-

To the west of India, Pakistan has been struggling to keep up due to gross mismanagement of the economy. It has negotiated a $6-billion facility with the International Monetary Fund but has not heard from the financier since then. The Pakistani rupee has weakened, too, and one Indian rupee now fetches 2.6 PKR.

Within India itself, there are niggling signs of concern. On 1 July finance minister Nirmala Sitharaman said she was in constant touch with the RBI on the exchange rate. The Centre has since raised taxes on the export of oil and on the import of gold.

On 5 July Piyush Goyal, minister of commerce and industry, tweeted that merchandise exports have broken new records for the third month in a row. A day later he informed us that toy imports have shrunk by 70 per cent and exports have shot up 61 per cent in three years. Sugar exports have risen 1,253 per cent, he announced on 7 July. Defence exports were up 54 per cent by 9 July. From textiles to honey, Goyal intends to prove that exports from Indian shores are rising faster than they have ever before.

Indeed exports are rising, but that is half the picture. For imports into India have risen faster than the country has been able to export, creating what we call a trade ‘deficit’. A popular school of thought has for long ascribed the trade deficit as the primary reason for the rupee’s fall.

According to data released by Goyal’s ministry, the trade balance for 2021-22 stands at a deficit of $190 billion. While $94 billion of this deficit is on account of oil imports, $96 billion accounts for everything else. India sells items in substantial quantities to countries overseas, including petroleum products, engineering goods, drugs and pharmaceuticals, chemicals and textiles.

But we also purchase items from the world markets, including crude oil, electronics, machinery, coal, silver and gold. And we buy more than we sell, including items like coal and oil seeds – all of which we have no business importing.

Weak currency

If a trade deficit were to cause the rupee to weaken then shouldn’t the US dollar be a weak currency? Indeed, the US has run a trade deficit for years and in the month of May alone, America’s international trade ran at a deficit of $85 billion, of which $32 billion is in trade with China. India ran a $3.2 billion trade surplus with the US in the same month.

In his book Growth with Financial Stability, published in 2012, former deputy governor Rakesh Mohan points out: “At least in the recent decade, countries with large current account deficits have surprisingly experienced a tendency for their exchange rates to appreciate. Open capital accounts and rapid movement of capital flows dominate the effect of current account deficits and drive exchange rate dynamics.”

While the US, a developed country, runs an open capital account, the Indian rupee is not yet fully convertible and is thus subject to the vagaries of a controlled currency.

-

While the US, a developed country, runs an open capital account, the Indian rupee is not yet fully convertible and is thus subject to the vagaries of a controlled currency

This brings us back to the trade deficit. Buying more than what the country can sell has been compared with living beyond one’s means, which creates a gap – a deficit – that must be financed.

Demand and supply

For this India depends on financial flows in and out of the country, that are recorded on either the current or the capital account.

The demand and supply of foreign currency arises from the earnings of exporters, and the demands of importers of goods and services. Demand also arises for reasons such as tourism or overseas education or medical and health treatment or even payment of interest on loan taken. These are current account transactions. On the other hand, when an investor takes a loan or invests in another country, it is considered a capital account transaction mainly because the obligations arise in regard to a future payment.

According to RBI data for 2021-22, non-resident Indians (NRIs) poured $139 billion into the country. Foreign direct investment continues to be strong at $39 billion in 2021-22, although lower than the $43 billion of the year before.

Over three months October-December 2021, while merchandise trade saw an outflow of $60 billion, ‘invisibles’ (such as travel, transportation, insurance and software) brought in $37 billion.

Within invisibles, export earnings, particularly in software services, climbed to $28 billion, higher by about $3 billion than the year before.

But foreigners also invest large sums in the equity markets, and to some extent debt. NSDL data shows that foreign portfolio investors have withdrawn $30 billion from the country – largely equity sales – in the seven months since January.

