-

Shantharaju: strong track record

REEL offers a wide range of waste management and resource recovery solutions to municipal corporations and possesses a large, diversified industrial customer base across pharmaceuticals, chemical, fertilisers and hospitals. Many large industrial houses and entities,including Reliance Industries, Tata Motors, Ford, Hindustan Petroleum, IOC, M&M, Coca-Cola, Colgate, Bayer, Johnson & Johnson Nissan and Asian Paints, are its clients. While catering to bio-medical waste management in the pharmaceutical and healthcare sectors, it serves names like Apollo Hospitals, Fortis, Max and Wockhardt.

Dominant presence

The company also offers environment consultancy services to over 200 industries and government bodies, including the Central PollutionControl Board, State Pollution Control Boards, Hyderabad Municipal Corporation, ISRO and the World Bank. Its service enjoys accreditations like ISO 9001:2015, NABET, NABL, NTPC, MoEF& CC, EPCO Bhopal, OSPCB and TSP CB. Besides, its facilities management vertical offers integrated and customised facilities management services in Singapore through a professionally-trained staff to about 200 customers, including Changi Airport and National Environmental Agency (NEA).Besides, in Singapore, it provides integrated end-to-end automated car park management services to more than 20 customers, including Changi Airport, National University of Singapore and Housing Development Board.

REEL manages over 6 million tonnes per annum of MSW in 21 cities across India. It manages over 1 million tonnes per annum of industrial hazardous waste. The company is a pioneer in this sector and operates 18 industrial waste management facilities, distributed over 12 states across India and the Middle East. Its bio-medical waste management footprint has facilities in 20 cities across India, servicing more than 340,000 hospital beds and 30,000 healthcare establishments. REEL is also at the forefront in managing and recycling emerging waste streams in a new and growing India. For example, the company today operates five construction and demolition (C&D) waste recycling facilities in India, all of which have been made operational recently.

The company has many credits to its name, including constructing the first US EPA standard landfill in India, operationalising the largest waste to energy plant in India andconverting a waste dump with over 15 million tonnes of municipal solid waste spread over 300 acres into a scientifically capped landfill to protect the environment.

REEL is committed to ensuring that its operations comply with the applicable laws, regulation and statutory provisions as per HSE. With over 20 years of operational history, the company has beena dominant presence across the entire waste value chain and a long-standing partner in the environmental solutions space to its customers.

It has built capacities and capabilities to deal with the mega challenge of the environment at scale and has emerged as one of the largest and fastest-growing waste management and integrated environmental service providers in the space. In fact, the company has undertaken several pioneering initiatives, thereby defining the industry’s revolution in India. The Indian waste management space, where only 10 per cent of waste is managed, presents a phenomenal $15-20 billion opportunity.

-

“In the last two decades we have come a long way in the domain we operate,” says M Goutham Reddy, managing director & CEO, REEL. “We have emerged as one of Asia’s largest environment and sustainability focussed companies and our purpose of existence is to protect and improve the environment. While, backed by technology and resources, we are ramping up our existing capabilities, we are also making steady progress in the new frontiers of recycling and resource recovery, waste to energy (WTE) and circular economy landscape, and are focussed on becoming an environment solution provider for emerging nations. These business areas and regions are expected to be the next driving force in the coming years and we have committed a large capex to capitalise on these opportunities.”

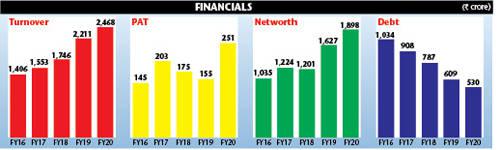

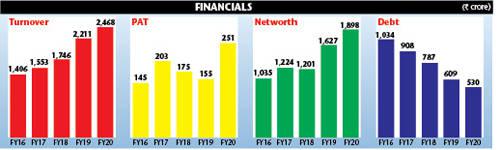

While carrying out these activities and initiatives, the company has recorded an impressive performance, with its revenue growing to Rs2,468 crore in 2019-20 from Rs1,406 in 2015-16 and its PAT moving to Rs251 crore from Rs145 crore during the same period. Last year, while the company’s revenue grew by 12 per cent, its PAT moved up by over 60 per cent. It has significantly pared its debt to Rs530 crore (debt: equity - 1.0) in 2019-20 from Rs1,034 crore (0.28) in 2015-16, whichhas helped the company upgrade its credit rating by India Ratings to AA from BBB as on March 2019.

