-

We have been quite late in taking decisive steps. However, what is happening now seems to be quite progressive and promising

Harish Mehta, Former Chairman, NASSCOM

According to him, the second big opportunity came around the turn of the century when chip giant Intel expressed its intention of setting up a large-scale chip plant. But after much prevarication by the government, it decided to shift the plant to Vietnam which is now a major global manufacturing centre for them. “We have been quite late in taking decisive steps. However, what is happening now seems to be quite progressive and promising. It triggers the hope that we will finally make a mark in this sphere,” Mehta adds.

And this ‘better late than never’ progressive attitude appears to be a common sentiment among stakeholders who believe that the growing YoY production volume is backed by the determined efforts of all involved in the value chain. “I can assure you, this time we have boarded the bus at the right moment,” says Sanjay Gupta, Chairman, India Electronics and Semiconductor Association (IESA).

“The environment for electronic production in the country is now extremely conducive. I believe at some stage in the future, we will see high-tech production seamlessly happening here since the country has a qualified talent pool,” says Ajay Mehta, MD, AIWA (India), a popular global brand which has recently made a comeback in the country.

Setting up higher targets

“The surge in electronics production we are noticing today is a result of the Government’s ‘Make in India’ programme which was adopted in 2014. Electronics and related businesses were its key focus areas. And in the initial years the government set the tone by introducing measures to encourage domestic production. While it enhanced the import duty on finished goods, the duty on components was reduced. So, the main focus was on developing domestic capabilities,” says Manish Sharma, Chairman, Panasonic Life Solutions (India & South Asia) who also spearheads the FICCI Electronics Manufacturing Committee.

This was followed by a spate of PLI and other schemes – PLI for Large Scale Electronics Manufacturing (2020), PLI for IT hardware (2020), Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS, 2020), Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme, Program for Development of Semiconductors and Display Manufacturing Ecosystem, etc.

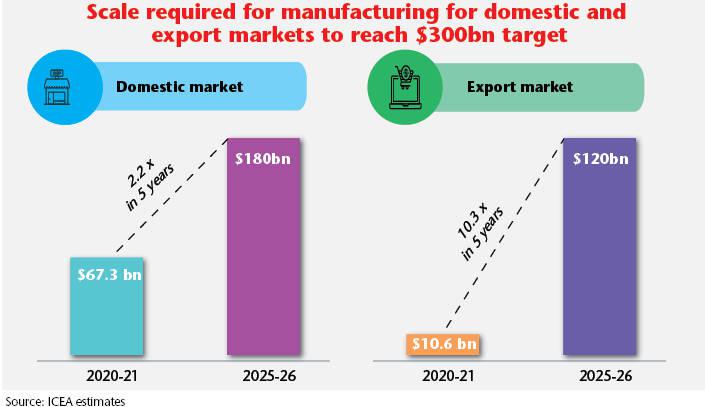

The initial wave of success has clearly emboldened the government to pursue bolder time-bound targets. Early last year, Ministry of Electronics and Information Technology, in association with ICEA, released a 5-year roadmap and Vision Document for the electronics sector titled ‘$300 bn Sustainable Electronics Manufacturing & Exports by 2026’. The report provides yearly production projections for the various products that will lead India’s transformation into a $300 billion electronics manufacturing powerhouse – an almost four-fold increase in terms of total estimated worth from last year.

According to the document, these key products include mobile phones, IT hardware (laptops, tablets), consumer electronics (TV and audio), industrial electronics, auto electronics, electronic components, LED lighting, strategic electronics, PCBA, wearables and hearables, and telecom equipment. Mobile manufacturing is expected to cross $100 billion in annual production – up from $30 billion last year – and is expected account for 40 per cent of this quantum leap journey.

