-

Flipkart is, of course, the biggest common factor which eventually brought them together. Industry insiders will tell you, three of them were critical members of the core team. Malvia headed technology at Flipkart and is credited with building and scaling Flipkart’s engineering platform. He had previously worked with ApnaPaise (formerly Apnaloan), i2 Technologies, Itellix Software Solutions and Riya Internet Technologies.

Kumar was President of Operations at Flipkart where he built operations, supply chain and logistics network for the company. One of the first employees of Flipkart, he practically saw the company evolving from scratch and reaching its zenith. Gupta held several leadership roles over a five-year period at Flipkart which included scaling Flipkart’s Business Finance & Analytics function. Prior to Flipkart, he had worked with consulting firm McKinsey & Company for three years at the firm’s US offices.

Talk to them and they do not hesitate in admitting that the lessons learnt at Flipkart have been priceless and have influenced their decision-making while shaping Udaan. “I used to spend countless numbers of hours with booksellers in Daryaganj trying to get them in the business loop during the evolving spell of Flipkart. When the business attained some scale, I realised that you would be more efficient if you are in control of logistics,” Kumar points out. And that is what Udaan has resorted to as part of its basic strategy – having a sizeable command of its supply chain operations rather than conveniently outsourcing to 3PL specialists.

According to Gupta, appointed as the CEO early last week, being a part of the evolution process of India’s leading internet company had infused the idea in their minds that many large-scale platforms are waiting to emerge. “Mobile internet was growing in this country and we believed that it would open up the economy. Plus, we had seen the kind of scale internet business can create at Flipkart. We were convinced that the internet could build large platforms in this country. And it will be used in spheres with lots of fragmentation, inefficiency and sub-scaled services,” says he.

And the sphere they spotted to make it big was B2B ecommerce. What particularly drew them was the high-scale fragmentation even though general goods are consumed and ultimately reach all places. “General trade, wholesale trade, distribution trade, etc, B2B retail business is still defined by many names. And we noticed this being driven by very fragmented lots of small players. But B2B retail is present everywhere – even at the mofussil and village level. That was our early thesis,” he adds.

Industry trends

The conviction that internet power plus capabilities offered by new age tools like Artificial Intelligence (AI), Data Analytics, etc will create new opportunities at an epic scale on the B2B retail side seems to be bang on the target five years later. This is what their current size and scale reflect. But it’s not only Udaan alone, the entire B2B retail segment seems to have picked up considerable pace.

-

Armed with new age tools Udaan is creating new opportunities at an epic scale

‘E-commerce and consumer internet sector,’ a report released by Ernst & Young (EY India) early this year highlights the churnings in this segment. According to the report, there has been a host of challenges for traditional B2B commerce, starting from the long chain of intermediaries making the supply chain more complicated to a shortage of supply chain financing and lack of credit facility for online deals. But now, technology empowered B2B retail service providers are trying to change the scene by offering higher capital efficiencies and effective digital supply chains.

The new players typically charge a small fee for their digital and logistics offerings while also offering online payment facility. 100 percent FDI in B2B ecommerce, demonetisation, goods and services tax (GST) and digital governance gave wings to established, well-run and funded start-ups in the space. “India is witnessing the emergence of many B2B ecommerce players. Amazon Business is one of the largest B2B e-commerce platforms in India. There are other players such as Flipkart, IndiaMART and Shopify. Over the last four to five years, several start-ups such as Udaan, ShopX, Ninjacart, IndiaMART, Moglix, and Jumbotail have been trying to digitise the wholesale supply chain in India,” the report underlines.

The author of this report, Ankur Pahwa, Partner and National Leader – E-Commerce and Consumer Internet, EY India, says, “There are multiple conglomerates trying to address the challenges in digitising the retail space, you also have upcoming social commerce companies connecting sellers directly to their end-customers and a third category of players brining in efficiencies into niche categories such as industrial sup-plies.”

