-

He is very good at execution. He built two verticals to the existing business and he is leveraging technology. Like Jio Platforms his retail foray will also be very big, going ahead

Deepak Parekh

The start-up, as Mukesh Ambani has been calling the foray into mobility and technology, has been given a valuation of Rs5 lakh crore by investors who are looking at future growth. Henry Kravis, co-founder and CEO of KKR, at the time of announcing the investment said: “Jio Platforms is a true homegrown, next generation technology leader in India, that is unmatched in its ability to deliver technology solutions and services to a country that is experiencing a digital revolution.”

Mukesh Ambani was ably assisted by his son Akash Ambani and daughter, Isha Ambani in his negotiations with Facebook, which started nearly four months back. The formalisation was done during the lockdown period. The strategy to get the best marquee investors was indeed a good strategy. “It is a systematic and well thought out strategy, superbly implemented,” says Deepak Parekh, chairman, HDFC who like Ambani, has grown various businesses in the financial sector from HDFC, India’s largest home mortgage company.

Parekh points out: “He is also very good at execution. He built up two verticals to his existing business of oil and gas and he is leveraging technology. Like Jio Platforms his retail foray will also be very big, going ahead.” Having seen the way technology has played up, investors will look keenly at how technology will spur growth in the retail sector. One view is that no foreigner will be able to teach Reliance about the Indian retail market!

A.M. Naik, who had grown L&T to its recent global stature during his leadership tenure at that company agrees. He points out: “Mukesh Ambani has a great vision and flawless execution capability. He has multiplied Reliance Industries many times over from what he inherited from his father.” Saying that he had known him since 1986, he says he has not seen “a more intelligent, creative and innovative person like him. He is an entrepreneur but can get the best out of professionals and makes the best of entrepreneurs and professionals.”

Apart from these two gentlemen, who have built mega businesses, the only possible person to have straddled different businesses in Asia is Li Ka-Shing. The Hongkong based businessman is ranked amongst the top 30 richest individual investors, globally. Shing’s Cheung Kong Holdings has varied interests in real estate, ports, financial services, retail, energy and utilities. In India Shing made news when his company, Hutchinson Whampoa, sold stake to Vodafone for $11.5 billion in 2007. His telecom enterprise is still very big in Europe.

While the jubilation at getting investors is in order, what are the reasons and concerns, which prompted global investors to look at Jio Platforms? One reason could be India now remains the only open market for digital play, with China being off bounds for many companies. The other, according to Deven Choksey, founder and MD of K.R. Choksey Investment Advisors, is “Jio Platform is a unique proposition created by Reliance. It is a rare start-up and has an edge as it has built a complete ecosystem to run not only the mobility business but also the Fiber to Home ( FTTH ) and Enterprise solutions, riding on the tower-to-fiber infrastructure so built.”

Choksey points out that it is this ability that holds the potential of producing a quantum jump in revenue and profits as business moves up in the value chain from individual to household to corporate customers. He says: “Unlike many global start-ups which have built businesses by burning cash, Jio has kept a focus on revenue generation and profit-making from day one." Being the last one to enter into India’s mobility business, in less than three years of commercial operations, it is the most profitable company with an annualised EBIDTA of Rs10,000 crore.

Applications like Jio Mart, powering the offsite to onsite (O2O) business of Reliance Retail, connecting retail stores with online customers, holds the power of earning revenue from subscriptions and transactions.

-

Being the last one to enter into India’s mobility business, in less than three years of commercial operations, Jio is the most profitable company declaring an annualised EBIDTA of Rs10,000 crore

FTTH with single-fibre connecting to fixed line, internet, and set-top box (STB) is expected to increase the average revenue per user by four to five times, to 700-1,000 per subscriber. Choksey predicts that Jio Platforms may register an annualised EBIDTA (earnings before interest, depreciation, tax and amortisation) of Rs25,000 crore in the quarterly results of FY-2021. From the $68-billion valuation at present, Jio Platforms could well enter the elite club of $200 billion valuation in two years.”

A. Balsubramanian, CEO and MD of Aditya Birla Sunlife Mutual Fund, agrees. “Jio is an integrated digital player along the lines of FANG (Facebook, Apple, Netflix, Google) and will become just as valuable. It has the ability to leverage a huge database and going forward, support data analytics of structured and unstructured data.”

