-

FCL is widely recognised as a total cable solution company

Along with electrical wires, FCL is also looking to expand its communication cable business. Keeping in mind the growing demand for optic fibre cables (OFC) in view of the 5G roll-out all over the country and the fibre-to-home requirement, FCL has decided to expand its range and capacity in optic fibre cables. At present, the company has a fibre drawing capacity of 4 million fibre km per year and cabling capacity of 8 million fibre km per year.

Backward integration

The company is expanding with an additional plant for fibre optic cables, adding fibre draw towers and also backward integrating to manufacture glass preforms, used for drawing fibre in the towers. The expansion is currently underway. With this expansion, its preforms capacity will increase to 4 million fibre km per year; Draw Tower capacity will reach 8 million fibre km per year and fibre optic cables will increase to10 million fibre km per year from the current 8 million currently. The company is also expanding its LAN cable capacity to 13,500 km per month by December this year from 11,250 km at present. The LAN cable capacity has been scaled up over the years from 4,600 km per month in 2018.

“The company has been importing these glass preforms which are drawn to make glass fibres. Once the company starts making them, it will be the second company to manufacture glass preforms in the country. There will be good value addition,” says Chhabria who joined his family business in 1991 after completing his studies.

With a Bachelor of Science in Engineering Management from the University of Evansville, Indiana, USA, he was promoted from managing director to the post of executive chairman in 2013. Under his leadership, the company has undergone a significant transition in the last few years, evolving from a wires & cables maker emerged into a complete electrical product company.

The company’s Goa plant manufactures Continuous Cast Copper Rods (CCC rods) which is a key raw material for producing copper-based electrical and communication cables. Backward integration ensures greater control over the raw material costs and quality of the final products. While most of the production in Goa plant is used to fulfil the captive requirement of the company, the surplus share is sold to third parties.

Last year, the company also launched PVC conduits and fittings. It has grown the business multifold in the past 12 months. Two expansions have already taken place in the Goa plant bringing the capacity to 25 lakh pieces per month. With the successful launch of this product category, the company now plans to replicate this in the Northern and Eastern part of India to serve the all-India market.

In order to augment the OFC business further, the company has also opened EPC division for executing orders for laying fibre-optic cable networks in various locations all over the country. The business has already commenced in Gujarat and is expected to be expanded to other geographies soon.

To keep up with its growth strategy, FCL is focused on setting up a robust two-tier distribution model to ensure its products are available on the store shelves of many retail outlets across the country.

-

The company, which currently has over 5,000 channel partners and 26 depots, is ramping up its retail outreach from 150,000 retailers to 200,000 retailers by the end of the financial year. This will drive the conversion of the large unorganised market to the branded universe of quality products that offer better performance and higher service levels. The company is also planning to increase its export business, going forward.