-

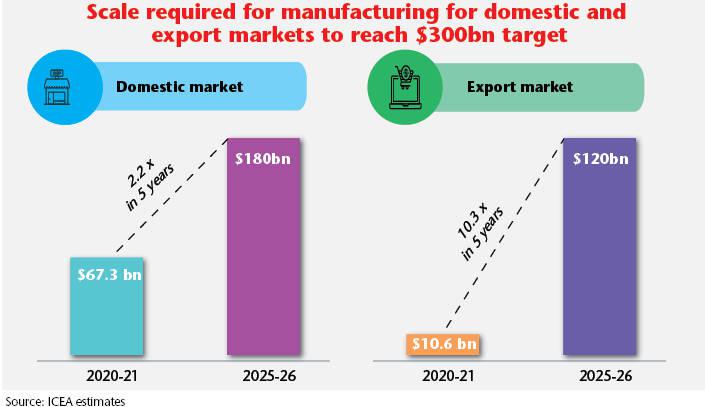

According to a government document, of the $300 billion production India is targeting by 2026, domestic demand will account for around $180 billion while exports are expected to reach $120 billion the same year. “The $300 billion electronics manufacturing comes on the back of a $10 billion PLI scheme announced by the government to propel the semiconductor and display ecosystem forward. The government has committed nearly $17 billion over the next 6 years across four PLI Schemes – semiconductor and design, smartphones, IT hardware and components,” the paper maintained.

Broader trends

The vision for electronics is undoubtedly on an epic scale and according to stakeholders, no serious gaps have been identified in its pursuit though certain areas need to be streamlined. “The environment for the growth of the electronics industry is quite favourable now vis-à-vis what it used to be. The compliance norms are quite precise, the process of BIS registration takes only one month as against the 6 months it used to take earlier. And there are some states which have aggressively come forward to encash the opportunity unleashed by the centre,” says a senior official of a leading global EMS (electronic manufacturing services) which specialises in high tech products and has been in India for the last couple of decades.

EMS, in fact, is quite an active category today taking a structured shape with a clutch of global giants expanding their operations while a new set of domestic players have appeared on the scene, almost from nowhere. “The scheme has simply energised the industry. And things have happened at a fast pace. We had just started with a small plant of LED lighting but we now also provide manufacturing services for a major AC brand,” says Sukrit Bharati, MD, Virtuoso Optoelectronics.

Some states are becoming extremely competitive in attracting manufacturers and other players in the electronics value chain, which is a critical component of the electronics growth story. “Gujarat, Odisha, Maharashtra, Karnataka, Uttar Pradesh, Tamil Nadu, Andhra Pradesh, and Telangana are some of the leading states that have shown the drive to capitalise on new opportunities,” says Sanjay Gupta of IESA.

According to industry insiders, the scheme for electronic cluster creation now plays a more critical role. Introduced in 2008, the scheme was modified in 2019 to be more friendly for those wanting to set up their operations. “Earlier, trying to set up your base in a cluster meant dealing with a diverse set of government agencies and their typical landlord attitude. Now, everything is integrated, and you can literally walk into a plug-and-play environment with fiscal incentives on top,” points out Vinod Sharma, MD of Deki Electronics and Chairman of the CII National Committee on ICTE.

-

India can become a global hub for manufacturing of IT hardware The surge in electronics production we are noticing today is a result of the Government’s ‘Make in India’ programme which was adopted in 2014

Manish Sharma, Chairman, Panasonic Life Solutions (India & South Asia)

An important contributing factor that many are pointing to is the broader ‘China plus one’ strategy of many advanced countries in the West post-Covid. Chinese hegemony in electronics exports, a gigantic $800 billion cumulative category, is a well-known factor. The US, Taiwan, Japan, Germany, and Vietnam are the other leading global suppliers, but they lag far behind the leader. In such a scenario, India’s determination to develop in electronics, backed by action to create a vibrant platform, seems to have gone down well.

“With a global emphasis on expanding semiconductor supply chains and reducing reliance on a single country, the world turns its gaze towards India to lead the ‘China plus one’ strategy, and work in that direction has already started. These efforts will create employment opportunities, reduce import dependency, and help India become an export hub,” says Hitesh Garg, Country Manager at NXP Semiconductors

Story of the decade

While statistics point to phenomenal growth in some areas, how high is actual growth in a sector which has a vast expanse and which will be the main stage for all experimentation and innovation unfolding across the globe in critical segments like semiconductors? “PLI, so far, has facilitated major scale building in assembling. Now it has to trigger large scale component manufacturing in the coming years to go to the next level,” says Vinod Sharma. “We are still importing a substantial part of the components. That too from China and we want to become their rivals. It’s quite early in the day. But yes, there is no denying the fact that enquiries are going up,” a senior official of a leading domestic EMS concurs. Like any other leading business, there is low hanging fruit in this business and experts are pointing at the lower crust of the electronics industry which India seems to have begun tapping.

