-

Patel: The CCAvenue mobile app with TapPay feature promises to be a game-changer

IAL has come a long way since 2007, when it was founded by Vishal Mehta, after returning from the US and quitting Amazon’s top executive job. “The idea of ‘Infibeam’ has evolved in the past two decades and, being an innovation-oriented fintech company, it will continue to evolve in future as well,” affirms Mehta. “The evolution has been sparked by various mergers & acquisitions and multifaceted collaborations to shape Infibeam into the way it is today”. His idea of Infibeam was to democratise digitalisation by enabling merchants through eCommerce, connecting with their customers through the web and mobile platforms.

“Digitalisation brought in credibility, enabling merchants to expand and prosper. Since inception, Infibeam nurtured its business mantra – DCB. D is for digital, allowing merchants to go digital (digital democratisation); C is for credible, as digitalisation brings transparency, accessibility and, as a result, credibility (credibility built and nurtures trust); and B stands for bankable. If all three (traders, merchants and customers) are credible, then access to credit is possible for all expansion purposes. High credibility makes them bankable (reliable)”, adds Mehta.

What started as an eCommerce software platform business, which ensures the creation of a digital and credible merchant base, eventually moved towards building ‘bankable’ merchants, by merging digital payments brand CCAvenue. It subsequently evolved into a huge digital payment infrastructure company.

And, in 2010, the company launched India’s first eCommerce technology platform for the enterprise. ‘The first RuPay debit card transaction was processed through CCAvenue, in 2013,” adds Mehta. “A year later, we were the first to offer social network in-stream payments for social media platforms, besides becoming the first internet registry in India to launch a generic, top-level domain ‘dot triple O’ (.OOO)”. He then incubated Fable Fintech, offering a cross-border payments platform to nine of the top 10 private banks in India across 150 plus international corridors.

Payments infrastructure

In 2016, IAL became the first new-age tech company to come up with R450 crore IPO and to get listed on the Indian stock exchanges (the share now trades at Rs13.66). A year later, Infibeam merged and took control of Avenues (India) Pvt Ltd (CCAvenue) through an equity stake. After the merger, IAL entered into the fintech space.

“The same year, we became, along with consortium partners, the first to be awarded contract to manage, design, develop, implement, operate and maintain the Government e-Marketplace (GeM),” discloses Mehta. “We were the first RBI licensed operating unit to onboard billers and agents across India”. In 2018, he launched B2B payments for corporates, offering vendor management, collections and payouts.

Today, IAL owns payments infrastructure that powers merchants of all size and shapes, from private to government. The company’s software platform and payments infrastructure powers payments for online businesses, physical retailers, subscriptions, online marketplaces, utility billing, remittance, government eCommerce marketplace, digital banking and everything in between with trust and safety as centrepiece.

“We have built state-of-the-art, risk-and-fraud solutions for payment infrastructure and enables merchant financing, e-invoicing and much more,” adds Patel. “Ambition has propelled IAL to grow into a one-stop-shop for banks, corporate and merchants, for their online commerce and digital payment requirements. And the ‘DCB’ business mantra has enhanced the company’s growth and made itto one of the top three B2B online payment players, with more than 8 per cent market share in India”.

-

Over the years, Infibeam has made investments to nurture its digital infrastructure capabilities. For instance, it picked up a substantial stake in Go Payments – a digital payments tech firm and incubated Fable Fintech – a digital end-to-end cross-border payment remittance solution for banks and financial institutions. In 2018, IAL invested in the Mumbai-based digital payments tech firm Instant Global Paytech Pvt Ltd (IGPL), which operates Go Payments.

“In 2019, we partnered with Riyad Bank for digital payments services,” informs Patel. “We signed a deal to license its e-commerce and payment software with Jio Platforms, Reliance Jio’s digital platform venture. And, in 2020, we partnered Oman’s Bank Dhofar SAOG to provide a CCAvenue payment gateway service, to process online card transactions of various payment networks for Bank Dhofar SAOG and help the bank authorize online payments for its customers. The same year, we entered into a definitive agreement with JPMorgan Chase Bank to provide the company’s flagship digital payment brand, CCAvenue, to process transactions for JPMorgan’s enterprise clients. In 2021, Infibeam has also signed up with a consortium led by Jio to apply for NUE licence”.