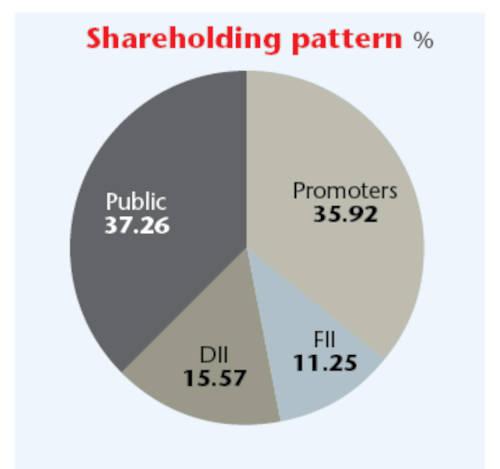

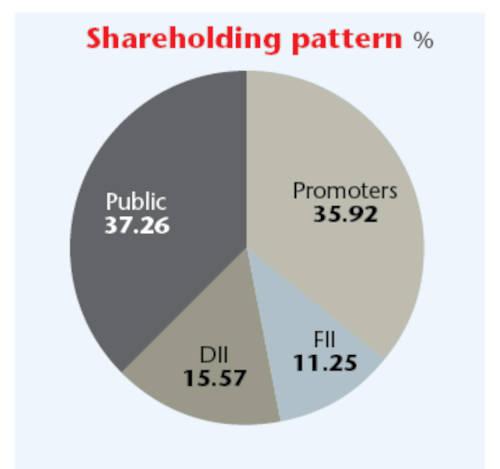

“In view of broad-based demand scenario, the capex of Rs500 crore over two years in upgrading the offerings in wires, OFC and backward integration, would boost volumes and margins of the company going forward. FCL has healthy cash, zero debt and a lean working capital cycle. All this augurs quite well for the company,” says a Sharekhan report.

“The investments made by us in the areas of brand visibility, product development, distribution network, and technology infrastructure will be a source of competitive advantage, enabling us to capitalise on the emerging opportunities and take the organisation to greater heights. We are now primed and totally ready to drive a stronger and more prosperous future,” says Chhabria.

“We continue to aggressively expand our capabilities and capacities, widen our retail footprint, enhance brand appeal and customer engagement to augment our market positioning and sustain consistent growth,” avers Viswanathan.

Experts are of the view that FCL is gearing up well to explore emerging opportunities. The increasing number of projects in the areas of roads and highways, railways, power transmission and distribution, airports, and solar power, among others, is expected to spur infrastructure and construction activities. Further, the government has extended its Rs111 lakh crore ($1.5 trillion) National Infrastructure Pipeline, which is an umbrella programme integrating multisector infrastructural projects, to encompass more projects by 2025.

The Production-Linked Incentive (PLI) scheme will further encourage private players to enhance their domestic manufacturing capabilities. Moreover, focus on 100 per cent electrification of existing railway network, rural electrification schemes, public charging infrastructure, growing demand for telecom and high-quality broadband services and laying optical fibre cables across the nation under Bharat Net project, and Smart city projects are some of the key factors which will augment the demand for cables and wires.

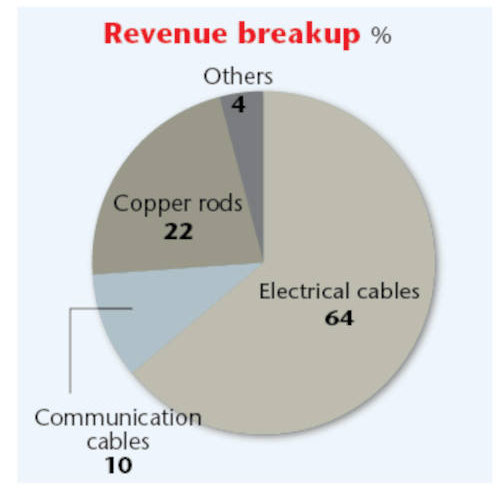

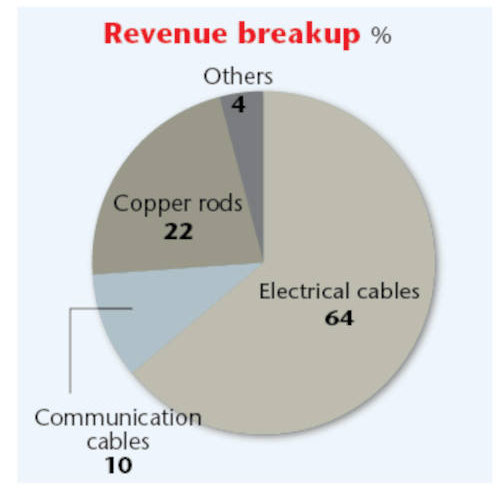

The electrical wires and cables segment which contributes around 85 per cent of the FCL’s total revenue, caters to the real estate market. NITI Aayog expects that the Indian real estate sector will reach a market size of $1 trillion by 2030 and will account for 13 per cent of India’s GDP by 2025. Already the third-largest sector to bring about economic growth, the real estate industry is expected to continue its upward trajectory, going ahead. As per an estimate, the domestic cables and wires industry is expected to grow at a CAGR of 12 per cent over FY21-26.

