-

The members of the third generation of promoters have their own ideas and the capability to execute them. Their passion drives professionals to put in their best foot forward, says Bala Subramanian, MD & CEO, Birla Sunlife Mutual fund. One of the hallmarks of the group has been the induction of top-quality professionals over the years. This has drawn appreciation from others in the industry. “Triveni Engineering is a well-run, integrated company, with professionals ably aiding the hands-on promoters,” says Vijay Banka, MD & CEO, Dwarikesh Sugar & Industries which, though smaller than several other companies, has amongst the highest yields of sugar in the business.

Sugar & ethanol refineries

The diversification into new initiatives, which were largely done to counter the cyclicity in businesses, are growing in their own right. Over the next decade, this may well change the perception of TEIL from a largely sugar and engineering company into a fully integrated sugar conglomerate.

Most sugar companies have had a great run over the last few years. Three factors have been responsible for this. One is the better quality of seeds, which has allowed farmers to improve their income by providing better cane crop with sucrose. And yields have improved dramatically over the last five years, adding to the income of the farmers. Companies like Triveni, which work closely with farmers, have employed AI and technology to guide farmers regarding suitable cropping and cutting times.

Suresh Taneja, group CFO. “We are continuously striving to increase yields. The yields, which were about 9.25-9.26 per cent across UP in 2012-13, have gone up steadily and are now at 12 per cent,” he adds.

The state government directs all sugar mills to sell a portion of their molasses to country liquor manufacturers at a reduced price. Triveni has instead gone up the value chain and is manufacturing country liquor – IMFL, as it is called. The company may also go in for branding the product and retailing it subsequently.

Secondly, technology is introduced through mobiles, for effective handling of parchis and payment. Once the weighing is done at the mills, the farmers are sent a message on their mobiles, which cuts down paperwork. Lastly, the industry plans to divert a higher quantity of material for making ethanol.

“Triveni has been looking at increasing its capacity through debottlenecking and improving yields on the final products,” claims Sameer Sinha, who has now been with the Triveni group since 2014-15, after earlier stints with L&T and Shaw Wallace. “TEIL also has a better mix of sugar. It sells refined sugar (40 per cent), which fetches it a better price. It also makes pharma grade sugar and sells it largely through institutional buyers, like soft drinks manufacturers, candy manufacturers, ice-cream makers and others.

Triveni has used its higher cash flows to expand its presence in various sectors, such as ethanol-making and co-generation of power. While power prices had collapsed in the last couple of years, with industrial activity picking up, unit power prices are on the recovery mode. Ethanol has been a saviour for the industry (see Business India, dated 29 June-12 July 2020). The government has incentivised sugar companies to set up distilleries to make ethanol from molasses, which is used as an additive to the fuel produced by the oil refineries.

Not only is it environment-friendly, but it also helps in reducing pollution in the overall fuel. The government has also fast-tracked the programme to double ethanol as an additive to 20 per cent by 2025 (instead of 2030, as planned earlier). The price of ethanol is considerably more than sugar. Ethanol from B grade molasses is priced at Rs57.5 per kl. So, in times of surplus, this allows companies to divert sugarcane to the production of ethanol. They have also been allowed to produce ethanol from B grade molasses (which has a higher percentage of juice than C grade molasses), as well as from food wastage or rotting food.

-

Nikhil: money flows from water

Triveni entered the refinery business, setting up its first refinery in 2007 in Muzaffarpur. Currently it has a capacity to produce 320 kl per day, which is being augmented by the setting up of two more refineries, with capacities of 160 kl and 40 kl. These projects are expected to be set up at a cost of Rs250 crore. The first unit will use C grade molasses, while the smaller one will use rotted grains of wheat, barley and corn. About 35 per cent of the cane crushed goes in producing ethanol.

Water business

BK Agarwal, president, corporate, who has a BTech degree from the University of Rourkee, joined TEIL as a management trainee in 1978 and handled water projects till 2018. “Barring a few jobs in the 1990s, the real thrust in the water sector came with the government of India announcing the Naomi Gange project,” he says. “These projects were reasonably balanced and if one did the estimation of the life cycle well there was enough opportunity.” Besides water treatment projects, Triveni also undertook sewage treating projects. Its Delhi-Faridabad project is expected to be completed by June. Over the last few decades, TEIL has got 120 plants working. In EPC, the company had earlier undertaken coal beneficiation and minerals concession projects too. Within the EPC division, besides coal beneficiation, the company has undertaken hydel projects, waste treatment and water projects, Agarwal adds.

Kamal Verma, a 30-year veteran, who is now president, water & waste tech treatment division, explains that, last year, the order intake was less from the state’s side. Armed with a degree in civil engineering and an MBA, Verma looks after the large-scale EPC/PPP businesses. He had earlier honed his skills with HCC. “The major change over the last three years is that the NCLT has become stringent,” says Verma.

