-

SCUF, on the other hand, had a well-established market position in SME loan and two-wheeler financing segments. SCUF flowered in the legacy chit fund ecosystem, where Shriram is a friend in need for the ‘common man’ of legendry cartoonist R.K. Lakshman. The company has grown significantly in the unique space created from its legacy chit fund ecosystem.

Borrowers in the SME loan portfolio have limited documentary income proof. Also, the ticket size is small, below Rs15 lakh. The inherited structural advantage should keep SFL in good stead as it looks to leapfrog in its new avatar. Since it is born out of amalgamation of these two entities, SFL is nicely positioned to reap cross-sell benefits.

“Shriram Finance will aim to provide 360-degree services to transform our customers’ lives as a whole and not just financially. Our business principle revolves around valuing relationships, building trust and helping our customers to prosper,” explains Revankar. Given its current net worth, it is theoretically well placed to scale up operations in the new revamped context. If past is any indication, Shriram Finance will have little difficulty in finding fresh growth funds should there be a need.

Where size is advantage

Notwithstanding the positives arising out of the emergence of a consolidated Shriram Finance, there are discernible worries though. The key concern is around its ability to negate the asset quality-related challenges. It lends to borrowers with modest credit profile. In its new avatar, this will be a critical factor to be an efficient lender going forward.

A significant aspect of this new Shriram Finance is that it will now have enhanced access to data – multiple ones, at that – in view of the consolidation of the two former entities. This should help the company to get a holistic view of the requirement of its borrowers. On the other hand, it does make it easier for a borrower to satiate his/her credit needs quickly with less hassles since SFC will have a composite understanding of its customer with enhanced data access.

Significantly enough, Shriram in this new avatar has no identifiable promoter. The employee trust – which has been in vogue for a few years now – has become the promoter now. A board of management ostensibly will manage the trust. This is, perhaps, unique in the Indian corporate world. The members’ trust in the board is going to be a critical element in the future of the Shiram group.

That the present board members are long-serving employees of Shriram and have a treasure of accumulated knowledge on the business must work positively for the group. Nevertheless, questions remain on how this new arrangement – employee trust as promoter – will impact the decision-making process in the group.

“I cannot take the knowledge of the customer out of my employees. Our close connection with the customer is our DNA. We will maintain our customer connect irrespective of the model we follow,” says, D. V. Ravi, managing trustee of SOT.

The talent of the two erstwhile organisations is now absorbed into SFL. Binding the workforce together in a unified set-up is indeed a challenging task. As the group undergoes a metamorphosis – from a founder-driven system to a broader collective decision-making arrangement – the dynamics of the employee relationship is bound to change.

The transformation process will throw up some hitherto unhandled issues in the employee relationship. When performance takes precedence over loyalty, the organisational ecosystem could experience a churn. In a highly competitive environment, this could have huge cost implications for the organisation. Keeping the loyalty to the employer in tack in the emerging system is unlikely to be easy, as the Shriram group spreads out and aspires big. The new Shriram will have to ponder over this lot seriously.

-

Fresh challenges

A top expert on NBFC – who had a long stint at the helm with a leading NBFC – has sounded a word of caution. He reckons that size could be a double-edged weapon. “The size could pose some problems on the liability front. Someday it would have come to a point as to how much they would have been able to leverage through term debt as the lenders would have hit their ‘per-borrower’ ceiling,” he says, while unwilling to be quoted. Viewed from this angle, experts wonder if Shriram would eventually be compelled to give a fresh shot at its banking aspiration as it moves forward in the new avatar.

After reaching a scale, HDFC thought it fit to quit NBFC space and merge itself with HDFC Bank. “The relative advantage of remaining as an NBFC is diminishing at that scale,” he feels. A bank – unlike an NBFC – would have access to an endless retail franchise. On the liabilities side, it could fetch them a serious clout. Experts are wondering if Shriram is indeed laying the road – albeit in a calibrated way – for its banking transformation in the future. If small is beautiful, size is an advantage.