And with big bets being made in the space the total organised retail business is all set to take a massive upward trajectory in the coming years. “Of the total Indian retail business currently estimated to be in the range of $950 billion-$1 trillion, the share of organised B2B retail would be slightly over 1 per cent. But with the fast-paced digitisation underway, this may well become 5-6 per cent of the total national retail pie (slated to cross $1.5 trillion mark soon) in the next four years.” The EY report projects a healthy 81 per cent CAGR for eB2B business projecting its total worth touching $60 billion by 2024.

Distance covered

The point is: far away from the public glare, the B2B retail segment has skipped to a new growth trajectory. The momentary break due to Covid last year eventually helped those who have developed the capability to deliver from the factory gate (or at least their own stocking hubs) to retail points across the country. And Udaan fits the bill here.

In all fairness, Udaan has largely been a company which maintained a guarded silence on its affairs for the larger part of its short journey. And that has triggered much speculation in the past. In India, the B2B retail business has traditionally been identified with the huge physical stores (as good as a mid-scale mall) operated by the likes of Walmart, Metro and Jio Mart, and often referred to as the cash and carry business for small retailers and wholesalers in high consumption locations in the country.

With Udaan beginning as a pure online play (others too have adopted this option now), the general buzz about the reticent Udaan was: it is a start-up which is building up scale using digital means and will probably be gobbled up by the other deep-pocketed giants at some stage. This perception changed somewhat early this year after a commendable fresh capital inflow and steep jump in valuation.

-

Udaan has a network of over 3 million registered users and 25,000-30,000 sellers

Qualifying Udaan as an emerging entity could be an underestimation now. Even some market observers believe it has emerged and carved its own position. “At a time when Amazon and others have been experimenting with their B2B plans, Udaan has used the opportunity to create space for itself with its single-minded focus. The kind of capital it has brought in is quite commendable,” says Akshay D’Souza, CMO, Bizom, an agency that closely tracks kirana trade in the country.

Typically reflecting the growth pattern of a start-up favoured by investors, the platform has raised over $1.2 billion starting with Series A funding of just $10 million in 2016. The company claims it has invested Rs4,000 crore so far in creating digital architecture and supply chain infrastructure. And its hunger for growth supported by substantial funding (the equity share of three co-founders is close to 10 per cent each now after five rounds of capital infusion), has resulted in the creation of a firm which has expanded at breakneck speed.

According to a senior company official, Udaan has a network of over three million registered users and 25,000-30,000 sellers across 900-plus cities in the country covering 12,000 pin codes. It has over 1.7 million retailers, chemists, kirana shops, HoReCa, farmers, etc, doing over 4.5 million transactions per month. An analysis of Udaan undertaken by Bernstein early this year had called it the largest player in the B2B retail space in the country now with over 0.5mn products offered across 2,500 brands on its platform.

According to the report, the number of branded companies on the platform have increased from 50 in December 2019 to nearly 300 in December 2020, while individual brands have increased from 200-300 in December 2019 to over 2,500 at the end of December 2020. Some of the big brands which are also using Udaan as a sales channel include major names like HUL, P&G, ITC, Coca Cola, PepsiCo, Reckitt Benckiser, Dabur, Colgate, Apple, LG, HP, Adidas, Godrej, Bajaj, Haldiram’s, Relaxo, etc. “In the first year, we were running a beta platform and the actual operations began in 2017. We had started with 8-10 product categories which have now gone up to over 200 and in that sense, we have an expansive portfolio ranging from packaged food products to electronics to gar-ments, pharma and also fresh products,” said Kumar.

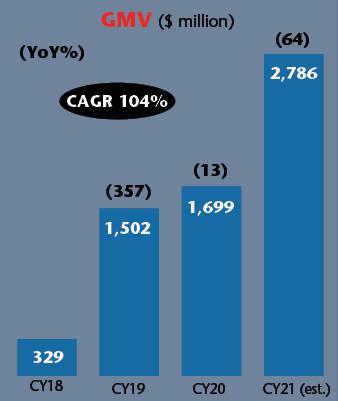

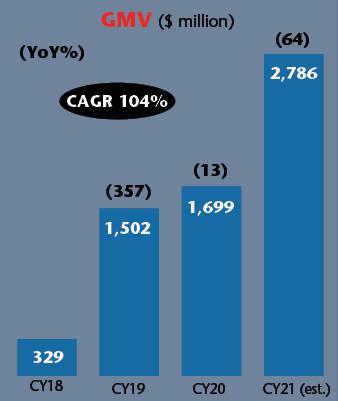

On the critical GMV parameter, the company claims to have grown by 114 per cent CAGR and could well end this calendar a tad shy of the $3 billion mark (refer to the graph – GMV growth). According to a company analysis, food and FMCG, electronics, fashion, appliances and pharma are the leading contributors to Udaan’s GMV.

