-

Jajoo: ‘our balance sheet is strong’; Photo: Sajal Bose

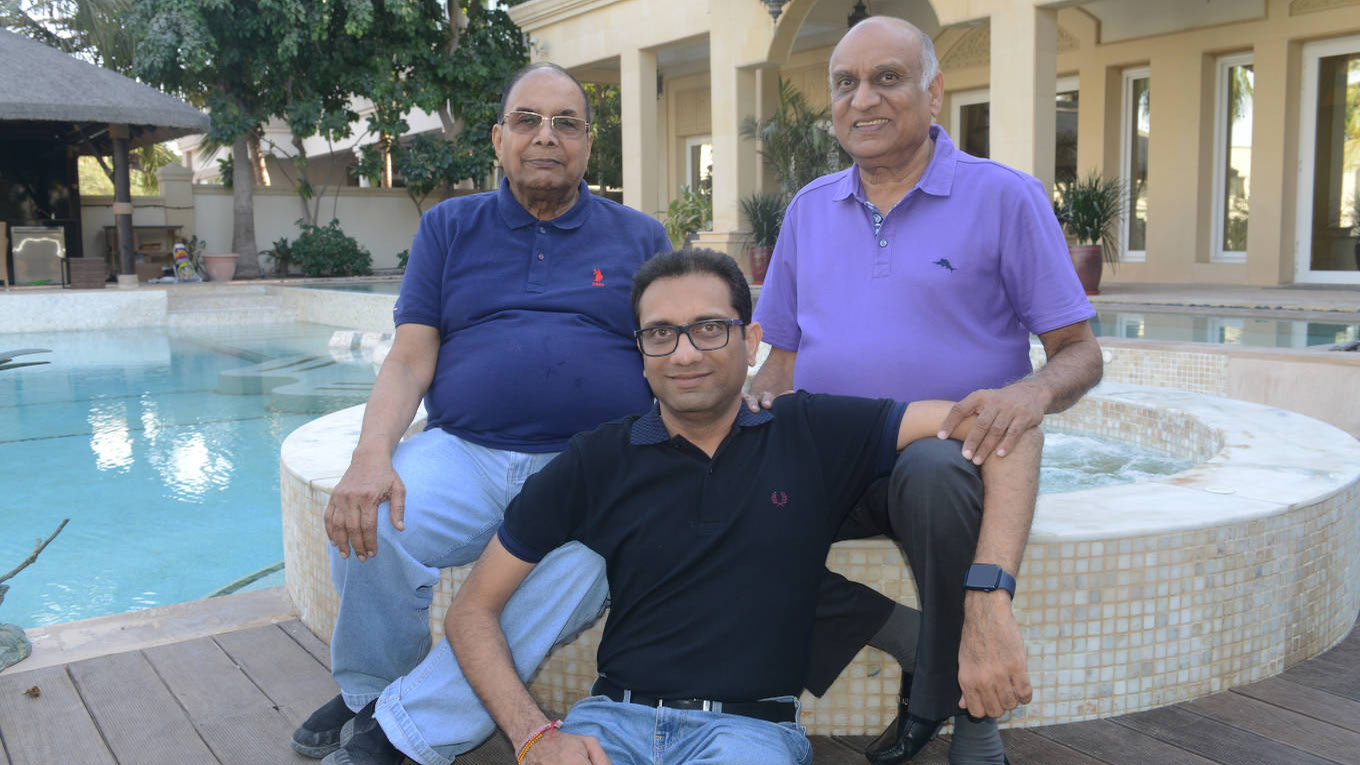

While the patriarch, BG Bangur, now 89, pursued the commercial aspect, his IIT chemical engineer son HM rolled up his sleeves and oversaw the stamping out of inefficiencies on the shop floor. Later, in 2004, HM’s son, Prashant Bangur, with an MBA from ISB, joined the business, spending his first years as a trainee at the under-construction company plant in Ras, Rajasthan. He was put on the board of directors only in 2012. This three-generation team has grown SCL from 600,000 tpa to 47 million tpa in two decades, which translates to a CAGR of 24 per cent.

The company’s current employee strength is 6,500. “Our plants are built at an average cost at Rs3,961 per tonne, against the industry average of Rs5,683,” says Subhas Jajoo, chief financial officer, SCL. “And, most importantly, all this was achieved primarily by creating massive cost savings through good management, by ploughing back internal accruals into expanding capacity and keeping to a policy of almost no borrowings.”

