However, it was not just passion alone. Gupta had a clear road map, even then. His aim was to galvanise the industry and change the way steel was made traditionally, by turning around sick units.

With clarity in his thinking, Gupta, started taking over mothballed and soon-to-be-mothballed units in the UK. Less than five years since then, Gupta has spread his operations across the globe, buying steel plants in four of the five continents – Europe, Asia, Australia and America. From a single two-million tonne plant, he is currently operating plants with capacities of 18 million tonnes of steel with plans to go up to 20 mtpa soon. From trading to steel, he has diversified his portfolio to include aluminium, power, (thermal, hydro and solar) besides steel with an estimated turnover of $20 billion. Antarctica is still untouched. Half in jest Gupta responds: “Who knows, one day, we could well consider doing something in Antarctica!”

UK's success strategy: focussing on the country’s pride and employment

Liberty’s major breakthrough came in FY17 when it acquired Tata’s speciality plants in the UK for £100 million. The plants, with a capacity of 1.1 mtpa of liquid steel, made high-value steel products for the aerospace, automotive and oil and gas industries. The facilities were spread across regions in South Yorkshire and the West Midlands with a service centre in China. Prior to that, in 2016, Liberty had acquired the assets of Caparo Industries and purchased Lochaber smelter and hydroelectric company in Scotland along with a plate manufacturing plant from the Tatas. Till early 2017, Liberty was largely a UK focussed metal manufacturing and global trading company.

