-

As many as 42 mega Green Hydrogen & Ammonia projects were announced. Nine semi-conductors and Display Fabs projects were also announced. In the case of green energy projects, the execution time is comparatively quicker than other projects. Tata Power had inked an agreement with the Tamil Nadu government in July 2022 for setting up a greenfield 4GW solar cell and a 4GW solar module.

The project, worth Rs3,000 crore is expected to be operational this year. Reliance Industries has announced plans to set up a 100GW energy park at its existing facility in Jamnagar. The company has committed to start manufacturing 10GW solar photovoltaic cells and module factory by 2024, with plans to double this by 2025. It also announced the setting up of a 10 GW green energy system in Andhra Pradesh.

According to the survey, Solar Power was a sought-after sector, with an investment commitment of Rs1,74,373 crore in the form of 152 projects. Interestingly, the year also saw announcement of 10 Solar-cum-Wind hybrid projects with a combined generation capacity of 10,265 MW.

E-vehicles & Infrastructure

In the automobile sector, 45 new Electric Vehicle (EV) projects have been announced, with plans to install capacity to produce two-wheelers, four-wheelers, and buses at a total investment of around Rs65,000 crore. This trend is only accelerating, as Eicher Motors recently guaranteed Rs1,000 crore for the manufacture of EVs, product development, and new product development under its internal engine combustion portfolio.

There is a lot of action in another significant area – infrastructure, which is seeing a lot of action, with roadways, real estate, data centres, and water supply being the sectors that accounted for around 70 per cent of the total fresh investment announced in this sector. Investment commitments in this area amount to Rs11.76 lakh crore, representing a growth of over 32 per cent from the previous year.

The capital goods industry is expected to be a major beneficiary of investments flowing into this sector, as reflected in the capital goods index, which has gone up by 9 per cent over the last 12 months, even as the infrastructure index shows a marginal decline. Companies like BHEL, BEL, Siemens, ABB, L&T, CG Power, GMR, HAL, and SKF make up the constituents of the capital goods industry. L&T shares have gone up by two-thirds over the last 12 months, as have BHEL shares, while Siemens has gone up by 65 per cent.

-

In FY23, 335 railway station modernisation projects were announced, with an estimated total expenditure of around Rs15,000 crore. Other infrastructure projects concern highways and road building projects, with NHAI and other state agencies committing investments of Rs4.28 lakh crore for 1,702 new roadway projects

The order books of capital goods companies have also started swelling, whether in reality or in anticipation of more orders coming in. The government is also doing its part to increase outlays of capital projects, having earmarked a budget of Rs10 lakh crore in the current budget, with a good amount set aside for railways. In FY23, 335 railway station modernisation projects were announced, with an estimated total expenditure of around Rs15,000 crore.

Other infrastructure projects concern highways and road building projects, with NHAI and other state agencies committing investments of Rs4.28 lakh crore for 1,702 new roadway projects. Water and pipeline projects accounted for Rs1.19 lakh crore. This year also saw an uptick in residential projects, with 30 large-sized residential complexes among the 1,469 new projects, representing an aggregate investment of Rs55,048 crore

The coming year, FY24, is a pre-election one and more commitment may be expected by the government. Besides new projects, several expenses on pre-existing projects will also be increased in a bid to finish certain major showpiece endeavours. The railways have already announced orders for several new Vande Bharat trains with both PSU as also private companies being the main beneficiaries.

With many state governments competing against each other to attract large projects one can expect more foreign companies to enter and set up projects in India. FPI is also looking towards the future and has increased investments. Since March they have invested around Rs40,000 crore. The only challenge in implementation is obtaining land clearances and dealing with geo-political issues which could dampen confidence levels.

-

Vishakhapatnam, the port city will soon be linked to major cities in other states

Who is the biggest?

Andhra Pradesh trumps over states in attracting new projects

Now one may argue about the relevance of rankings when it comes to states and projects. However, rankings do play an important role. Andhra Pradesh, which was relatively unknown after the bifurcation of the erstwhile Andhra Pradesh into Telangana and Andhra Pradesh as per the Andhra Pradesh Reorganisation Act 2014, has emerged as a prominent state. It shares its border with the Bay of Bengal and boasts the second-longest coastline in India after Gujarat. The executive capital of Andhra Pradesh is Vishakhapatnam, located along the state’s 974 km coastline.

