-

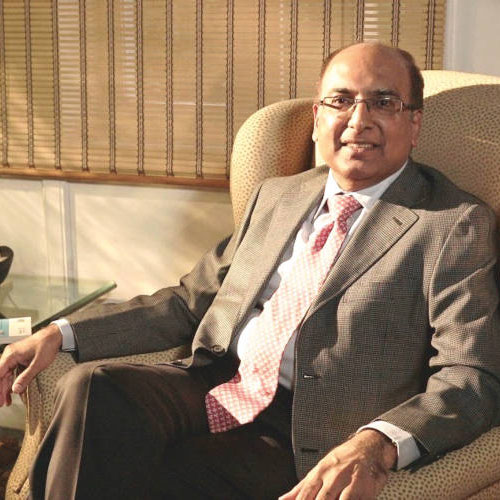

Chhabria: focus on quality and culture

The Chhabrias have come a long way. P.P. Chhabria had come to Pune from Karachi in July 1945 in search of a livelihood and, within six months, set up a small shop selling electrical cables. K.P. Chhabria joined him in 1947. Soon, the retail business became quite successful, with “a sizeable order in the mid-1950s from the defence department for wire harnesses for trucks and tanks, bolstering our confidence. And, then, the brothers decided to manufacture cables themselves,” says Chhabria.

Starting as a small-scale industrial unit in 1956, the duo began making PVC insulated cables for the automobile industry. “The Finolex brand was a coinage from ‘Fine’ and ‘Flexibles’”, observes Chhabria. “And the ‘O’ with an electric arc across it signifies the electrical cable industry the business was in. Their relentless search for growth and doughty perseverance saw them through some difficult times and, in 1972, they bought a private limited company, dissolved the partnership firm and the enterprise turned into a limited company – Finolex Cables Limited.”

New generation steps in

Since then, there has been no looking back. After a public offering in July 1983, FCL embarked on a continuous process of expansion and modernisation, which enabled it to become the most diversified and largest cable manufacturer in the country. Their relentless quest for growth saw the two brothers establish Finolex Industries Limited (FIL) in 981.

FIL sought to manufacture rigid PVC pipes and fittings at Pune, which find large-scale application in the agriculture sector. In a shrewd move towards backward integration, FIL set up a PVC resin manufacturing facility at Ratnagiri on the west coast of India.

As these two companies continued to expand, P.P. Chhabria took on the role of executive chairman, FCL, and non-executive chairman of FIL, while K.P. Chhabria fulfilled the responsibilities of the executive vice-chairman of FIL. Over the years, the next generation of the family stepped in, when Prakash Chhabria, son of P.P. Chhabria took over as executive chairman, FIL, while Deepak Chhabria, son of K.P. Chhabria assumed charge as executive chairman, FCL.

“Under my father and uncle’s leadership, I learnt the best of both worlds – marketing, purchase and general management from my uncle P.P. Chhabria, and efficient manufacturing, R&D, setting up new plants, etc, from my father K.P. Chhabria. After joining the family business, I have worked closely with my uncle, P.P. Chhabria,” says Deepak.

Deepak completed his A-Levels from Seven Oaks, Kent, England, and then completed his Bachelor of Science in Engineering Management from the University of Evansville, Indiana, US. He got his first training in 1985 from Bajaj Tempo Ltd, when he worked on the assembly line. Having started his job as an operator on the moulding machine in the plant shop floor at FCL, he worked his way upwards, till he was promoted as managing director in 2001. Today, he runs FCL as executive chairman.

Deepak was actively involved in setting up nine different manufacturing plants across four locations in India. Under his guidance, FCL now produces a variety of electrical and communication cable products, copper rods, electrical switches, LED lights, MCB, fans and water heaters.

