Data is fuel and two IITians who got together to fuel the business intelligence industry have already emerged among the global top 5. This is the story of 36-year-old Neha Singh and 40-year-old Abhishek Goyal who kicked their jobs to set up Tracxn Technologies Limited (TTL) as a private market intelligence platform. “Private companies have always been a backbone of global economic growth and continue to contribute to the positive business environment,” says Neha, an IIT-Bombay alumnus. “The rate of creation of companies has increased exponentially, while companies are remaining private for longer,” says Goyal, an IIT-Kanpur product, and quoting a Frost & Sullivan Analysis. On the idea behind Tracxn, Neha recalls that there are many platforms for public companies, but the private ones were doing tracking data manually. “That’s where we thought of this platform and we launched it in the US,” she says. Today, Tracxn is 900-customer strong across the globe. “Our job is to facilitate investors to make informed decisions,” says Goyal, Vice Chairman and ED, explaining: “They track for hundreds of key data points and we provide all those”. The firm offers customers private company data for deal sourcing, identifying M&A targets, deal diligence, analysis and tracking emerging themes across industries and markets, among others. “In short,” says Neha, “we want to accelerate innovation globally in the private space as investors look for opportunities and start-ups aspire for funds.” “While we are an Indian SaaS (Software As a Service) company, our platform Tracxn serves customers globally,” explains Goyal. “Our ability to develop and deploy the platform in India provides us with significant cost advantages. Service providers, especially those operating out of regions like India, have cost advantage as their pricing is much more competitive than their global competitors. Our business is technology driven, asset light and scalable,” he adds. As per estimates, there are around 190 million to 200 million private companies worldwide. Private companies have shown continuous signs of growth and with globalisation and the emergence of favourable business environments across most countries globally, private sector companies are expected to further push for growth. The increasing private market is becoming more and more relevant and private market AUM stood at around $6 trillion in 2019 and is expected to reach around $8.45 trillion by 2025. Growth in AUM will mostly be driven by private equity firms and venture capital firms who will look to focus more on shifting their investments from public equity funds to private equity markets. Private equity firms have been faring well in the global markets. These companies have witnessed increased investments, strong exits and attractive returns. Due to these increased activities among the PE firms, the global economies have seen robust growth and this has resulted in the increased fund-raising activities among the private sector companies. Private companies have been successful in raising close to $3 to $3.5 trillion in the past five years. The global economic slowdown affecting geo-politics and the ongoing health emergency across the globe is seriously challenging the way businesses function today. “In these volatile times, having the means that can help organisations to make informed decisions on where to invest, how to invest and how much to invest, can prove handy. The demand for this type of business intelligence is growing and is expected to further intensify in these testing times,” says Goyal.

-

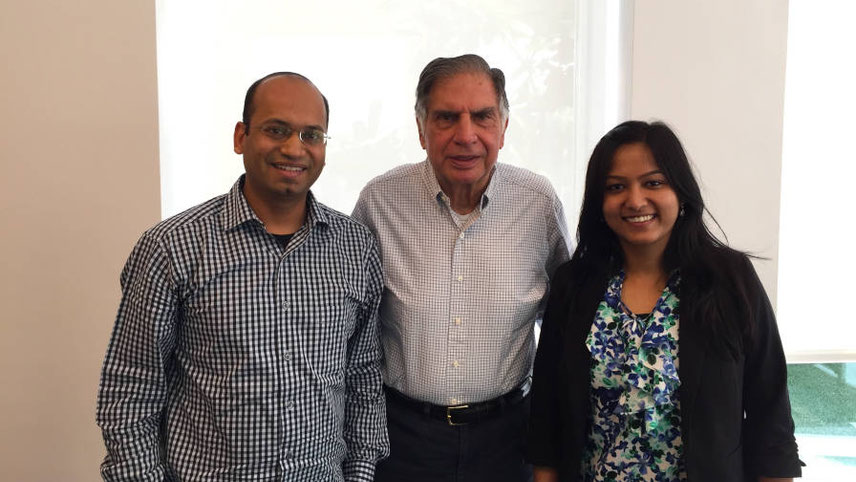

Neha and Goyal: Our job is to facilitate investors to make informed decisions