Explaining that there is a worldwide move towards digital, a platform like Jio, supporting an entire ecosystem, makes global investors realise its true worth. Reliance Jio Platform’s market cap would at the current valuation be far smaller than the valuations of Netflix Inc, which has a valuation of $185 billion, Facebook, $653 billion, Alphabet of Google fame $968.7 billion and Amazon Inc having crossed the $1.202 trillion mark.

However, the potential to grow exponentially for a technology company is high. Zoom Communications, for instance, was listed at $16 billion (first day’s closing) on 18 April 2019. Today, the market cap has gone up 3x to $48 billion in less than a year.

Jio Platforms has a similar app, Jio Meet which works on any device, any operating system, allowing complete collaboration. This app, according to insiders, has been used effectively during the lockdown period for medi-teleconferencing, education and other purposes. The tie-up with Facebook is likely to facilitate Jio Platforms to be taken to a global audience, and also ensure better reception.

While the investment in Jio Platform has validated the efforts of Reliance Industries, not many investors in India had been able to comprehend the magnitude of the structure which was envisaged when it was launched. Krishna Kumar Karwa, MD, Emkay Global Financial Services, a BSE listed broking company, points out that Reliance has, over the last 30 years, been at the forefront in building capacities of global size and global standards.

-

“Mukesh Ambani has a great vision and flawless execution capability. He has multiplied Reliance Industries many times over from what he inherited from his father

A.M. Naik

“Today, we are applauding the investments by Facebook and a bunch of top-notch PE funds in Jio Platforms at valuations which are at substantial premium to the other telecom majors. However, when Jio was in the build-out phase, the street was unable to comprehend the massive investment in capacities and capabilities, and was unable to justify the possible telecom revenues that the infrastructure would yield. Today, Jio is not only about telecom but also the massive leverage that the platform enables, and the multiple products which will be offered to its customers.”

Will other mobility companies like Airtel and Vodafone-Idea be able to replicate the Reliance model? Seems difficult, as they already had a headstart on Reliance Jio but have not, as yet, been able to capitalise on it. Reliance has its own content creation outfits and has been investing heavily in building a ecosystem around it.

Airtel has a payment bank but does not have any in-house content to offer subscribers. In the case of Idea-Vodafone, the current focus will be to raise capital but to repay debt. Microsoft and Google are the only companies which have not invested in Reliance Jio. There is a possibility that either or both, may associate with Bharti or Idea Vodafone.

Critics say the success of Reliance was due to some changes in policies favouring the company. A sharp lowering of IUC charges – and lowering them to zero by January 2020 – was one such instance which favoured incumbents like Jio. Jio, at that time, had argued that lowering charges helped in spreading the digital revolution by including the masses.

Another point raised by analysts and experts concerned the huge bet which Reliance took in building this growth vertical. Some even say that the bet was big enough to seriously dent the company had the telecom venture not taken off. However, nothing succeeds like success. It was a very well thought out move of building separate verticals to diversify the income stream and also to guard against the cyclicity of the commodity business, from oil to chemicals.

Success is all about taking risk. And the Ambanis did it and there is no looking back now.

Tatas and Birlas also had similar exposure to retail and telecom and similar investment opportunities. They too had the chance to build similar Jio-like structures on their telecom platforms. The risk-taking appetite of both groups is also legendary. But the fact was neither saw the huge opportunities or were not convinced that such huge bets in telecom and retail would complement each other and pay off.

Tatas exited telecom early and preferred to build their retail ventures. Birlas have not been able to succeed in telecom and tied up with Vodafone. Reliance was the last to enter the telecom space. Its strategy to ensure that even the lowest segment of society could take part in the digital revolution, really paid off. Even now, Airtel and Idea-Vodafone are large enough to ensure that Reliance does not become the Bell Corporation of India and enjoy a monopoly in the telecom sector.

