There is a popular saying in the market which, translated from Gujarati, roughly means, never try to be a hero ahead of the exams, implying that second guessing a major event and acting on it can be disastrous. FIIs, many of which have scoffed at traditional brokers, learnt the logic of this statement the hard way. In the five session ahead of the budget, from 23 January, they started selling in a big way. They cumulatively sold to the extent of around Rs12,700 crore. The selling started a day before the F&O settlement and lasted till budget day. Post the budget the tide turned with the Finance Minister announcing a growth oriented budget with growth taking precedence over the earlier obsession of curbing the fiscal deficit. Realizing their folly, FIIs not only covered up their sales in the first five sessions in February but also brought in Rs1,000 crore more than all they had sold in the last five sessions. This was one of the major reasons for the sharp swings in the Sensex, which after making an intraday high of 50000 on 21 January, made an intraday low of 46160 on the day before the budget was announced. And, in the five subsequent sessions also made a strong move to touch an intraday high of 51000 on Friday, 5 February. The post-budget rally, in a way, was much more than a relief rally. FIIs have again resumed their buying with vigour. Apart from the shenanigans of the market players and the relief that no additional taxes were to be collected from any sections, there was a flow of very good corporate reports this fortnight. In early January, it was dominated by the better than expected results of the IT majors including TCS, Infosys, Wipro and Tech Mahindra. This time, it was the finance sector, in particular the banks, NBFCs and cement sectors. In the case of cement, two outstanding results were those of Shree Cement and UltraTech. Shree Cement saw a sharp rise of Rs4,000 per share soon after the results were announced and it made a 52-week high of Rs27,476 on 4 February. Its operating margins for the quarter ended December were the highest amongst large cement companies at 34.36 per cent as compared to UltraTech’s 24.5 per cent and Ambuja Cement’s 25 per cent. UltraTech, which has become the largest cement company, taking over quite a few companies in the last five years, is in the top six cement companies globally. It has still to ensure that the companies taken over start performing to the benchmark of UltraTech. Its PAT, for the quarter ending December 2020, at Rs1,550 crore, is however 2.5x that of Shree Cement. UltraTech made a new all-time high of Rs6,400 on 5 February. Its market cap of Rs1.83 lakh crore is more than twice that of Shree Cement. However, the combined cap of ACC and Ambuja Cement is lower than Shree Cement. The scrappage of the old cars policy, a mention of which was made in the budget, saw automobile company shares going gaga. Tata Motors and Mahindra, amongst the largest car makers globally, saw their share prices going through the roof. Better than expected results contributed to this bullish move. Tata Motors reported a PAT of Rs2,940 crore for the last quarter ending 31 December, 2020,on a consolidated basis. This saw share prices making a record high of Rs342 on 3 February. Mahindra and Mahindra’s shares also hit a 52-week high of Rs894 on 4 February and although the consolidated profit was lower, its market cap was higher than that of Tata Motors. M&M has also proposed disposing off its loss making Korean company. Ashok Leyland, largely into commercial vehicles, hit a new yearly high of Rs138 although the results for the quarter are not yet out. They have been scheduled for 11 February.

-

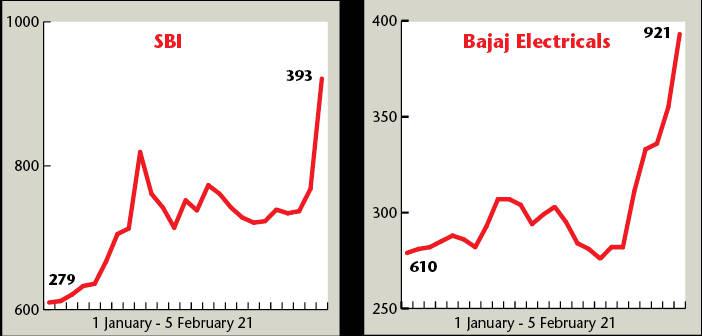

A stock specific strategy rather than an index base is likely to pay better returns