-

Vijay Menon is content to ‘slow and steady’ to meet his goals

Anand Mahindra had recalled Chandran Menon’s key role in the tractor and jeep major’s survival, when petrol prices went through the roof during the 1976 oil crisis, following the Gulf war and its jeep sales 'went for a complete toss'. "This led to the diesel jeep being born in India with a modified tractor engine; but producing the engine was a problem: we needed high-quality machined cylinder blocks,” he explained. Chandran Menon came to the rescue, teaming up with Mahindra engineers and ‘throwing himself into the development’. The Mahindra balance sheet for that year actually acknowledged his contribution formally.

Menon & Menon continues to be one of Mahindra’s preferred sources for cylinder blocks. From one large volume cylinder block for its auto division and one for its tractor division in April 2005, it now produces almost all the variants of cylinder blocks used by both divisions, taking into account the products that are under development: from about 200 tonnes per month (tpm) to over 1,000 tpm of castings for Mahindra. “This number is expected to grow to 1,500 tpm in the coming two years,” Menon says.

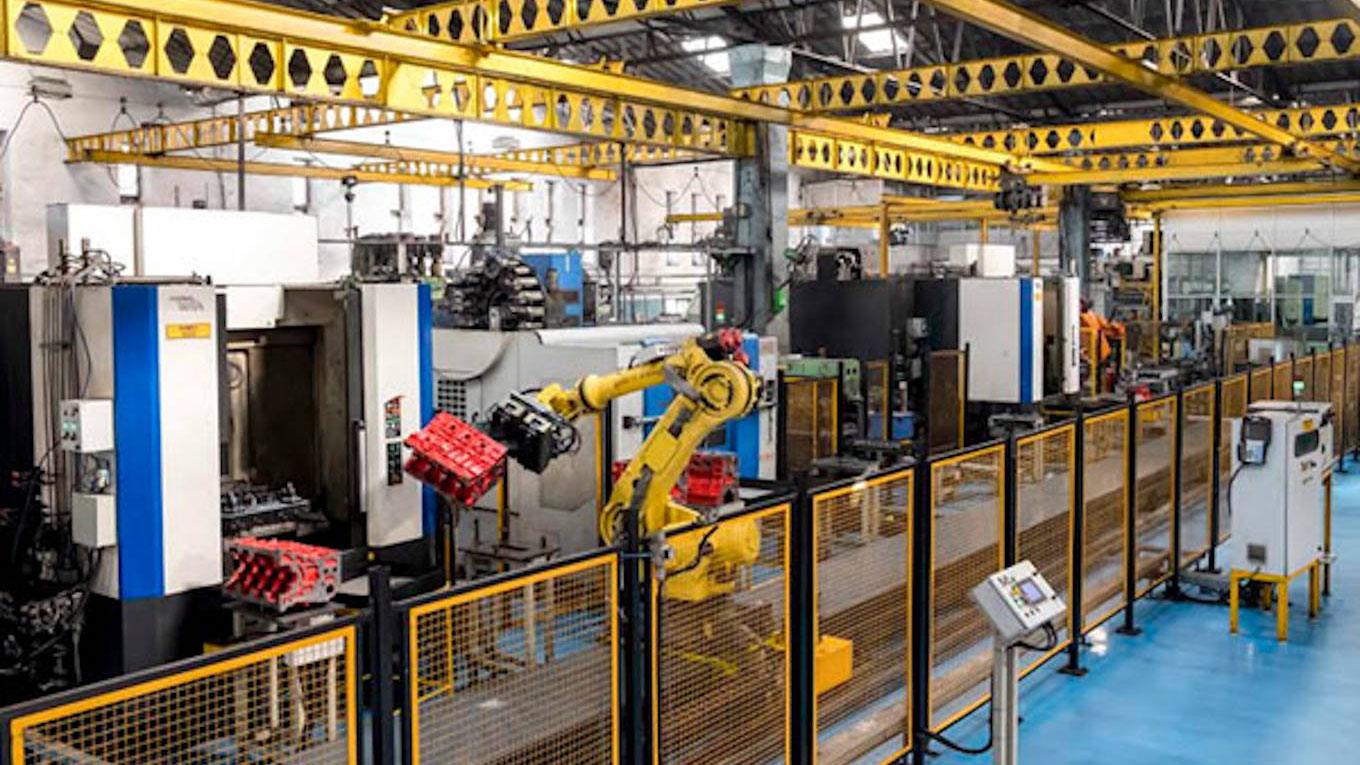

Talking of the gap Jambavdekar refers to, Menon says: “We were making cylinder blocks in 2005 and were, at that time, rated as one of the better producers of cylinder blocks in the country; but there definitely was a large capability gap between us in India and other major foundries in the world. This was specially felt in our design and manufacturing capabilities. Today, thanks to the massive investments that we have made in these capabilities over the past 15 years, we are proud to say that this gap has narrowed down to such an extent that in many cases we would be considered to be better than our European and American counterparts.”

Quality products

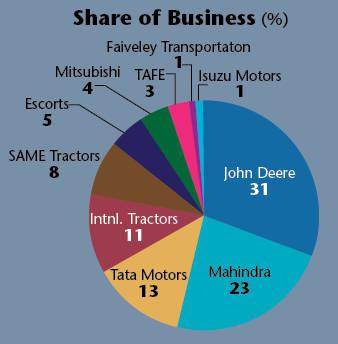

For example, he says, John Deere – a major customer, which buys blocks and heads from us as well as other world-class foundries -- has recently rated Menon & Menon as its best cylinder block and cylinder head supplier in terms of quality. “John Deere Worldwide Supply Management ranked us as its best and most consistent block and head supplier, for achieving the best quality levels for four out of the preceding five years,” he says. “This award is based purely on measurable quality levels of the blocks and heads supplied to them. Such transformations have happened in the auto-component space. This recognition, coming from a company known for its high quality standards, makes it all the more satisfying.”