“There are two distinctive components of electronics manufacturing. One is driven by open-source technology (eg LED lighting or any other common electronic device) and the second part is based on high value IP based technology (eg advanced semiconductor chips). We have currently started making a mark in the former,” points out Ankur Bisen, Senior Partner, Technopak Advisors, while emphasising that the latter is being used as a geopolitical tool by the countries in the West, particularly the US.

Last year, US President Joe Biden signed the CHIPS (Creating Helpful Incentives to Produce Semiconductors) Act doling out $52 billion worth of government subsidies and incentives for the semiconductor industry to boost manufacturing within the country. The move is clearly aimed at discouraging technology transfer to China as the law specifies that if any company transfers technology to its centre in China, it would not be able to take advantage of subsidy benefits or other government support.

-

Efforts like China plus one strategy will create employment opportunities, reduce import dependency, and help India become an export hub

Hitesh Garg, Country Manager at NXP Semiconductors

In a similar move last year, the European Union (EU) had proposed the European Chips Act, which would enhance the market share of semiconductors made within the EU to 20 per cent from less than 10 per cent. “This is also termed chip nationalism. Several billion dollars will be spent on it in the coming years. Our PLI scheme is providing support of $10 billion but Samsung alone is spending a higher amount to set up a mega chip manufacturing unit in the US,” explains Bisen.

“India can become a global hub for manufacturing of IT hardware, but the question is – of what kind? Wafers? At 20Nm? Or 10Nm? Or the cutting edge which is 3Nm just now? Or DRAM chips? Or embedded processors – as IoT becomes embedded in most manufactured goods this could be a large area. In none of these areas is India at the cutting edge right now,” says Professor Arvind Sahay of IIM – Ahmedabad.

Developing expertise in the semiconductor segment will be extremely important as the country pushes its electronics prowess to the next level. “India is not quite as far along in terms of manufacturing what we at Synaptics would consider the most essential part of the electronics hardware segment – which is the semiconductor portion.

Manufacturing semiconductors is a complex, expensive and resource-intensive type of operation and we are far from achieving the type of scale and success that chip manufacturing regions like Taiwan, Korea, and the US have achieved. The ecosystem around manufacturing – testing and packaging, for example – is also quite competitive with emerging economies like Vietnam, Southeast Asia, and Mexico all vying to establish themselves,” points out Michael Hurlston, President & CEO, Synaptics.

Private companies in India like Tatas and Vedanta have shown a willingness to lead in this lucrative game but dramatic results are not expected in the near run. Official circles in Delhi, meanwhile, are abuzz with speculation that the government is working on a new set of incentives for the semiconductor business which is expected to be announced by the end of July.

-

India is not quite as far along in terms of manufacturing what we at Synaptics would consider the most essential part of the electronics hardware segment – which is the semiconductor portion

Michael Hurlston, President & CEO, Synaptics

But in other sectors, the country’s recently begun rapid stride trend is expected to continue unabated. However, stakeholders are suggesting a set of measures to further consolidate the entire drive. “Since electronics is also emerging as a stronghold component of the export basket, we must look at joining hands with consumer-led economies via FTAs (free trade agreements),” says Manish Sharma of Panasonic. “We need to get MSMEs in the PLI fold. The current impression is that it is meant more for the big companies. The entire drive has to develop an inclusive character,” adds Vinod Sharma.

The preliminary results of India’s fresh impetus in harnessing the electronics business seem to have created an extremely positive atmosphere overall. “It is true that we are still importing 60-70 per cent of components for common items like television or refrigerators. But a decade earlier, it was 90 per cent and in a decade from now, it might well be 10 per cent. So, see the difference and imagine the benefits for the country,” Sanjay Gupta of IESA says. And like Gupta, there are many who believe that electronics could well turn out to be the most exciting transformative story or even the story of the decade for the Indian economy.