But more than hard numbers on performance, for the company’s top brass probably a more satisfying fact is their expanding ecosystem wherein technology is linking sellers of all size and scale with the mainstream retail business. The company says it has assisted a slew of small and medium range brands get better visibility and market.

For instance, despite the pandemic and its impact on businesses, the company maintains enabling over 250 sellers under the Lifestyle category achieve sales worth of Rs10 million on the platform in 2020. As per a company note, Udaan’s lifestyle business – comprising of clothing, accessories, and footwear – shipped over 230 million products to 20 per cent of the total Lifestyle retailers present in India while catering to more than 26 lakh orders in 2020.

-

Udaan’s claim of infusing the inclusive element in the B2B trade is endorsed by sellers across the product spectrum. Meet Devraj Singh, who runs a Farmer Producer Organisation (FPO) called Agra Kisan Agro at Pentkeda village near Khandauli in Uttar Pradesh. This FPO has nearly 110 potato farmers and they are selling 500-700 metric tonnes on a monthly basis. “Collectively we have been selling through Udaan for the past two years. The online pricing mechanism is transparent and there is no case of fre-quent rate fluctuation triggered by arhitya (middle men) in the usual mandis. And the payment is guaranteed. So instead of taking our produce to local mandis, we are taking it to their local collection store,” he says.

In Ludhiana, Punjab, Sagar Kohli, a local bicycle manufacturer has a similar story to narrate. Kohli sells on Amazon and Flipkart too but his volume sales to Udaan is higher as the latter buys in bulk for retailers and wholesalers. Says Sagar: “I have been selling through all online platforms and started on Udaan in early 2019. The volume on this platform has grown significantly, amounting to 5,000-6,000 units every month.

And if its tribe of satisfied trade partners is on the rise, technology enabled capabilities are playing a critical role in it. The platform’s SaaS offerings such as analysis of real time marketing feedback through app data analytics enables brands and manufacturers to make well-informed decisions about product launches and testing of new products in different markets.

Ecommerce plus strategy

There are other evolving aspects too. Every day while facilitating retail trade on a pan-India basis, the company claims it handles 6,000 tonnes of goods (in transit or stored) which even goes up to 8,000 tonnes during the festive season. A humungous volume indeed and usually a task of this nature and scale is often outsourced to third-party logistics service providers. However, the company with its Udaan Express (set up in 2018) subsidiary is very much in control of the back-end operations. The company currently controls nearly 200 warehousing units across the country comprising 10 million square feet space. And a dedicated large fleet size which criss-crosses the country every day.

“We do not own warehouses or trucks. But we include them in our network on a lease basis for which we pay them monthly rental. These lease deals are exclusive and usually on a long-term basis,” Kumar explains. The management, however, has planned that Udaan Express become a full-fledged logistics service provider growing beyond its captive strength and start serving others – an example which has been set up by the likes of Mahindra with its logistics unit. A company official confirms that as a standalone unit, Udaan Express has now been taking orders from others for three months and it will be encouraged to move in that direction.

Udaan Capital is the third critical component of the mega structure which the promoters have put in place (in 2018). It is also picking up steam with the MSME lending space, growing bigger and is a major focus area for the established financial powerhouses and the new age fintechs today. With a huge pack of retailers and small business entities in its network, Udaan’s NBFC business may well be on the roll.

-

The company controls nearly 200 warehousing units

“We had received the NBFC licence three years ago and we are providing collateral free loans to traders who are part of our system. We have data intelligence on their transaction pattern. With a corpus of Rs500 crore, we did a lending business of over $1 billion in 2020,” says Kumar. The usual ticket size of short-term loans provided by Udaan Capital varies between Rs10,000 to Rs5 lakh and the repayment period between seven (kirana) to 45-60 days (for high-value businesses like apparel or electronics).