“Older plants have to now be redone with new technologies. After the introduction of hybrid annuity models in allocation of projects, the outlook has become more positive. The government policy of ‘One city, one project’ is quite good. And, the Mathura project, which was bagged under this scheme, is nearly 90 per cent completed,” he adds. “We have bid for projects across India. In the Maldives, we have undertaken to build a desalination plant. We are looking at water projects in Bangladesh, Nepal and across South Asia.”

“In Agra, we convert the Yamuna’s water to potable water and meet 40 per cent of the needs of the city. TEIL is hopeful of bagging more contracts in Rajasthan and MP. Tie-ups with Israeli companies and the imbibing of their technology have helped us in converting river water to potable water. The orders outstanding in the water business as of 31 March 2021 were of Rs912 crore.”

Another thrust area TEIL is concentrating on is defence projects – getting orders for the power transmission business, which has been located in Mysuru, Karnataka, since 1976. Rajiv Rajpal, executive officer, an alumnus of the Birla Institute of technology & Science, Pilani, has been with the group since 1991. The business has been doing well and has shown a 15x jump in the topline in the last 20 years, with the PAT showing a 20 per cent jump, says Rajpal. About 80 per cent of the products manufactured are high-speed turbo-gears.

A majority of the products are customised and the main differentiator is that they provide total solutions and have transformed themselves from a ‘product only’ company to a solution provider, getting involved in the products and the customers, right from the planning stage to execution and life cycle. Most of these are used in new equipment in power generation and as import substitutes. It caters to both replacement markets, as also OEM markets, with the latter constituting 60 per cent of the business. The biggest gear box made till date is of 65 MW, he claims. The products also find use in captive power plants, and having a leadership position has helped TEIL get a good set of clients, including Siemens, Tatas and BHEL, amongst others.

-

Taneja: increasing yields

The company’s involvement with the defence products mainly relates to the Indian Navy. The division employs 255 people, with 55 people in R&D. The supplies include propulsion systems, steam turbines and turbo steam engines. Progress is, however, slow and until now they have got only a few orders for multiple engineered products. However, once accredited, the opportunity to get huge orders in existing ship and subsurface ships is enormous in the next decade, which will be a good growth area for the company, claims Rajpal. The professionals in the sector are given a lot of autonomy to run their businesses and are treated well.

What can really galvanise the sugar industry and good companies like Triveni Engineering is the continued help from the government, to manage the Rs1,00,000 crore sugar industry, with ethanol almost having the potential to assume more importance than sugar in the decades to come. Export markets are good now, with crops in Brazil and Thailand falling and the prices of sugar in global markets going up by 17 per cent, as against 10 per cent last year. The government should have in place a uniform policy, which will allow Indian companies to build loyal customers overseas.

The government is toying with the idea of making drip irrigation mandatory. This will allow it to stave off criticism of diversion of sugar and depleting ground water for fuel. TEIL, with a good balance sheet and cash flow, is now in an excellent position to look at organic and inorganic growth. Currently, the entire industry is too fragmented – it boasts of 576 units, none of them with a share of more than 4-5 per cent. The working environment for Triveni Engineering is now better than what it was in 2005 and, so, the next five years should see good growth.

-

Tarun: focussing on good performance

‘The face of Triveni will change’

Tarun Sawhney, who looks after growth in the newer areas of water and defence for TEIL, besides growing his ethanol business to a leadership position, comments on the company’s growth and prospects

What is your vision for Triveni Engineering?

Our corporate vision is to be in the top three players in whichever industry we choose to be. I aim to continue with that vision. In the distillery business, our aim is again to be in the top three. We plan to invest in building capacity, and also procure talent at a faster pace. While our new businesses – defence and alcohol – are small, we are emotional about growing the same, as we earnestly believe that sophistication of customers demands quality. However, Triveni values will be adhered to across all our sectors.

Alcohol will be our first pure play from B-B to B-C segment. In ethanol, we are already building new capacities and hope to double them over the next few quarters. In defence, we believe we will have an edge, as Triveni recognises the need to indigenise. In our gear business, we have already demonstrated our ability to provide technical prowess and we have been building gears for decades.

What about the water business?

In the water business, there is a huge lack of infrastructure. However, it holds immense opportunities. We are looking at the municipal sector in a different way and working with them to provide innovative solutions to make projects happen. We are all geared to take on new projects. We have one of the best corporate structures in place, built on the bedrock of good governance. We are building good operating assets and have the ability to operate in our unique style. Technology has been our redeeming factor.

What are the challenges in tendering the water projects?

Tendering of water projects is still on lowest bid L1-L3. This is a big challenge. However, we have the ability to own and operate businesses and have demonstrated it. Nikhil manages the water and gear businesses. However, the major challenge is that, during the Covid period, there are many uncertainties and the execution of a large on-ground water project is slow, as it is people-oriented. I feel that, over the next 10 years, India as a water-maker and re-user of water will reach a different level of sophistication.

What style of management do you and Nikhil follow?

Both of us believe in getting hands-on in the business. That is the only way we can experience and share problems and provide solutions on the ground. Except during the Covid period, I travel, on an average, 120 days in a year, spending time with customers, vendors, supply-chain vendors. Both Nikhil and I get involved in new projects, with consultants and the selection of technology.