Even as he was racing to the top in the telecom sector, his strategy of creating diverse platforms, riding on the telecom platform will soon be put in place and tested in the marketplace. Jio Fiber for homes and enterprises being the immediate initiatives. However, this will expose it to competition from different players in different verticals. In petrochemicals it will be IOCL, HPCL, MRPL. In gas it will be IOCL, in big format retail it will be Big Bazar, D Mart, Amazon, Flipkart, in electronic stores it will be Croma and Ezone. Given the huge potential of the Indian market, the pie is big enough for everyone to grow.

-

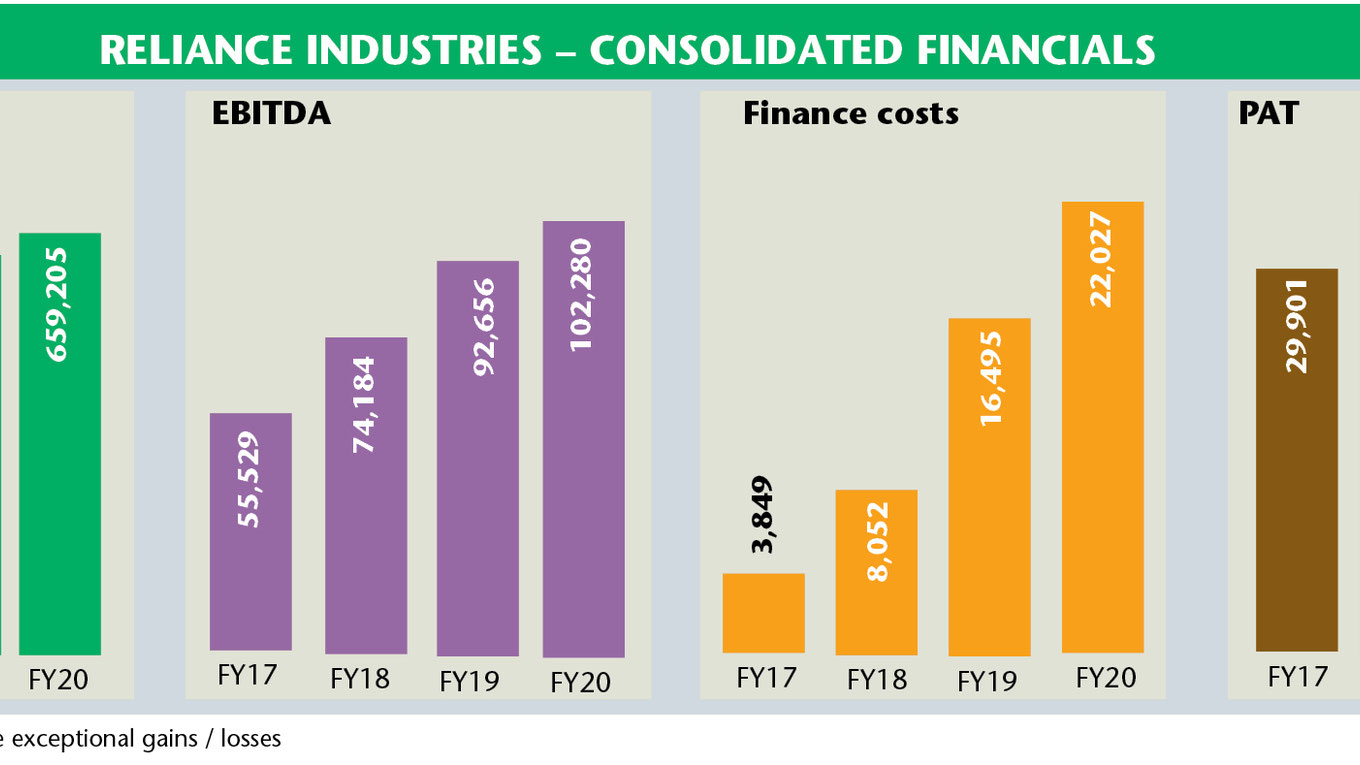

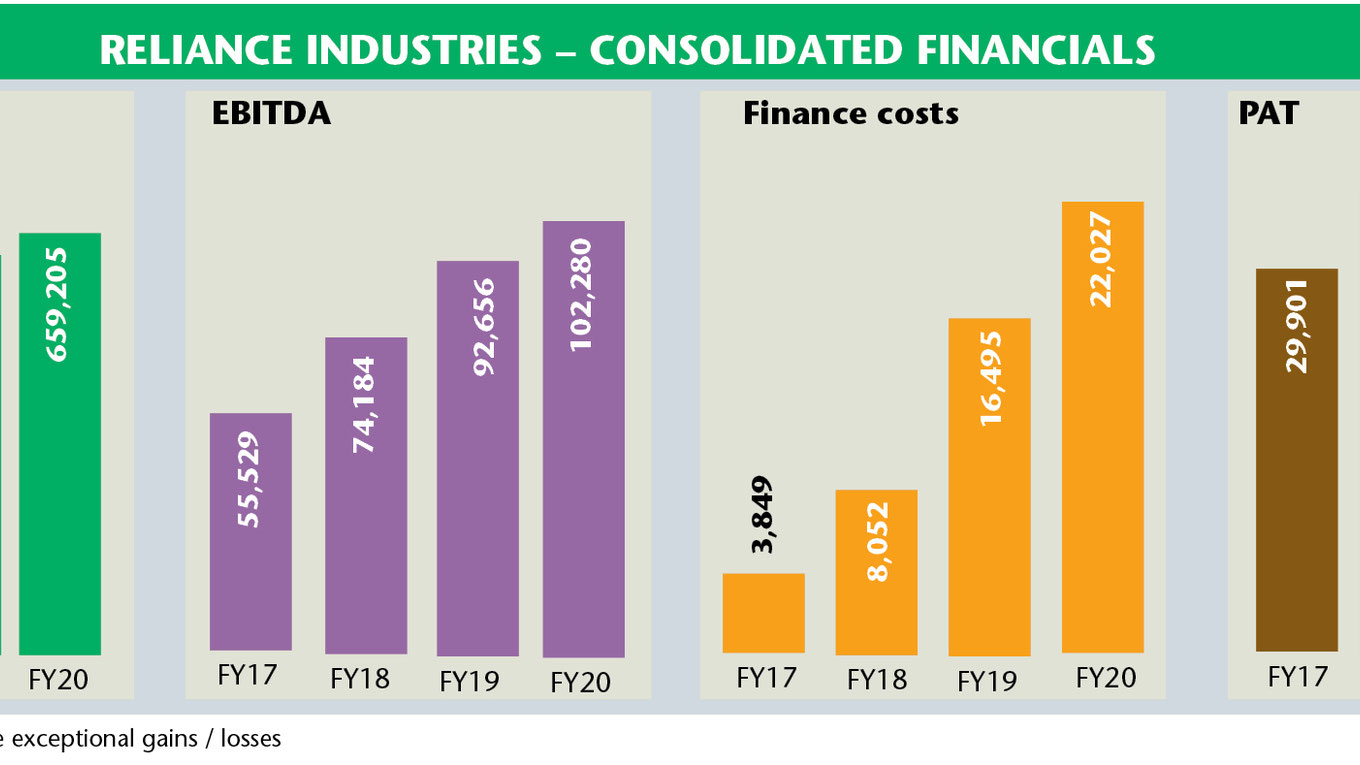

The other concern for Reliance is the huge debt piled up on the balance sheet to grow the future growth engines. Finance charges were piling up and in 2020 stood at Rs22,027 crore as against the PAT of Rs39,880 crore. However, Ambani had already announced that he aimed to make Reliance Industries debt free and that by FY2021, Reliance would be a zero-debt company. He has made considerable progress towards this and with the cash flows from rights, investments in Jio platforms, as also strategic partnerships already forged and some more likely to be forged, making Reliance debt free, at least on the net debt level, may not be such an problem.

Reliance Retail & Finance

With Jio platforms soon on a self-growth propelling drive, attention will shift to the retail business. The company has been riding on apps created by Jio Platforms. In the current lockdown, Jio apps were used extensively by kiranawalas and grocers to ensure steady supply. Retail would aggregate the orders placed, and place orders from various suppliers and make cash payments, thereby getting goods at a discount.

It would, in a way, act as a super wholesaler and be in a position to offer goods for onward distribution to retailers and kiranawalas at a discounted rate rather than what they would otherwise have got. Besides, it would also provide better planning for managing inventory.