Shrugging off the Covid-related slowdown, the company has continued its expansion mode. Going forward, the company is planning to double its turnover in the next three to four years, even as it looks to more than double its overall waste handling capacity as well, across its various verticals. The company also plans to invest Rs4,000 crore in expanding its operations and footprint. In the current fiscal year, it has continued with its Rs500-crore investment target, as it looks to close the year with revenues of over Rs3,000 crore.

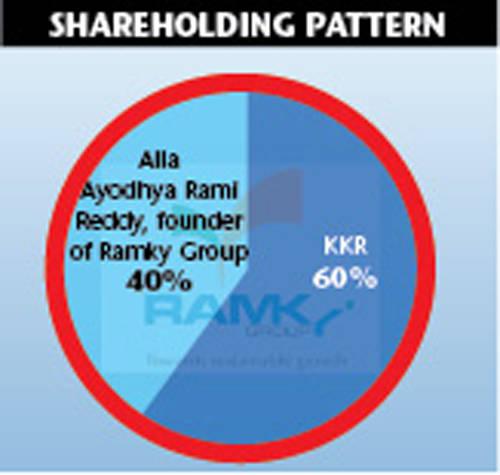

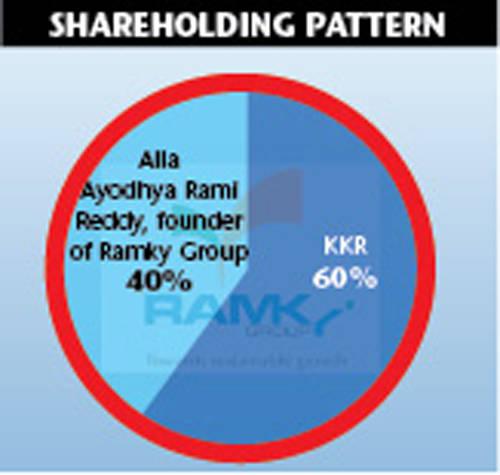

REEL’s unique approach to deal with waste and environment-related issues amidst the growing significance of the environmental solutions space, in the wake of increasing urbanisation and industrialisation, has attracted the attention of global investors. In 2018, PE funds such as Brookfield, KKR, CDC and Blackstone were among those that showed interest in the company. However, it was KKR that won the race, picking up 60 per cent stake in REEL in August that year for about $530 million, valuing the company at close to $1 billion.

KKR bought the stake from the promoter Alla Ayodhya Rami Reddy of Ramky group as also the existing PE investors – Standard Chartered IL&FS Asia Infrastructure Growth Fund and IL&FS PE – which together held a 10 per cent stake. It was in 2009 that Standard Chartered IL&FS Asia Infrastructure Growth Fundinitially picked up a 5 per cent stake in the company. Investment bank Barclays advised REEL on the KKR deal.

Apart from investing in REEL from its KKR Asian Fund III, the investment also served to enhance KKR’s global impact strategy, which is focussed on identifying and investing behind businesses with positive social or environmental impact that measurably contribute solutions to one or more of the United Nations’ Sustainable Development Goals (SDCs).

“Supporting promising companies that offer solutions to global challenges in areas such as the environment, health and human capital has become an increasingly important focus for KKR worldwide,” acknowledged Rupen Jhaveri, managing director, KKR, at the closure of the deal in February 2019. “REEL is exemplary in being a comprehensive environmental management company, theactivities of which supports the Swachh Bharat Mission to reduce pollution and improve critical sanitation infrastructure nationwide. We are confident that, with our industry experience and resources, REEL will be better positioned to achieve its social mission over the long term,” he added.

-

Mallick: delivering sustainable solutions

“Responsibly managing waste is a critical global challenge, particularly in one of the world’s fastest growing nations,” concur Robert Antablin and Ken Mehlman, co-heads, KKR Global Impact. “We believe REEL will address this critical need, while advancing two of the United Nations’ SDGs.”

