-

Raamdeo Agrawal, Co-founder & MD, Motilal Oswal Financial: the markets have unwound ; Photo: Sanjay Borade

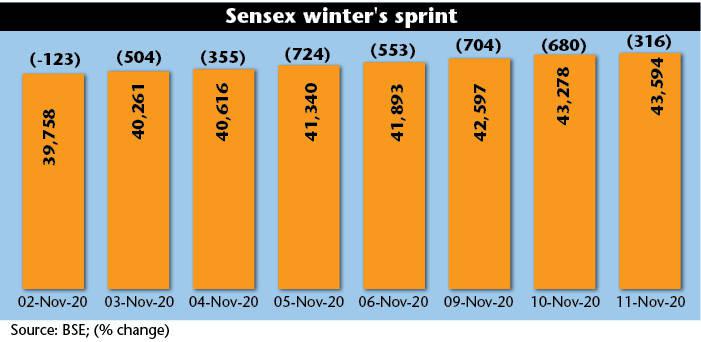

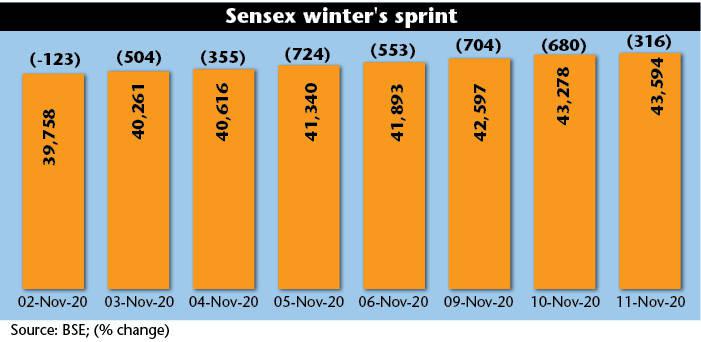

Modi’s address to global investors ignites hopes

The address of the prime minister Narendra Modi, who chaired a virtual conference of global investors, also seemed to have gone down well with investors. Addressing a group of 20 leading global investors including pension funds and sovereign funds, Modi extolled them to become a partner in India’s growth, spelling out the country’s vision to become a $5 trillion economy. Six top industrialists from India, Deepak Parekh, Mukesh Ambani, Ratan Tata, Uday Kotak, Dilip Shanghvi and Nandan Nilekani, also participated in the virtual conference besides the finance minister and RBI governor.

One does not know the impact on the funds which collectively manage $6 trillion. However the sharp FII inflows of nearly Rs30,000 crore in November (till 11th) seems to indicate a positive impact. DIIs were happy to let the FIIs don the mantle of the bull, offloading shares worth Rs15,000 crore.

“The results of the corporate sector were good and many companies expressed confidence about growth over the next three to four years. Expectations and optimism have been the main contributors to this rally,” says A. Balasubramanian, MD and CEO of Aditya Birla Sun Life Mutual Fund.

Balasubramanian adds that Biden’s victory could be a big positive for emerging markets. He reckons that if Biden sticks to his promise of raising taxes in USA, more funds will find their way to the emerging markets. “I foresee a multiyear bull run in emerging markets, at least over the next 10 years.”

While one may debate the tenure of the bull run, the optimism is clearly all-pervasive. Some are little guarded. “The fear over Covid-19, witnessed in March and April earlier in the year has been replaced by resilience. Everyone is looking forward to coming back to normal,” says Pranav Thakkar, director and CEO, Parag Parikh Financial and Advisory Services, a company offering PMS and managing mutual funds. Following the principles of value investing, Thakkar points out that “while markets have rebounded, economic pain could continue. Low economic activity, concerns on job losses, still remain”. He adds: “I would recommend investors to follow a stock specific approach.” He says industries which have made effective use of internet and technology should do well. Retailers using omni-channels, following online and offline models, will also do well. He does not favour infrastructure, which is a capital-intensive industry and also carries an element of risk due to government policies. One could selectively look at infrastructure proxy companies in cement and steel.

“Economic growth has been the major casualty during the Covid period,” says Agrawal, who points out that the rally this time is highly polarised. Speaking ahead of the government’s reforms package announced at Diwali, Agrawal points out that out of 30 sectors there are only five to six sectors (IT, private banks, pharma, consumer durables, automobiles) which have given return of equity of over 12 per cent. This is probably the worst period in the last three decades. Normally at least 20 of the 30 sectors do well during good times. Emphasising that poverty alleviation requires the economy to grow at least 7 per cent, he says government has to lay emphasis on growth above everything else. Instead of inflation targeting, the priority should be growth targeting with inflation following behind. Agrawal says: “The government has to formulate a very sharp strategy to ensure that the target of making India a $5 trillion economy by 2024 is met.”