Yet, largeness alone does not guarantee automatic success but the quality of asset does. It is where the new Shriram will be tested, and this could be critical monitoring measure for experts and others alike going forward. Also, as you get bigger, pressure to perform better will be higher. Size will build its own pressure.

NBFCs such as Bajaj, Shriram, Sundaram Finance, Mahindras, Chola and the like have played a phenomenal role in bringing the un-served and under-served into the credit mainstream. If we go down memory lane to comprehend the history of bank nationalisation, financial inclusion was the real intent behind the move. Social inclusion as a terminology did not exist then. Several years down the line, we have, no doubt, found new jargon (financial inclusion!). Yet, we are incessantly talking about the need to cater to the underserved segment. Given this, the new Shiram has a lot of space to cover the much-talked about `bottom of the pyramid’ road.

The fulcrum

In the largely reorganised set-up, Shriram Chits (set up in 1974 heralding the group’s birth) even today acts as a crucial fulcrum for all its business such as insurance, stock broking, asset management and the like. Indeed, Shriram Chits remains the bedrock of the Shriram group of companies. There is an interesting angle to Shriram’s evolution in the NBFC spaces. While most big NBFCs such Bajaj Finserv (Bajaj group), Sundaram Finance (one of the erstwhile TVS families), Cholamandalam (Murugappa group) and Mahindra Finance (M&M) are backed by strong and reputed industrial power houses, Shriram is self-nurtured and self-reliant.

Also, the Shriram group pursued an uncharacteristic business model in the truck financing business. It spotted opportunities in `high risk and difficult business segments’. How else could one view its decision to lend to entrepreneurs and not fleet owners? It zeroed in on persons with lesser credit risk as against those with higher credit worthiness. With the benefit of hindsight, one could conclude that Shriram had indeed thought out-of-the-box and ventured into an unexplored path early enough. But it has a flip side to it. And, the new Shriram can’t just brush away this.

-

Shriram Finance will aim to provide 360-degree services to transform our customers’ lives as a whole and not just financially

Business model

The Shriram business model, all the same, got a validation of sorts when Telco (now Tata Motors) and Ashok Leyland invested in the erstwhile STFC. Association with such big names helped to improve the perception of Shriram the brand which by then had significantly gained mindshare among common man in Tamil Nadu, in particular. As companies fed on each other, Shriram Chit remained the fulcrum. While STFC succeeded in its business model, SCUF was established sometime in the mid-1980s.

It followed the chit model which was based on low costs and high scalability. While other companies appointed collection agents for a fee, Shriram ensured collections happened through its own employees, thus creating a relationship-based model. This helped Shriram to understand the customer lifecycle closely and meet all financial needs of customers.

Shriram did not look at credit scores to lend. Instead, it developed its own methodology to assess customers’ credit worthiness. It grew its SME lending this way. As this business needed mobility to work, it started lending two-wheeler loans, thereby becoming the largest two-wheeler lender in the country.

Tough times

The 1990s proved a tough phase for the NBFCs, in general. Shenanigans of a few NBFCs of unincorporated variety brought disrepute to the whole industry and forced the Reserve Bank of India (RBI) to introduce tighter norms. Shriram itself was badly hurt by an RBI notification that cautioned the depositors against parking funds with it. The RBI caution was the result of a perception that the Shriram group was allegedly funneling funds to manufacturing activities.

The issue, insiders said, was deftly handled by RT (R. Thyagarajan) when Shriram group had chosen to issue debentures instead of accepting fresh deposits. “That was a masterstroke then,” says an insider who declined to be quoted. After RBI’s notification, in 1999-2000, Shriram was forced to sell mature businesses such as Medicorp Technologies, Sembawang Shriram Integrated and Hi-Tech Arai. In the changed context, Shriram will aspire to become a name to reckon with in the financial services and insurance space.