In its latest report – India Real Estate: Vision 2047, Knight Frank India in association with NAREDCO, has projected that India’s real estate sector will expand to $5.8 trillion by 2047. This estimated real estate output value will contribute 15.5 per cent to the total economic output in 2047 from an existing share of 7.3 per cent.

-

“The next 25 years are going to witness a dramatic transformation in the Indian economy and the real estate sector. Factors like demographic advantages, improving business and investment sentiments, and government policy push towards high-value output sectors such as manufacturing, infrastructure, etc will robustly support the economic expansion of India. In the imminent future, India’s economy is expected to grow at a rapid pace, and the structural shift in the economy will be led by a major push to the growth of all sectors including real estate,” says Shishir Baijal, Chairman & Managing Director, Knight Frank India.

“The company has over 5 decades of experience in wires and cables with 22 per cent of organised market share. It has constantly endeavoured to augment its product range. The company has in-house manufacturing of compounds, copper rods, glass fibres and many other raw materials, which enables it to generate a better margin than its peers. The EBITDA margin is in the higher teens (15.5 per cent for FY23) unlike other leading players which are in the lower double-digits,” says a SBICAP Securities report.

Maintaining momentum

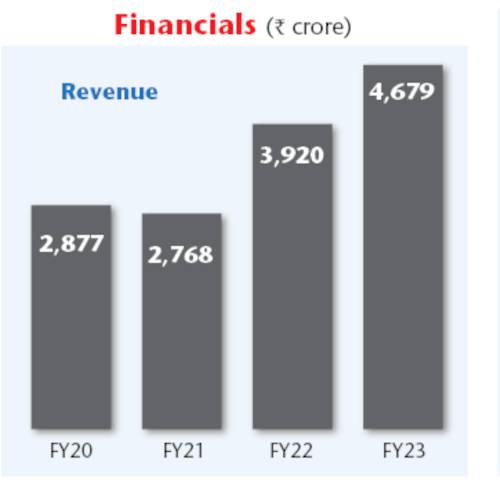

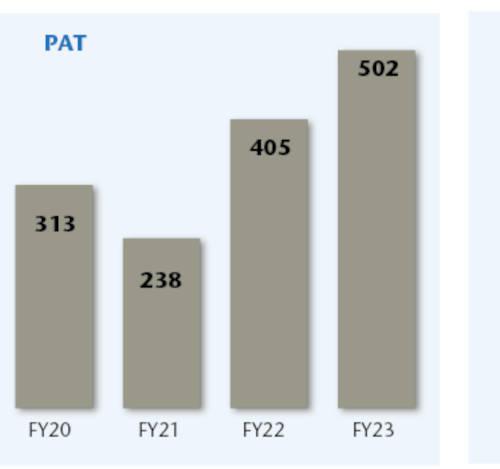

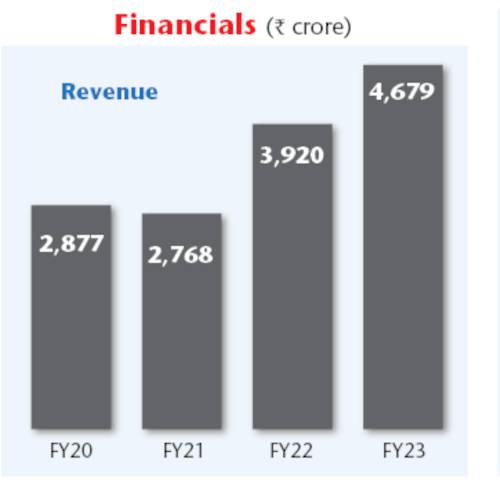

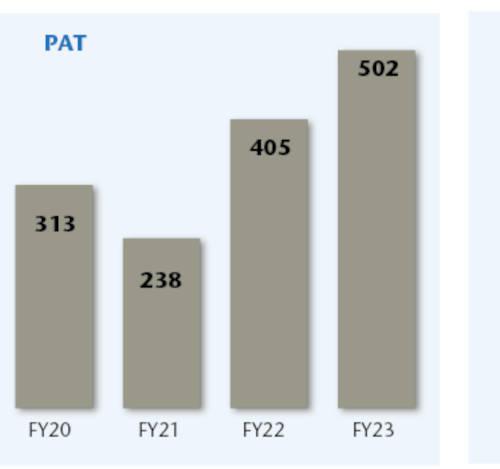

In FY23, the company recorded sales of Rs4,679 crore compared to Rs3,920 crore in the previous year – an improvement of around 19 per cent. During this period, PAT stood at Rs502 crore, a 24 per cent increase from Rs405 crore. For the full year, electrical wires grew by 16 per cent in volume, OFC volumes grew by more than 50 per cent, and all other products in the communication segment experienced growth of more than 25 per cent.

“During the year, commodity prices continued to remain volatile, which led to several price revisions in order to pass on both cost reductions as well as cost increases to the end customers, resulting in a situation where margins fluctuated every quarter. Changes in the energy efficiency norms affected the sale of fans during the last two quarters and impacted overall growth in the new product lines. The addition to product range and expansion of distribution network has all contributed to the better revenues and volumes within these product segments,” says the company CFO.

The company has kept its momentum going in the current fiscal as well. Revenues for the quarter ended June 2023 were around Rs1,204 crore as against Rs1,016 crore for the corresponding period in FY23, representing a 19 per cent growth in value terms. Profit for the quarter, after taxes, amounted to Rs132 crore as compared to around Rs96 crore in the previous year, an improvement of 39 per cent. In terms of volume, electrical wires increased by 29 per cent, while power cables saw an increase of 3 per cent.