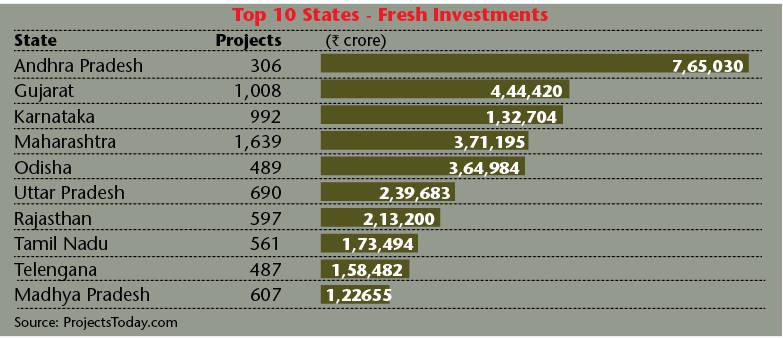

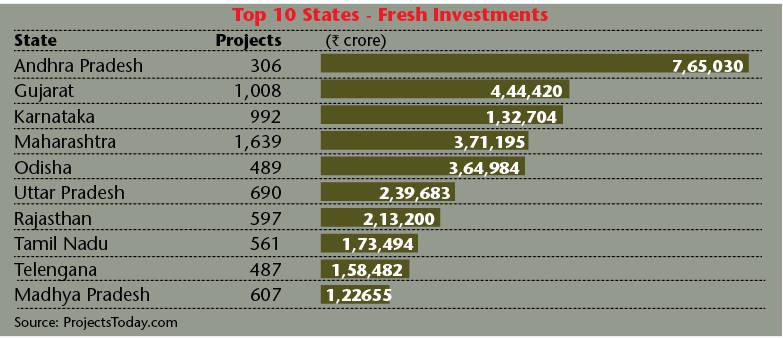

Under the leadership of Chief Minister YS Jagan Mohan Reddy, who assumed office on 30 May, 2019, Andhra Pradesh has secured the top spot in attracting new investments. In the fiscal year ending March 2023, the state surpassed traditional investment hubs such as Gujarat, Maharashtra, and Karnataka in terms of project investments. According to the annual survey conducted by ProjectsToday.com, a Mumbai-based research firm, the new investments in Andhra Pradesh in FY23 amounted to approximately R7.65 lakh crore, surpassing Gujarat (R4.44 lakh crore), Karnataka (Rs4.42 lakh crore), and Maharashtra (Rs3.71 lakh crore). Please refer to the table, ranking states based on the value of new projects committed in FY23. (source: ProjectsToday.com)

Andhra Pradesh has attracted interest from numerous large corporations planning to establish projects in the state. Reliance Industries, a major investor in the KG D-6 offshore natural gas project, has committed to setting up a 10 GW solar energy project, with a promise to create 50,000 new jobs in the state. Jindal Steel and Power has also committed to establishing a 3 million tonnes per annum (mtpa) steel plant in Andhra Pradesh and has plans for renewable energy projects in solar, wind, and hydro sectors across the state. The initial investment for these projects is estimated at Rs10,000 crore.

NTPC, one of the biggest investors in the state has committed Rs1.10 lakh crore in new energy projects including green hydrogen, green ammonia and green methane. The project is to be set up in two phases of Rs55,000 crore each and will be executed in 2027 and 2032 respectively.

-

Of the 13 districts in the state, nine districts have a coastline on the Bay of Bengal and the government is making significant efforts to establish connectivity with neighbouring states through the implementation of roads, ports and airports. In FY23, 39 national highway projects have been sanctioned/approved. The cumulative cost of these projects has been estimated at Rs31,000 crore.

This was stated by Union Road Transport and Highways Minister Nitin Gadkari in the Rajya Sabha in March 2023. The Bengaluru-Vijayawada motorway, with a length of 160 km and a cost of R6,169 crore, was one of the largest NH projects being considered. Vishakhapatnam, the port city will soon be linked to major cities in other states including Nagpur.

Hyderabad will also be linked through expressways proposed by the Central government. Six of the 26 national highways will be in Andhra Pradesh. The Nagpur to Vijayawada highway will be completed by 2025 while Vijayawada-Raipur is expected to be completed in 2024.

Some of the mega projects in AP are given in the table above.

Besides these mega projects, the other projects in the state include the Bhogapuram Greenfield Airport project in Vishakhapatnam being developed at a cost of around Rs4,500 crore by the GMR group. ArcelorMittal is setting up a renewable energy (solar and wind) project of 975 MW at a cost of Rs4,600 crore. ArcelorMittal/Nippon Steel India (AM/NS), which had taken over Essar Steel, is also expanding its petrochemicals capacity from 8 mtpa to 11 mtpa at a cost of Rs1,000 crore.

Adani is also planning to set up a data centre and a tech park through its company Vizag Techpower. Both projects will cost Rs10,600 crore.

Given the significant amount of project activity going on in the coastal state of Andhra Pradesh it will not be long before it becomes a state to reckon with, attracting new investors.