-

L&T is a strong brand name, on the lines of the Tatas, State Bank of India, HDFC, etc

The company had set out on an aggressive journey of being in the Top Three in each of the business it was involved in. “We were at number 12 in the mutual fund business, and it would have required a lot of investment and time to move up to the Top Three in this space,” says Dubhashi. “We figured that, if investment was deployed in our focussed businesses, the chances of success would be much higher. So, it was a practical call taken then,” he adds.

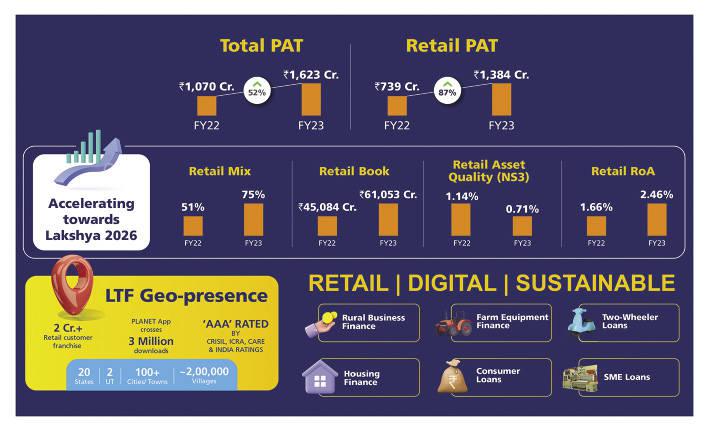

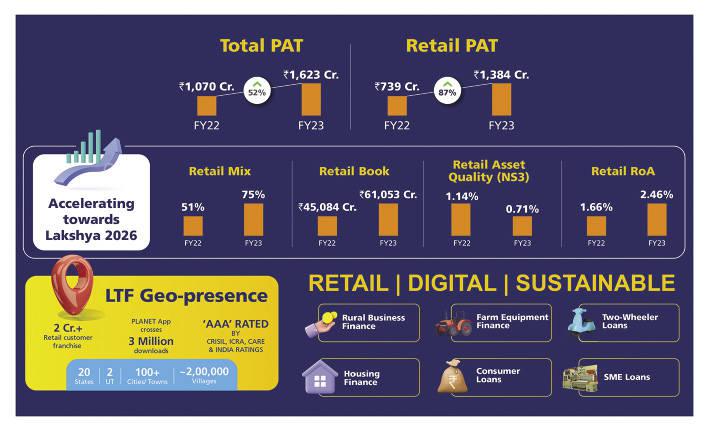

As the next step in its journey, in April 2022, LTF launched ‘Lakshya 2026’. “Our ‘Lakshya 2026’ strategy is crisp. We want to become a top-notch, digitally-enabled, retail finance company. So, every word of this strategy is important: ‘top-notch’ meant that it would be amongst the top three players in each business segment. ‘Digitally-enabled’ implied that all aspects of the business will be digital, to benefit the final customer tremendously.”

LTF, whose retail portfolio was 51 per cent in 2021-22, aims to grow its retail portfolio to more than 80 per cent in the next four years (by 2025-26) as per its Lakshya plan, without compromising on its asset quality. The company’s strong retail mix stood at 75 per cent of the overall portfolio in Q4 2022-23 and the company is well-poised to achieve its Lakshya goal of over 80 per cent retailisation well ahead of time. It also recorded the highest-ever annual retail disbursements of Rs42,065 crore – up 69 per cent year on year, driven by strong growth across all retail segments. Besides, there has been an accelerated reduction of the wholesale book by 54 per cent in 2022-23 to Rs19,840 crore.

“Lakshya 2026 focusses on establishing a dominant retail book, which is in line with our plans of healthy growth in the retail book as well as accelerated sell-down of our wholesale book,” informs Sachinn Joshi, group chief financial officer, L&T Finance. “Our strong retail Return on Assets (RoA) led to a higher profit, while we continued to maintain a steady asset quality.”

Joshi highlights that LTF has established a sustainable differentiator amongst its peers, including a transformational digital and data analytics platform, granular customer franchise and distribution network, a strong balance sheet, as well as a AAA rating by 4 top credit rating agencies. “We are confident of achieving our goals way before our originally planned target date of 2026,” adds Joshi.

LTF has articulated its four ‘pillars for growth’ strategy: a strong growth and profitability engine; strengths in risk management, including new-age risks; creating ‘Fintech@Scale’; and finally, an environmental, social and governance (ESG) and corporate social responsibility (CSR) focus.

The growth agenda

On growth, Dubhashi elaborates that a few years back there were companies specialising in commercial vehicle finance, tractor finance, two-wheeler finance, gold loans, housing loans, etc. Reason: information about the asset being financed was easily available. However, information about the borrower was not easily available, like earnings of the borrower, detailed credit record of the borrower, etc.

This limitation got corrected with credit bureaus coming up, and the data analytics which the industry is now developing. Information about the borrowers is easily available and it can be used legally within the parameters of data privacy laws. Rich information is available and anybody who believes in the power of data can now use this information to lend more and with safety. This forms the basis for LTF’s growth strategy.