The company reports a low NPA of 3 per cent (typical of tech-enabled NBFCs since they also have access to digital transactions of the firms they have lent to). Udaan’s NBFC ecosystem also receives support from financial powerhouses like Kotak, Tata Capital and ICICI and is in expansion mode. “The MSME credit market is going to grow exponentially in the coming years, much along the lines of what we have witnessed in the consumer lending space in the past. It is inevitable,” says Sachindra Nath, Chairman, UGRO Capital, a noted fintech start-up which is in the process of integrating its offerings with the Udaan Capital platform.

Next stage

Nobody, including the promoters themselves, are hazarding a guess as how much growth can really happen in these two verticals on a stand-alone basis in the coming years. But they are clearly verticals backed by strong growth currents thanks to increasing digitisation and the top management of Udaan is convinced the company is in a position to reap dividends. “The active credit line in Udaan Capital is currently 100,000 mostly given to small kirana stores. We want to take it to over a million active credit lines over the next five years. Credit to MSMEs will become a $300 billion market in this country in not so distant a future,” says Gupta.

For the company, the next major milestone would be an IPO in the next two years and the process has been set afoot. Quite interestingly, Udaan as a company has been a CEO-less firm since its inception with the three co-founders running the show collectively. But early this month, the company announced elevating Gupta as the CEO. As board members, the other co-founders would support the CEO led management and help create a world class institution.

This company maintained the changes are in line with the evolution needed to become a publicly listed entity over the next 18-24 months. Incidentally, the change triggered some media speculation hinting at a growing rift between the three co-founders even suggesting the possible exit of the others. Company officials, however, strongly deny this. “We have embarked upon our journey to the next level and from that standpoint these changes were important,” says Kumar who is also a board member at Edtech firm Unacademy. Meanwhile, before the public enlisting, another PE round could happen which is expected to further shoot up its valuation, pos-sibly in the vicinity of $5 billion.

The company undoubtedly has prepared a stage for a grand show. But market observers believe there would be challenges in the near to medium run. Considering the mammoth growth potential of the B2B retail business (a $60 billion opportunity by 2024 as per EY India report) the big guns are paying more attention to it. According to recent media reports, Flipkart Wholesale is working to treble its geographical footprint to 2,700 cities in the coming years following strong growth in the first half of 2021.

-

Udaan covers 12,000 pin codes in the country

The company witnessed 17 per cent growth in its kirana customer base in January-June 2021 compared to the same period last year. Reliance Jio Mart, Amazon, and Metro Cash & Carry are also giving a major push to kirana customer acquisition. “If Udaan is in the same category of products and the same clusters vis-a-vis the established giants who are now trying to make it very big in B2B too after winning the B2C frontier, the going may get tough for them. Customer stickiness would be a critical issue as kirana owners will have too many players chasing them,” points out Ankur Bisen, Senior Vice President of the Retail & Consumer Products division at Technopak.

“Finding some niche product lines would become critical for them as it would be difficult to compete with the likes of Reliance Jio Mart in the food and FMCG category. Additionally, the B2B customer engagement modalities are changing. An FMCG giant like HUL has launched its own Shikar app for retail distribution. More companies may follow suit and this would be a new competing channel for everyone,” says D’Souza of Bizom.

Incidentally, Udaan recently got into a serious tiff with India’s largest biscuits manufac-turer Parle and also dairy giant Amul when they stopped their direct supplies alleging monopolisation of retailers by the Bengaluru-based firm. Udaan, on its part, has moved the Competition Commission of India (CCI) against Parle with the same charge of misusing its prominent market positioning.

“This is part of the evolution process,” says Kumar. “They should avoid such conflicts and rather work more closely with big brands for better margins in their operations. The likes of Parle and Amul were not born yesterday and have established existing channels. If they are taking it casually, it could be a sign of overconfidence. They are a new entity getting into the big league and now they will encounter new dynamics,” observes a senior industry insider. Quite clearly, Udaan’s further ascendancy in an expanding sky would be closely monitored now, unlike its take off which had almost gone completely unnoticed.