With a slew of other customers, Menon & Menon’s capacities have consistently increased from 700 tpm in 2005 to 5,000 tpm now and will go up further to 7,500 tpm by September 2022. Two-thirds of this capacity will come from the Kagal division, which is rated as a facility that meets global best practices and standards. It has added more customers who are selective – including, besides John Deere, big global names like SAME Deutz Tractors and Mitsubishi Heavy Industries, to most of which it is a single-source supplier. Large Indian OEMs like Tata Motors, International Tractors, which makes the Sonalika brand, TAFE Motors and Tractors – and of course Mahindra & Mahindra – are also major customers.

Besides the automotive industry, the company has also started supplying to the growing railway industry. “We supply critical safety parts to Faiveley Transport, which is a major supplier to the railways,” says Menon. “It is the world leader in railway technology; our components are used in its systems supplied all over the world.”

-

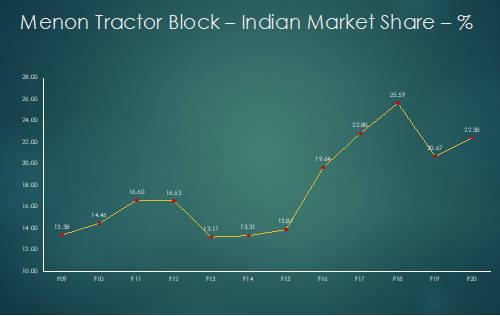

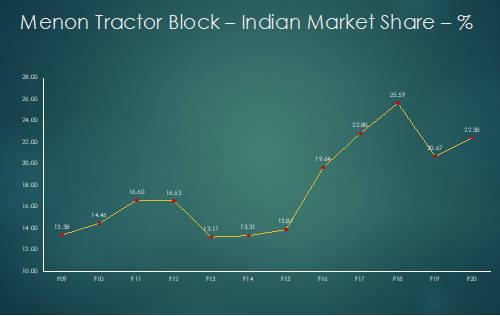

Menon & Menon is not directly exporting castings, but its supplies to global customers in India, who are used to meet their overseas requirements too. “Every fourth tractor made in India is fitted with our blocks and heads, while one in 10 produced world-wide use our castings,” Menon says. Without the company’s involvement in the manufacture of critical engine castings for OEMs’ requirements, he says, a large portion of the requirements would have still been imported. When India did not have the capability to make these kinds of complex castings, Mahindra used to import large number of blocks from Teksid China – the foundry division of Fiat, Italy – to meet its high-volume, intricate cylinder block requirements. “Today, the castings produced in out Kagal foundry are in the final stages of validation and approval, and these imports will stop completely soon,” he adds.