In October-December 2021, the latest figures available, India’s current account, which is fully convertible, ran a deficit of $23 billion – covered by a surplus in the capital account of $23 billion.

But as Subbarao says in Who Moved My Interest Rate? “The more we depend on external financing the more vulnerable we become a to sudden ‘stop and exit’ – a situation in which external finance not only stops but even the investment made is withdrawn.”

Excess spends

While external factors can impact the strength of the rupee, the rupee is also impacted by domestic pressures like inflation. On 31 May, government data showed that the fiscal deficit – the government’s excess spending over income – for 2021-22 improved to 6.71 per cent of GDP, on account of higher tax realisation. A high tax imposed by the government on oil has also been blamed for its direct impact on inflation. Moreover, India’s external debt totals about $620 billion, of which the Centre’s share is $130.8 billion.

But on 9 July, in a speech delivered in Delhi, Das blamed inflation on global factors – including the war in Ukraine and expenditure on account of Covid-19. “With several indicators pointing to resilience of the recovery in the first quarter (April-June) of 2022-23, our current assessment is that inflation may ease gradually in the second half of 2022-23, precluding the chances of a hard landing in India,” he said.

-

Rangarajan: steered the Central bank through the balance of payments crisis

Inflation is a double-edged sword. When the price of an item rises faster in India than it does in, say, a competing nation like China – it creates a natural attraction for traders to exploit gains through arbitrage. Indeed, consumer price inflation in China at 2-odd per cent is far lower than India’s own track record, with inflation inching towards 8 per cent. Domestic inflation can thus also affect the flow of goods and services into the country.

But, perhaps, the key determinant of the rupee’s movement remains in the hands of the RBI itself. Between September 2016 and February 2020 average CPI inflation was 3.9 per cent. Unlike the previous Congress government, the BJP ran a tight ship at the Centre till the onset of the Covid-19 pandemic. With inflation, and fiscal and trade deficit under control, foreign capital started to stream into the country – mostly into the stock markets. In theory, this should have imposed an upward pressure on the rupee – but the currency has shown modest declines or remained comfortably static during this period.

Temper the pace

In his 2017 book I Do What I Do, Raghuram Rajan points to one such dilemma. “Every one-rupee rise in the dollar-rupee rate would cost us Rs40,000 crore more in import costs. Assuming the rupee was undervalued by Rs3 for a couple of years, this would mean a loss of lakhs of crores to national income. In contrast, even if an FCNR deposit scheme was wildly successful in attracting inflows, the pay-out would only be in the tens of thousands of crores,” he said.

The RBI’s stated stand is to intervene in the forex markets, not to determine the trajectory of the rupee but only to soften the pace at which it is moving in either direction. When capital flows from overseas cause a sudden appreciation in the rupee, the RBI steps in to cool its heels and temper its pace. The Central bank buys those dollars with rupees, thus affecting domestic liquidity but also building up foreign exchange reserves. Indeed, foreign exchange reserves have risen by about $200 billion dollars under Das’s watchful eyes.

And when the rupee is in free fall – which arrives as a then and there moment with little time for deliberation – the RBI intervenes again, to sell dollars and purchase rupees to weaken its pace. In the month of March, when the rupee approached 77 to the dollar, the RBI sold as much as $20 billion in the spot markets – the highest ever in a month. The rupee has since crossed 79.

Since the RBI has the power to print rupees, it is easier for it to frame a strategy that involves collecting dollars. But the foreign exchange reserves it accumulates and controls are finite. Thus, in defending the rupee’s downfall it must cross that river by feeling the stones.

Mark to market

That brings us to the next question: what can Indian companies do to protect themselves against volatility in currency movements? In 2008, Indian companies were brutally exposed to exotic derivative contracts, with a banker’s estimate back then of mark-to-market losses at as much as Rs30,000 crore. The market has wisened up, but even the best of minds can find themselves in choppy waters.