Over the last decade, KKR has been a leader in driving and protecting value throughout the firm’s private markets portfolio through thoughtful environmental, social and governance (ESG) management, as well as measuring and reporting on performance to the public and investors. The firm also has a history of investing in businesses that promote sustainable solutions to societal challenges. This experience of responsible investment combined with a changing landscape of global challenges led to KKR’s decision to create a dedicated global impact business in 2018. KKR’s impact strategy and investment in REEL will build on this experience.

“India is home to some of the world’s most pressing waste management needs,” remarks Reddy. “And REEL has an important role to play in providing critical solutions to communities across the country. KKR’s expertise in environmental issue management, extensive global and local resources, and aligned vision to enact positive change, makes KKR the ideal partner to help us keep pace with the environmental challenges facing our society and provide impactful solutions. We are off to a great start with multiple strong hires added to the management team and process enhancements work to better our ESG efforts,”he adds.

Reddy brings with him over 23 years of experience related to the environment. He has the credit and distinction of establishing India’s first integrated hazardous waste, medical waste and municipal waste management facilities and has been part of developing India’s largest WTE project. Prior to being CEO, REEL, he had worked as executive director, Ramky Group. Reddy had also worked as a research scientist at the Environment Protection Training and Research Institute, a premier autonomous research institute of the government of Andhra Pradesh. He holds a Bachelor’s degree in Civil Engineering from Nagarjuna University in Andhra Pradesh, and a Master’s degree in Environmental Engineering from the University of Nevada, USA.

While the company is ramping up its capabilities in the existing space, it is making steady progress in the new frontiers of recycling and resource recovery, WTE and a circular economy landscape,and is focussed on becoming an environment solution provider for emerging nations. The company has displayed its exceptional environmental engineering capabilities by executing marquee projects with cutting-edge technologies like the AI-enabled material recovery facility in Dubai, the marpol (marine pollution) waste treatment facility in Oman and the largest WTE plants in Delhi (24 MW) and Hyderabad (19.8 MW). Apart from commissioning two facilities(total capacity: 44 MW, PPP, BOT), the company is implementing two more WTE projects (15 MW and 28 MW, to be ready in the next two years) in Hyderabad.

In November this year, REEL commissioned a 19.8 MW WTE plant at Jawaharnagar in Hyderabad. The company has set up this largest WTE facility in South India in collaboration with Telangana State Southern Power Distribution Co, Telangana Pollution Control Board and Greater Hyderabad Municipal Corporation (GHMC).

-

Ramky WTE Hyderabad project: a solution for the solid waste management in the country

The new WTE plant, which involves an investment of Rs500 crore, consumes about 1,200 tonnes per day of ‘refuse derived fuel’ (RDF), whichwill help urban areas get rid of their growing waste problem, while generating electricity as a by-product.

The project uses the environment-friendly technology of thermal combustion to dispose RDF, while generating green power. Hyderabad city’s population of over 10 million produces 6,000 tonnes of waste daily. REEL has set up the new facility following the PPP model/BOT and is setting up two more WTE facilities in the city in the next 18-24 months. And, once these two facilities are also operational, the entire waste management requirements of Hyderabad city for the next 5-10 years will be fully managed.

“As one of Asia’s largest environmental solutions providers, we are proud to achieve a new milestone with the launch of this new project, the biggest WTE plant in South India,” says Reddy. “This is one of the most technologically advanced WTE projects, which will go a long way in transforming the landscape of waste management in the country. In India, which has a population of 1.30 billion, a sustainable future lies in changing behaviour to reduce the amount of waste produced and working towards a circular economy, where discarded items are increasingly reused and recycled. WTE is just an emerging technology in India and we are chartering to bring it as a solution for the long-pending solid waste management in the country.”

Despite the pandemic-related challenges, REEL launched one of the most modern construction &demolition (C&D) waste recycling plants for GHMC in Jeedimetla, Hyderabad in November. This plant is another step in the company’s efforts to help address the low C&D waste recycling rate of the country. This plant is a state-of-the-art processing facility, fully equipped to handle the collection, transportation, processing and management of C&D waste generated in and around Hyderabad. It has the capacity to process up to 500 tonnes of C&D waste for recycling per day. It will operate under a public-private partnership model.