Investors’ beeline

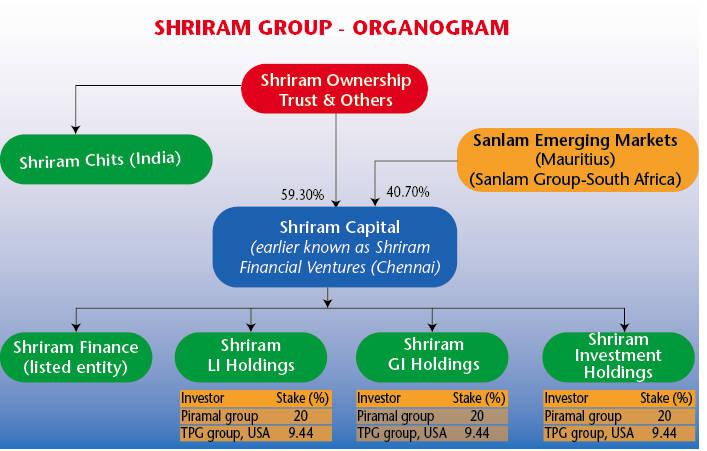

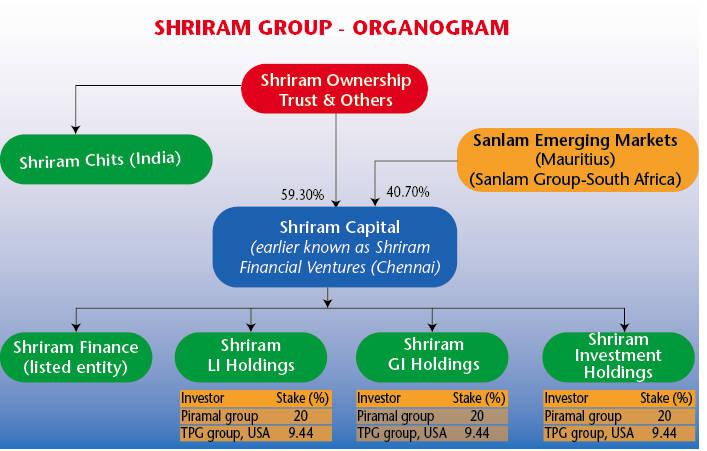

Post-2000, things began to happen at Shriram. The Shriram Ownership Trust was created sometime in 2006 with all owners transferring their shares to the trust. A series of institutional investors came in one by one. The investment of ChrysCapital, Sanlam, TPG, Piramal and the like brought in growth capital, no doubt. Significantly enough, their investment validated the soundness of the business model and went along to help the Shriram group clear perception issues.

A few weeks ago, ADB too put money into the revamped Shriram Finance. Stating that none would put his/her funds into a venture with a porous balance-sheet, Shriram insiders argue that investment by these institutional players is a validation of the systems and practices in place at the moment. Puneet Bhatia, MD, TPG Capital, found in Shriram “a real partnership mindset and deep understanding of the customer and his business needs”.

-

The company spotted opportunities in the truck financing business

Relationship-based

With a focus on relationship-based approach, the group has chosen to move in a calibrated way to de-risk by spreading out across the country. In the emerging dynamic ecosystem, size does matter. The merger of STFC and SCUF must be read in the context. After all, both are in the lending business and the template is similar in both. It also gave its investors – Piramal and TPG – exit opportunities. They were investors in the holding company of the group – Shriram Capital. “It then made sense to merge SCL along with STFC and SCUF so that they could find their exit at any time,” said a spokesman of the group.

So many factors make Shriram different from others. For one, it is not backed by industrial houses. For another, its ownership rests with the employees (through the trust). More than all these, its relationship-based model allows it the leeway to go after what is usually perceived as difficult business like truck financing – that too in the second-hand truck field!

Missed opportunity

As the Shriram group is set for a new journey, questions have also been asked about the wisdom of Piramal letting an opportunity to go. Somewhere along in his sojourn with Shriram, Piramal found things weren’t going the way he wished. Insiders did point to his cultural gap. “He (Piramal) perhaps was in a hurry and wanted to make Shriram a Piramal Enterprise. But that did not go down well with many within,” said a Shriram insider who is unwilling to be quoted. In the reorganized Shriram group, the investing partners have all gone down to the operating company-level.