-

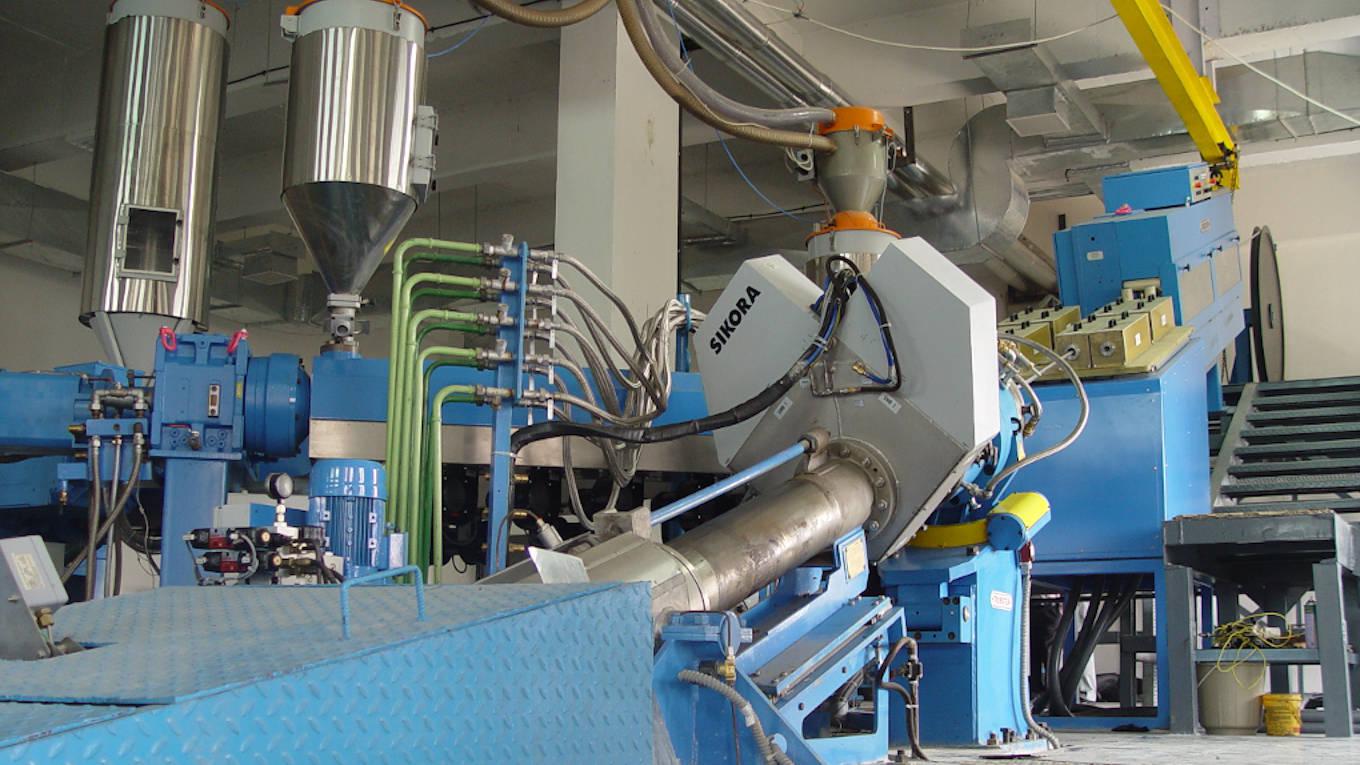

Finolex Cables Rourkee Plant: planning to launch new products

“My focus in the business has always been on quality and culture – man, machine and material; leading to high quality production,” says Deepak, who was the first to bring the latest technology of fibre-optic cables to India. He is actively involved in forging joint ventures and technology transfers with the world’s best and leading companies in their fields, such as AT&T, Corning, Essex, GE, Sumitomo, Hitachi, NSW, to name a few.

FCL has a lot of firsts to its credit. It was the first company in the private sector to make and supply jelly-filled telephone cables (JFTC), to launch FRLS wires and cables, to make coaxial cables using the physical foam process, to make aerial cable designs, to have 30m-tall optical fibre draw towers, to have developed ‘foam skin’ type of cables, et al.

“We were a JFTC company to begin with and we had one customer pre-dominantly – DoT. And, if you have one tender a year, basically, you are set for the year once you get that business. So, Finolex was a one-product, one-customer company then. And, the good fortune was that we used to win a sizeable tender order every year,” says Deepak.

Then, suddenly, mobile telephony emerged as the new fashion. But FCL felt that that fixed line phone would not disappear all that soon, because the mobile phone was priced at Rs16 per minute for incoming and outgoing calls ¬– quite expensive in those days.

“So, we said, okay, this will have a market for the elite and the rich; some people will talk on a mobile, especially, when travelling; but the majority of phone calls will still come through fixed lines,” reminisces Deepak. “But, as it happened, mobile picked up fast and, within a year, the fixed line tenders disappeared. So, our company got a big jolt and, to overcome that, we started running around to see what could be done and how we should plan our company's future. At that time, we developed new products which today we carry in our portfolio, one of which is the house-wiring product, which is made out of flexible copper wire,” he adds. FCL drew strands of copper drawn and twisted together and coated them with PVC to make a flexible wire.

In those days, India catered to the British Standard, which favoured solid conductor wires. FCL brought these flexible wires in trying to convince the installer that, in India, because the walls of houses are for the most part made of brick and plaster, PVC conduits inside such walls get damaged, when they are pulled through the bends – unless they are flexible in nature.

“Our flexible product took off well,” discloses Chhabria. “We basically designed the product using our own R&D, which decided on the dimensions and the sizes. Soon, this product became the de facto standard for the country and even the ISI adopted those standards, based on our products. Now, that is the product used and manufactured by everyone in the country.”

-

Viswanathan: distribution strategy brings rewards

Once FCL moved into this product line, it started selling it too – in 1992-93. “We set up shops all over the country, starting with the South; even today, we are strong in the south,” says Chhabria. “The South and the West are where we are strong, with the East and the North comparatively weak, due to poor distribution networks, which need to be improved”.

FCL started the process through its channel partners, selling to shops, which were mostly in the centre of the market and frequented by many electricians. The company used to target such shops and make them channel partners to carry the product. So, the distribution was not sufficiently penetrative, as it was mostly a large shop with a good clientele handling FCL products in different cities. This is how it grew and spread across India with this product line.