-

According to RBI data for 2021-22, non-resident Indians poured $139 billion into the country

In his book Custodian of Trust, former SBI Chairman Rajnish Kumar points out: “The depreciation from 45 to 65 between 2011 and 2014 became a source of contention between the distribution companies and the power plants relying on imported coal at the Mundra plant owned by the Adanis and the Tatas. The depreciation not only impacted imported coal-based power plants but also led to a hike of almost 30 per cent in the capital costs of the power plants using imported plants and machinery from China. The power producers did not fully hedge the risks, and the absence of a pass-through mechanism of the increased capital cost adversely affected the commercial viability of the projects.”

Introduced in 2014 by the International Finance Corporation (IFC), Masala bonds are a more recent financial innovation. These are rupee-denominated but issued outside India, allowing the borrower to tap liquidity overseas without having to bear currency risk. In September 2021,

HDFC Bank raised Rs739 crore through this route at a coupon of 7.55 per cent. In 2019, the Kerala Infrastructure Investment Fund Board raised Rs2,150 crore through a debut bond on the London Stock Exchange at a coupon of 9.7 per cent. Several others have opted to raise funds through this route, though the coupon rate would still be affected by currency fluctuations.

Which brings us to the final question: how low can the rupee go? At its worst depreciation has been called the death of a currency. At its best, a school of thought has argued in favour of depreciation.

In his book Devaluing to Prosperity, economist Surjit Bhalla has argued that much of China’s growth can be attributed to a timely, beggar-thy-neighbour policy. “Currency undervaluation increases the growth rate and increases the current account balance. Simply put, undervaluation increases the growth rate, but given that these exports will have to be bought by someone else, one’s own undervaluation increases someone else’s imports. Since currency undervaluation offers such sweet deliverance, there are incentives for individual countries to practice it. But all cannot follow such policies. So, second, the consequence. Countries hurt by a beggar-thy-neighbour policy react but can only do so via a crisis,” he says.

At the core, most developed economy currencies derive their strength from trade – surplus or not. In its ‘golden years’, the Indian subcontinent indeed exported spices and the arts and crafts to places as diverse as South Asia, the Gulf, Africa and the Mediterranean.

The rupee was a reserve currency in much of the Middle East till as recently as the 1950s. It is still a safe haven for NRI money, but a conservative RBI has prevented India from turning into an exporter of financial services. On this front, 75 years into independence, we have barely scratched the surface.

Perhaps, a deliberate decline in the consumption of oil will ultimately save precious currency from crossing the borders, leading to a trade surplus that could last for decades.

And the ruling BJP government has shown signs of impatience on this front. In the southern state of Goa, a junior lawmaker, on being questioned about the rising price of petrol recently retorted: “At least we are getting petrol in India because of the prime minister. See what is happening in Sri Lanka. Change to electric vehicles. Let petrol be 200.”

-

In the month of March, when the rupee approached 77 to the dollar, the RBI sold as much as $20 billion in the spot markets – the highest ever in a month

Perhaps a more charitable view came from Union Minister Nitin Gadkari, who on 9 July said that petrol in vehicles will vanish in five years. And that ‘green’ hydrogen, and ethanol flex-fuel, CNG or LNG will end the need for petrol.

Perhaps, progress in the rapid expansion of solar and wind farms, and new technologies related to hydrogen, will free the country from its dependence on oil imports. At that time, it may show a surplus on both the current as well as capital accounts.

Perhaps, then, against a surge in foreign exchange inflows, the Central bank will be forced to stop to accumulate reserves as a defence against import payments, and refocus instead on investment. And perhaps, then the rupee will be ready for capital account convertibility.

It is tempting to say that if fluctuations in the rupee are a temporary problem, they should be met with temporary solutions. Bearing in mind that capital controls were introduced as a temporary World War II measure that never came to an end.

Business India has consistently argued in favour of a strong currency. For if a weak currency is a sign of development, then the dollar would be the weakest currency.