IAL’s payment solution includes acquiring and issuing solutions and offering infrastructure for banks. The core Payment Gateway (PG) business provides over 200 plus payment options to the merchants allowing them to accept payments through website and mobile devices in 27 international currencies. The company’s enterprise software platform hosts India’s largest online marketplace for government procurement.

The company processed transaction worth Rs2.8 lakh crore ($37 billion) in 2021-22 for its 5 million plus clients across digital payments and enterprise software platforms. Infibeam Avenues’ international operations are based in the UAE, Saudi Arabia, Australia and the US. It also has a business presence in Oman.

“The company has new business initiatives, such as Uviksoft point of sale (PoS) terminal technology product and lending aggregator platform and trust avenues, which are expected to help it grow its TPVs and margins,” says Deven Choksey of KR Choksey India. “The Indian market is hugely underpenetrated for digital payments. The company is awaiting RBI’s nod on payment gateway licence applied in September 2021, which is mandatory for all payments companies in India. Licensing will ensure customer safety in payment transactions. The company is also waiting for a nod from RBI on New Umbrella Entity (Payment Network) for which licence was applied in 2021 in tandem with one large India conglomerate and two other internet companies.”

Milestone moment

“GeM achieved a significant milestone last year, crossing Rs1 lakh crore in GMV in 2021-22. And the company expects even higher GMV in 2022-23, with the integration of railways, public works and other initiatives, to bring more business on the GeM portal, to enhance transparency, efficiency and savings. It plans to launch its payments solutions in Saudi Arabia and the US in 2022-23 and is evaluating other geographies to launch in the coming time”.

-

The world’s most advanced omnichannel payments app is being launched

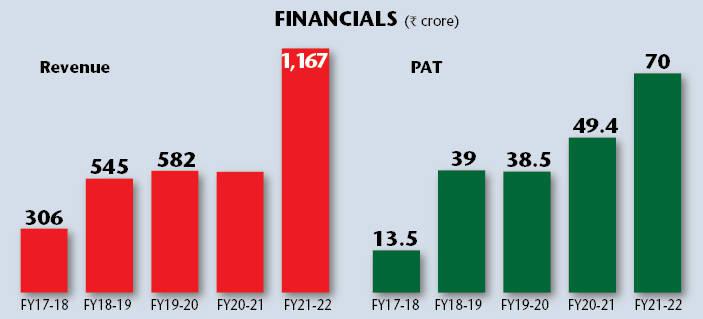

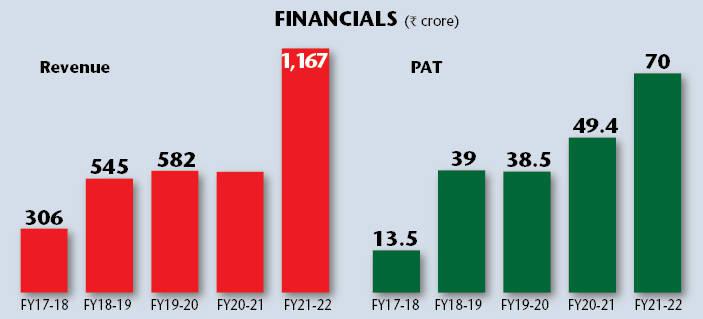

And for 2021-22, adds Choksey, “The payments methods mix was 45 per cent credit cards (including BNPL) and 5 per cent UPI, with the remaining spread over debit cards, wallets, net-banking, etc. Also, lower UPI and bill payments, express settlement and infrastructure services are contributing to the increase in net take rates. The company expects to process Rs4 lakh crore in 2022-23 and have TPV of Rs5 lakh crore by the beginning of 2023-24E. The company hopes to reach revenues of Rs1,600-1,700 crore during 2022-23 and clock in EBIDTA of Rs110-120 crore and a net income of Rs110-120 crore for 2022-23”.

