-

Umesh Chowdhary: metro rail order is a big boost; Photo: Sajal Bose

A man with full of ideas and sharp business acumen, Chowdhary started making crossing component for railways. The big change came when he set up a wagon manufacturing unit, as a part of his forward integration moves, with a production capacity of 180 wagons a year in 1997. He used his canny business sense and lower overheads to flourish – so much so that, today, TWL is the largest wagon-maker in the country, with a total capacity of 8,000 units per annum.

The company also entered into diverse portfolios. The 79-year-old Chowdhary is now a patriarch,his son Umesh, 46, involved in the day-to-day business activities being the driving force for the company’s growth. He is also the honorary consul of Switzerland in Kolkata. Umesh’s son 19-year-old Prithish, a second year BCom student, is now learning the nitty-gritty of the business from his father and also seen in the power corridors in Delhi in the company of his father.

The Pune Metro Rail order received by TWL was for 102 ultra-modern aluminium-bodied metro rail coaches. A total 34 sets of three coaches each. Total order value Rs1,200 crore. A consortium of TWL and Titagarh Firema Spa, its wholly-owned subsidiary in Italy, emerged as the lowest bidder for the project at a tender issued by Maharashtra Metro Rail Corporation (Maha-Metro). The two lanes of metro together would cover 32 km. The purple and aqua lines are expected to be operational by 2021 and the project cost would be Rs11,500 crore.

“This is for the first time that aluminium will be used to make metro rail coaches in India,” informs Sandeep Fuller, CEO, Transit & Propulsion, TWL. “Each coach is lighter by five tonnes and reduces the energy consumption substantially”. The trains are designed to get up to a speed of up to 80 km per hour. The use of aluminium for passenger rolling stock car body is the most updated technology worldwide for high-speed trains and metros. It is corrosion and vibration resistant and gives an excellent aesthetic finish. It has a life span of 35 years and will cost less to maintain, in comparison to the steel body coach.

“Firema’s advance technology has given us an edge for the metro rail order,” argues Umesh. “We are the only Indian company, which has its own design, drawing and technology for high-speed trains. So, apart from the cost advantage, we also have complete control of the value chain from concept designing up to after-sales services or AMC.”

TWL acquired Firema five years back from the Ministry of Economic Development, government of Italy, for €50 million to strengthen the company’s exposure in passenger division. Firema SpA has a proven track record of high-speed, double and single decker trains, EMUs, metros, LRTs, DMUs, propulsion system, etc. It is the second largest rolling stock manufacturer in Italy having a capacity to produce 60 coaches per month.

-

Prithish: learning the nitty-gritty of the business; Photo: Sajal Bose

Aluminium coach building

TWL is now investing Rs100 crore at its existing unit in Uttarpara in West Bengal to make aluminium coaches for the Pune metro. The Uttarpara unit, spread over 32 acres, was set up in 2005 to make EMUs and MEMU coaches. The land, which was a part of the heavy engineering division of Hindustan Motors, was acquired from Birla. The construction work for the new unit for aluminium coach manufacturing is in full swing. It will have capacity to produce 20 coaches per month and will ramp up gradually.

“Initially, nine coaches will be made in Italy; then, we will make them in Uttarpara. The first train is expected to be delivered in June 2021. Making the aluminium coaches is a high-precession job and our people are picking up the knack to do it,” says Fuller, a veteran in the rolling stock industry and former managing director, Texmaco. The state-of-the-art facility will have computer simulation. The unit will have a dynamic test bed to comply with the safety and comfort parameters, including other characteristics of the rolling stock. In future, TWL has plans to use this large facility for making coaches for export.

“We required high-end technology to get into high-speed train making,” informs Umesh. “Either we needed to have a JV partner or a technology partner. We decided that, instead of going for a technology tie-up, we would rather control technology. Hence, we gained access to the technology and robust manufacturing base of Firema”. He expects to participate in more such tenders in future. The current political situation being what it is, participation of low-cost Chinese companies in Indian projects has now become uncertain, which will benefit the domestic players.

“The passenger train is a high-technology segment and an opportunity to grow in this segment is enormous,” says Umesh. “The total anticipated demand of metro coaches in India today is 10,000. Valued at Rs30,000 crore, it is a great opportunity coming up in the next 4-5 years.” There are three other large players – Bombardier, BEML and Alsthom – active in the country making metro coaches.