Predominantly a North-based player, SCL has a 20 per cent market share in the 70-million tpa northern India market, where it stands second largest, next to UltraTech. At the base, it has two large integrated cement plants in Beawar and Ras (both in Rajasthan) and grinding units in Khushkhera, Jobner, Suratgarh (Rajasthan), Laksar (Uttarakhand) and Panipat (Haryana). It caters to the needs of Rajasthan, Haryana, Punjab, Himachal Pradesh, Uttarakhand, Uttar Pradesh and Delhi-NCR, which gobble up about 55 per cent of the company’s capacity. Its Ras plant, with 13.5 million tpa clinkerisation capacity, makes it the largest single location plant in the world.

After its consolidation in the Northern market, the challenge for SCL was to increase its presence in other markets. It first entered the Eastern market, with an integrated cement plant in Baloda (Chhattisgarh) and grinding plants in Buridih (Jharkhand), Aurangabad (Bihar) and Athagarh (Odisha), where it has a market share of 9 per cent. SCL, now ranked the third-largest, has set foot in South India too, with a 3 million tpa integrated cement plant at Kodla, Karnataka, in 2018.

Built on a total area of 170 acres, this is the first integrated cement unit of the company in South India. Its limestone mine is located merely 2 km away and has been providing material for 70 years. “When we were setting up in Kodla, people thought we were making a mistake by venturing into the South, where cement capacity is saturated,” says Prashant. “But we proved them wrong. Today, our cement brands are doing well and supplying to markets in Maharashtra, Telangana, Goa and Andhra, as also Karnataka.” It sources energy partly from its 30 MW waste heat recovery plant and the rest from wind power energy units. Also, the railway linkage is only 20 km from the plant.

“Our plant is running at 70 per cent capacity. The limestone is good and soft, which gives us an edge on energy costs,” explains Arvindkumar Patil, assistant vice-president, operations, SCL. The unit has also created a rainwater-harvesting capacity of 200,000 kl. “We will go full strength to gain share in the new markets,” affirms Diwakar Payal, president, marketing, SCL. “In the East, we have plans to set up a grinding unit in West Bengal, which has a demand of 2.5 million tpa.”

-

Payal: confident of gaining strength in new markets; Photo: Sajal Bose

The newly commissioned 3 million tpa grinding plant in Athagarh, Odisha, is spread over 108 acres. This greenfield unit is strategically located on the NH 55, close to the nearby rail link of Rajathgarh, which is connected to the Raipur-Sambalpur broad gauge line. The new, modern unit has been commissioned at an investment of Rs500 crore. The clinker from Chhattisgarh will be ground with fly ash from the thermal power plant located less than 100 km away or slag available from the steel plant close by. A high-energy efficient vertical roller mill from Germany has been put up for grinding. This gives flexibility in producing different types of cement like OPC, PPC and PSC, which use wet fly ash and wet slag as raw materials.

The unit will cater to key markets like Bhubaneswar, Angul and some parts of West Bengal. SCL has been strengthening its markets and brands and setting logistics right in the eastern states. It has developed links with dealers in Odisha (875) and West Bengal (800) too.

The demand for cement in the East is about 60 million tpa, of which a large share comes from Odisha and West Bengal. And, the market is growing. However, none of these states in the east are on the limestone map and they depend on clinker supply either from Chattisgarh or Andhra to operate their grinding units. “Looking at the emerging opportunity, our grinding units will help us increase our market share in East India,” says RK Vijay, joint vice president, operations, SCL.

The upcoming clinker line III at Baloda Bazar, which has a capacity of 3.6 million tpa, is a brown-field expansion, strategically located in the limestone cluster of Chhattisgarh. The unit will use the nearby railway link of Raipur-Bilaspur, which in turn connects to the Howrah-Kharagpur broad-gauge line.

The new state-of-the-art plant will involve an investment of about Rs1,000 crore and is targeted for completion by September 2022. “This will help augment clinker availability for meeting the requirements of the company’s present and future grinding units, located in the Eastern India market,” says PN Chhangani, whole-time director, who oversees all the company’s manufacturing operations.

Proximity to the company’s large limestone deposit at Baloda Bazar will ensure that it has an assured supply. A state-of-the-art waste heat recovery plant will not only help meet the entire power requirement of the kiln, but will extend a much-needed cost advantage, while also helping the sustainability cause pursued rigorously by the company. The requirement for the coal for clinker production will be procured mainly by way of imports.

