-

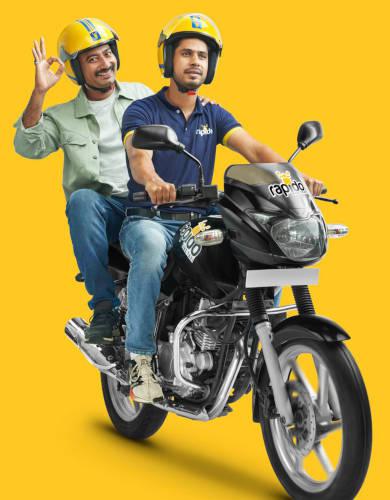

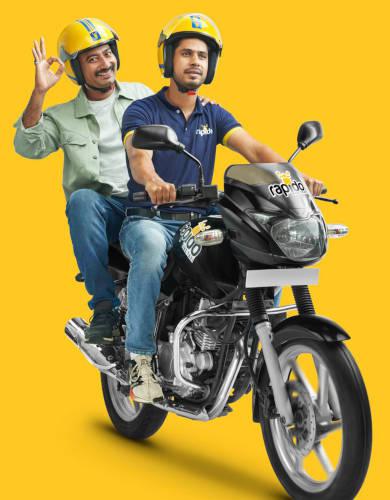

Rapido is the first mover in the bike taxi segment

Turning the bike taxi services to a big show, as the other co-founder Aravind underlines, has been quite an effort as the lack of clarity in regulation (allowing bikes for formal ride hailing services) got into legal troubles in several locations. Nevertheless, as the industry insiders also point out, the company persisted as the demand for bike taxi gradually picked up momentum with the business push particularly coming from youth and college-goers.

Not surprising that the company is today recognised as the first mover and pioneer in the bike taxi segment, which is reportedly growing by leaps and bounds trajectory especially in Tier II and locations down below. “You go to a place like Jorhat (in Assam) and you will find Rapido app usage quite high, next only to leading e-commerce apps like Flipkart,” Pavan underlines.

Making the most of its bottom-up approach (starting with two-wheeler taxis), the second major addition happened after Covid, when the company decided to bring in three-wheeler auto services to its network. “It purely happened because our customers started asking for it. It is a three-year-old service now and it has expanded quite rapidly becoming the second most important vertical for us,” he further adds.

And then, late last year, Rapido also announced foraying in the four-wheeler cab segment in select cities, which practically makes the platform quite comprehensive, covering the three main elements of usual mobility solution.

Diluting commission model

With gradual addition of two other segments after establishing taxi bike as the niche, Rapido claims to have eventually created quite a formidable fleet strength panned across 100 cities which is now translating into robust performance numbers. “If you look at our fleet size, we have 4-5 million bikes registered with us. In the three-wheeler auto category, we have over 500,000 vehicles and in the recently launched four-wheeler cabs, the volume of units registered with us is close to 150,000.

On a cumulative basis, this fleet strength is resulting in over 1.5 million rides every day,” informs Pavan, while adding that in terms of daily rides volume, Rapido is quite close to market leaders Ola and Uber. The two leading players are estimated to be touching daily rides figure of around 2 million on a per day basis.

According to Pavan, bike taxi continues to remain the main pillar for Rapido, contributing nearly 45 per cent of its business, closely followed by auto (35-40 per cent), with the rest coming from four-wheeler cabs and the delivery business. The typical average ticket size of a taxi ride is pegged at Rs60 while, for auto, it is estimated to be about Rs130.

Rapido now seems to be in the mood of upping the ante in the game, with the initiation of a new business model – replacing commission with a more convenient subscription model. “We had explored and introduced this when we forayed in cab services last year and now our auto taxi services have been moved to this model which entails zero commission for the lifetime,” explains Aravind Sanka.

-

Rapido auto: the second most important vertical

As per the subscription model, the captain of a cab or auto can register his presence on everyday basis (even weekly in the case of cabs). This would entail paying a nominal fee, Rs9-15 in the case of auto taxis for subscribing for a 24-hour cycle. A typical SaaS innovation, the drivers or captains will not have to pay any commission or extra charges for the rides he will undertake during the subscription period validity.