In the communication cables segment, the volume of metal-based products improved by 17 per cent during the quarter, while OFC volumes grew by over 50 per cent during the same period. Volume growth in new products within the FMEG segment was marginal due to continued inflationary pressures affecting consumer sentiment.

Established in 1958 as an SSI unit manufacturing PVC insulated cables for the automobile industry, FCL is today the country’s largest manufacturer of electrical and telecommunication cables. Finolex is widely recognised as a ‘Total Cable Solutions’ provider and caters to the diverse electrical requirements of commercial, industrial and consumer markets through its array of electrical wires and cables.

-

FCL has established its reputation as an innovative leader and quality manufacturer

The company has a wide product portfolio encompassing over 50,000 SKUs in wires and cables, FMEG and home appliances segments. Its FMEG product portfolio comprising LED lights, electrical switches, fans, water heaters, and switchgear, is well-positioned to seize new growth opportunities. The FMEG business has been gaining significant traction and steadily increasing its share in the revenue mix, currently at 5 per cent (Rs200 crore). The company is looking to expand its FMEG business to Rs500 crore in the next year or two.

Backed by five manufacturing sites at Goa, Pune and Roorkee, the company has established a distinct mark in the industry as a manufacturer of the highest quality cable and wire products. It manufactures high-quality, light-duty PVC insulated electrical cables and power and control cables.

While light-duty electrical cables are primarily used for general purpose lighting, they are also utilised for electrification of industrial establishments and electrical panel wiring in various industrial facilities. Furthermore, these cables also find applications in consumer durable goods, automobiles, agricultural pumps and small generators.

Besides, the company also manufactures high voltage power and control cables that are designed exclusively for underground applications. These cables are insulated with fire retardant compounds and meet international technical and quality specifications. The company is able to manufacture cables from 1.1kV to 66kV.

The communication cable segment comprises state-of-the-art, new generation communication cables and traditional telephone cables. The state-of-the-art communication cables include copper-based cables and glass-based OFC cables. Copper-based cables are further categorised into LAN cables, coaxial cables, PE insulated switchboard cables, and V-SAT cables. LAN cables are used for high-speed data transfer, while coaxial cables find applications in microwave connections, mobile towers, and delivering content to TV receiving sets.