-

Somany at the plant in the UAE: a good buy; Photo: Sajal Bose

SCL is also quietly working to commission a grinding unit in Pune – its first venture in the 48 million tpa western India market. The 110-acre plant, located on the NH 9, is close to the nearby rail link of Patas, which connects to the Pune-Mumbai broad-gauge line. The new, modern unit is almost ready and awaiting connectivity to the nearest power sub-station. The clinker for the plant will be sourced from the company’s clinker unit at Kodla in Karnataka. Fly ash will be sourced from the thermal powerplants located at Nashik and Solapur, which are within 200 km distance from the plant. SCL is also seeding a 1,400 strong dealer network in western India.

SCL’s strategy of keeping costs low has paid off. Its brands have consumer salience –it has increased its consumer sales from 70 per cent of the output to 82 per cent. Consumer retail sales give dealers confidence, high profits and lower institutional buyer discounts.

A diversified brand portfolio consisting of Roofon, Bangur Power, Shree Jung Rodhak, Bangur Cement and Rockstrong have been designed to meet the requirements of a cross-section of customers. Its concrete testing lab is equipped with modern facilities to test the quality of raw materials and concrete cubes for better performance and product development. “Shree Jung Rodhak is the highest selling brand of the company,” says Payal. “It is corrosion-resistant, which makes it the preferred choice of customers.”

The company introduced Roofon and Bangur Power brands in 2019. While Roofon, a top-quality grade cement, offers higher strength to roofs with denser concrete, Bangur Power offers extra fineness, smoothness and corrosion resistance. SCL’s brands are sold through a strong pan-India network of 20,000 dealers and 1,100 distributors. The company is also exploring possibilities to get into construction-related products, adds Payal.

“We have been associated with Shree Cement for the last 34 years,” says Manoj Goel, a second-generation family member of Manoj Brothers Private Limited, a major dealer of SCL in Delhi. “We have grown with the company and find Shree Cement a good brand and the customer’s first choice for quality. An innovative company, with a high degree of transparency in dealership, SCL fulfils all its commitments.”

In July 2018, SCL set its foot overseas for the first time and paid $300 million for the 4-million tpa integrated plant of Union Cement at Ras Al Khaimah in the UAE. Established in 1972, Union Cement Co is a big performer in the region, with a strong brand recall. It produces ordinary Portland cement, sulphate resisting cement and oil-well cement. It is also a large exporter of clinker to Bangladesh and the African countries. Prior to its acquisition by SCL, it had gone private, after delisting from the Abu Dhabi Securities Exchange. SCL bought the entire stake from Sheikh Saud Bin Saqr Al Qasimi, the ruler of Ras al Khaimah, who wanted to exit the cement business, because his family wanted to foray into tourism development in a big way.

-

Chhangani with his team: innovation is continuous; Photo: Sajal Bose

UCC, a strong player

“It is a good buy. It is a running plant, close to a good limestone source and a port to reach the world market. It has got huge logistic advantages,” says HM Bangur. And when one moves to a foreign land, the rules of the game change too. It is easier to acquire a unit, rather than grow on it, adds Bangur. UCC has 450 people working with it, and a nationality distribution of 48.

“Post-acquisition, we invested $27 million to improve our production capacity, as also waste heat recovery for long-term viability. Our variable cost has come down by 30 per cent now, which adds to our bottom line,” explains Vijay Kumar Somani, managing director, UCC. The plant has also been generating 24 MW of power from its WHR plant. Somani feels UCC will become a strong player in the 35 million tpa UAE cement market in the next two years. It has also been producing 300,000 tonnes of specialised oil-well cement, which is in huge demand in countries with oil wells, such as Kuwait, Iraq and Saudi Arabia, among others.

The plant’s kiln, with a capacity of 14,000 tonnes per day, is now the world’s largest cement kiln. According to the data available, earlier, ACC’s Wadi plant in Karnataka was the largest kiln, with 12,500 tonnes per day.

SCL is a smart player and has grown organically in India. The company was never in the race for acquisitions, whether large or small. Any greenfield project it commissions, has a minimum size of 3 million tpa and it keeps a provision for doubling that capacity in the near future. Prashant explains: “Plant size less than 3 million tpa is not economically viable anymore as the fixed cost has gone up substantially."

It has been a constant endeavour of the company to formulate, adopt and improve its business model for sustainability and growth. Its renewable energy continues to remain a thrust area. Over the years, the company has been steadily ramping up renewable power generation, whether through waste heat recovery or solar and wind power. The company claims its 211 MW WHR is the largest capacity in the world cement industry, excluding China.

