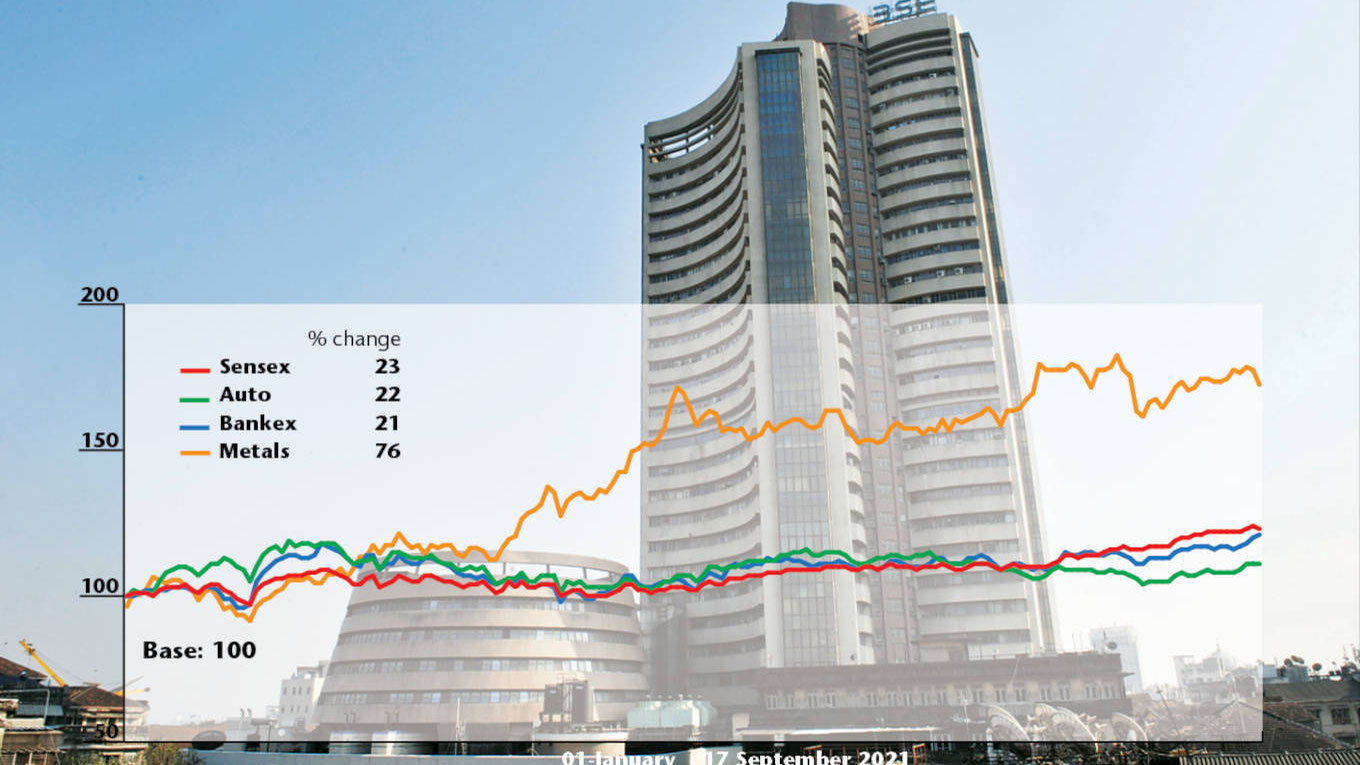

From a marathon runner, the Indian markets have started sprinting ahead as if it was a mere 400 metres run. And it is the young and apparently new investors who are apparently rushing ahead of the pack in unchartered territories. The government clearly acted as the cheerleader. It made a slew of announcement aimed at encouraging production in automotive, textiles and other sectors even as it chose to provide relief to the beleaguered telecom sector. From the level of 52951 on 1 August the Sensex made a new intraday high of 59737 on 17 September, before closing at 59015. This is a near double digit jump in just over a month. India is currently ranked at No. 5 globally on the basis of monthly returns of 6.4 per cent. Argentina, which is beset with problems of its own, has given 14.6 per cent returns while Japan has given over 10 per cent. Over the last one year since end-August the Sensex has given 53 per cent returns. From any point in time, the markets have given good returns. From January 2021 till today, returns at 23 per cent are amongst the best, globally. Russia is the only other country which has given marginally higher returns and tops the countries’ returns chart. Buoyed by the sharp rise in prices the cumulative marketcap of the stocks on BSE has gone up to Rs260.78 lakh crore. It was Rs95 lakh crore in FY16. In 6.5 years, the market cap has gone up by nearly three times. Since the March low of 2020 during the pandemic, the markets have added more than Rs150 lakh crore. At the current market cap India has gate-crashed into the top 5 countries group ranked by overall marketcap, at $3.41 trillion, marginally ahead of France. Of course, the difference between the two countries is marginal. Of course, it is not just the elevated prices which have contributed to the rise in the market cap. 39 new issues which have been listed have also contributed to the rise, the largest, of course, being Zomato which has a market cap of Rs1.08 lakh crore. With more mega issues in the pipeline, including the mother of all issues, Life Insurance Corporation of India, the market cap may well cross Rs300 lakh crore by end of FY22. The listing of LIC will be a big booster with the total market cap of LIC expected to be in the region of Rs12-16 lakh crore. One 97 Communications, promoter of Paytm will be another company which will join the Rs1 lakh crore club and more, domestic companies league. There are currently more than 50 companies with market caps of Rs1 lakh crore and more. Seven companies have market cap of over Rs5 lakh crore. Telcom concessions & PLI schemes Following the policy announcements, the markets were quick to rerate some of the shares which could possibly be benefited. In telecom, where the objective was not to foster a duopoly, one of the main concessions given to the industry was an extension of time, upto four years for payment of dues. And also allow 100 per cent foreign holdings on an automatic route basis. Following the announcement, Vodafone-Idea saw its share price shoot up by 28 per cent in the following two days to Rs11.17. Bharti Airtel rose by nearly 5 per cent to end the fortnight at Rs725. Reliance Industries was not impacted. Even the ailing MTNL saw its share prices move up by a rupee to Rs18.65. The other large player, BSNL, is not yet listed.

