-

Bakshi: differentiated business strategy

“From inception, we have adopted a differentiated business strategy,” says Amit Bakshi, 46, chairman & managing director, Eris Lifesciences. “While most new entrants in our space started off with regional business models in acute therapies and focussed on local general physicians, we chose to build a pan-India cardio-metabolic business and pivoted around super-specialists. The team’s experience in cardio-metabolic therapies enabled us to successfully execute along this strategy and scale up the business to over Rs1,200 crore today.”

Backed by private equity fund ChrysCapital, the company has built up an extensive portfolio of about 650 registered products (across 100 mother brands), with a presence across lifestyle-related therapies like diabetes care, cardiac care, nutrition, central nervous system (CNS), gastroenterology and gynaecology. The Ahmedabad-based company’s unique patient care initiatives approach ensured it is today ranked 22 in India, having climbed seven ranks in the last three years and entered the elite list of the Top 25 pharmaceutical companies in India.

Eris, with its focus on super-specialists and high-end consulting physicians, caters to over 80,000 specialists and medical practioners across cities, through its 11 marketing divisions. Its pan-India distribution network of over 2,200 stockists and over 500,000 chemists give it a seamless presence across a much larger geography.

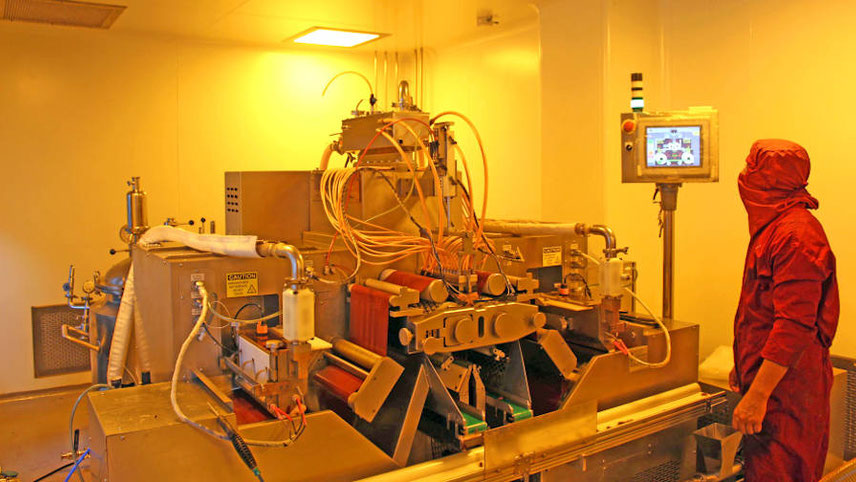

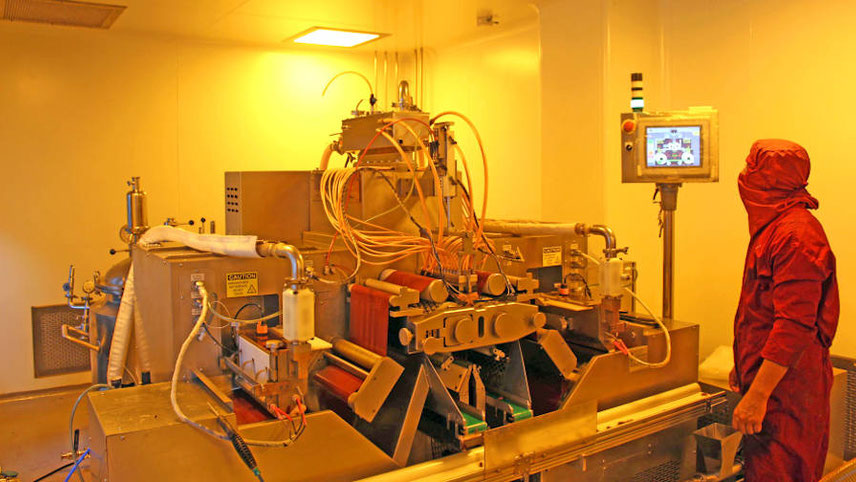

Backed by 4,000 employees (about 2,450 medical representatives) the company has a modern, fully integrated manufacturing facility (WHO GMP-compliant) in Guwahati, where it produces over 70 per cent of its branded formulations in-house. The Guwahati facility also enjoys income tax exemption till 2023-24 and GST subsidies till 2024-25.