-

The housing sector, which has a multiplier effect, should be nurtured and all possible efforts inhibiting growth are required to be dealt with firmly. The time taken for getting regulatory clearances have to be compressed and corruption should be firmly dealt with, he says.

Boosting government revenues

Given the pandemic and the measures taken by the government to alleviate its pains, finances for the fiscal year ending March 2021 are likely to go for a toss. Lockdowns in the initial periods have also hampered production, and the economy – as per the RBI’s definition, a decline in GDP growth in two consecutive quarters – is in recession. While a good production of crops has led to rural incomes rising, for the most part, consumption will be rural-driven. However this is unlikely to nullify the fall in the overall consumption in the economy. During pandemics, people tend to save more than spend. As a result the government tends to earn less, be it through GST or income tax. Should the government be bogged down by a short term increase in deficits and curb spending on infrastructure?

Manish Chokhani, a respected financial advisor, formerly with the Enam group feels otherwise. He says: “With global markets awash with liquidity and interest rates near ground zero, the government should take bold steps to pursue growth.” And use funds from disinvestment to create income generating assets and sell them later on to other sovereign investors at a good profit. Proceeds from disinvestments must be used entirely for creating new assets, he says, and adds that India has to shed its mindset of being a third world country and don a hat befitting the fifth largest economy in the world.

Government should take advantage of this bull rally

The government should take full advantage of this bull rally, Balasubramanian points out. “The value of road assets will go, post Covid, and NHAI can exit from such assets and use the money to build fresh assets.” Balasubramanian is also optimistic that the housing sector will revive, given the low interest rates, stable prices and government policies to encourage demand.

-

Pranav Thakkar, Director & CEO, Parag Parikh Financial & Advisory Services: follow a stock specific approach

Currently, the rally is driven on hopes of rural-led consumption driving growth. No one seems to be hopeful about infra-led demand boosting growth. This despite the low interest rates and several policy measures taken by the government. With a gnawing deficit staring it in the face due to falling revenues, the government is understandably guarded about pumping in more funds into mega projects. The government has recalibrated its budgetary spends and has proposed nearly 40 per cent cuts across non-priority spends to ensure that budgets earmarked on old projects do not suffer for want of finance.

What is required is to use the heightened interest amongst investors to push ahead with its divestment plans. NSDL shows that assets worth nearly Rs200 lakh crore are held in 206 lakh demat accounts. CSDL holds securities worth Rs20 lakh crore.

Given the current interest in the markets the government, instead of waiting for strategic sales, should offload the shares of the companies it has identified for divestment. Even if the prices are lower than their book value, the profits will go to the general public at large. Instead of using funds for paying interest charges and salaries, the government need to re-invest the funds in projects in those particular sectors. This is also the time for the government to consider setting up a few sovereign funds which could look at taking assets both in India and overseas at good bargains. With growth as its paramount agenda, the government can really look at the future more optimistically.

The government is required to act now when optimism is pervading the capital markets, globally. This is a golden opportunity which it should seize with both hands. While boom and busts are common in many a market cycle, this time around, the rally seems to have more steam in it. Corrections may and should happen, but the long-term trend is clearly upbeat and one should take full advantage of this now.

-

A. Balasubramanian, MD & CEO, Aditya Birla Sun Life Mutual Fund: the housing sector will revive

The Sensex over the last 30 years

Markets by and large are optimistic. Going by the trend witnessed in the last 30 years, the BSE Sensex has given negative returns in only eight years in the last three decades. And in most cases, this was preceded by the surfacing of a scam. In 1995, it was the securities scam, which involved brokers and banks ‘borrowing money’ from the system and investing in the stock markets. While Harshad

Mehta was the poster boy who borrowed money from banks and made a killing in the stock markets, other brokers borrowed money from banks to fund the losses. Likewise, the market went into a tizzy five years later when the Ketan Mehta scam surfaced.

The markets went in a limbo and the bull rally really took off towards July 2003. This time it was the banks and finance sector which led the rally. In 2003, the market between July and December gave as much as 73 per cent returns. The divestment carried out saw the markets lapping up good stocks.

Earlier it was the replacement theory of Harshad Mehta in 1990 which really gave wings to the markets. The Rs100 paid-up ACC share, earlier referred to as a widows share, got a total make up and shot to Rs1,000 in 1989-90. And went on all the way to Rs10,000!

While leaders kept changing during the rallies, what is noteworthy is that scams really saw the markets sulk. While the earlier two scams were desi, 2008 was the year of the global scam, following the sub-prime crisis in the USA. The exodus of FIIs saw the markets dipping by as much as 52 per cent. The recovery was just as swift, with FIIs pouring in upwards of Rs83,000 crore in 2009.

Year 2011 was a bad one for India. The falling rupee, rising interest rates and a perception of virtual policy paralysis and a slowdown in capital expenditures were but some negative events. Production dipped and consumer demand was also muted. This led to the markets dipping by 25 per cent.