-

“We are a leading financer in three of our retail products which is microfinance, tractors and two-wheelers,” says Dubhashi. LTF dominates financing in tractor loans, micro loans and two-wheeler loans, and has demonstrated its ‘Right to Win’ in these products for more than a decade. Upselling and cross-selling is helping LTF scale up its retail loan portfolio.

A customer who has taken a tractor loan or a micro loan and has almost repaid the loan amount, automatically becomes a prospect for an upsell i.e., can be offered a top-up loan, or a customer who has availed a two-wheeler loan and has a good repayment track record can be offered a personal loan, based on the data that is available with LTF.

LTF is also seeing rapid growth from products that were introduced just 2-3 years ago, like consumer loans and small and medium enterprise (SME) loans. The expectation is that newer products like small-sized business loans and Warehouse Receipt Financing (an agri-allied loan product) will also add to LTF’s revenue significantly.

This kind of rapid growth and scalability is only possible on the back of robust digital processes, which is where our proprietary customer facing application PLANET fits in. Launched in April 2022, the PLANET app, which has over 3 million downloads and growing rapidly, has witnessed considerable success. For example, a customer can apply for Insta Loan – a consumer loan product – which can be processed within seven minutes of application. Loan servicing and repayment can be done through the app.

“This year we aim to grow our top-line by at least 25 per cent in retail. And we are expecting to grow at a CAGR of 25 per cent over the next 2-3 years without taking any undue risks,” says Dubhashi. “The market is growing well, and we are changing our focus from products to customers. We have the strengths and the data analytics to take full advantage of it.” Dubhashi adds confidently.

The strong focus on growth is not happening in isolation, as there is significant attention being paid to manage risks. Typically, the most important risk for lending will be credit risk; whether the monies lent will be paid back or not. With ample data available these days, keeping an eye on repayment risk is relatively easy. However, there are newer risks that need closer attention, like operational risks. For example, as it increased its lending, did the company make any mistake?

Cyber risk is a huge risk too, as hackers are always thinking of newer ways of duping. LTF is constantly upgrading and developing stronger tools to minimise risks and has been ISO 27001 certified, since March 2022, which helps organisations improve their information security posture, comply with regulatory requirements, increase customer confidence, gain a competitive advantage, and manage risk, demonstrate a commitment to protecting the data, and ensure the highest level of security.

Fintech@Scale

‘Fintech@Scale’, the third pillar of LTF’s growth strategy is the most important. In current times, there are two types of companies in the financial sector; NBFCs which have scaled up and fintechs which are technologically proficient but don’t scale up much. LTF has combined both. Adopting new-age technology like a fintech, with a big book size that is in line with traditional NBFCs. LTF’s retail book size as of 31 March 2023 is at Rs61,053 crore – up 35 per cent year on year and growing at a minimum 25 per cent every year.

-

Joshi: maintaining a steady asset quality

“What we believe is that Fintech@Scale should be used at every stage of the loan process,” Dubhashi opined, “We have built a vast database of customers over the years, and this database provides us with umpteen business value. Like a fintech, we are harnessing this data into insights, and with years of experience and expertise in lending, we can reap the benefits of these insights, thus creating a powerhouse to not only cross-sell and upsell but also reach out to the new-to-credit customers across India.”

The fourth pillar of LTF’s strategy is ESG and CSR because whatever the company does has to be environmentally responsible and sustainable, have a level of governance as well as do well for the society. The company runs a “Digital Sakhi” programme, which brings together rural women and technology, promoting digital financial inclusion among rural women.

“Since its inception in 2017, the Digital Sakhi project has been implemented in 7 states. The Digital Sakhi project aims to nurture a strong network of women who are extensively trained in digital financial literacy, leadership, and communication. These women, in turn educate, influence, and help their communities to leverage the digital financial infrastructure effectively, which also leads to their economic upliftment. Since inception, the project has created a cadre of 1,370 Digital Sakhis who have helped upskill over 11,500 women entrepreneurs. In the last year alone, Digital Sakhis have reached out to 1 million plus community members, creating awareness on financial and digital literacy,” Dubhashi affirms.

Digital Sakhis get trained with a tablet in executing all financial transactions like opening and closing an account, withdrawing and depositing money, use of government schemes – which a lot of people living in villages don’t even know about. Digital Sakhis make people in rural areas aware of such schemes and help them through the process of availing them.

The company has been conferred with numerous awards and accolades for its ESG and CSR initiatives over the years, including the Dun & Bradstreet India ESG Award 2023 for ‘Business Sustainability, Social and Business Enterprise Responsible Awards (SABERA) for the Digital Sakhi project and awarded a plaque in ICAI Sustainability Reporting Awards.

“So far, Lakshya 2026 is off to a great start, with regards to LTF’s growth and profitability. Though we have just concluded the first year of our project, we have surpassed our annual targets, and will continue to execute our strategy over the next three years, carefully and confidently,” sums up Dubhashi.