No doubt, there is clarity now with the employee trust becoming the promoter of the group. Will the group be better off without an identifiable promoter? Time alone can answer this.

The new Shriram

In the over four-and-a-half decades of its journey, the Shriram group has survived the vicissitudes of times and regulations. Its ability to manage perception has come under test time and again during these years. Yet, the Shriram group has managed to emerge bigger. The new Shriram owes as much to the indefatigable employee spirit within the organisation as is to the indomitable RT and his astute guidance. The task turns a lot onerous in the new order.

-

RT has guided the Shriram group to a dominant position in the NBFC space

RT, the face of Shriram

RT (R. Thyagarajan) is Shriram and Shriram is RT. From the day the Shriram group came into being sometime in 1974 with the birth of Shriram Chits, RT (as Thyagarajan is known to many) has been its face for the world outside. A simple human being, RT is an extraordinary strategist. He has the uncanny ability to spot management talent, discover business partners and navigate the good, bad and ugly with an assured fineness.

Through his unalloyed commitment and detached attachment to business, RT has guided the Shriram group to a dominant position in the NBFC (non-banking finance companies) space. He doesn’t hold a single share in any of the group companies. He doesn’t occupy board positions anywhere in the group. He is also not an employee.

Yet, RT commands an unparalleled respect and adoration from everybody within the group. Even in the new order, RT has no visible presence. Yet, it was he who announced to the world that SOT (Shriram Ownership Trust) would be the promoter of the Shriram group and that it would be run by a board of management (BoM). RT remains ‘inclusive’ for the Shriram!

-

Revankar: we have helped build sustainable business and wealth for many families across the country

“We are unique model’’

Shriram Finance will aim to provide 360-degree services to transform our customers’ lives as a whole and not just financially, says Umesh G Revankar, Executive Vice-Chairman, Shriram Finance. Excerpts from the interview

Shriram has become the largest retail NBFC. How has the journey been?

We began over four decades ago with the vision of providing finance to the ‘Aam Aadmi’. We believe that the empowerment of the common person is the surest and safest way to the preservation of wealth. Growing each year and expanding from the south where we originated, we are today spread across 3,600+ locations and counting. We wanted to provide finance to those who were not catered to by banks due to informal income. Today, we cater to over 6.7 million customers.

Shriram’s relationship-driven model is unique to us, and we have helped build sustainable business and wealth for many families across the country. The self-employed ecosystem is going to be the driver of growth for Shriram Finance in the next decade. We will maintain our leadership position in the commercial vehicle finance and two-wheeler finance segment and grow the MSME lending business to ensure that we become market leaders in MSME lending, too.

What is going to be the positioning of Shriram Finance?

The Shriram Group is a financial services conglomerate known for its commitment to providing financial services to the underserved and unserved sections of the population. Our lending businesses have always catered to customers in rural and semi-urban geographies, with a strong ethos of looking at our customers as the Shriram community. Shriram Finance will aim to provide 360-degree services to transform our customers’ lives as a whole and not just financially. Our business principle revolves around valuing relationships, building trust and helping our customers to prosper.

What could any potential borrower expect from Shriram Finance?

There have been significant changes in the last 20 years in economic conditions. A borrower’s requirements today differ, say, from the straightjacket vehicle loans in the past. Until now, we had all commercial vehicle and equipment lending activity in one company and business loans and two-wheeler lending activity in the other company. By bringing them together, we have all the products. So, the ability to reach the customer with multi-products becomes easy. Customers get a one-stop shop for all products – lending, insurance, any protection product, and also, if at all he has some additional income, saving through fixed deposits as well.

So, it is a composite one-stop shop for a borrower. For company purposes, when we look at lending, we normally look at the individual product. For example, when you’re in a joint family, the money becomes fungible. As a company, if we have a total income flow of a family, including all businesses, it helps us much better. It is good to have multi-data or multi-information in that way. Both for borrowers and Shriram Finance it’s a win-win.

-

We wanted to provide finance to those who were not catered to by banks due to informal income. Today, we cater to over 6.7 million customer

What is the outlook on growth?