-

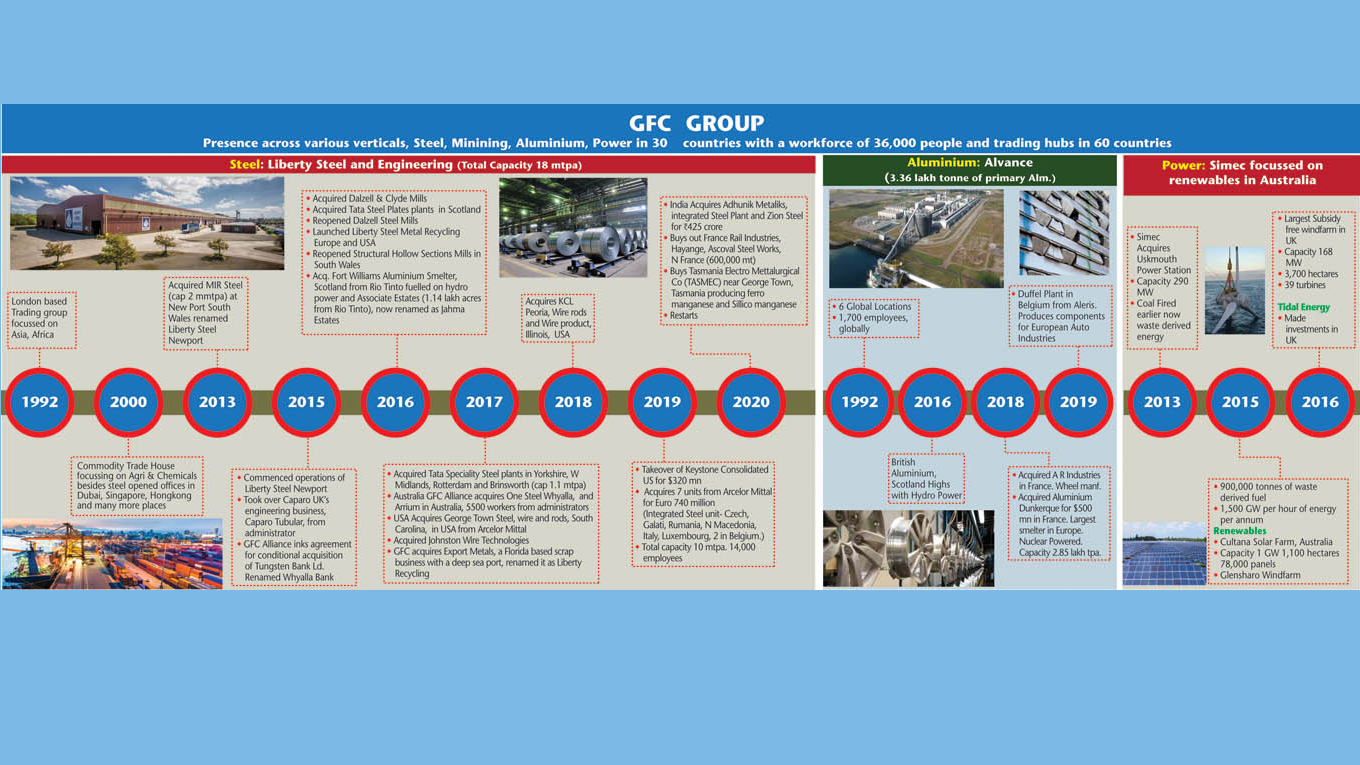

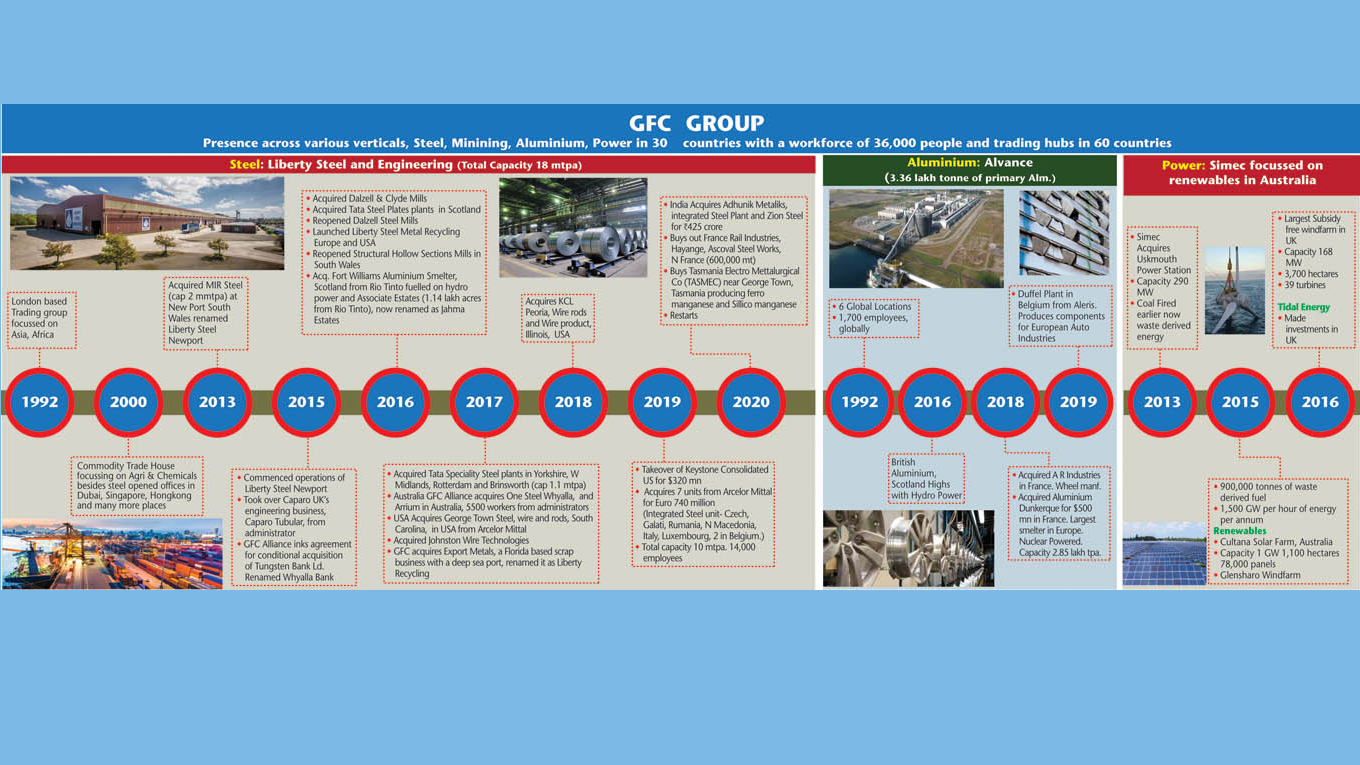

The group. Graphic by Mathew Thomas

Gupta had an integrated strategy of having self-sufficiency in raw materials, and his own power with a view to reduce the carbon footprint. With this in mind he started taking over sick units. The initial strategy was similar to that of steel mogul, Lakshmi Mittal, founder of ArcelorMittal, who built his empire, the biggest one in steel, largely through takeovers: the most notable ones being the takeover of Arcelor in 2006 and Essar Steel in 2019. Essar Steel in India had grown through building greenfield ventures and was sold to the ArcelorMittal-Nippon Steel combine. Tatas, JSW Steel and JSPL followed a hybrid model of growth through organic and inorganic means.

Like Mittal, Gupta has also largely built his empire of 18 million tonnes by taking units from the government’s administrators or from those large companies mandating sale to meet with anti-competition requirements. Some of his best assets are from ArcelorMittal’s portfolio, Tatas and BHP and the Rio Tinto groups.

The environment for making steel is not exactly conducive in the UK. The country does not have large deposits of iron ore nor facilities for coking coal. Both have to be imported. And to top that, the UK has a carbon tax on steel manufacture. Power in the UK is also costly. As a result, it is more profitable to import steel from elsewhere rather than manufacture it in the country and export scrap.

Gupta wanted to change this. He wanted to make the industry future-ready and bring steel-making back to advanced countries. He uses recycled scrap, sourced from his commodity business and available in plenty in the UK itself, as raw material, and produces steel through the Electric Arc Furnace (EAF) route with power drawn to the extent possible from his own units. Steel produced by scrap is as good as virgin steel. This strategy has since been refined to cut carbon emissions even further by using greener sources of producing power, solar power in Australia and in parts of Europe, and hydropower in the UK. Producing what is called green steel has become his calling card, despite the fact that producing green steel is still a work-in-progress for the group. Liberty is also doing pilot projects on using hydrogen extensively. This is produced using solar power. It is also looking at tidal and waves for generating power.