As part of its strategy, Eris has differentiated itself in two ways – through generating actionable scientific evidence and patient care. The company has pioneered the generation of actionable medical evidence through initiatives such as the India Heart Study (IHS) and India Diabetes Study (IDS). These studies help in creating bodies of knowledge hitherto unknown and are paving the way for better management of health and treatment outcomes. The IHS, the only study of its kind on hypertension based on the Indian population, has been jointly accepted by the European Society of Hypertension and the International Society of Hypertension.

Multiple insights

The HIS study involved about 19,000 patients and over 1,200 doctors across India and focussed on understanding the diagnosis and treatment methods in hypertension. The company came up with multiple insights through this study, including the fact that nearly 45 per cent of hypertension cases in India are misdiagnosed and hence wrongly treated. This study was published in the Journal of Hypertension, the official journal of the International Society of Hypertension and the European Society of Hypertension.

On the back of this study, the company has just launched an IDS study, involving over 15,000 subjects and over 2,500 medical practitioners across India. The study is expected to generate insights to help customise the treatment protocol for diabetic patients, thereby improving long-term health outcomes. Thus, investing in generating actionable scientific evidence is the first pillar of the company’s engagement with medical practitioners.

Eris also boasts of a unique Patient Care Initiatives (PCI) platform, which enables it to bring cutting-edge healthcare solutions to its patients through the involvement and cooperation of key opinion leaders in its specialty businesses. These initiatives are focussed on bringing state-of-the-art diagnostic facilities and subsequent treatment options to patients.

In fact, what started as a small initiative has turned into a mammoth programme over the years and has helped tens of thousands of patients towards healthier lives through initiatives such as Ambulatory Blood Pressure Monitoring (ABPM), Sleep Study, CGM (Continuous Glucose Monitoring) on Call, Mobility Patron, ANC (Ante Natal Care) and more recently newer initiatives like ‘save kidney, save heart.’

-

Krishnakumar:building strong brands

Under the PCI platform, the company has popularised the use of ABPM in the country. ABPM is a 24-hour BP measurement technique and is the gold standard for diagnosing hypertension worldwide. It generates more insightful data on a patient’s health in comparison with spot BP measurement. This in turn enables the correct treatment and medicines to be prescribed to the patient. L

ikewise, it has also popularised the use of CGM, which is a much better technique to track and maintain blood sugar levels, compared to taking spot measurements. Understanding the movement of blood sugar levels in the body 24x7 helps doctors fine-tune their treatment, depending on the specific health conditions of patients.

“Our differentiated strategy, backed by generating actionable scientific evidence and patient care, has positioned us strongly in the market,” observes Bakshi. “We will continue to work around these two pillars and maintain the growth momentum. Today, we have emerged as one of India’s largest domestic branded formulations companies.”

After working with Indian and global pharmaceutical companies for over two decades, Bakshi founded Eris in 2007, focussing on driving applied innovation-led transformation in the domestic pharma industry. “He handles the strategic manager’s role for the company across all functions of our business and takes a long-term view of the business and believes in building enduring and sustainable brands,” says a company spokesperson.

Under his leadership, Eris has won multiple accolades and distinctions including the ‘Competitive Strategy Leadership Award’ by Frost & Sullivan and the Yes Bank Award in ‘Scalability of Business Model’, as also ‘Managing Operational Efficiencies’ in 2013. In June 2017, he successfully led the company to its maiden IPO. The Rs1,741-crore IPO was oversubscribed 3.3 times. The price band for the IPO was Rs600-603 per share. Validating his differentiated strategy, ChrysCapital invested about Rs195 crore for a 16 per cent stake in Eris in 2011.

It exited the company fully during the IPO, with over 6.9 times gain. However, the PE player, which has been betting big on the Indian pharma market, again took a 2.6 per cent exposure in the company in 2019, subsequently increasing it to 5.51 per cent in March 2020. The exit had given ChrysCapital an IRR of 39 per cent in its six-year-old investment. Private equity firms typically chase an IRR of 20-30 per cent in India.

The company, with its focus on branded prescription-based pharmaceutical products catering to lifestyle related disorders, today commands a leadership position in the branded formulation market, with a significant presence in chronic, sub-chronic and acute segments. It also backed by a series of inorganic acquisitions and has put in place a strong portfolio of over 100 mother brands across 650 registered products.

Major areas of growth

While about 60 per cent of Eris’s revenue comes from the two major areas of cardiovascular and anti-diabetics, in chronic therapies (over 90 per cent contribution), it has also catered to therapeutic areas like neurology, chronic respiratory and chronic pain (analgesics). Besides, the company has also grown its product portfolio in the acute category, catering primarily to therapeutic areas like vitamins, gastroenterology, pain-analgesics, anti-infectives and gynaecology. In the acute category, the company also has a presence in areas like acute respiratory treatment, hepato-protectives, hormones, haematology and dermatology.

