-

Aloke: pentonic is a game-changer

Bolstered by the success of his refills business, he started manufacturing pens. He began with direct-fill pens of the use-and-throw variety, sourcing tips and ink from Switzerland and Germany. The product, whose name was changed to Linc, became popular in the market. His entire focus was on quality at an affordable price. He is now 84 and not involved in the business. His sons Deepak, 59 and Aloke, 52 have played a crucial role in shaping the business and have taken the company to new heights.

Linc is the third largest writing instruments company in India, with 8 per cent of the Rs4,000 crore industry. The unorganised sector controls about 25 per cent of the total market. The segment is growing at 5-6 per cent per annum. Flair Pens is the market leader, followed by BIC Cello in second position. Linc produces 850 million pens per annum – a diverse range of ballpoint pens, and gel pens for the mass and popular segments, with prices ranging from Rs5 to Rs150.

Linc has a portfolio of over 50 types of pens. Pentonic, Glycer, Linc Smart and Signetta are some of the prominent brands of the company. “Pentonic is our highest selling brand and contributes 25 per cent to our total revenue. It is growing at a fast pace and our target is to double its contribution,” says Aloke.

The Indian writing instruments segment is fragmented and most competitive, because of low entry barriers and undercut pricing. Close to 75 per cent of the industry revenue comes from pens priced below Rs10. Therefore, it is important to be distinctive. Linc has constantly endeavoured to bring innovative product ranges to the market. “Our aim is to offer customers innovative designs, wide choice and affordability,” says Deepak.

The Pentonic success

Launched in 2019, the Pentonic pen brand is one of the finest and most technologically advanced products from the company and has been a great success. The black matted-textured pen with ultra-smooth grip known for its aesthetics offers a great writing experience. It was designed in Korea – a hub for the development of writing instruments. This advanced mechanism new-generation pen is priced between Rs10-Rs20 and is available in several variants. “The product and the price point have created buzz in the industry,” claims Deepak sitting in his corner office at the company’s sprawling 20,000 sq ft new address at Sector V in Salt Lake in Kolkata. He wants to diversify the Pentonic range.

“Linc is a healthy competitor. It is an innovative company with quality products. During the past few years, they have reinvented themselves and maintained a healthy topline and bottom-line. Their brand, Pentonic, has given them an edge in the market,” says executive director of Flair Pens, Mohit Rathod.

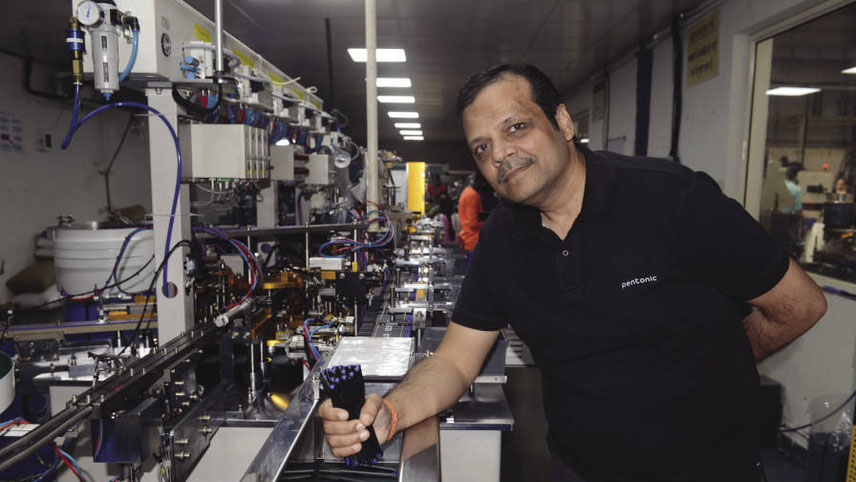

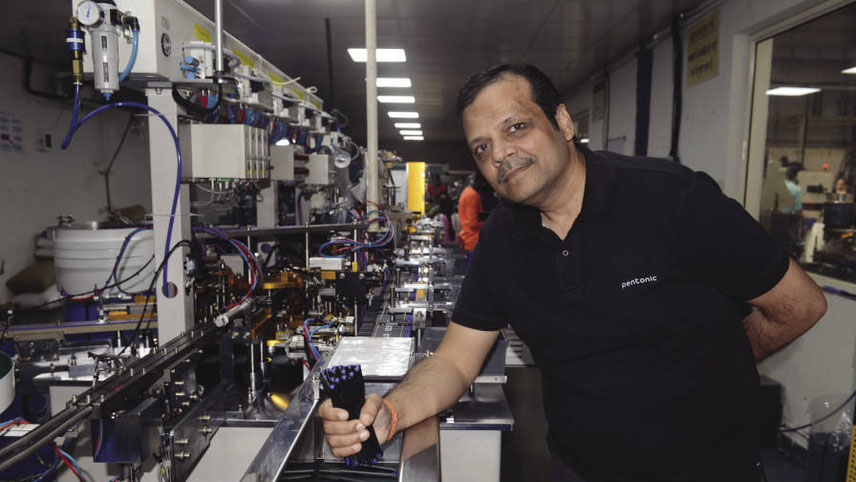

Linc has two manufacturing facilities – in Serakol in Kolkata and Umbergaon in Gujarat. The Umbergaon unit is the mother unit of the company and was set up in 2017. The modern integrated manufacturing facility has the capacity to produce 350 million pens per annum. The unit has an auto-feeding raw material system for production. The advanced injection moulding and robotic system reduces the percentage of manual labour involved. The management claims the overall manpower used is 30 per cent less than with normal pen manufacturing and the operational cost is 5 per cent less than its peers.