-

Hambro: strategic not opportunistic

The UK Government supported Gupta, as the Liberty group ensured no job loss of skilled workers. In the case of Mir Steel, later named Liberty Steel South Wales, he continued to pay the workers half their salaries for a full period of two years ahead of the reopening. This foresight, employment regeneration and genuinely taking pride in getting steel production back wherever it had gone down, went well with the government. The Scottish government, in one instance, even bought out two small steel plants of the Tatas when they were contemplating mothballing the same, and gave them to Liberty Steel, which promised to salvage the jobs.

Europe: growth through acquisitions

Gupta genuinely believes that future demand for low carbon steel or aluminium will be driven by the customer. He has a very active M&A team which is headed by Jay Hambro, chief investment officer, who had joined GFG (the Gupta Family Group Alliance) in 2016 and has been responsible for all the acquisitions from 2016 onwards. A well-known name in investment banking circles, Hambro had worked at NM Rothschild, HSBC and was the CIO of a Russian company which he had taken for listing. Besides being the CIO of the group, he also holds additional charge as the CEO of ALVANCE, the aluminium vertical of GFG, the holding company. Talking about the strategy he says: “The group has had a good run over the last five years. It is not just opportunistic buys. We look at the assets, evaluate strategic interest and to what extent can more life be added to the asset.”

Hambro’s team’s largest deal was the takeover of seven European assets of ArcelorMittal along with five service centres, in 2019. These included integrated steel units in Ostrava, the Czech Republic, Galati Rumania, besides plants in Italy, and two in Belgium, all for €740 million. This transaction was funded by a clutch of banks. The steel products are sourced by leading automotive companies besides aerospace, construction and other infra projects. In the UK, Liberty supplies steel products to JLR and other automobile companies.