-

Sachdeva: markets tend to reflect the economy

The production linked Incentive (PLI) scheme for textiles, which is the second largest employer, did not have as dramatic an impact as was felt on telecom. All the more as the total amount of PLI envisaged was smaller at Rs10,683 crore. These involved incentives based on fresh investments for man-made textiles and technical textiles as also based on turnover. It is debatable as to how many companies will look at setting up new units.

However, given that textiles and technical textiles has huge markets overseas, especially in the wake of several countries looking at adopting alternative bases to China, a few companies will definitely take the plunge in setting up manmade fibre based new units. Currently, however, it is a little too early to try and assess the impact on markets. For one, the threshold limit of investment of sRs100 crore and Rs300 crore may be difficult for garment producers to achieve. However, given that the markets are buoyant, a few companies may tap the capital market. After all Reliance Industries, India’s largest company by market cap also started with a small public issue in the 80s.

“For any PLI scheme, it will take time to see results. Post the announcement, the details will have to be studied and plans will take time to make and then implement,” says Sunil Singhania, Founder, Abakkus Asset Management Company, a Mumbai based company managing AUM of over Rs7,000 crore.

The Rs26,000 crore PLI scheme for the automobiles sector spread over five years was more euphorically greeted by the markets. It is part of the PLI scheme for 13 sectors announced in the budget of FY22 envisaging an outlay of Rs1.97 lakh crore. The BSE Auto index saw a sharp rise of 2.5 per cent in the two sessions post the announcement of the scheme. The shares of Maruti Suzuki went up by more than 10 per cent to Rs7,012.

However, Maruti Suzuki which like other car makers has been plagued by shortage of semiconductor chips, is still nearly 9 per cent below its price in January, 2021. Besides the shortage, there is also a demand contraction of a kind seen in new purchases of cars with many aspirants waiting to having clarity on electric vehicles and the entry price for these vehicles.

Besides auto, auto ancillaries have also evoked good interest from investors. Bosch, Varroc, Endurance, Sundaram Clayton, Sundaram Fasteners, Rane Group, Minda and Motherson Sumi are some of the prominent companies in the sector which have been less impacted as they cater to replacement demand and also have good export markets. The PLI scheme envisages localisation of 22 advanced technologies, details of which are yet to be announced. One part of the OEM is applicable to new vehicles powered by electric batteries and hydrogen.

