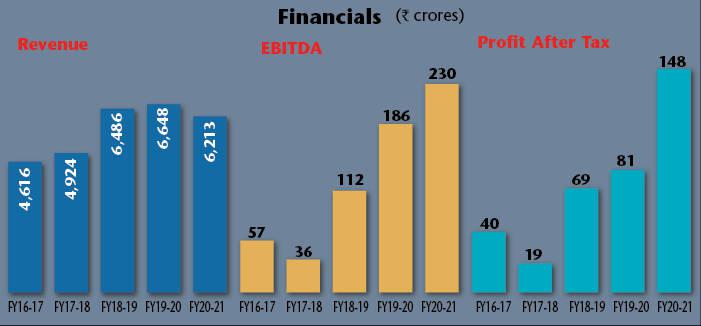

In May 2021, the Rs6,213 crore PDS Multinational Fashions Ltd, a global plug and play design-led platform, acquired 50 per cent stake in Yellow Octopus for $11.31 million. The company offers product development, sourcing, virtual manufacturing and supply chain platforms, catering to leading brands and retailers globally, while Yellow Octopus is an entity that focusses on providing commercial sustainability solutions in the fashion industry, with an aim to transform the fashion industry from a linear to a circular economy model. “This has further strengthened PDS’s value proposition,” explained Sanjay Jain, group CEO, PDS Multinational Fashions Limited, while announcing the company’s working for March 2021. “Yellow Octopus works with leading brands to buy the unsold inventory, return products and distributes these products to smaller retailers in Eastern Europe and Africa, thereby strengthening PDS’ environmental social and governance (ESG) agenda. These are three central themes for measuring the sustainability and positive impact of an investment or business.” Jain comes from the retail and finance industry, with over 26 years of experience in transformation across various companies. His new role with PDS began in January 2021. Prior to joining PDS, Jain was associated with the Future group as CEO, Future Retail; he also functioned as group CFO, Future group, for nearly six years. In his capacity as CEO and CFO, Future group, he was a part of the core leadership team, spearheading the transformation and growth agenda, as also introducing systems and processes. During his career, he raised over $4 billion from some of the world’s marquee strategic, private equity and financial investors. He was also instrumental in acquiring companies in India, Belgium, Canada, the US, Ireland, France, and Indonesia. The 2020-21 results of PDS showed that its revenues stood at Rs6,213 crore, as against Rs6,648 crore, earned from operations in 2019-20. Despite this marginal drop, the operating profit (EBIDTA) rose to Rs230 crore, as against Rs186 crore in 2019-20. The EBIDTA margin had improved by 3.7 per cent in 2020-21, from 2.8 per cent in 2019-20, while the net profit went up to Rs148 crore, as against Rs81 crore in the previous year. The company’s earnings per share (EPS) today works out to Rs32.37. It has declared a dividend of Rs15.75 per share, which translates into a 49 per cent pay-out, based on the EPS. PDS’ counter is trading at Rs1,014, at a price to earnings ratio of 31 times, with its market cap aggregating to Rs2,643 crore, 66 per cent of which is with the promoter family. However, no analysts have tracked the company so far, though it has been performing well. In the last five years (2017-21), its sale has risen 1.3 times from Rs4,616 crore in 2017, while the EBIDTA has gone up by four times – from Rs57 crore in 2017 to Rs230 crore by 2021. Its profit after tax has also risen by 40 per cent CAGR by 2021, while the return on capital employed (RoCE) has gone up from 6 per cent in 2017 to 22 per cent in 2021 – up 3.8 times. “Last year posed a lot of challenges, due to the unprecedented impact of Covid on the business and life in general,” observes Deepak Seth, the 70-year-old chairman, PDS Multinational. “However, the entire PDS team has faced these rough waters together and has come out stronger. As we move ahead in our journey of growth and profitability, I strongly believe we are well-placed to distribute steady-state dividends to our shareholders.” “PDS has built an integrated global tech-enabled platform through which retailers, brands and entrepreneurs can leverage and derive scale and agility,” adds Pallak Seth, 43, vice-chairman, PDS Multinational. “We are focussed on maintaining the momentum and are constantly evaluating opportunities of expanding our business to new categories and new geographies, thereby enhancing value for our stakeholders.” Pallak graduated from Northwestern University in 1999 and subsequently launched the House of Pearl Fashions’ design sourcing and distribution business, with the establishment of Norwest Industries Ltd.

-

Deepak Seth: well-placed to pay dividends