-

Sharma: there are several steps being taken towards developing a favourable ecosystem

“More initiatives in the pipeline”

Alkesh Sharma, Secretary, MeitY speaks about the broader nature of the surge in electronics business while indicating a possible future direction

How would you explain the churnings witnessed in the Indian electronics industry in the recent years?

India witnessed unprecedented growth in electronics manufacturing in the last 5 years. The growth rate in the electronics manufacturing sector has been in excess of 23 per cent. The domestic production of electronic items has increased substantially from Rs3.17 lakh crore ($42 billion) in 2016-17 to Rs6.40 lakh crore in 2021-22 ($87.1 billion) at a CAGR of 15 per cent. India’s share in global electronics manufacturing has grown from 1.3 per cent in 2012 to 3.75 per cent in FY21-22, as per industry estimates. It is predicted that India’s electronics production will rise to $300 billion from the current $87 billion, as part of the $1 trillion digital economy vision.

Has it reached the decisive stage where it will catapult India to a major global hub in electronics manufacturing?

Indeed, Government of India’s goal is to broaden and deepen the country’s electronic manufacturing ecosystem. At this juncture, National Policy on Electronics 2019 (NPE 2019) envisions positioning India as a global hub for Electronics System Design and Manufacturing (ESDM) by encouraging and driving capabilities in the country for developing core components, including chipsets, and creating an enabling environment for the industry to compete globally. Resonating with industry demands, MeitY’s interventions and policies have been globally hailed by the concerned stakeholders.

How would you explain the response of the private sector to push Indian electronics business to a new growth orbit?

The participation and response by the private sector players in various Government of India initiatives has been enthusiastic. The growth story of Indian electronics has been a result of the trust and confidence shown by private players towards GOI’s schemes. As a result of this, the PLI Scheme for LSEM is making desirable progress.

Under this scheme, by FY27, the 32 approved companies are expected to lead to a total production of approximately Rs8,12,550 crore over the next 4 years. This will create 2,00,000 additional direct jobs. The scheme is expected to bring an additional investment in electronics manufacturing to the tune of Rs12,700 crore and will lead to creation of 1,80,000 additional jobs.

Concerns have been expressed that the absence of a full-fledged ecosystem for components will turn out to be a major hurdle. How would you respond to that?