Aluminium and Steel

While PLI schemes will see better impact in the future, certain sectors have benefitted from global factors. Metals have continued to rule firm with companies in aluminium, steel, copper all gaining ground. Hindalco, amongst the larger integrated companies globally, has seen a rise of nearly 70 per cent since January. In both steel and aluminium, the curtailment of the commodity by China, one of the largest producers, is the dominant factor driving prices. Aluminium at the London Metal Exchange has seen more than a 100 per cent rise since April 2020. Hindalco, which is expanding across all its divisions, aluminium, copper and speciality aluminium, is also paying off its debt used for expansion.

By March 2022 it plans to deleverage debt by $2.9 billion; the bulk of it will be in its subsidiary Novelis. Given its global presence has expanded further with the $2.8 billion takeover of Aleris in 2020, the company is well placed to leverage the aluminium and copper boom. The company, through Novelis, will be able to cater to the can business, aerospace and automobiles, besides having its own primary units in India. The shares have gone up by nearly 70 per cent since January and are currently hovering at around Rs474. Hindalco’s PAT of Rs2,797 crore for the first quarter, is the highest over the last 10 quarters. Its annual profit for FY21 was Rs3,489 crore.

Hindustan Copper, a PSU company, which saw 10 per cent being disinvested by the government, has given returns of 81 per cent and is currently quoted at Rs117. The share prices had risen to over Rs150 towards the end of July.

The steel industry, which is also a large beneficiary of China’s lower production, has been riding high on elevated prices over the last few months. Tata Steel, which has also embarked on an expansion plan, has gone up by 115 per cent since the beginning of the year and is currently ruling around Rs1,400. The problems between Australia and China have seen a sharp fall in iron-ore prices, which is beneficial to the industry.

JSW has gone up 3x from its 52-week low of Rs257 in September 2020. Jindal Steel & Power is ruling at more than twice its price since last September, at Rs387. It had made its 52-week low of Rs160 on 22 September 2020. Steel Authority of India is ruling at Rs115 from the low of Rs33 on 20 September. Expectations of higher demand from infrastructure across geographies including US, EU and India are expected to keep the rates of steel elevated for the next few years. Tata Steel, with its plants in UK and Europe, should benefit more from this bounce in steel prices. It is due to these factors that metal index has given the maximum returns of 75 per cent since January, three times higher than the Sensex returns of 23 per cent and the auto sector’s return of 11 per cent.

Bankex, a late starter, has given 21 per cent and is now fast catching up with other sectoral indices. The bad bank, as the National Asset Reconstruction Corporation announcement by the government, will initially see Rs2 lakh crore of NPA being taken over from the banking system. Since most of the NPA will already have been accounted for in the banks’ books, the transfer to the bad bank will only mean profit to the extent of 15 per cent cash paid up front initially and later on post the liquidation or recovery, going directly to the bottom line of the banks. It was on this assumption that banks’ shares have gone up sharply.

-

Rohokale: new investors are quite savvy

Like metals even non-metals are looking up. Cement shares are shooting through the roof. UltraTech which made a 52-week high on 8 September is twice its 52-weeks’ low in September 2020.

What does the future hold?

Investors are not interested in the past. What has happened has happened but the moot question is the future. Can the markets continue to make gains? “I feel the momentum may slow down,” says Singhania. “It will be difficult to say when a steep correction will happen. Six months later, 12 months or even one year. However, the upward trend will continue.” Singhania says the current problems in China which had seen a massive erosion in several of its key ITE companies may in fact benefit India and see more global funds seeking a safe haven in India.

Corrections are always part and parcel of any trend in the markets. However, post the pandemic, everything is going right for the economy. GST receipts are averaging more than Rs1 lakh crore per month. The corporate sector’s profitability is also on the uptrend with many choosing to deleverage or swap costly borrowing with lower interest ones. The good monsoon with a robust demand, will see companies doing well. With markets running up quite a bit, everyone, including non-participants in the markets, are rooting for a correction.

