-

The company sold 23,453 residential and commercial units (as of March 2022), with an aggregate saleable area of 14.59 million sq ft. Its sales (net of cancellation) have grown at a compounded annual growth rate of 142.62 per cent, from Rs440.01 crore in Fiscal 2020 to Rs2,590.04 crore in fiscal 2022. As of March 2022, it sold 21,478 residential units with an average selling price of Rs28.1 lakh per unit.

Between fiscal 2020 and 2022, of the 10 projects that Signature Global launched, eight witnessed an oversubscription at launch. Its project Millennia4, launched in January 2022, witnessed complete subscription of the 814 units on offer within 24 hours of launch while Imperial, launched in March 2022, witnessed subscription of all 1,141 units on offer within 12 hours of launch.

For projects that it launched under the DDJAY-APHP in Gurugram and Sohna, it was able to sell 52.38 per cent of the inventory within six months. As of 31 March, 2022, Signature Global had completed an aggregate developable area of 4.08 million sq ft in completed projects and an additional 0.55 million sq ft in ongoing projects, comprising 6,282 residential units and 566 commercial units.

Developing Delhi-NCR

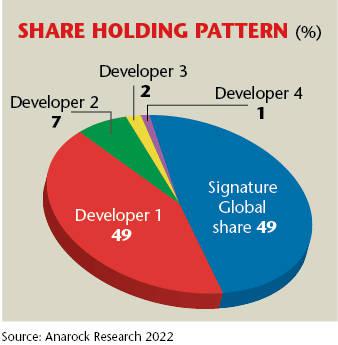

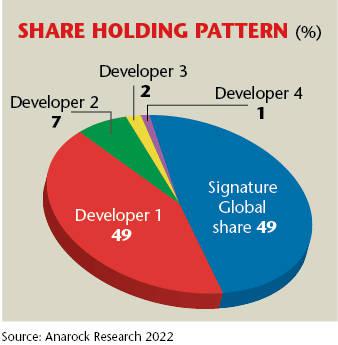

In the National Capital Region (NCR) of Delhi, it is the largest real estate developer focused on affordable and mid-segment housing between 2019 and 2021. As per an Anarock report, the company’s market share is 19 per cent. With a population of more than 46 million and spread over 53,000 sq km, the urban agglomeration of Delhi NCR has witnessed urbanisation levels of around 62 per cent.

Delhi NCR is considered to be among the top two markets in India. Around 99,534 units were launched in the affordable and mid-segment in Delhi NCR between 2017 and 2021. Gurugram was the key contributor, accounting for 41 per cent between 2017 and 2021. The absorption level in Delhi NCR in the affordable and mid-segment cumulatively for the last five years stood at 158,916 units, against a supply of 99,534 units. The cumulative units launched in the last three years, from 2019 to 2021 period based on monetary terms in NCR is Rs591,000 million, with Gurugram having a share of 63 per cent – the highest amongst all regions.

Says Joint MD Devender Aggarwal: “We aspire to continue to focus on the affordable and mid-segment housing in Delhi-NCR. We shall further consolidate our leadership position in Gurugram and expand selectively in micro-markets within Delhi NCR. We will selectively acquire land to ensure efficient utilisation of capital and enter into collaboration agreements to further grow our operations. We want to focus on growth with cost and price optimisation.”

The key growth drivers for Gurugram include strong economic setup of corporates. Development in Gurugram accelerated with the development of NH-48 in 2008. It was followed by other prominent infrastructure initiatives like Delhi metro extension, Rapid Metro, Signal free corridor in Golf Course Road and Cybercity, and the Kundali Manesar Palwal Expressway.

The NCR currently has air connectivity through the Indira Gandhi International Airport, which is located on the border of Gurugram, which has further boosted the development in the region. With the Haryana portion of the Delhi-Mumbai industrial corridor and the Sohna elevated road likely to be finished by next year (2023), it is estimated that the real estate sector will see a major development as these projects improve access, create jobs and allow people to move with ease. The micro market will get excellent connectivity with the corporate hub of Gurugram, reputed educational institutions and recreational developments in and around the city.

-

Kathuria: strong balance sheet

“We have adopted an integrated real estate development model, with in-house capabilities and resources to execute projects from inception to completion which enables us to offer projects at competitive prices,” says Ravi Aggarwal, MD, Signature Global.

“Among our core strengths is our ability to efficiently turnaround projects. We have typically launched projects within 18 months from the date of land acquisition. Our high asset turnover has enabled us to generate positive cash flows in a relatively short period to support further developments,” adds Ravi.