Strong currencies are reserve currencies, but right since independence, a depreciation in the rupee has been more or less visibly permanent. If Governor Das is more fortunate than some of his predecessors, he will find the rupee exactly where he wants it to be.

-

Real and effective

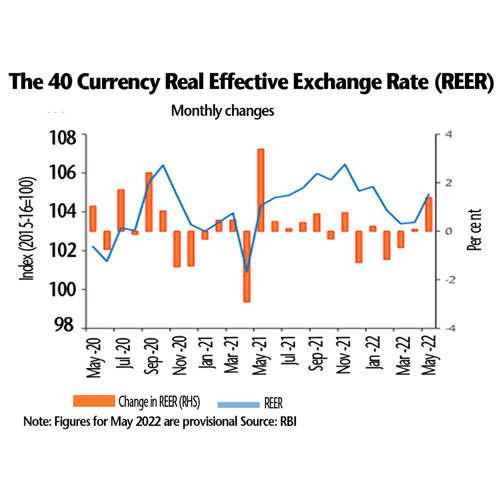

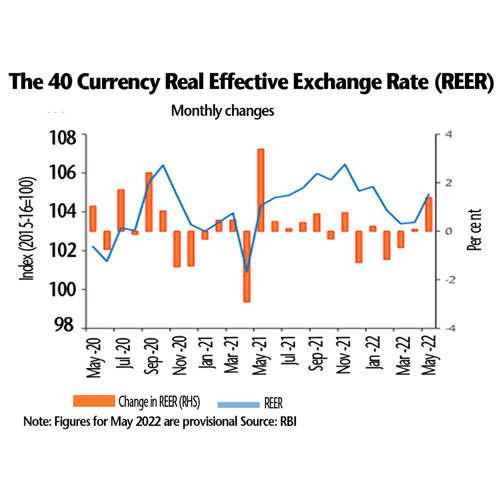

The RBI calculates a ‘Real Effective Exchange Rate’ of the rupee and puts it in the public domain at regular intervals, as an insistent and alternative view of the rupee’s movement. This index is different from the ‘nominal’ exchange rate that we use in day-to-day transactions.

REER tries to capture the relative effects of inflation on the rupee exchange rate, by comparing select countries with which India has significant trade. Expressed as an index, when it is more than 100, it reflects overvaluation, and an index of less than 100 reflects undervaluation.

Thus, in May 2022, the rupee depreciated against the dollar but appreciated in the REER, a 40-country basket of currencies representing India’s major trading partners (see chart). At above 100, the rupee could in fact be viewed in some circles as over-valued (the rupee has since depreciated further).

Is the nominal rate then the ‘real’, ‘effective’, exchange rate, or the REER as presented by India’s Central bank? Herein is the catch. Until external trade is denominated, represented and transacted in the largest portion through dollars, the nominal rate will continue to be seen and experienced as the real and effective rate.

-

At the core, most developed economy currencies derive their strength from trade – surplus or not

Tweaks and twists

New directions announced by the RBI aim to trigger an inward flow of dollars which in turn would lend support to the rupee. While this is not the first time that similar measures have been deployed, they aim to assert confidence in the market, arrest speculative trade, and put the RBI back in control.

• Incremental FCNR(B) and NRE deposits are exempt from the maintenance of CRR and SLR by banks. This relaxation will be available for deposits mobilised up to 4 November 2022.

• Banks have been allowed to raise fresh FCNR(B) and NRE deposits without reference to the extant regulations on interest rates. This relaxation will be available for the period up to 31 October 2022.

• Banks have been allowed to utilise overseas foreign currency borrowings (OFCBs) for lending in foreign currency to entities for a wider set of end-use purposes, subject to the negative list set out for external commercial borrowings (ECBs). The RBI expects this measure to facilitate foreign currency borrowing by a larger set of borrowers who may find it difficult to directly access overseas markets. This dispensation for raising such borrowings is available till 31 October 2022.