Funding issues

For a company which has grown so fast and so big in a short period of time, several questions have been raised. One concerns funding. In the initial stages, he is alleged to have used esoteric means of funding by packaging future receivables of a plant and creating bonds for funding the acquisition costs. Gupta retorts: “Nothing wrong in funding from receivables. They are a safe mode.”

-

However, eyebrows have been raised over the opaque means used and in particular the outside relationship with the UK-based Greensill Capital which had initially a major role to play in providing acquisition financing. Hostile reports have emerged from the European press. Are those real concerns or merely a European disdain for new money?

Initially, there were also reports about funding coming from operations in South Africa. However, Gupta does not have any financial relations with his two brothers who run an independent steel business in Nigeria.

His future acquisitions have had a clutch of bankers funding his projects, in the US, Europe and Australia. Gupta has also acquired two banks in his family company. “There is no dearth of funds for good projects,” says Gupta. “Funding is not really a challenge,” says V. Ashok, group CFO of GFG. Gupta, who had earlier worked as group CFO for Essar Steel in India says: “There is an opportunity to grow stressed assets across the globe. The choice is between salvaging assets or liquidating.” It is not clear as to how much the group really does earn. In the absence of information about profitability figures, one can only go by the statements made by the company.

On the allegation of the opaque nature of the organisation, V. Ashok says: “At operating levels all our companies are EBITDA positive. In the holding company where most debt is housed, it is within acceptable limits.” Gupta says that the current annual reports of Liberty Steel Group are under preparation and will put at rest all unfounded speculation. Even getting accounts for the earlier years is a challenge. More so, as the companies are neither listed on any stock exchanges and are under no obligations to share reports.

-

Patel: he thinks differently

Australia: working in consonance with workers’ unions

Liberty Group works closely with workers’ unions and holds consultations ahead of making a formal offer. In 2017, they won a bid to acquire a leading but heavily debt-laden steel company, Arrium group, which has Whyalla Steel Works, an integrated steel unit, manufacturing units in Sydney and Melbourne (total capacity 1.5 mtpa) along with downstream facilities for manufacturing rods, pipes and bars. It has iron ore mines in South Australia.

Earlier known as One Steel, it was divested by BHP at one stage and the group was in receivership since 2016. The company was facing huge problems and Liberty won the bid against a South Korean group which had asked for more concessions from the government. The company, now renamed Liberty One Steel, has reportedly bid A$700 million for the takeover of Arrium. The workers were also in favour of Liberty, which had built a good reputation in its earlier acquisitions in the UK and Europe. Daksesh Patel, a Fiji born, businessman in his own right and a now a director on the global board in charge of Australia, reminisces that on the day Gupta had made his maiden visit to the plant, it seemed like the entire town of Whyalla came out to commemorate the takeover. The takeover saved an estimated 3,000 jobs in a town of 20,000.

-

The group forays into tidal and wave energy too

The restructuring plans involve putting up a new electric arc furnace in lieu of the aging boiler using scrap and natural gas. It is also working on using hydrogen, which will be produced from the solar plants being set up in the country. Liberty Group plans to invest in the complete revamp of the mills, revive mining and build the infrastructure to the ports.

Patel was enamoured by Gupta’s aim of becoming carbon neutral by 2030, which made him team up with the Liberty group. “It was this philosophical compatibility which aims at doing things differently in the future. I appreciate his courage and convictions,” Patel points out. “Sanjeev is a consultative person, listens to everyone, and takes quick decisions also based on his gut feeling like any other entrepreneur.”

Liberty also has a presence in East Australia. Infrabuild is in the manufacture, distribution and recycling business. The manufacturing capacity of 1.5 mtpa in Victoria and Sydney in East Australia mainly produces steel longs used for building construction material. Scrap is used extensively in these facilities. Geoff Feurtado, CFO, Infrabuild, says: “We are not only self-sufficient in scrap but also export scrap to places like Vietnam.” Feurtado in his 25-year career had served with Qantas and Price Waterhouse.