It has developed extensive in-house capabilities right from identification of land, conceptualisation of the project, to execution of the project involving planning, obtaining regulatory approvals, designing, marketing and sales, and delivery. The group has an extensive distribution network focused on target customer segments with 484 channel partners and an in-house team of 43 employees engaged in direct sales and 96 for indirect sales, as of 31 March, 2022.

Tech edge

Signature Global incorporates technology in all its operations. “Our customer relationship management system from salesforce, broker portals, human resources, social media channels, customer mobile application, financials and management information systems and in-house sales are all integrated over a common platform,” says Pradeep who has implemented an advanced ERP platform, SAP that has further strengthened internal processes apart from an automated sales booking system and tools for pre- and post-sales management.

Signature Global’s AHP projects are sold exclusively through digital channels, as mandated by the Directorate of Town and Country Planning, Haryana (DTCP) and since January 2022, its entire project inventory under AHP projects is being exclusively sold online, including on the government website. Since 2014, prior to the mandate by the DTCP, it was selling inventory through its website www.signatureglobal.in.

In order to further strengthen the brand, Signature Global engaged celebrity brand ambassadors for various campaigns from time to time. In addition, actress Vidya Balan is its brand ambassador and has been associated with the brand for over five years. In its advertisement and promotional campaigns, it has been communicating the mission “HarPariwarEkGhar” under which it has run campaigns like ‘ApnaGharTohApna Hi Hota Hai’, ‘ApneGharPeKaisa Lockdown’, ‘Kiraye Se Azaadi’, ‘Diwali ApneGharWali’ and ‘Smart Decision’.

It also ran project-specific campaigns like the ‘Independent Floors for the Independent You’ campaign in 2020 to promote its newly launched ‘Independent Premium Floors’ project, which highlighted various age groups, genders and ideologies. In addition, its August 2021 campaign ‘Life at Signature Global’ showcased the benefits of living in a gated community.

Signature Global undertakes sales efforts through a combination of electronic marketing and advertising in the mass media, centrally from its head office. It actively participates in real estate exhibitions that are attended by the local population. It keeps customers, existing and potential, updated about the company’s latest developments, new launches, upcoming launches, existing projects, events and achievements though social media platforms.

It has also undertaken a number of advertisement and promotional campaigns at a national level and run targeted campaigns to engage audiences digitally. Coupled with a strong presence across social media platforms and strategic appointments of brand ambassadors to promote the brand, its campaigns have generally been well-received by target audiences.

-

Signature Global's products are seen more as ‘value housing’ rather than ‘affordable housing’

It also engages in digital marketing efforts in order to target customers, undertaking direct sales efforts through a combination of telephonic marketing and electronic marketing. It markets projects through in-house sales teams and brokers. A client relationship management team services customers from the property booking stage, through to the final delivery of the property.

“We also propose to improve customer satisfaction and service to measure customer satisfaction scores and reduce turnaround time with respect to inquiries. The established brand allows us to cross sell to the existing customer base and also enables us to market offerings to prospective customers by way of referrals from existing customers. We ensure that all communication is easily identifiable under the brand, and believe that this ensures brand recall by existing and potential customers,” says Pradeep.

As of March 2022, the company has 65 trademarks for the names and logos of their brand ‘SignatureGlobal’ and projects, including, amongst others, ‘Signatureglobal Homes’, ‘The Roselia’, ‘The Serenas’, ‘Orchard Avenue’ and ‘Orchard Avenue 2’, which have been registered under various classes with the registrar of trademarks.

The execution team, in coordination with the architecture team, completes the processes required to achieve the necessary compliance and statutory certifications for each of its sites including with respect to environmental clearance, occupation, completion, fire safety, waste disposal, rain water harvesting and recycling of water.

Signature Global has the magic power of the total involvement of promoters and a senior management team of experienced professionals, who are instrumental in implementing business strategies, and who collectively have significant experience in real estate development, project planning and execution, fund raising, IT, tax, legal and compliance, corporate finance and accounts as well as management at reputed Indian companies and multinationals. The group’s investor base includes IFC and HDFC Capital Advisors who participated in multiple rounds of capital raise undertaken by the company thereby affirming their confidence and trust in the company.

Profitable at project level

Signature Global has positive operating cash flows with low levels of debt. Its continued focus on efficiency and productivity has enabled it to deliver consistent financial performance. Its asset turnover ratio (calculated as sales divided by capital employed) was 0.44, 1.53 and 2.73 in fiscal 2020, 2021 and 2022, respectively. “We believe this demonstrates our strong execution capabilities and ability to achieve faster turnaround with shorter development cycles thereby helping us achieve scale in a short span of time,” emphasises Ravi.

