the financials reported for the year do not truly reflect the challenges that the business faced. Starting a financial year with a complete lockdown of the economy in the two key markets for the company, India and Italy, and recording a near-zero revenue in the first month (April, 2020) in some of the key markets, set a challenging tone for the year,” says the ELGi MD.

“India was only about 1 per cent growth. The bulk of our growth came from North America, Europe and Australia. So, the internationalisation of the business has really helped us during this period. It is a positive thing and it is the right thing to do and this is a validation that we are moving along in the right direction,” he adds..

The company is all set to improve its performance during the current fiscal year if the first quarter performance is any indication, where the revenue has gone up to Rs489 crore from Rs286 crore and PAT was Rs12 crore as against a loss of Rs8.74 crore. However, the spiralling raw material cost continued to impact profitability.

-

The company’s recent resilience is also the result of multiple efforts it undertook to sustain quality and efficiency, while at the same time being cost competitive. “There was a need for strategic backward integration. Over the past five years, we have integrated backward to manufacture our own pressure vessels, castings, motors and key production machines.

These have given us better control over the quality of our products, efficiency of our products, cost of our products and inventory. These have yielded an increase in the value added internally from about 30 per cent to 60 per cent,” says Varadaraj who firmly believes that the company’s recent measures and efforts have put it in a much stronger position and going forward, it is ready to leverage them in a more structured manner.

Experts are of the opinion that the company is into a business that is quite profitable. Compressed air is required in almost all forms of manufacturing. This provides a diversified revenue source without a dependence on any specific industry vertical. Besides, the geographical opportunity reduces the risk of dependence on any one economy and its business cycle. The compressor business enjoys significant recurring revenue in the form of aftermarket parts and services.

Also, ELGi, as an organisation, has shown a great deal of determination and keenness to proactively deal with its customer and market requirements and has created a niche for itself in the market. The recent rolling out of the Strategic Business Plan clearly shows that the company, which has already been in the business for over six decades now, not only wants to sustain its business in the market but also grow this in a significant manner. It shows that the company is consciously adapting to changing market needs. It has put in place all the required measures and tools to pursue its next growth phase.