“In the next two years – 2022-23 to 2023-24 – we expect to touch $100 billion worth processing on our combined digital and fintech infrastructure platform & payment,” forecasts Mehta. “Our run rate at the moment is $48 billion in transaction processing. The future of payments in India and globally will be real-time payments, borderless payments and contactless payments, with security and trust at the centre of all these, which will turn the future into a cashless economy”. He sees Infibeam’s growth propellant touching $1 trillion in transaction processing by 2032 for the domestic and global. It will then be 10x what it is today. Higher transaction processing will result in higher revenue for the company then”.

“This is possible as the future of payments is going to change dramatically,” adds Mehta. “In future payments, we will be moving towards a cashless economy/ economies and, with the advent of 5G internet in India as well in other countries, the digital payment growth will further accelerate”. Mehta presumes the four major propellants to aid IAL to touch $1 trillion by 2023.

“We provide eCommerce platform technology for two of the largest eCommerce players in India – GeM and JioMart, along with several other prominent players in the international markets, including Saudi Telecom,” adds Mehta. “We expect an increase in transactions on eCommerce platforms and have a great chance of witnessing earning surge. Offline payment, via CCAvenueTapPay, throws open a huge opportunity, where we are not only solving a pain point by doing away with expensive PoS machines for merchants and increasing transaction processing volume for us, but are also enabling ourselves to create some sort of lending framework for merchants, as we have data on of their cash flow on our digital infrastructure”. One of the major concerns for merchants is gaining access to short-term capital, and “with us using CCAvenueTapPay, we will be able to convert our 5 million plus merchants and newly acquired merchants into our customers for lending business as well”.

“Merchant lending will be big, as we are soon to step into the lending business, where we will be using our huge 5 million plus merchant base for digital lending and using artificial intelligence (AI)-based lending, using our database will ensure that we do zero-risk lending,” says Patel, who is also looking at merchant GST lending.

“We see huge opportunities to lend to millions of merchants for their GST payment obligation, which are short-term loan requirements for merchants and are a highly secured lending format for us. I hope banks and NBFCs will have the necessary regulatory approval for making GST lending to merchants.”

-

We see huge opportunities to lend to millions of merchants for their GST payment obligation, which are short-term loan requirements for merchants and are a highly secured lending format for us

“In lending, providing a loan is not much of a challenge, but recovering the loan is,” adds Patel. “And, we are sitting on billions of transactional data, where we know which merchants have decent cash flow, enabling us to shortlist them and provide quality lending (risk-free lending) for banks and NBFCs. We will not be into lending per se, so currently, we are not looking into getting any NBFC licence. We would be a platform – like Shaadi.com – where we play a role of just a mediator/ match-maker and ensure quality lenders (banks & NBFCs) and borrowers/debtors (merchants) are on board”.

IAL sees a big opportunity in international transactional for NUE card network (provided the consortium led by Jio, where IAL is a part, get the licence). And, in the international transactional business, IAL sees substantial exponential growth potential. “We are number two in terms of ranking amongst non-banking private payment companies in the UAE. We have partnered the top two banks of Oman (which holds 90 per cent market share) for card processing. We are in Saudi Arabia and other GCC (Gulf Co-operation Council) markets too. We will be expanding in the US market, where we have five senior sales persons, including a CEO, in action. We plan to launch a payment gateway service in top 3-4 markets in terms of potential, such as Indonesia, Thailand and the Philippines in next 2-3 years and then will gradually expand into other ASEAN markets. We will target other geographies of MEA, Eastern Europe and a few developed markets globally. This will give us a huge base of payment transactional processing business in the international arena”

As IAL sees payment infrastructure and digital lending (based on the processing data) as a major growth propellant it is hopeful of reaching $1 trillion in transactional processing by 2032, and this will translate into higher revenue for Infibeam Avenues as well.