Till recently, Finolex Cables and Finolex Pipes were under one management. However, a family dispute that arose between Prakash Chhabria and his cousin Deepak Chhabria led to a split, with each cousin ending up running one, separate company.

Last year, FCL underwent a slight change in its distribution strategy. “Now, we want to penetrate the smaller towns, we want to reach the interiors and not just the big cities,” says Amit Mathur, head, sales & marketing, FCL. “And so, we have adopted a two-tier system, with a distributer and a retailer. In the process, the distributer ends up distributing to a minimum of 200-400 retail counters. And, it has been chalked out, with the help of distribution-management software run by us, developed by us. We track the distributer and how he is selling to the retailer. Also, he can bill only through our software; so, we control the pricing that goes to the retailer, as also the pricing levied to the customer. We run schemes, where retail sales can be tracked because of this computerisation. Also, when we were selling through the channel partners, we were always getting payment in advance. So, now, we make the distributer also pay in advance, though the distributer gives credit to the retailer,” Mathur adds.

Mathur started as territory head, western region, to end up as head, sales & marketing, “The journey has been exciting and challenging,” he admits. “Finolex is known for its rich legacy of introducing innovative and technologically advanced products. The consistency in the quality of our product offerings has made the consumer benefit and has developed eminent loyalty towards our brand for so many years. We invest in the future while being aware of the need to build people and society. Over the last five years, not only have I grown as a professional but also as an individual."

“With the market demand for credit being taken care of by the distributor, FCL can now manage a better penetration and reach out to more customers,” explains Mathur. “So, this year, we have taken a target of reaching 500 distributors. We have done a market mapping exercise, as we would like to reach about 150,000 retail counters. So far, we have reached about 50,000 retail counters and 400 distributers and we are working on adding more retail counters. By the year-end, I hope we can reach the target we set for them.”

-

Finolex will make wires for automobiles and engine compartments for the railways

“On the retail front, with the wires selling well now, we have put more products in the portfolio, which we launched a last couple of years earlier,” says Chhabria. “They can all be sold through this distributor-retailer network because they are all products that can be sold across retail counters. I am talking of products like fans, water heaters, lighting products, MCB and switches, which also can be carried through this network and help grow our sales.” He acknowledges that the pandemic has slowed things down for FCL. “During April and May, we suffered, as everything was shut. We re-opened on 19 May 2020 and, despite minor issues, the sales people are now willing to go out and meet customers.”

FCL is planning to launch new products. “We are working on designing some new products,” observes Chhabria, talking about other technical products that he plans to launch. “They are all electrical, consumer-oriented products. Most of them are under design right now, being worked on by designers who are experienced, and it could take a year for these products to be ready. And once that is successfully done, we want to go for more products. Someday, we will become more of an electrical company rather than a wire and cable company.”

“We have set up a plant in Verna Industrial Estate, Goa, which will go live anytime now,” adds Chhabria. “The machines are under commissioning for ‘electrical conduits’. I feel, when a salesperson goes to a builder to sell the wire, he should also sell him the MCB, the switch, lighting and fan. Ideally, he should go when the civil works are on and they are putting the conduits inside and are going to plaster the wall. If the relationship starts at that time, then it becomes easier to sell the products, going forward.”

Special materials

At Urse in Pune, FCL has another construction going on for a plant for installing electron beams. These electron beams are used for curing materials, especially on products like solar cables. “If we make solar cables, we want the cables to run and operate outside in the harsh environment with hot and cold temperatures round the clock,” says Chhabria. “We require special materials and they need to get cured and locked in the carbon chain so that they can withstand the harsh climate. And, for the electron beam curing equipment, you have to get BARC approval, because this is radiation equipment.”

-

If we make solar cables, we want the cables to run and operate outside in the harsh environment with hot and cold temperatures round the clock

It’s to meet all these approvals and designs and the machines that are already ordered, that the plant is now under construction. It will take a year before it goes live. In the new Urse setup, FCL has ordered two different types of electron beam equipment, one each for small wires and big wires. The plant will make wires for automobiles (for high temperatures), and engine compartments for the railways. “Railways are going to expand a lot in the coming years and they will require products that are of this type of curing material. So, we are looking at a new product line to be made from the Urse plant.”

FCL is also expanding in fibre-optics, where it is adding new equipment for fibre to home cables, for which the demand is picking up a lot now, especially with people working from home. There is a huge demand for fibre-optic, small-sized cables, because now people want fibre connectivity coming into their homes, to enable them to work from home. “And we expect a big demand for that; we already have an order from Reliance,” says Chhabria. FCL today enjoys the status of being debt-free, with the capex touching about Rs200 crore.

“All this will come from internal accruals. We, in fact, have so much cash on book that we would actually like to make an acquisition, if we can find the right fit. We have been looking for some time but we have not been successful. Now is the time to make such a move and we may find a good buy also. We are certainly going to look at such an opportunity,” sums up Chhabria.