Upgrading technology

PE insulated switchboard cables are used in telephone instruments and EPABX (voice communication) systems, whereas V-SAT cables enable last-mile connectivity by establishing a connection between the V-SAT dish and a base station. In light of the growing demand for surveillance, the company has also launched innovative, special cables for image capture and CCTV cameras as well as solutions in the power sector.

OFCs are glass-based cables known for their ability to carry maximum bandwidth and transmit data at high speeds. While they are primarily used for data distribution by telecom companies and multiservice organisations, they also serve as trunk cables for long-distance networks. Communication cables play a critical role in the infrastructure development of the country due to their demonstrated abilities in transmitting digital data at high speed and high bandwidth.

Today, FCL has established its reputation as an innovative leader and quality manufacturer by continuously upgrading technology, modernising manufacturing facilities and maintaining the highest standards of quality and services. Every cable is manufactured with the latest state-of-the-art machines using bright, annealed electrolytic grade copper of 99.97 per cent purity, manufactured in-house.

Additionally, the insulation is composed of virgin grade PVC, also formulated in-house. In a move towards backward integration, the company has set up a copper rod manufacturing facility at Goa and in-house PVC compound manufacturing facilities at its Urse, Pimpri, and Roorkee plants to ensure self-sufficiency and quality control.

-

The company has recently added additional machinery at its Goa plant to meet the demand for its PVC conduits. This will enable it to establish business relationships with project developers and offer a comprehensive range of wires, MCBs, switches, lighting, etc. The company has been at the forefront of introducing innovative products to the market.

It is the first company in India to introduce Flame Retardant Low Smoke electrical wires, which are recommended for concealed and conduit wiring. These FR-LSH wires emit very little smoke and toxic gases and retard the spread of fire, making them ideal for safety-conscious consumers.

With all these developments in place, FCL has significantly strengthened its place in the market. The company’s ongoing expansion and diversification into newer products as well as its backward integration moves will not only help it to scale up its business in a big way but will also boost its bottom line. Over the years, it has built a strong brand and it is now consciously trying to leverage this by enlarging its portfolio.

The company is also ramping up its FMEG business. Diversification within the cable business as well as expansion into FMEG, will also help it mitigate business risks. Along with a diversified offering, the company is expanding its retail footprint with a goal of reaching 200,000 retailers by the end of this fiscal year. This strategic approach firmly positions the company and enables it to enter the next growth phase confidently.

-

Quest for growth

Finolex Cables was established in 1958 as an SSI unit manufacturing PVC insulated cables for the automobile industry (the PVC auto cable was the major product for the company for many years), by Deepak Chhabria’s father Kishan Chhabria and his uncle Pralhad Chhabria.

The Chhabrias came to Pune from Karachi in 1945 and set up a small shop selling electrical wires & cables. The retail business became quite successful. A sizeable order in the mid-1950s from the Defence Department for wire harnesses for trucks and tanks bolstered their confidence and they decided to manufacture cables, themselves.

Their relentless search for growth and doughty perseverance saw them through some difficult times and in 1972 the enterprise turned into a limited company. Since then, there has been no looking back and following a public offering in July 1983, FCL has embarked upon a continuous process of expansion and modernisation which enabled it to become the most diversified and largest cable manufacturer in the country.

Their quest for growth saw the brothers establishing Finolex Industries Ltd (FIL) in 1981. The company (Finolex Pipes) had a modest beginning as a rigid PVC pipes manufacturer with a manufacturing plant in Pune. In 1994, FIL set up a state-of-the-art PVC Resin plant near Ratnagiri on the Western Coast of Maharashtra. The 130,000 MT PVC plant was set up in technical collaboration with Uhde GmbH of Germany and under technology licence from Hoechst AG.

The Rs4,000-crore entity is today the largest and sole backward-integrated manufacturer of PVC pipes and fittings in India. Pralhad Chhabria’s son Prakash Chhabria is the chairman of FIL. Pralhad passed away in 2016, while his younger brother Kishan continues to oversee the activities at FCL without having any post. Both the companies are currently run separately. However, there has been some dispute between the two promoter families due to crossholding.