Earlier, in 2017, the company had commissioned India’s largest 24-MW WTE plant at Narela-Bawana in Delhi and has been successfully managing it ever since. The Rs650-crore project for the North Delhi Municipal Corporation combusts 1,200-1,600 tonnes per day of waste incineration with two MSW combustors, each of 600-800 tonnes and electricity generation capacity of 24 MW. The project deploys multiple processes such as composting, refuse derived fuel and waste-to-energy (thermal processing) to derive optimum advantage of processing to minimise the landfill footprint of the residues.

The processing facility has a capacity to treat 2,000 tonnes a day. The plant produces about 150 tonnes per day of city compost which is sold as a soil enricher through multiple fertiliser selling companies. The plant is equipped with reciprocating grate technology coupled with a semi-dry-type flue gas treatment system and helps control particulate emissions. The plant has marked the beginning of a new era in urban waste management in India.

-

Khandelwal: looking for M&A opportunities

In February this year, the company launched FARZ, a fully automatic material recovery facility (MRF) in Dubai, in a public-private partnership deal with Imdaad, a Dubai-based group of companies, which provides integrated, sustainable facilities management services.

The AI-enabled project marks its foray into the Dubai market. Spanning across 45,322 sq m with a recycling capacity of 1,200 tonnes of municipal, commercialand industrial waste – equivalent to 13 per cent of daily waste generated in Dubai – it is one of the largest of its kind in the region. The project uses advanced technologies like magnetic, optical and ballistic separators and smart recovery technologies to segregate (per type and colour) and reclaim valuables with a recovery rate of 25-30 per cent. The plant will also help reduce landfill area and emissions caused by trucks which collect andcarry waste to landfills.

“With this project, we have entered the Dubai market, expanding our geographical footprint further,” says Masood Mallick, joint managing director, REEL. “As a leading provider of comprehensive environmental solutions, launching FARZ is a part of our vision to deliver sustainable solutions at scale around the world. The project has the most efficient recovery rate of any MRF with two separate lines, one to deal with household waste and the other focussing on commercial and industrial waste. The launch of the FARZ facility is core to our transformation into a fully integrated global circular economy company.”

Mallick oversees the company’s operations globally, across all business verticals. He has been working closely with industries and investors for close to 25 years to manage resource and sustainability risks across the business life cycle. He is also recognised as an expert in the management of hazardous materials, waste management and rehabilitation of contaminated sites. Prior to joining REEL in February 2019, he was managing director, ERM, and a member of ERM's global senior leadership team.

He has also been involved in advising the government of India, including the Ministry of Environment, Forest & Climate Change, the Central Pollution Control Board and Niti Aayog, on policy, legislation and technical aspects, including regulatory frameworks, standards and the SDGs. He holds a Master’s degree in Environmental Sciences and Technology; and a Diploma in Environmental Law. He has also gone through an advanced management programme from Harvard Business School.

First mar pol in the Gulf

REEL created the Gulf region’s first ‘mar pol’(marine pollution) plant. It has formed a joint venture,Oman Maritime Waste Treatment, with Khimji Ramdas of Oman and Nature Group of theNetherlands to develop a mar pol waste discharge facility at Sohar Port and Freezone. Equipped with multistage processing technology, the facility will comply with the most stringent waste disposal standards, both at the anchorage area and within the port through a purpose-built vessel. A project of extreme significanceto the international marine environment, it will pave the way to reduce ocean contamination and enhance the quality of marine life.

Besides, REEL is building Abu Dhabi’s first integrated hazardous and biomedical waste plant. It has formed a joint venture with AH Investments owned by Abdulla Alhaj Alawadhi, to pioneer the area of hazardous/medical waste management in Abu Dhabi. The JV, which will work to capitalise on the massive opportunity in the segment, was awarded an integrated waste management project in the Al Dhafra Region of Abu Dhabi awarded by Tadweer – Centre for Waste Management under the ‘build-own-operate’ model. The project, spread across a 40,500 sqm area, involves building a waste stabilisation plant, hazardous and medical wasterotary kiln incinerator, USEPA norm secured landfill, waste storage & refrigerate storage area, site laboratory, weighbridge and other supporting infrastructure. Construction of the project, which started in 2019, is 80 per cent complete, while the remaining work is expected to be completed shortly.

