-

Mohit Burman: Eveready needs some push and direction

Burman-owned Dabur India started its journey from Calcutta. The family later shifted to Delhi. The 137-year-old Dabur is one of the leading FMCG companies in the country. The Burmans have successfully transformed themselves from being a family-run business to become a professionally managed enterprise.

New leadership

On receipt of the public announcement at the end of February, in relation to the open offer by the Burmans, Aditya Khaitan and his nephew Amritanshu Khaitan tendered their resignation from the board as non-executive chairman and managing director of the company on 3 March, 2022.

In a touching letter to board members Amritanshu Khaitan mentioned: “As the largest shareholder of the company, the Burman family have expressed their interest to take management control of your company and give new leadership and direction to the company. It would be appropriate for me to step down from the board. I will continue to be a long-term stakeholder in the company and participate in the future growth plans of the company.” He also thanked the entire Eveready family for enriching his career with many unforgettable experience and moments.

Later, on 8 March, the Eveready board appointed Suvamoy Saha, 63, as the new managing director of the company with the consensus of the Burman family. With 37 years of experience in corporate management in diverse fields, both in India and abroad, Saha became joint managing director of Eveready in August 2021. This is the first time the Khaitans are not present on the board after they acquired Eveready (the erstwhile Union Carbide India Ltd).

The Eveready promoter Khaitan family had borrowed heavily by pledging their shares in Eveready and their tea company McLeod Russel, to save the group’s ailing engineering company McNally Bharat, engaged in turnkey solutions for infrastructure projects. An industry insider thinks some key senior management people who had been running the day-to-day affairs of McNally Bharat misguided Aditya Khaitan.

They painted a rosy picture of the EPC industry and the overambitious Khaitan trusted them and felt that infra could be the next business and growth for the group, and started funding. It finally turned out to be bad business judgment and dragged down the entire BM Khaitan group.

“It was the wrong decision to fund McNally and their unviable projects and this landed the Khaitans in big trouble. It was stupidity,” recalls a senior person in Eveready. McNally has been now admitted into the corporate insolvency process. The lead creditor, Bank of India, moved the petition to start the insolvency process against the company.

After Deepak Khaitan died, the former chairman and managing director of Eveready, his son Amritanshu, became the managing director of Eveready. According to sources, Amritanshu told his uncle Aditya to take a one-time hit and put McNally Bharat up for sale. But Aditya disagreed and kept pumping money into it. And in 2016-17 Eveready’s shares were pledged to raise R600 crore. Sources say Amritanshu still repents not being able to block the decision, which was taken when the founding patriarch BM Khaitan was still alive.

-

Aditya and Amritanshu Khaitan tenderd their resignation from Eveready board; Photo: Sajal Bose

Family dispute and a shelved deal

Also, a few years ago, the Khaitan family had taken a call that they would sell Eveready and retain MRIL. Several MNC battery manufacturers including Duracell showed interest. The Group had shortlisted Duracell Inc, owned by Warren Buffett’s Berkshire Hathaway. A person who had knowledge about the deal said that it was fixed at around Rs1,700 crore.

Duracell had started due diligence of Eveready’s battery and flashlight business including the manufacturing plants and distribution network. Unfortunately, during the process, BM Khaitan died. The deal was shelved because a family dispute surfaced. The dispute continues and sources say relations between uncle and nephew are strained.

People blame the Khaitans for the company’s downfall. However, nobody ever questions their intention and integrity. It was just a bad decision which caused a decline in the Group’s fortunes. The family is well known for their culture, inherited from BM Khaitan. They are considered good employers, generous and have tremendous respect for people.

“I have not seen a better person than BM Khaitan in my life. He was a true visionary. It is good that BM Khaitan did not live to see the empire he had created collapse due to mismanagement and family feuds. The Burman group is a professionally managed company. They will run it well,” says a well-known person in the city’s corporate circles.

“Promoters cannot flow funds and give guarantees between group companies in isolation. Inevitably the downfall of one will have repercussions on the other. Emami, Zee, Britannia are some examples. Some have navigated well and some have seen promoter stake sale, dilution, etc when the tide turned. But appropriate action against any irregularities is must.” says Pankaj Singhania, founder, Lake Water Advisors, an equity research firm.

“Taking charge of Eveready is a shot in the arm for Burman. Dabur’s large distribution network could be leveraged. The battery business is a very competitive segment, though, so we have to wait and see how the Burmans handle the situation,” adds Singhania.