This positive operating cash flows has come despite incurring business development expenses for growth and without increasing leverage. In fiscals 2020, 2021 and 2022, the operating surplus before land advance and acquisition, which reflects surplus post construction expenses, selling, general and administrative expenses and taxes adjusted from collections, was Rs219.17 crore, Rs248.8 crore and Rs470.14 crore respectively.

-

Between FY20 and 22, of the 10 projects that Signature Global launched, eight witnessed an oversubscription at launch

“In order to continue launching new projects, we strive to maintain an optimal capital structure with prudent use of leverage and a conservative debt policy. We have been able to grow our sales at a CAGR of 142.62 per cent from Rs440 crore in fiscal 2020 to Rs2,590 crore in fiscal 2022 without incurring significant debt. Our net debt as of March 2020, 2021 and 2022 was Rs507.03 crore, Rs557.32 crore and Rs517.34 crore respectively,” says Pradeep.

The group also witnessed strong collections and healthy gross profit margins (GPMs). For example, project Synera was launched in December 2014 and achieved an adjusted GPM of 16.10 per cent on residential sales and an adjusted GPM of 74.70 per cent on commercial sales, with a blended adjusted GPM of 21.30 per cent.

These GPMs were achieved prior to the amendments to the AHP through which developers were provided certain additional incentives. Previously, the FAR under the AHP for commercial development was limited to 4 per cent of the net planned area, instead of the current 8 per cent; the price ceiling for residential units stood at Rs4,000 per sq ft of the carpet area, which has since been increased to Rs4,200 per sq ft, where carpet area is the saleable area under the AHP; and the price ceiling of balcony areas stood at Rs500 per sq ft, instead of Rs1,000 per sq ft, with a cap of Rs100,000 per unit, as currently permitted. In the DDJAY-APHP projects as well, most of which were launched only after 2019, the GPM on residential sales itself was 30.59 per cent, without commercial sales.

“We believe our cash flow management and balance sheet strength has facilitated us to attract strategic lending partners which has ensured continued financial support to our projects,” says Rajat Kathuria, CEO of Signature Global who has debt arrangements with International Finance Corporation, HDFC Capital Affordable Real-Estate Fund-II, ICICI Bank Limited, IndusInd Bank Limited, Kotak Mahindra Investments Limited, Tata Capital Finance Service Limited, ArkaFincap Limited, IIFL Home Finance Limited and YES Bank Limited, among others. Additionally, prior to the filing of the Red Herring Prospectus with the RoC, the outstanding CCDs that have been issued to HCARE and International Finance Corporation will be converted into equity shares, which will result in improvement of its debt/equity ratio.

-

As part of its development activities, Signature Global is focused on sustainable development and inculcates green concepts and techniques such as sustainable water management facilities and low flow fixtures that result in water saving; solid waste management and the use of solar panels. The International Finance Corporation created the Excellence in Design for Greater Efficiencies (EDGE) to respond to the need for a measurable and credible solution to prove the business case for building green projects and unlock financial investment.

All of its projects launched between Fiscal 2020 and Fiscal 2022 are certified by the Indian Green Building Council (IGBC) in accordance with the IGBC green affordable housing system or have received EDGE certification in the affordable housing segment in Delhi NCR. Its efforts towards sustainability have been recognised through various awards and recognitions including the Signature Global group being conferred the 8th IGBC Green Champion Award under the category of ‘Developer Leading the Green Affordable Housing Movement in India’.

Scaling up

Signature Global has demonstrated its ability to scale up rapidly by growing its project portfolio from 90.6 lakh sq ft of Saleable Area as on 31 March, 2018 to 3.867 crore sq ft of Saleable Area as on 31 March, 2022, which includes the Saleable Area of Completed Projects and Ongoing Projects and the estimated Saleable area of Forthcoming Projects.

It launched its first project in 2014 and as of 31 March, 2022, had sold 23,453 units with an aggregate Saleable Area of 1.46 crore sq ft. As of 31 March, 2022, it had 27 Ongoing Projects comprising approximately 1.61 crore sq ft of Saleable Area. Further, it has launched 4,752 units, 5,209 units and 5,739 units in Fiscals 2020, 2021 and 2022, respectively, which amounted to 28.5 lakh, 35 lakh and 40.1 lakh sq ft of Saleable Area for the corresponding periods.