-

As part of its growth drive, the company is stepping up the existing capacity in Umbergaon. It is exploring doubling the existing capacity of this unit in a phased manner. “We are in the final stage of land acquisition adjacent to the existing one. The new facility is expected to be commissioned in the last quarter of FY24 with an approximate investment of Rs50 crore,” says Aloke. The expanded capacity is likely to significantly reduce the company’s dependency on contractual manufacturers.

Gujarat is where the most of the input such as polymers, ink and other components and its suppliers are based. This allows it to have a lean inventory and improve margins. However, raw material prices have increased almost 20 per cent in the last one-and-a-half years due to high crude prices. “We were able to absorb part of the cost increase in the trade due to a higher mix of the flagship brand Pentonic in the revenue basket and the rest through a price rise,” Deepak clarifies. Also, the imposition of 18 per cent GST on writing instruments, which are mostly used by students, is considered very high and impractical. This escalated the cost for pen manufacturers.

Gujarat’s proximity to the port from which the company exports its products helps as well. Linc is one of the largest exporters of pens and 20 per cent of its turnover comes from exports. It exports to more than 40 countries, including the Middle East, Central & South America, CIS, Europe, South East Asia and the SAARC nations.

“We will continue to strengthen our export market with our premium brands,’ says 34-year-old Rohit Jalan, director and Deepak’s son. He handles exports, stationery and the IT initiatives of the company. He has practically eliminated manual processes and his upgrading of the company’s ERP system improves efficiency by reducing the time and effort required by the company’s workforce to carry out their activities.

Linc re-oriented its business by reaching out to a considerably large number of retailers across the Indian landmass. Besides general trade, the company’s products are also sold through modern trade like Bigbazar, Reliance, Walmart and Starmark. The company also uses e-commerce platforms like Amazon and Flipkart.

“We are working to build our e-commerce platform,” says Rohit. “The East is our strongest market and contributes to 40 per cent of the company’s revenue, followed by the North (30 per cent) South and West (15 per cent each). The thrust is now on the West and South to increase the contribution,” says Aloke.

Diverse product range

Luit Enterprises in Guwahati is the channel partner for Linc and controls 90 distributors and dealers across Assam. “I have been associated with Linc for 25 years,” says Debabrata Chakraborty, proprietor. “Linc offers a diverse quality product range. The company’s brand Pentonic has changed the rule of the game. It is the customer’s first choice.”

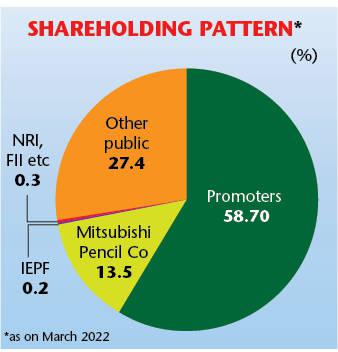

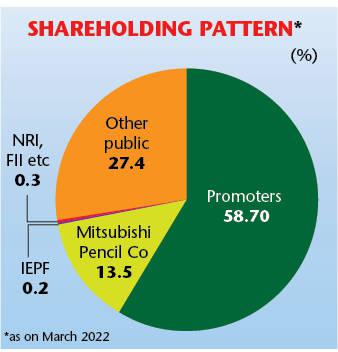

Since 1992, Linc also has an exclusive marketing alliance with Mitsubishi Pencil Company, Japan to market their Uniball brand in India. The long relationship was further cemented when in 2012 Mitsubishi made a strategic investment in Linc, picking up 13.53 per cent of its stake. Aloke is responsible for the Uniball brand. There was only one product at first, but the brand now has 25 products, and they cost between Rs50 and Rs1,000.

-

Expanding capacity for future growth

Commenting on Linc, director Mitsubishi Hiroshi Yokoishi says: “Our long association with Jalan is based on mutual trust, respect and transparency. A strong brand in India, Linc is an innovative company with youthful energy and an extensive ever-growing network, which keep us moving.” “Today the Uniball brand contributes to 10 per cent of our company’s revenue,” says Aloke.

In 2018, Linc Ltd also tied up with China-based Deli, as the exclusive importer and distributor of Asia’s biggest stationery giant. It has a presence in both segments – office and school stationery. The demand for stationery products is set to increase at a CAGR of 6.2 per cent in the next five years. Jalan expects the Deli brand will contribute 15 per cent of Linc’s revenue in next three-four years.

Despite the enhanced use of computers and smartphones pens continue to grow with the increase in the population. “Even though the domestic market size volume is 9-10 billion pens, they are mostly low-ticket products. There is a good opportunity for premiumisation and that’s what Linc Pentonic is aiming at,” says Deepak.

A quiet performer, Linc has pens for every pocket and enjoys strong brand equity. Jalan has set a target to double the turnover by 2025.

-

How the pen industry has changed over the years

Over the last few decades, the writing instruments industry has witnessed a sea change as far as the emergence of new products, their quality and technology are concerned. First, it was fountain pens, and then came the ballpoints, the direct-fill ballpoints, roller ballpoints and, finally, the gel pens. Due to their convenience (and cartridges) ballpoints and gel pens have gradually eased fountain pens out. The choice has subsequently been widened, with newer designs, colours and affordability coming into the picture.