• Under the automatic ECB route, eligible borrowers are allowed to raise funds through their banks, without approaching the RBI, as long as the borrowing is in conformity with the ECB framework. That limit has been increased from $750 million per financial year to $1.5 billion. The above dispensations are available up to 31 December 2022.

-

What they said

RBI governors seldom speak their true minds while negotiating the hustle and bustle and humdrum of office. In RBI parlance, to have taken no position is also a position taken. Some former governors, however, have taken the trouble to set the record straight after their term ended, as torchbearers for those who must follow in their footsteps. Others like former governor Urjit Patel have chosen to not discuss key events like demonetization, even after they left office.

Excerpts from some of these books:

1967: Thinking that she would get massive support from international financial institutions, Indira Gandhi devalued the rupee by over 50 per cent (though the support we finally got hardly matched her expectations). The rupee devaluation made the price of imports go up, which caused further stress on the economy.

Y.V. Reddy

Advice and Dissent (Published in 2017)

1996: Countries that held large levels of foreign currency reserves in relation to imports did not necessarily escape the crisis (Asian financial crisis). These countries had large reserves, but the reserves disappeared quickly as they tried to defend their currencies. Some parts of the reserves could not be accessed as they were invested in illiquid assets.

Bimal Jalan

Emerging India: Economics, Politics, And Reforms. 2012

-

2012-13: Global factors were just the proximate cause for our exchange rate turmoil; the root cause lay in our domestic economy where for years we had been heaping pressure on the rupee, an issue that the RBI consistently raised in monetary policy statements.

D.V. Subbarao

Who Moved My Interest Rate? 2016

2013: I had to send four messages. We had to present a facade of confidence to assure the public and investors that the RBI knew what had to be done. Second, we would emphasise our commitment to bringing inflation down. Third, we signalled that the RBI could be bold and farsighted, and our ability to look beyond the currency turmoil to discuss, for instance, the eventual internationalisation of the rupee. Finally, I wanted to set standards for transparency and predictability.

Raghuram Rajan

I Do What I Do. 2017

2020: There is a stark asymmetry prevailing in the provision of swap lines by systemic central banks. Emerging market economies that are at the receiving end of global financial turbulence are denied access. The time has come to end this sectarian approach and make available access to swap lines.

Urjit Patel

Overdraft: Saving the Indian Saver. 2020

Bhavish Aggarwal is confident of playing a big role in India’s EV revolution

The textiles & apparel sector gears up to imbibe circularity into supply chain

Market anticipates a correction amid budget expectations and investor activity

UltraTech buys stake in India Cements. What lies ahead?

Our letter to you, once a week.

Register with The CSR Weekly for free!

Published on Jan. 21, 2023, 3:49 p.m.

The introduction of black pepper as an inter-crop in the sopari and coconut orchards, has enabled farmers to cultivate crops simultaneously

Published on Jan. 21, 2023, 3:43 p.m.

In 2020-21, the programme reached over 112,482 girls in urban and rural locations across six states in India, including 10,000 across Delhi

Published on Jan. 21, 2023, 3:34 p.m.

The event brought together stakeholders and changemakers to participate in a series of conversations on global trends and recent developments

Published on Jan. 21, 2023, 3:28 p.m.

The programme will focus on educating children on oral health and building awareness around the dangers of tobacco use

Published on Aug. 17, 2023, 11:54 a.m.

BioEnergy will showcase its innovative biogas technology in India

Published on Aug. 17, 2023, 11:26 a.m.

Ather aims to produce 20,000 units every month, soon

Published on Aug. 17, 2023, 11:06 a.m.

German Development Agency, GIZ is working on a roadmap for a green hydrogen cluster in Kochi

Published on Aug. 17, 2023, 10:45 a.m.

AGEL set to play a big role in India’s carbon neutrality target

Stay ahead of the times.

Register with The Climate Change Weekly for free!