“Going forward, the company, as part of portfolio diversification, is working on opportunities in high-growth areas like neurology, women’s health and dermatology,” says Krishnakumar, who joined the company in November 2020. “However, we will continue to work towards maintaining our leadership in existing core areas.”

-

Prior to joining Eris, Krishnakumar was a corporate finance partner with EY India for over nine years. He has over 22 years of experience across corporate finance, pharmaceutics and management consulting. During his over two-decade career in corporate finance and Avendus Capital, he oversaw several key M&A and private equity transactions. Prior to that, he was president, strategy, Piramal Healthcare, where he was a start-up team member of Piramal’s international business.

An IIM Calcutta alumnus, Krishnakumar began his career as a management consultant with McKinsey & Co, where he advised clients across various sectors on topics related to strategy, operations and organisation. As executive director & COO, Eris, he oversees the business operations of the company, which have effectively bucked the recent market vagaries.

Despite all the challenges in 2020-21, Eris had five significant new product launches. The first of them is Gluxit, the company’s offering which contains the strategically important Dapagliflozin molecule, which is an SGLT2 inhibitor in oral diabetes care. This was among the first generic versions of Dapagliflozin to be launched. Gluxit ranks #1 by volume and value among all 30-plus generic versions of Dapagliflozin in the market. The brand ranks #1 by volume and #3 by value, including the innovator brands. Gluxit showed an exit run rate of Rs2.5 crore per month sales in March 2021.

The company’s other new launch, ZAC D, is a unique combination of zinc and vitamins A, C and D in a convenient once-a-day chewable tablet. Rivalto was launched in the recently off-patent Rivaroxaban molecule in the anti-thrombotic segment. Zomelis, the Vildagliptin brand the company acquired in December 2019, has grown by nearly 4.5 times in the sales run rate post acquisition. The market share of Zomelis among the generics in value terms has increased from 7.3 per cent in December 2019 to 10.9 per cent in March 2021.

Earlier, in November 2017, Eris had acquired the Bengaluru-based Strides Shasun Ltd’s domestic branded formulations business for an aggregate cash consideration of Rs500 crore. Strides’ Indian generics business comprised a portfolio of more than 130 brands in the domains of neurology, psychiatry and nutraceuticals.

The acquisition was Eris’s fourth and the largest buyout in the previous 18 months (before November 2017). With this, the company has not only diversified its business into the CNS segment but also become among the top 10 companies in the Rs5,000 crore CNS market in the country.

Previously, in August 2016, Eris had signed an agreement with Ahmedabad-based Amay Pharmaceuticals to acquire the trademarks of 40 brands (comprising registered and unregistered trademarks) for Rs32.87 crore and a non-compete fee of Rs5 crore to strengthen its cardiovascular and anti-diabetics therapeutic segments.

In December 2016, the company increased its stake in Kinedex Healthcare (a company focussing on products catering to mobility related disorders in the musculoskeletal therapeutic area) from 61.48 per cent to 75.48 per cent. The stake was increased to 82.19 per cent in November 2018, with Eris finally purchasing the remaining stake in April 2019, making Kinedex a wholly-owned subsidiary.

-

Guwahati factory: modern, fully integrated manufacturing facility

Inorganic push

In October 2017, Eris acquired nutraceuticals maker UTH Healthcare of Pune for Rs12.85 crore. The company also entered into a tie-up agreement in May 2017 to exclusively market certain formulations in the acute pain-analgesics therapeutics area in India, manufactured by Pharmanza under a licence from the CSIR-Central Drug Research Institute.

More recently, in December 2019, Eris acquired the trademark for anti-diabetic drug Zomelis for Rs92.9 crore from Novartis AG for the Indian market, as the drug maker continues to explore inorganic opportunities for growth. Zomelis, (vildagliptin) is used to treat ‘type 2’ diabetes and comes under a new class of anti-diabetic drugs known as DPP 4 inhibitors. This was Eris’s third acquisition since it got listed on the stock exchanges in June 2017.

Over the years, the company has not only seamlessly integrated these brands and products into its business model but has also strengthened their position in the market. Zomelis, in oral diabetic care, has consistently ranked #1 among all generic versions of vildagliptin and ranks third among the innovator brands in the Rs1,000 crore vildagliptin and combinations market.