The new Shriram Finance has multiple opportunities. The resale price of used vehicles has gone up by around 20 per cent across all segments. That means that my lending tickets will go up by 20 per cent automatically. Even if I don’t change my LTV, the resale price has gone up and, therefore, the lending volume will go up.

Without adding more customers, the existing customer base which comes back every 3 or 4 years to replace their vehicles will give me around 5-7 per cent growth. In this cycle, people are buying second-hand vehicles a little more aggressively than in the normal year because the capital outlay is high. The used vehicle is available at 50 per cent of the new vehicle price. People would prefer to buy a used vehicle even though it’s expensive.

So, demand for buying used vehicles has gone up. New demand is expected to come from the infrastructure spend, PM Gati Shakti Yojana and the national logistics policy. There is going to be additional demand because it is not normal demand. Out of the infrastructure spend, 10 per cent goes for the assets like vehicles/equipment that are required to build infrastructure. So, the demand for this is going to be very high. We can easily grow double digits in the next 3 years.

We feel the scope for growth in the MSME and two-wheeler lending segment is much higher because the penetration level and opportunity is large. Shriram City was mostly in the south and some part of the West, but not much in the Central, North and East. Now we are tapping a much bigger geography. In a phased manner, we are launching all products across the network. We are expecting a 15 per cent AUM growth over the next 3 years.

What is happening on the talent integration front at Shriram Finance?

At Shriram Finance we have put in place a robust framework to ensure success. At the board-level, we have prioritised employees — through purpose, culture, leadership and connections — and have been deploying technology and automation as tools to support their capabilities. We believe that through these steps the true human potential for agility, creativity and innovation will go up and the integration can realize its full impact.

Thus, the new entity Shriram Finance, as an organisation, can achieve the synergy targets designed to chart a new course for growth. While mergers and acquisitions may be integral to a company’s growth strategy, they can only prove useful when employee integration is successful.

-

Shriram is a composite one-stop shop for a borrower

Complex amalgamation

Shriram Financial Ventures Chennai P Ltd. (SFVCPL), Shrilekha Business Consultancy P Ltd. (SBCPL) and Shriram Capital Ltd. (SCL) were all unlisted entities -- each with significant external investors. Sanlam group of South Africa, Piramal Enterprises and TPG India Investments II, Inc Mauritius had all formed the axis around which the holding structure was built as Shriram grew along. They had shaken hands with the Shriram group at various points in time to gain a strategic foothold in the group.

They co-invested in the various private limited group holding companies and needed an exit which was not possible unless they swapped their investments with the shares of the listed entity. It was essentially to facilitate this that a composite and complex scheme was conceived and executed. This has not only resulted in a clearer ownership structure but also pitch-forked Shriram into a dominant place in the NBFC space as well.

One too many steps

This reorganisation involved several steps. SBCPL was first merged with SCL. Following this, the shareholding that SCL gets in SFVCPL was cancelled and SFVCPL was renamed for convenience to Shriram Capital Ltd.

Once this was done, various pre-existing ventures of SCL such as its investment in life insurance, non-life insurance and other ancillary financial ventures were hived off into three resulting entities, respectively, for life insurance, non-life insurance and the rest. That left SCL with just two investments – one in STFC and the other in SCUF.

The next step was to merge SCL into STFC. And, finally, SCUF is merged into STFC, which has since been renamed to Shriram Finance Ltd. One view is that the entire reorganisation has helped Piramal (in SBPCL) and TPG (in SCL) get their shares swapped for STFC (now Shriram Finance) shares.

-

Shriram group focussed on ESG even before it became popular. It is a socially conscious group and bats for the customer. That is the legacy of RT

In employees, it trusts

Much water has flown under the bridge since 1974 when Shriram group was born with the establishment of Shriram Chit. A reorganisation last year with a series of mergers saw the Shriram group overhauling itself significantly. The revamp has demystified the ownership to a large extent. The Shriram Ownership Trust – though in vogue for many years now – has now emerged as promoter of the now overhauled Shriram group. Is the ownership structure unique in Indian corporate history?