“Auto drivers, we have realised, are more inclined for instant payment and this subscription model therefore is a big value proposition for them which in turn will shore up their volume presence with us,” Pavan underlines. “These are the early days but the response to subscription model is quite encouraging,” adds Aravind.

Growth propellers

The company has adopted the subscription model for the 4- and 3-wheeler taxi segment while its bike taxi is still being run on the commission model. And the top brass is hopeful that this model will further consolidate Rapido’s positioning in a market, which is expected to grow exponentially in the coming years. According to a TechSci Research report, the ride hailing market in India will turn out to be a staggering $4.67 billion opportunity by 2029 and it is expected to maintain a hefty CAGR of about 23 per cent during 2023-29.

“Regulations, lower penetration in rural areas, surge pricing and rising fuel costs pose challenges, while electric vehicle integration, rising chauffeur services and multi-modal offerings are emerging trends shaping the future of this dynamic market. Therefore, the ride-hailing sector is poised to maintain its vibrancy and competitiveness, providing ample opportunities for expansion and innovation in the forecast period,” says the report.

Rapido’s Aravind confirms that post-Corona, the robust growth pattern is emerging again in the ride hailing business, particularly in new segments. “If you look at taxi bikes and auto segments, the growth has almost been in 3x trajectory after Corona. In car taxi, the figure has touched pre-Covid levels. After Corona, auto drivers who were earlier reluctant to join online platforms, too realised that it helps in business generation,” says he.

And it is this growing momentum that Rapido is confident of tapping further. “With our subscription model, we are targeting to onboard additional 4 lakh auto captains in the country in next one year,” Pavan says. Incidentally, dominant player in the ride hailing space like Ola and Uber too have expanded their portfolio to include taxi bike and scores of other players are now also entering in the space which is Rapido’s stronghold.

Does it entail increasing competitive pressure for Rapido, which is also trying to strengthen its positioning in the segments where others lead? Point it out to Pavan and he asserts that there would be enough space for serious players as the business is going to expand exponentially. “China’s leading player DiDi is doing 30 million rides every day. Just imagine, the kind of growth opportunity that exists for us.”

-

Rapido cabs: closing the gap

There are a set of other growth propellers which the top brass believes will give a serious push to their bigger growth design. A recent notification by the ministry of transportation, giving legal validity to bike taxi services across the country has come as a major shot in the arm. “It is a big relief for us and everybody who is part of this business,” Aravind responds. The company, meanwhile, has the financial backing of some noted names from the corporate sector and investment agencies – Pawan Munjal’s Hero, TVS, Swiggy, Shell Ventures, Yamaha, West Bridge, Nexus Partners, etc.

On a cumulative basis, the company has raised over $300 million till date and is valued at a little less than $1 billion currently. Pavan says the growth in volume in recent years has also bolstered its financial numbers. In 2022-23, the company had reported a staggering three times jump in its revenue to Rs497 crore, as against Rs147 crore in the previous fiscal. During the fiscal, its GMV (gross merchandise value, which is the total business generated through its system) had almost galloped by four times to Rs2,520 crore from Rs674 crore in 2021-22.

However, the fiscal also saw the losses increasing to Rs675 crore, as against Rs439 crore last year. According to Pavan, the recent growth momentum is increasingly shrinking the loss ratio vis-à-vis actual earnings. “Operationally, we have almost reached to a profitable stage on a monthly basis. And considering the growth push our recent initiatives has triggered, we are expecting to reach to EBIDTA positive stage in next one year,” says he.

Meanwhile, in terms of further addition to its operational profile, the company has set clear targets. These include getting into EV linked ride hailing business and the ecosystem, including segments like e-rikshaw to its portfolio in Tier III or Tier IV locations and adding other elements of public mobility services like offering metro or bus tickets. “We will just focus to further consolidate our core areas. There is no plan of any new line of service or exploring opportunity in new geographies,” Pavan sums up. The company clearly seems to know where it will be making rapid gains in the near-to-medium term.