The brand has gained 4.4x growth in monthly sales run rate since acquisition. It enjoys market shares of around 11 per cent (in generic) and around 5 per cent (overall molecule) as on March 2021. Besides, the company has reduced Zomelis’s COGS (cost on goods sold) by 500+ bps since acquisition, by insourcing manufacturing to its Guwahati facility which enjoys income tax exemption and subsidies.

In the case of Strides Shasun, the company has consolidated the portfolio by discontinuing the tail end brands and focusing attention on the Top Five brands in the portfolio (Renerve, Raricap, Ginkocer, Serlift and Desval). Eris has optimised and ramped up field-force productivity by about 2.5 times in three years. Besides, the in-sourced manufacturing of key products in the Guwahati facility has led to a reduction of portfolio COGS from 35 per cent to 22 per cent.

In a short span of time the company has built up a strong portfolio of brands, where seven of the company’s Top 15 mother brands are ranked among the Top Five in their respective categories. In oral diabetic care, Tendia ranks five in the Rs1,100 crore teneligliptin and combinations market; Glimisave ranks sixth in the Rs4,500 crore glimepiride and combinations market and Cyblex ranks fifth in the Rs650 crore gliclazide and combinations market.

In cardiac care, Eritel ranks fifth in the Rs3,500 crore telmisartan and combinations market; Olmin ranks fourth in the Rs1,000 crore Olmesartan and combinations market; LNBloc ranks second in the Rs600 crore cilnidipine and combinations market; and Olmin Trio ranks first in the Olmesartan + cilnidipine + chlorthalidone market. Similarly, in the VMN segment, Eris’s brand Renerve ranks second in the Rs1,700 crore methylcobalamin and combinations market and Tayo ranks fifth in the Rs1,400 crore cholecalciferol and combinations market.

“These acquisitions are part of our portfolio diversification and building sustainable brands, which has enabled us to not only maintain leadership position, but also expand market shares in our respective therapies,” says Bakshi. “On the back of value-accretive deals like Strides and Zomelis, we continue to look for high-return inorganic opportunities to complement our organic growth initiatives.”

The company is now all set to maintain its leadership position and increase its market share. It has an exciting pipeline of patent expiration opportunities coming up in the cardio-metabolic segment over the next three to four years. It is well-positioned in the cardio-metabolic space to gain significant leverage from these expirations. Zomelis and Gluxit bear testimony as to how the company has performed in the market. Eris plans to launch over 10 new products in 2021-22 and its Zomelis SG (vildagliptin + remogliflozin) brand is the first to be launched in this series.

-

WHO GMP-compliant factory in Guwahati

Roadmap for future growth

“We propose to significantly expand our coverage of specialists and consulting physicians in the next five years,” says Krishnakumar, while laying out the outline of the roadmap for the company’s future growth. “Besides, we are working on diversification opportunities in high-growth areas like neurology, women’s health and dermatology.”

With all these developments in place, Eris has uniquely positioned itself in the market. In order to establish itself in the highly competitive pharmaceutical market in a short period of time, the company has adopted a strategy where it has consciously decided to focus on high-growth chronic and sub-chronic therapies which, being lifestyle-related areas, are primarily prevalent in cities and tackled by high-end specialists and consultants.

This approach has helped the company immensely in establishing itself in the market in a much shorter time frame as it has to address its focused target audience in well-defined geographies. Besides, the company has also strategically differentiated itself in two areas – generating actionable scientific evidence and patient care. This differentiated strategy has paid rich dividends to the company.

In the last few years, the company has shown aggressive intent and gone in for a series of inorganic acquisitions as also collaborations. This, along with organic expansions, has helped it build up a strong portfolio across 650 registered products and 100 mother brands. Today, seven out of its 15 power brands are ranked among the Top Five brands in the market. Most importantly, the company has nurtured its brands quite well in the market, even as it is making over 70 per cent of its portfolio in-house to maintain the quality of its products.

Last year, when many of its peers struggled, the company’s digital transition to connect with the market and doctors was quite impressive. In fact, 2020-21 was critical for the company, with it registering robust improvement across all operating and financial parameters. It also saw prescriber preference shifting to established incumbent brands during this period, which has augured well for it.

All in all, Eris has been able to harness the power of its fundamental business pillars, like leadership brands in the chronic specialty space, a strong cash flow generating business model, debt-free balance sheet and its consistent focus on operational excellence, in a more effective manner. Besides, it will also significantly expand its coverage of specialists and consulting physicians in the next five years. With all this, the company looks more determined and prepared to start its next growth phase where it will not only try to sustain its leadership position but also expand its overall business and market share.