“I do not try to second guess the stock market movements,” says Vikaas Sachdeva, CEO, Emkay Investments Managers, a company managing assets of around Rs1,000 crore. Sachdeva, who was earlier with Edelweiss AMC, says markets tend to reflect the economy, running ahead by maybe a couple of quarters. “The Indian economy is quite robust. Corporate India has been deleveraging for the past several quarters and is now contemplating new capex plans. While the plans may take a couple of quarters to be finalised, the mood is positive. Demand is reviving and government is helping industry. Inclusion in the MSCI Global Bond Index will allow companies to tap the overseas markets which are awash with liquidity, and lower their borrowing costs. The aggressive vaccination drive may not see the third wave making as adverse an impact as it did in 2020.”

Voicing his concern on the geopolitical fronts particularly on the USA and China which are facing problems of their own, Sachdeva feels India is relatively better off than most countries with buoyant internal demand and not so much on exports, though they are also picking up.

“In earlier bull runs it was said that when markets took a directional turn, it was the retail investors who were the last to deboard, says Sunil Rohokale, CEO and MD, Blackstone controlled ASK Investment Advisors. “The current lot of investors, especially the ones who have recently boarded post the pandemic, are quite savvy. They held on in the earlier correction and did well for themselves. With more money flowing in equities, it is unlikely to see a directional reverse” he says. Even in India, many traders have found there is more money to be made in the stock markets than in their own business and more inflows will continue for some time.

-

Singhania: the momentum may slow down

Rohokale, who manages AUM of over Rs75,000 crore, the largest amongst PMS advisors, feels that “at some point part of the money may flow into real estate. That has always been the trend in the past. However, this time around whether the money flows into solid assets on the ground or companies in real estate is the big question.”

While there has not been any large project announcement, with developers trying to sell inventories and finish incomplete projects, some developer companies’ shares are doing pretty well on the bourses. Companies in the south like Prestige, Brigade, Puravankara, have moved up sharply by as much as 100 per cent in the last one year. Macrotech Developers, (Lodha group) has seen its share prices double, while Oberoi has gone up by a little less than 100 per cent.

Business India which has been tracking markets over the last several decades having seen several cycles, tends to feel that this could be a multiyear bull run. While corrections may and should happen as has happened in all bull runs, the buoyancy in the markets may continue. In the bull run which started in June 2003, it was the financial sector which was at the forefront. In the current bull run, banks and the finance sector have just started taking meaningful strides. Low interest rates and good demand could see the current rally take higher strides despite immediate corrections.

Having gained nearly 6000 points in less than two months, some corrections may take place. Notwithstanding this, this time round we could see Sensex moving up sharply before the end of this fiscal. Staying invested would be more prudent rather than grabbing every opportunity being thrown in. The risks are more from global than domestic ones. Marathon runners or sprinters, once a runner always a runner – for some years at least.

Cover Feature

Ola’s EVolution theory

Bhavish Aggarwal is confident of playing a big role in India’s EV revolution

Focus

Textiles goes circular

The textiles & apparel sector gears up to imbibe circularity into supply chain

Special Report

Will budget trigger a correction?

Market anticipates a correction amid budget expectations and investor activity

Corporate Report

India Cements: Facing a new normal

UltraTech buys stake in India Cements. What lies ahead?

Agriculture

GHCL Foundation's horticulture initiative: community development and farmer prosperity

Published on Jan. 21, 2023, 3:49 p.m.The introduction of black pepper as an inter-crop in the sopari and coconut orchards, has enabled farmers to cultivate crops simultaneously

Skill Development

Mastercard empowers young Indian women through expansion of Girls4Tech programme

Published on Jan. 21, 2023, 3:43 p.m.In 2020-21, the programme reached over 112,482 girls in urban and rural locations across six states in India, including 10,000 across Delhi

Collaboration

Mercedes-Benz accelerates with Sustainability Dialogue and Innovator Fellowship Programme

Published on Jan. 21, 2023, 3:34 p.m.The event brought together stakeholders and changemakers to participate in a series of conversations on global trends and recent developments

Healthcare

Brushing up on Oral Health: Colgate-Palmolive India teams up with Andhra Government

Published on Jan. 21, 2023, 3:28 p.m.The programme will focus on educating children on oral health and building awareness around the dangers of tobacco use

Biogas

BioEnergy will showcase its innovative biogas technology in India

Mobility

Ather aims to produce 20,000 units every month, soon

Green Hydrogen

German Development Agency, GIZ is working on a roadmap for a green hydrogen cluster in Kochi

Renewable Energy

AGEL set to play a big role in India’s carbon neutrality target