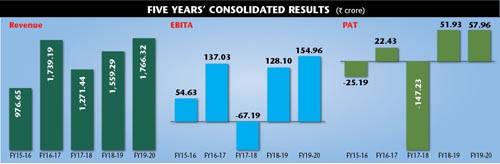

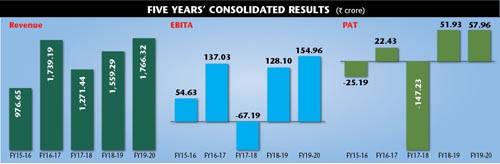

Firema may have given Titagarh the modern technology and ready market access in Europe, but it has also put a stress on TWL’s books. A legacy contract which the company had to execute had led to the company incurring losses and debt piling up. “We are now going through a proper rearrangement of the operation,” says Saurav Singhania, vice-president, strategy & management services, TWL. “There was a thorough management overhaul, with a new CEO being appointed and several cost reduction initiatives implemented to improve margins of new orders. The EBITA turned positive in 2019-20, from a loss of €6.33 million in 2017-18”.

-

TWL today has five manufacturing facilities. Two units are in Titagarh – one for wagon, shipbuilding and engineering and, the other, for foundries. Uttarpara is for passenger coaches. Bharatpur in Rajasthan is for wagon and maintenance and the fifth, a wholly-owned overseas subsidiary called Titagarh Firema is in Italy. TWL ventured into the wagon business in 1997, forward-integrating to its then existing foundry business.

The integrated wagon unit in Titagarh is the centre of excellence spread across 50 acres on the bank of Hooghly River and also connected to the railway track. This mother wagon unit has a capacity to produce over 5,000 units a year, with full design flexibility, primarily for the Indian Railways and also for private companies by skilled workmen. Its Bharatpur unit in Rajasthan is having a rated capacity of 3,000 wagons per year.

The combined capacity at Titagarh and Bharatpur makes TWL the largest wagon manufacturer in the country, with Texmaco coming as the second. In the current year, TWL received the highest wagon order from the railway of 1,800 units, valued at Rs500 crore. It covers 47 per cent share of the total order of 3,800 units. The company has also secured 40 per cent of the total 1,265 units of non-railways orders.

Contrarian strategy

The recession for last few years and the present slowdown for corona virus have affected the freight rolling stock demand, resulting in a decrease in the order book from railways, as also private players. TWL has embarked on a contrarian strategy in slowly expanding in a bear market. The company is always at the forefront of innovation and has been developing new products, based on the technology advancement for better margin.

“We are the first Indian multinational company to come up with its own rail freight wagon designs in the sector of automobile, steel, cement, multi modal and higher capacity flat wagons,” informs Sudipta Mukherjee, director, TWL. “Some of them have been approved and are in advance stages of consideration with Indian Railways”. TWL offers large portfolios like flat wagons, hopper wagons, tank wagons, box wagons, automobile wagons, brake wagons, special purpose wagons, covered wagons, etc, used by all sectors of the industry.

In the two large steel casting foundries, the company make components like bogies, couplers and draft gears for rolling stock. “All our products go through stage wise stringent quality parameters before they roll out the factory,” affirms Mukherjee.

The Indian Railways has a fleet of 260,000 wagons. Freight contributes 60-65 of the railway’s revenue. The industry expects the dedicated freight corridors will lead the growth of the railways by 15-20 per cent by 2021.

-

Singhania, Agarwal, Fuller, Mukherjee, Kandoi: the core team; Photo: Sajal Bose

TWL is now moving into green energy in all its facilities in West Bengal. This will effectively replace 25 per cent of its current annual electricity with clean energy expected to be commissioned by 2021. The initiatives to reduce the carbon emission has been mooted by Prithish, who managed to convince the management that green energy is no longer an option but a global imperative.

“Apart from a significant reduction in our carbon footprint, solar power is also cheaper than grid electricity and is a valuable commercial proposition for manufacturing firms that are energy-intensive. “We expect to see substantial saving in our annual power costs through the use of solar energy,” informs Prithish, vice-president & management co-ordinator. The solar power unit cost will be only half of the power from grid. The company is likely to save Rs1 crore a month.

Broadening of business horizon by taking advantages of its fabrication skill in wagon-making, TWL had entered into a small-sized specialised shipbuilding venture three years back in Titagarh. The company has successfully manufactured and delivered four ships to Indian navy and also several coastal research vessels for the National Institute of Ocean Technology (NIOT), under the Ministry of Earth Science – the total order value was to Rs350 crore. The 72 m 1,000 tonne oil tankers for navy were the largest yard craft included by Navy.