Perhaps, it is. With SOT, there is no single identifiable promoter. The trust – comprising eligible employees – is run by the board of management. It is a perpetual trust where eligible members (nay employees) get in during their service term and exit the trust upon retirement with permissible compensation. In a way, there is a kind of `dynamism’ in the composition of the trust. The efficacy or otherwise of the Shriram ownership structure will be tested as the dynamics of the business change constantly in the fast-evolving ecosystem. Nevertheless, the SOT sets at rest the succession issue at Shriram. SOT is indeed the answer to the much asked question: Who next at Shriram? “No one individual can create wealth. It is in partnership with others that we do it. It was only fair to share the wealth that was created in partnership with employees. Employees who helped build Shriram are partners in it,” RT was quoted in an interview in a financial daily sometime in December 2012.

“Shriram group focussed on ESG even before it became popular. It is a socially conscious group and bats for the customer. That is the legacy of RT (founder of the group). Its people-centric culture and backing hard working entrepreneurs are key success points,” says Arun Duggal, former Citibank head and also former Shriram Capital’s chairman. The way the Shriram group has transformed in the wake of a series of mergers reflects this significant thought-process of one of the three founders who, for whatever reason, is seen as the real face of the Shriram group.

-

Honestly, I had no vision. Each business was set up to help a friend who wanted to do something

RT, Founder, Shriram Group

How it began

Besides RT, the Shriram group has two other founders – A.V.S. Raja and T. Jayaraman. Raja was working with the Railways. Carnatic music was the common bond between RT and Raja. Both were active participants in Kalasagaram in Hyderabad, a cultural platform which organises music, dance and art programmes. The settlement of a dispute over the land owned by Lakshmi Mudaliar, one of the sponsors of the Sabha, brought RT and Raja closer. Raja helped Lakshmi retrieve her land from illegal occupants. Later, he also purchased the land from her after getting a loan from RT. When Raja returned the money upon sale of the property to RT with interest and also a share in profit, RT refused. Instead, RT had asked Raja to give away the windfall to the Communist Party of India.

“My dad, without question, wrote a cheque and gave it to the party,” wrote Sudhakar Raja, son of A.V.S. Raja, in a Linkedin post. Perhaps, this quality of RT has endeared him to many in the organisation. The adoration and loyalty he gets within is unparalleled even today. After an early stint at Indian statistical Institute in the late 50s, RT got into New India Assurance. Post nationalisation of the insurance companies, RT quit and took up a new role at Mount Mettur Pharmaceuticals.

“Honestly, I had no vision,” RT was quoted saying in an interview in 2012. “Each business was set up to help a friend who wanted to do something,”. RT had indeed invested in many companies. Shriram was not his first. Nor was it his last. He had invested in companies such as India Chemicals, Kartik Pharma, Novhem Labs, Sahyatha Chit Fund, Shrilekha Chit Funds, Madras Motor Finance and Guarantee Co and many such ventures.

The association with Raja culminated in the formation of Shriram Chits in 1974. T. Jayaraman, brother-in-law of RT, too, joined the founding team. RT – as an investor and advisor – was the driving force, helping the two from behind. As time went by, things had gotten a bit tough as the chit industry as a whole encountered reputation issues due to the shenanigans of a few. That was the time when Amudhasurabi, a Tamil literary magazine, was acquired by Shriram. It was a collective decision by the three founders.

The group has been a significant patron of Carnatic music, a niche art form. The uninitiated often wonder what could be the return on investment from such sponsorships. The fact of the matter is that they are a significant tool in reputation management. Like the Chit fund, Shriram Transport Finance, too, was born out of his desire to help Carnatic violinist Lalgudi G. Jayaraman.

RT had a fair understanding of the hire-purchase business while working with the subsidiary of New India Assurance. He also had investment experience with Madras Motors Finance and Guarantee Company. All these had allowed him the liberty to get into vehicle finance. He chose to leverage the strength of the chit business to grow the vehicle finance business.