Apps also enable omni-channel distribution and allow flexibility to customers to order goods online and collect them offline from nearby stores like D-mart. As on 30 March 2020, the company had 11,700 stores covering 28.7 million customers. These stores offer groceries, fashion and lifestyle products and consumer electronics. With Reliance Jio, telecom provides a captive catchment segment to RIL Retail.

While the margins in stores shopping are relatively lower, a mix of online and offline will give a better blended EBIDTA margin ranging between 6-8 per cent. Reliance Retail’s revenue has been growing at a CAGR of 56 per cent over the last five years. In FY2020 it was nearly Rs1.63 lakh crore. PBDIT was Rs9,654 crore with PAT more than Rs5,360 crore in FY2019 and Rs1,993 crore in FY2018. FY2021 will be a bad year with all stores, save for grocery, remaining shut from 15 March due to the extended lockdown observed in most parts of the country. And it may not be possible to replicate the growth of earlier years.

Along with developing its O2O strategy (online to offline and vice-versa) the retail sector will also benefit from the development of finance, a new vertical. Besides helping consumers by offering them credit, vendors credit, as also credit for mobiles. For every transaction, a small fee will be charged.

“Jio Platforms is possibly the only company in the world which is focusing on integrating the online selling of goods and services with offline business (O2O), that too across various business verticals including retailing or commerce, media and entertainment, healthcare, education, gaming, payments and banking,” says Choksey.

Till date, the vision of the founder has been to build mega enterprises. And despite one view that the finance will be an NBFC, offering lending and insurance broking services, more products will soon be offered. Bajaj Finance, one of the largest NBFCs, also started by offering finance for scooters before it branched out into a full-fledged consumer lending company.

-

In the current lockdown, Jio apps were used extensively by kiranawalas and grocers to ensure a steady supply. Retail would aggregate orders from various suppliers and make cash payments, thereby acquiring goods at a discount

“Creating a finance vertical is a natural progression,” says A. Balasubramanian, who feels that with the growth in digital transactions a large pool of customers and vendors offering personal finance also makes sense. “It is natural that a finance play will be rolled out sooner rather than later. Possibly, the Facebook investment in Jio Platform will leverage on WhatsApp Pay/WhatsApp Commerce. It would be incorrect to compare Reliance's foray into any business segment with any of the incumbents. It sets its own benchmarks,” says Krishna Kumar Karwa. One view however is that operating a shadow bank may be a difficult proposition as unlike banks, it will be difficult for a new NBFC to get access to low interest deposits.

Be that as it may, Reliance already has two new growth verticals in place with a fledging finance business in the making. This also may become a vertical in its own right. All conglomerates including Tatas, Birlas, Bajaj, have their own finance companies catering to the needs of their consumers across the group and new customers outside. Reliance Industries, though a latecomer, may well become a leader, sooner than one may anticipate.

The existing business of oil, refining, exploration, petrochemicals and retailing is all clubbed in its new Reliance Oil to Chemicals company which is still the single largest and most profitable one. And will fund new forays easily.

The current year may be bad for Reliance Industries, as the first quarter has been virtually a washout period with at least two months being wasted during the lockdown. In FY20, following a sharp decline in crude oil prices in the global market, it had to write down the inventory holdings, taking a hit of over Rs4,000 crore.

Even so, the company managed to put up a reasonably good show following better performance of its technology and retail vertical. On a consolidated basis the company reported a turnover of Rs6.59 lakh crore as against Rs6.25 lakh crore in FY19. While finance costs during the year were higher by almost a third, at Rs22,072 crore as against Rs16,495 crore, profit after tax remained virtually unchanged.

The coming year could show a different picture, in spite of the two months lost during the year. Interest costs would be much lower but the real growth will be seen in FY2022 and beyond. The joker in the pack will of course be Reliance Jio Platforms. The profits from this company could offset the lower earnings from the O2O business.

In the midst of a full-blown crisis everything appears abnormal and vision tends to gets clouded. However once things start improving better clarity will emerge on the earnings. Thankfully Mukesh Ambani does not wear glasses and his vision is likely to be less foggy. His exuberance will be better appreciated in a few months from now.