-

In the last few years, REEL has aggressively looked at the overseas market, with almost 25 per cent of the revenue coming from nine international locations. Going ahead, the company plans to increase the share of foreign locations by not only ramping up its operations in existing locations but also by expanding to other promising countries.

While REEL has increased its foray into overseas market, it has continued to ramp up its operation in the domestic market too. During the Covid-19 pandemic, the company has truly exhibited its exceptional deploymentcapabilities. Despite the dangers of the highly contagious virus, its 20,000 odd on-ground workforce relentlessly servedthe community. The company, which established India’s first bio-medical waste facility in 2000, has seen a surge in biomedical waste during the pandemic, even as the waste generated by commercial establishments and industries is seeing a gradual uptick, not counting multiplexes, food joints, bars, etc. The waste generated is now 85-90 per cent of pre-Covid levels.

“The impact of Covid on the industry is lower here than in other sectors, given the essential and emergency nature of the services,” says Anil Khandelwal, Joint MD & CFO, REEL. “However, the sector has had its share of challenges in terms of workforce availability and their motivation to perform. Specifically, in terms of the impact of the pandemic on REEL, there was some disruption in operations in the first few days, when we saw a dip in the waste generated. However, things improved quickly and we got the required support from the government and local authorities.”

Khandelwal is of the view that, despite the ongoing economic challenges, the company is wellplaced to close the current fiscal year with a growth of 15-20 per cent. Though the revenue and profitability in the first quarter were impacted by about 25-30 per cent, things have looked up in the last few months and, hence, the company is confident of ending the current year on a positive note.

“We have signed agreements in ventures overseas to increase our stake,” adds Khandelwal. “We have also closed deals with banks in this pandemic time and are actively looking for M&A opportunities with a small size strategic acquisition expected to close soon. Our capex/investment plan is on and even in the current fiscal year, we are on track to invest/spend over Rs500 crore. We are confident that our Rating of AA by India Ratings will be amply proved since business is robust with strong competitive advantage.” Khandelwal, who heads finance and accounts, procurement, IT, risk and contract management, is a qualified CA, with over 30 years of experience working with large corporations. He brings extensive financial and commercial expertise including managing cash flow needs to foster organisational growth in India and overseas markets. Before joining REEL, Khandelwal was the CFO with Tata Projects.

-

Despite the pandemic, the group’s 20,000 odd on-ground workforce relentlessly serve the community

Experts are of the view that the waste management space presents a massive opportunity in emerging country like India, where only 10 per cent of the overall waste generated (and only 5 per cent MSW) is managed and hence there is huge scope for improvement. In fact, there is huge opportunity of $15-20 billion which the company like REEL is well poised to explore with its expertise and capabilities.

“Emerging economies as we all know are some of the worst performers in terms of SWM due to large population, high population density, poverty and lack of technology advancement,” informs Reddy. “But the good thing is the rising awareness among citizens, who are increasingly demanding their right to clean air, water and soil. This puts us in a position to grow well in future.”

With all these developments in place, REEL has positioned itself quite strongly in the market. Over the years, the company has built up its expertise and capabilities across the value chain. It has put in place a well-diversified offering, which not only helpsit ramp up its revenue but also provides it with a much-needed hedging mechanism. I

n a country like India (or for that matter,any other emerging economy), handling waste and its safe disposal hasbecome a major issue and the situation will only get more challenging, as most of these economies are on a growth mode. This is where a company like REEL will play a big role through a gamut of solutions, which are now graduating into recycling, recovery and a circular economy from mere managing, handling and disposal. In this context, REEL’s business has never been more imperative.

The company has emerged as one of Asia’s largest environment and sustainability focused entities. And it has been fairly successful in building a large company with a sturdy business model that has always been ahead in terms of legislation, technology and delivering solutions. With KKR coming onboard to support its vision, the company has now greater access to capital and global markets. This will also help in strengthening its goodwill and trust and hence help it ramp up its capabilities and portfolio in a big way, going ahead.