Besides, the total renewable capacity, including wind and solar plants, is 234 MW. “In all, 45 per cent of our energy consumption to run our plants is met through renewables. The initiative, which we started in 2008, is now paying us dividends,” says Chhangani. SCL also has plans to set up wind power generators in Maharashtra.

SCL has not only used industry waste as an input in the manufacturing process, but has also invented materials like synthetic gypsum. The company has set up a manufacturing unit for synthetic gypsum, as a sustainable alternative to natural gypsum, approved by the government. “Synthetic gypsum gives consistency in quality as against natural gypsum,’ says Prashant. Incidentally, the company was the first in the cement industry to use pet coke, an industrial waste, as fuel.

-

Shree Cement is the lowest cost producer; Photo: Sajal Bose

Making good progress

Innovation leading to cost reduction is a continuous process in SCL. The company has invented a mechanised clinker wagon loading method, which has automated the loading of clinker wagons using telescopic chutes at Ras. This is the first time it has been in use in the Indian cement industry. Five wagons can be loaded simultaneously from five hoppers, each having a rail static weighbridge installed below the wagon for online weighing. The loading operation too has been reduced drastically, from 10 hours to two hours for the entire rake. “The company’s sustainability interventions have been an integral part of our growth story,” says Chhangani.

“SCL’s reported figures suggest it has been able to make good progress in efficiency and profitability. It is among the frontrunners in the cement industry to do so,” remarks Mahendra Singhi, MD & CEO, Dalmia Cement and a veteran in the industry. Concurs Pushpraj Singh, president, marketing (grey cement), JK Cement: “Shree Cement is the fastest growing dynamic cement company and a healthy competitor. Through innovation in manufacturing and logistics, it could be one of the lowest cost producers.”

SCL has also been making a positive social impact. It has addressed the social needs of the neighbouring communities of all its plant locations. The Shree Foundation Trust works in about 255 villages, touching about 10 million lives and aiming to create sustainability and self-reliance. It works towards education, health and family welfare, women empowerment, infrastructure development, etc.

In December 2021, SCL introduced ‘Project Naman’ – a national initiative to provide free cement to the families of armed forces personnel martyred in the past 20 years. They will get free cement for building a house on a plot size area of up to 4,000 sq ft. Launching the Naman initiative, Alok Kler, C-in-C, South-Western Command, Indian Army, said: “It is a wonderful gesture by Shree Cement to extend its support and solidarity for our veterans, martyrs who have given their lives for the country. This is a rare and unique recognition.”

For the nine months ended December 2020, SCL reported sales of Rs9,609 crore, with a net profit of Rs1,489 crore, as against Rs9,629 crore of sales and Rs1,007 as net profit, during the corresponding period in 2019. “We have a strong balance sheet, with a net cash balance of Rs5,500 crore. This will help us fund new capacity additions,” says Jajoo. “Our EBIDTA margin is the highest in the industry.” The company has won possession of several limestone mines, through auction, in the last five to six years – some of them located in Gujarat, Rajasthan and Chhattisgarh.

-

Shree Cement's plant in Ras: the largest single location unit; Photo: Sajal Bose

The cement industry is highly cyclical in nature and depends to a large extent on the economic growth of the country. During the last two years, the challenging macro-economic conditions with lower infra spending have adversely impacted the industry. The Covid-19 pandemic and the nation-wide lockdown, as also the dip in overall economic activities, have dented demand. However, the sector has witnessed improved demand since September, with cement companies performing well in the last quarter.

“In December 2020, our profit level was almost on par with the previous year,” says HM Bangur. The strong focus on infrastructure in the budget will help the industry immensely. This will also create employment. India is a growing country and, so, the growth in cement production is a given, he adds. Today, India is the second largest cement producer in the world, after China. But, its per capita cement consumption is merely 200 kg, as against a world average of 500 kg, with China ranking the highest, with 1,750 kg.

During the peak of the Covid crisis in India, the Bangurs shifted to Dubai. “Dubai is peaceful and we have been looking at our business more pragmatically,” explains HM. “No meetings, no social commitment, no clubbing. We get increased family time, with a focus on health and diet.” What he could not adopt is his favourite bridge game. “Prashant is enjoying his cycling, covering 20 km a day. I have reduced 8 kg,” he adds with a smile , sitting at their sprawling bungalow in Emirates Hills.

The company is built on hard work, talent and innovation, along with farsighted capital allocation from the promoters, which defines its success. All these efforts will ensure Shree Cement is always an important player for the country’s cement industry.