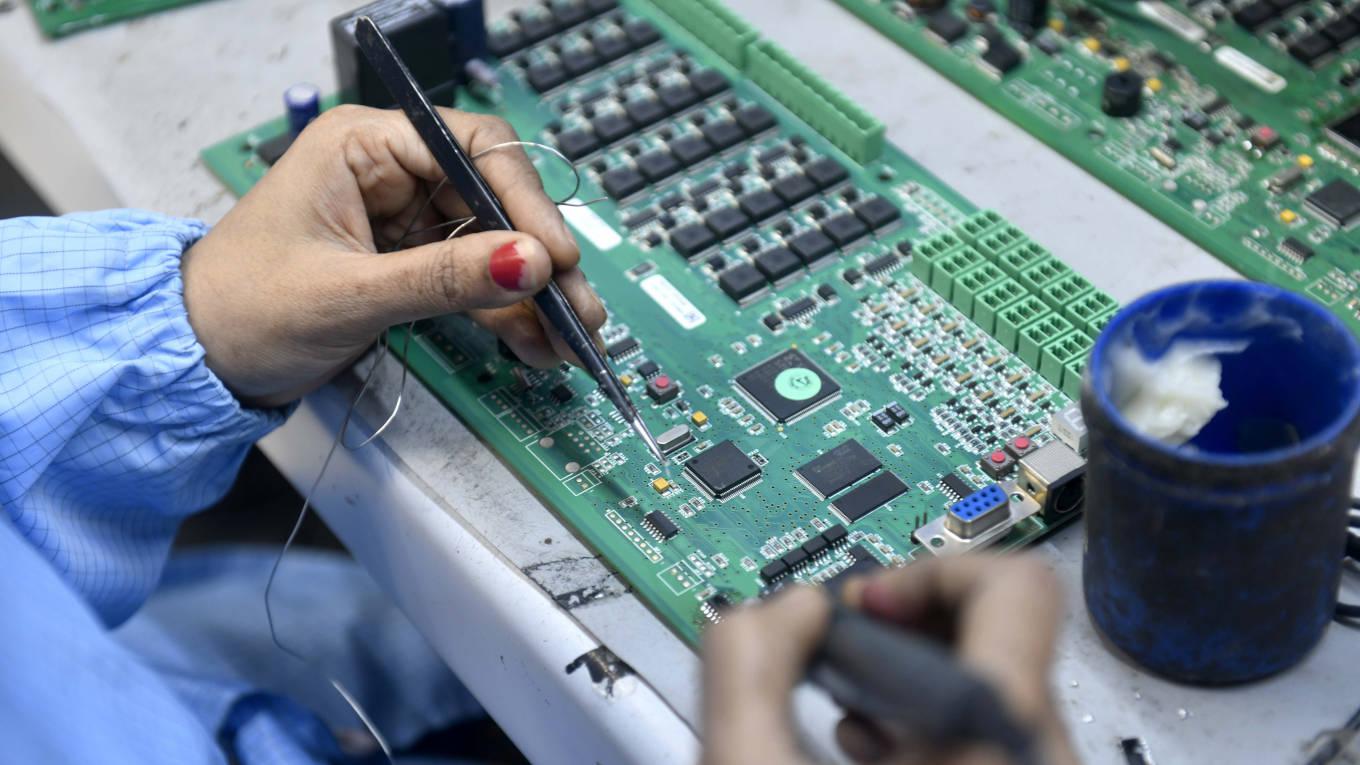

Building sub-assemblies and a component ecosystem are at the heart of electronics manufacturing and are a natural extension towards assembling finished products. An electronic device contains a high density of components and the manufacturing of these components holds immense job and value addition potential.

Components such as battery packs, chargers, USB cables, connectors, inductive coils, magnetics, flexible PCBAs, charger enclosures, active and passive components, etc can be manufactured in India within existing capabilities with modest policy support. In order to attract global investors, the cost advantages that a country offers are of paramount importance.

However, as the ecosystem develops and the cost advantage starts to wane, leading global firms may scout for an alternate and more attractive manufacturing destination to retain a competitive advantage. The global demand for components is currently being met by manufacturers located outside India. This may provide India with a platform from which Indian ecosystems may take over, in the near future.

-

Building sub-assemblies and a component ecosystem are at the heart of electronics manufacturing and are a natural extension towards assembling finished products

Do you think the broader China plus one strategy adopted by many countries post-Covid is helping the Indian electronics industry?

With the world more connected than ever and the digital push caused by the Covid-19 pandemic, the demand for electronic devices is expected to grow steadily and continue to be a major economic driver globally. The goal of the Government of India is to boost electronics manufacturing in the country and reduce the dependency on China for electronics trade.

To deepen and widen electronics manufacturing in the country and increase participation in Electronics Global Value Chains (GVCs), a collaborative effort by the industry and government is being made to increase scale, competitiveness, domestic value addition, and build large-scale electronics manufacturing capabilities to achieve a substantial contribution to electronics exports.

The Ministry of Electronics and Information Technology (MeitY) has launched several policies and schemes providing fiscal incentives to the industry, creating a level playing field vis-à-vis competing nations.

The government, of course, has helped with initiatives like the PLI scheme. In the near to medium run, might there be more initiatives to further extend the support line to the sector?

Yes. Government of India is indeed working in the direction of formulating more initiatives like the PLI Scheme, which will again aim to extend the best possible support to the sector and make India a global manufacturing hub for electronics. To mention a few of these initiatives, MeitY is working on the PLI for IT Hardware 2.0.

Another initiative on which the Ministry is working towards is engaging with supply chain partners of global mobile manufacturing companies. The core objective of these interactions is to make these global players aware about the various schemes and programs of the Government and entice them to explore India as their next destination for investment. In addition, there are several steps being taken towards developing a favourable ecosystem for components and other product segments like hearable & wearables, IT accessories, etc.