Even during the pandemic, the group has closed two M&A transactions in August 2020. One was the steel assets of France Rail Industry at Hayange and Ascoval Steel works. Ascoval has an EAF which is using scrap to produce steel and will be supplying material to the Hayange plant to produce international grade railway tracks. The rail products are used by railways in France and Switzerland.

India: yet to make a mark

Gupta has, for the better part, been focussing on rebuilding stressed assets in advanced countries. The rationale, according to him, being that advanced countries have better infrastructure and bankers support industries’ growth as do government, who value jobs.

His initial experience in India has not been very good and left the wrong perception about his group. In 2018, Liberty had been an aggressive bidder in assets auctioned by the National Company Law Tribunal (NCLT) a body set up to look at reconstruction, arbitration and liquidation of assets.

-

Junck: everyone respects winning culture

Liberty had bid aggressively for assets of Amtex Auto, ABG Shipyard and Bhushan Steel – this was after it had acquired the assets of Amtex Auto in the UK. However, it reportedly backed out subsequently as it failed to meet its commitments. Liberty justifies its decision by saying that crucial audit information was not shared. This information would have resulted in a sharp write-down in value of assets due to a higher debt emerging subsequently. In the case of ABG Shipyard, it was the sole bidder twice and its bid to offer deferred payment was rejected by the Committee of Creditors who ultimately took it for liquidation. Bhushan Steel was taken over by Tatas.

Liberty was, however, successful in its bid to takeover Adhunik Steel along with its associate concern, Zion Steel. Adhunik has a blast furnace and an electric arc furnace with a capacity to produce 0.5 million tonnes. Zion has a rolling steel capacity of 0.4 million tonnes. Gupta plans to double the capacity by making the necessary changes and improving the hybrid model to use more scrap.

Undeterred by its initial setback, there are unconfirmed reports that Liberty group has won the bid for another integrated steel plant of 0.5 mtpa, manufacturing steel and steel pipes at a port-based location in south India. NCLT has already given its order to go in for liquidation in the second week of September. The deal has yet to be consummated.

Green steel and reducing carbon emissions

Modernising assets that have a useful life has been the winning mantra for the group, allowing it to take over assets at cheaper rates, with a view to lower their carbon footprints. Dubbing it a green steel strategy, the group aims to increasingly use steel scrap in Electric Arc Furnaces in addition to or in replacement of iron-ore and coke. Using low carbon and renewable energy allows it to reduce the carbon footprints in steel making. The steel industry globally contributes to 8-9 per cent of carbon and efforts are being made by leaders in the industry to transform the way in which steel is being made so as to cut down carbon emissions. The best instance seen is in the USA.

Post the takeover of ageing plants, the group is looking at reducing carbon emissions by building combined-cycle gas power plants, putting up new arc furnaces and making additions to existing capacities. In the US, where it has taken plants in South Carolina, Texas and other places, the group plans to put in place green steel manufacturing capacity to the tune of 5 mtpa by 2020-2021.

Liberty Steel’s strategy of taking a lead as a new champion of steel with reaching carbon neutrality is apparently paying off. It has set itself an aggressive target at group level of becoming carbon neutral by 2030. “This is indeed commendable, as most large groups have targeted 2040 and 2050,” says H.V. Harish, managing partner, ECube India, an investment advisory firm. Harish, who was earlier with Grant Thornton, says: “Focus on producing steel through environmentally friendly technology such as hydrogen generated from renewable power is indeed commendable. I hope it sets the tone for other steelmakers worldwide.”

Powering green initiatives

Gupta had also taken a holistic view of the manufacturing business from the beginning. P. Gupta, Sanjeev’s father, had just prior to the restart of the Mir Steel plant, bought a closed thermal power unit on the shores on Uskmouth (as against coal this plant is looking at making power from waste). This was followed by a hydro company in Scotland and setting up solar and wind farms in Australia and the UK. All power initiatives are brought under SIMEC Power, a sister group concern. It has also taken a 49 per cent stake in SIMEC Atlantis, an AIMs listed technology-driven company which is doing work in tidal and waves energy.