“They are pioneers in engine cylinder block and cylinder head castings in India as well as in the globe,” agrees Rakesh Ingrole, senior general manager, SAME Deutz-Fahr, Vellore, Tamil Nadu, which has been a Menon & Menon customer for more than 20 years. Even during the current pandemic situation, he says, the tractor major has been receiving a clear communication and delivery plan right since March 2020. “This needs to be appreciated. In fact, to make our production plan a reality, they have taken many measures to run their production without compromising any quality parameters.”

SAME India, which was buying only about 200 cylinder blocks and 700 cylinder heads for its two models in 2008, multiplied its portfolio to six models for blocks and three for heads in 2014. It also faced challenges in developing its Euro-IV engine block and cylinder head, but Vijay Menon and his team had made it possible in the shortest period. “Menon & Menon is known for its quality, systems and delivery, thanks to which it is are our single source for all our critical and killer parts. And never did we think of going for an alternative source,” Ingrole says, adding that its new world-class facility will ensure that it expands and grows continuously.

Globally well-known

These world-class capabilities, Menon himself says, are the result of the ‘painful and time-consuming route’ taken to develop them internally. “Used in conjunction with high standards of process controls, these facilities help us produce products that are able to meet customers’ expectations of quality and cost consistently.” Going forward, he adds, the company wants to leverage these capabilities to increase its domestic and international market share. Already among the more efficient producers of castings in the country, it is also well-known in the global market, especially with ‘global productivity – Indian wages’ giving it a high level of competitiveness globally.

For Mitsubishi Heavy Industries, a comparatively new customer, the company developed a component which they were finding difficult to source locally. “Our product meets their Japanese quality standards,” he says. Prashanth S., section head, vendor development, at Mitsubishi VST Diesel Engines (MVDE), Hebbal Industrial Area, Mysore, says MVDE has been associated with Menon & Menon since 2015, because of the foundry’s latest technology and best-in-class equipment to make high-precision cylinder head and block castings.

“They have an excellent team with technical expertise, continuously striving to meet customer requirements through continual improvement in quality and have exceeded MVDE’s expectations in new products development by achieving ‘first time right’ in the shortest lead time in the industry,” he explains. “They were initially chosen for one project. Down the line, after four years, they are proving to be a single source for all our projects. They have converted MVDE’s superior engine design to superior quality products!”

-

At International Tractors Ltd (ITL), which has been associated with Menon & Menon right from the cylinder block for its first Sonalika tractor 25 years ago, Parveen Sardana, senior vice-president (corporate purchase), says they have since made the blocks for ITL’s complete series. “They are specialists in block castings. Their component is always first, they have the lowest lead time; their quality, cost and delivery are great,” he says. The company, which makes 15,000 tractors every month covering the entire range from 20hp to 120hp, buys blocks from other manufacturers too.

On his part, Menon plans to exploit these advantages to gain market share both in the domestic as well as international markers. “Today our capacity is a bottleneck. We are planning to increase our capacity to 7,500 tpm; and with that capacity enhancement we will be ready to play the global game,” he says. “We will also explore other product adjacencies – our cylinder block and head casting capabilities can be leveraged to increase our railway business as well as gain entry to the fast-growing Indian defence business.” Railways already form about 5 per cent of the overall business, which he plans to grow to a level of 15 to 20 per cent. Defence is zero now, but he sees it forming a significant part of the company’s overall business in future.

“We have already started moving in these directions,” he says. “We are aware of the long gestation periods involved and prepared to give all this the required time. We are in no hurry -- we will take slow but steady steps in this direction.”

Menon, 65, has his succession plan is in place: both his daughters will be in the business, ready to take over the reins. The elder, Divya, is back from Wharton and is already in the company, while the younger, Shreya, is at Cleveland and will join, too. After the new plant comes up, he says, he will look for private equity and “maybe an IPO after a year or so”.