Two NIOT research vessels are 32 m long and have three on-board laboratories with more than 45 different types of scientific equipment to monitor deep sea parameters. “Our focus remains on the specialised vessels,” says Saket Kandoi, senior vice-president, Transit & Shipbuilding. “We have also participated in various tenders for defence and expect to get more such orders”.

TWL, the licensed partner of Matiere, France, for modular steel bridges, has built more than 100 bridges in India and Nepal. Recently, it has won the order from the National Highways and Infrastructure Development Corporation to build bridges in Manipur, which are pre-designed, with interchangeable components and quick to install. They are light and therefore easy to store and transport. The present order book is above Rs50 crore.

“The company has risen from a small level and is growing gradually,” says A.K. Vijay, finance director, Texmaco, commenting on TWL. “The opportunity in railway is robust. But, with the growth, TWL needs to manage the company professionally.”

-

Future-ready plants

“For the last four years we have upgraded our plants for making them future ready,” says Anil Kumar Agarwal, chief financial officer, TWL. “Operational efficiency, working capital management, simplified corporate structure and diversified product portfolio have helped us to improve operational profitability. Our net debt for Indian operation reduced to Rs50 crore from Rs450 crore in 2018”. He expects the Indian operation to be net debt free by the current financial year. As far as the debt relating to overseas operations, it may take few more years depending on the business plans.

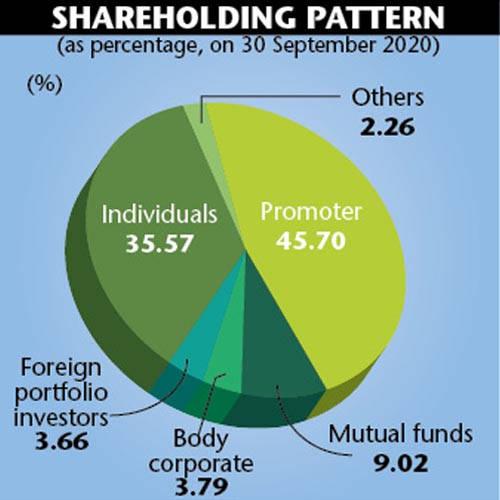

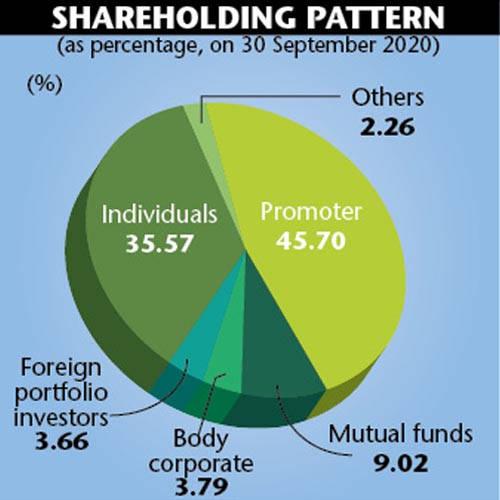

Kunal Seth, analyst, B&K Securities, who has been tracking the company, predicts: “The company had been facing difficult times over the last three years due to adverse market conditions, both in domestic as well as overseas. The right focus on business and improvement of demand environment should help the company’s fortune. It can also reap the benefits from its overseas subsidiary.” The present market cap of TWL is Rs490 crore.

During the six months to September 2020, the company’s revenue had declined to Rs646 crore, as against Rs921 crore in September 2019. It has recorded a loss of Rs18 crore, as against a profit of Rs17.28 crore during the corresponding period. “The Covid pandemic has hit the industry badly. Italy was the worst effected country in the world at one time, with its operations shut down for four months,” clarifies Umesh.

The company has spent a significant amount in R&D in Italy. It is now planning to set up a design centre in India. The idea is to develop competence in India and develop Indian engineers to be able to take up future projects in India. “We are searching for a place, where availability of technical experts is found easily,” says Prithish.

TWL’s thrust is on mobility. It has entered several new areas and has set up a robust system. “The Indian Railways is proactively moving towards privatisation, particularly in rolling stock business,” says Umesh. “We have been investing in technology, processes and people. Now, the challenge for us is to manage the sustainable growth and take the company to a new height”.