Professionalising the set-up

Given the sprawling empire, Gupta has currently grouped all its assets under the umbrella company, Gupta Family Group Alliance, GFG, in three distinct verticals: steel, aluminium and power. Post the consolidation going on currently, all steel plants globally are grouped under the Liberty Steel vertical, while all power is under SIMEC. In the case of aluminium, where the group has bought companies in Europe, including in France and the UK, the assets are grouped under a new vertical called ALVANCE which currently produces 3.32 lakh tonnes per annum and has good downstream facilities for supplying products for the automotive and aerospace industry.

-

Kahlon: blast furnaces can be turned around

A powerful team of experienced steel veterans has been put in place. Roland Junck, with 40 years of experience, is the president and interim CEO of Europe and UK. Having served as the first CEO of ArcelorMittal, Junck has chosen to work with Gupta out of choice. “I do what I like. I choose my own gods,” he says, half in jest in response to why he has chosen Liberty Steel. He says the vision of promoters is different. Cultures may vary across countries. Whatever be the culture, “all people respect a winning culture”. Junck feels that what Gupta is trying to do is bring in a new revolution, a technological revolution in the way steel is and will be made in the future. Admiring Gupta’s vision, he says: “Liberty is well placed to be at the forefront of change. I find Sanjeev to be very humane, intelligent, and clever. Sanjeev is young. His management style is of the 21st century. He does not micro-manage operations but has confidence in his team members,” says Paramjit Kahlon, CEO, primary steelmaking and integrated mining operations. Kahlon, who is known as a turnaround artist, globally, was the former CEO of ArcelorMittal CIS. In Liberty he directly oversees the production of integrated steel companies in the Czech Republic, Poland, Australia and the US. Kahlon is confident: “Any mills with blast furnaces can be turned around.”

-

Ashok: companies are EBIDTA positive

Putting together a professional team and a good board is the winning part of the game. However, maintaining aggressive growth globally is more daunting as many of the low hanging fruits have already been taken. Even so, Jay Hambro and his team are scouting for assets in steel and aluminium, worldwide. While everyone pays lip service to consolidation in the industry, nothing big has been achieved. In Europe, the two major groups are Thyssen Krupp and Tata Steel Europe. The pride of Germany, Thyssen has a capacity for producing 11 mtpa. The company is not doing well and had reported losses of $1.2 billion with pressure mounting to sell off its steel division. Earlier plans to merge with Tata Steel Europe failed. The other German maker, Salzgitter, has also not shown interest in Thyssen. Tata Steel Europe is saddled with its loss-making plant at Port Talbot in the UK. Gupta, who is a big admirer of the Tatas, says he is willing to work with them to provide sustainable solutions to bring Port Talbot Steel unit, once the pride of UK, onto a profitability path. Any large takeover will nevertheless catapult Liberty Steel, which is currently placed at No.15 amongst the major steel producers (or top 10 ex-China as the group puts it) within the top 10 players in the world. Tatas, with a capacity of 30 mtpa, are placed at No 10.

Liberty is already making waves. However, it may not be long before it gets listed and strikes it really big. Listing will give it access to more capital for both acquisition as well as provide capital for restructuring assets. Steel, green steel or otherwise, is a capital-intensive industry and a listed Liberty group will provide it with more financial power. If listed with 20 mtpa capacity, the company, which has a publicly stated top line of $15 billion, could easily look at getting a valuation of anywhere between $12-15 billion. For a company that has grown nearly 10x in five years, EBITDA may not be such a large factor as long as it is between $2-3 billion.

While no one in the group is publicly talking about listing at this stage, the listing will happen sooner rather than later. Maybe as early as 2021-22. This time around, however, we are not taking any bets. The stakes are much higher than in 2015!