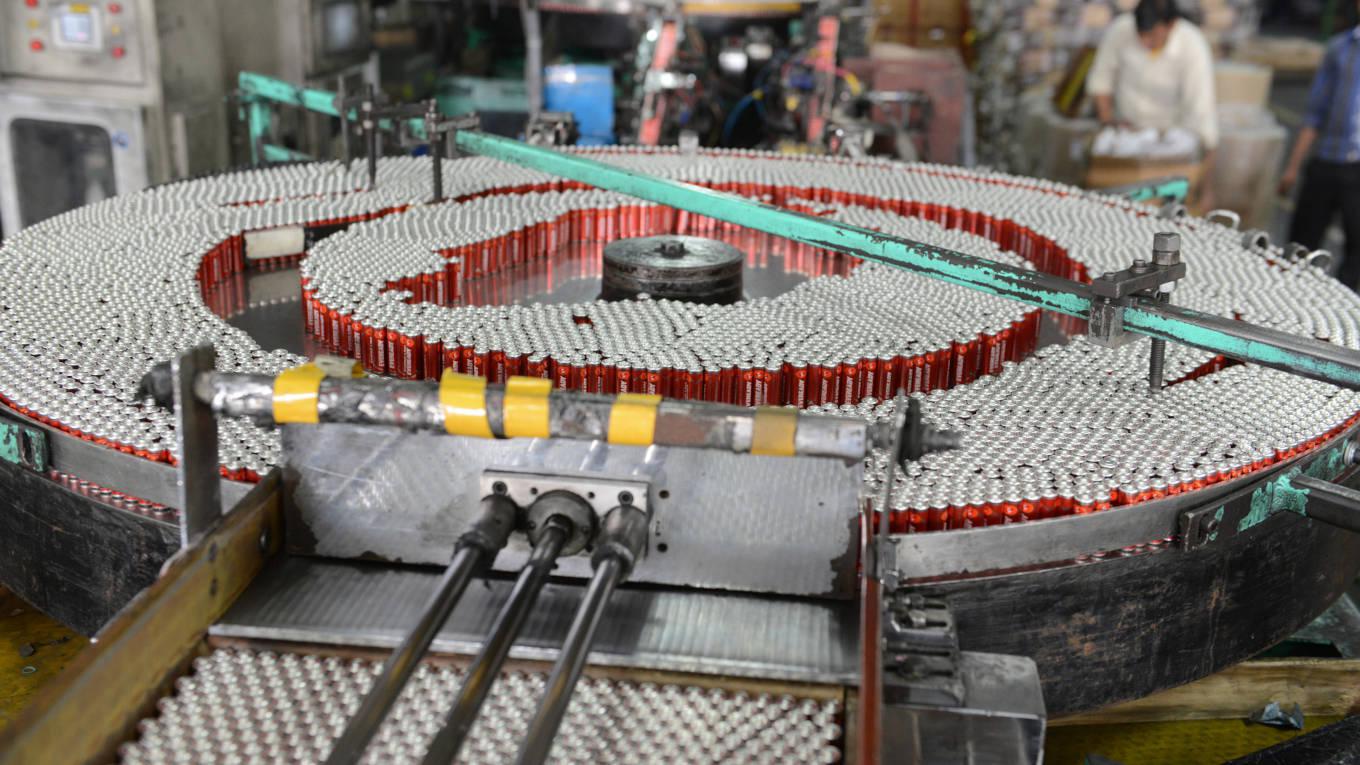

Eveready is the largest player in India with regard to dry cell batteries and flashlights – they have a market share of over 50 per cent in both categories. The company has six manufacturing units across India which produce 1.3 billion batteries. All the units are backed by integrated management systems with the latest versions of ISO accreditations. The plants maintain the highest level of environmental standards.

Market leader

Eveready has a strong brand value with a robust distribution network. Out of the total FMCG universe of about 8.5 million outlets, battery stocking comprises around 53 per cent. Eveready batteries were stocked in 70 per cent of such outlets – higher than any other battery brand by a wide margin.

Eveready achieved annual sales of Rs1,206.75 crore in the financial year ended March 2022 as against Rs1,248.98 crore the previous year. The net profit recorded was Rs47.84 crore in FY22 against a loss of Rs307.45 in FY21. The current debt of the company is Rs350 crore.

-

Saha: the new man in charge

The Indian dry cell battery market is now estimated at Rs1,500 crore and growing at 5-6 per cent. The battery category benefitted from a generation of healthy demand coupled with a decline in the import of poor-quality products from China post the implementation of BIS standards. The market segment pattern underwent changes during the past several years as consumers shifted from the more expensive ‘D’ size batteries to ‘AA’ sized ones.

The consumption of batteries is driven by growth in the offtake of its applications. A growing need for portable power and the advent of a number of battery-operated gadgets like remotes, toys, clocks, and torches have catalysed consumption. Since these gadgets are used on an everyday basis, batteries have enjoyed a non-cyclical demand. Also, the rural segment is a high growth one for the industry.

The Burmans have appointed Bain & Company to advise on the future road map for Eveready. “We plan to focus on its existing businesses in the immediate future and then look at new businesses in the medium to long term, both in batteries and in some new categories too,” says Burman. “We are expecting their reports in the next 2-3 months.”

The Burmans think whatever happened earlier in Eveready is past history. Now they want to start afresh. Can one safely say this is a cat with nine lives?