How do you use technology as an enabler?

We get involved with farmers, purchases and the development of seeds. We have armed everyone with a hand-held and, through technology, have ensured that the farmers selling cane do not have to get any receipts. We partner with farmers and are looking to have drones to capture the date of planting and advise the farmer when to cut. We use satellite images and have a team of consultants to ensure the right amount of nutrient balance.

Your companies have been trying to ride the efficiency wave over the last several years. But to what extent can you keep at it?

Five years ago, our sugar recovery was 9.5 per cent. Over the years, our efficiency has improved to 11.5 per cent and today we are looking at about 12 per cent. While government policies are favourable, we are continuously evaluating new varieties to increase the yields of farmers and obtain better sucrose content and have better output.

Why have investors’ perceptions not changed? Why are you still looked at as a cyclical commodity company?

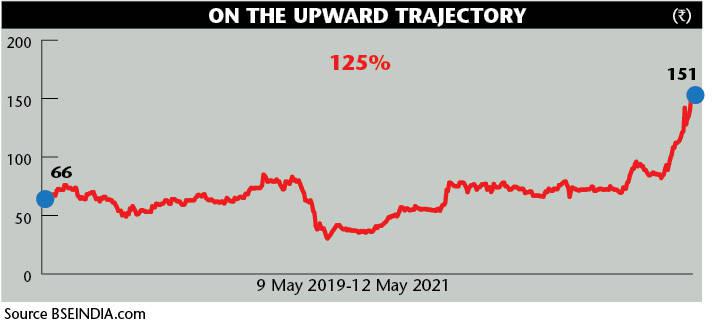

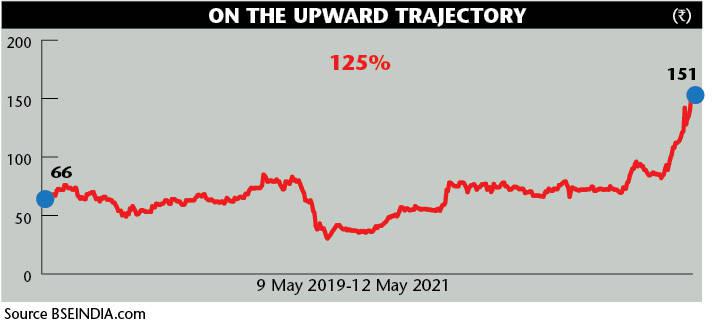

The recent spurt in the prices of sugar companies has shown that investors are rerating the industry. Ethanol itself will be a Rs1 lakh crore industry. We focus on providing good performance, which has been the case over the last five years.

-

Sweet surprise!

May has been good for the sugar industry, which is being rerated. With many shares touching their 52-week highs, Dhampur Sugar too touched its best level at Rs355 on 11 May. Dwarikesh Sugar touched this mark on 10 May at Rs51, while Dalmia Bharat peaked at Rs1,742 on 11 May and EID Parry’s did it at Rs455. Triveni Engineering’s stocks hit a new high of Rs160 on 11 May.

While all stocks soar, most still have a commodity P/E assigned to them and are discounted around 10x – better than the P/E multiples of 4-5x. It ranged between 4x and 5x in June 2020. This is despite the fact that many companies are trying to diversify. “Higher yielding varieties introduced in UP have seen the per acre realisation of farmers going up. Not only has the production increased, but the recovery is also higher. While nearly 80 per cent of mills have embraced the C0-238 variety, which was introduced a few years ago, ISMA, which does field trials, is now looking at new varieties that will give farmers even better yields. A few companies also have invested in capex across the mills.

The third factor is ethanol, which has given the company an edge over the last few years. “Ethanol not only fetches better prices, but its realisations too are faster,” says Abinash Varma, secretary general, Indian Sugar Mills Association. The market does not seem to be taking cognisance of the huge potential of ethanol, which will play an important role in changing the face of sugar mills. The industry is expected to be worth Rs100,000 crore soon.

Deven Choksey, promoter & MD, K R Choksey group, says that all commodity stocks are on a high. “In the case of sugar, poor production in Brazil and Thailand has seen India benefitting, with global sugar prices rising by more than 60 per cent since December 2020. However, it would be wrong to classify Triveni Engineering as a typical commodity stock. While sugar and allied businesses do form the bulk of the turnover, ethanol will be the next big change and a game-changer.

And with Triveni Engineering announcing its intention to double its capacity, I feel it is on the right track. Triveni has a strong balance sheet and over the next few years, it will be able to grow the new businesses of water and defence. Ethanol will be a sustainable business and, if the government follows a good pricing policy, all good mills will benefit. Even if the government does make it mandatory to install drip irrigation across India, companies like Triveni and EID Parry will not face any problem.”

Triveni Engineering’s new business initiatives in water and defence also hold good promise and, once the defence businesses come of age, they will really change perception of investors. Though it took the company 15 years to grow 5x, it will probably double that in less than five years to grow and become a Rs10,000 crore company, feel the experts following the changing phase of the sugar industry.