-

Anand: focussing on the company’s core LTL business

As per the new scrappage policy in 2021, commercial vehicles aged over 15 years will have to be mandatorily scrapped if they do not pass fitness and emission tests. The policy does not treat a vehicle as scrap just because of its age, but considers other factors such as quality of brakes, engine performance and others. The objective is to phase out old vehicles to reduce pollution levels and stimulate automotive sales.

Commenting on the restricted age of commercial vehicles to only 15 years, Sankeshwar says: “India is a poor country where small operators will have a tough time to conform to the new rule. But for VRL it is not a big issue. Today, of our total fleet strength, 50 per cent of our vehicles are fully depreciated and almost 90 per cent are debt-free.”

VRL is proactively preparing for the scrapping policy with an aggressive capex plan. Its truck fleet of 4,816 vehicles has a carrying capacity of 71,056 tonnes. As many as 1,178 vehicles are more than 15 years old, as of 30 June, 2022 with a total capacity of 12,026 tonnes, whereas it has added 16,934 tonnes, capacity from 2019 onwards. A further 1,200-plus vehicles of higher capacity (13000 tonnes) are also being added.

To strengthen the focus on the core business of goods transport, the company has announced the sale of its passenger bus operations for Rs230 crore. In a letter to the stock exchange on 17 September, it has stated that newly incorporated promoter group entity – Vijayanand Travels Pvt Ltd – is buying the luxury passenger bus operation of VRL, subject to non-promoter share-holder approval through postal ballot within six months.

VRL’s passenger bus service owns 277 buses and operates in the states of Karnataka, Maharashtra, Andhra Pradesh, Telangana, and Goa. The division is debt-free. It recorded revenues of Rs204 crore which contributes 8.50 per cent of the total revenue of the company in FY22 as against 18 per cent in FY18.

Covid has impacted its revenue as well. Over 65 per cent of its buses are old and heavy capex is needed to phase out old vehicles. The entire transaction value, net of capital gains thereon, would be an additional cash inflow to VRL. It is understood that Anand’s 21-year-old son Shiva Sankeshwar will be at the helm of affairs of Vijayanand Travels.

Similarly in July, VRL sold its 42 MW wind power it had invested several years back to Ratna Cement for a sum of Rs48 crore. These turbines are installed at Kappatgudda in Karnataka.

Sankeshwar was born into a small business family in Gadag, in North Karnataka where the family had a printing press for dictionaries, Kannada literature books and school textbooks. After helping it run for sometime, he decided to venture into his own business. He found the goods transportation business was mostly in the hands of the unorganised sector, with no reliability in services.

Young Sankeshwar saw this as an opportunity. But his family was against his business idea. He finally borrowed Rs1.20 lakh from friends and bought his first truck against his family’s wishes in 1976. His vision was ahead of his time. He even drove the truck himself for long distances deliveries so that his driver could rest.

-

Nalavadi: keeping the balance sheet healthy

Ups and downs

A hard-working Sankeshwar incurred huge losses for first few years. But his determination, customer commitment and faster delivery at a low cost helped grow business volume gradually and allowed him to add more vehicles. In 1983, he incorporated the company as Vijayanand Roadlines Private Limited, which was changed to VRL Logistics Limited in 2006. The company has faced the usual ups and downs of the business cycle, emerging stronger every time.

It is the first listed logistic company in the LTL segment in the country and one of the largest companies in the segment. VRL entered the stock market in 2015, with its IPO. “The response of our IPO was tremendous and the issue oversubscribed 74 times. Our listing changed the stock market. The segment started generating interest among investors,” says Sunil Nalavadi, CFO. Mahindra Logistics and Future Supply Chain Solution also came up with IPOs after that.

From humble beginnings in the mid-70s the company has grown multiple times. The current revenue is Rs2,410 crore and it employs over 20,000 people. “This was an eventful journey,” recalls Sankeshwar, 72. He also owns a leading Kannada daily, Vijayavani as well as Digvijay, a 24x7 Kannada TV channel. He is a Padma Shri awardee (2020), for his contribution to trade and industry. VRL also finds mention in the Limca Book of Records as the largest fleet owner of commercial vehicles in India in the private sector.

While Sankeshwar, holds the fort, his son Anand, 47, a B Com graduate is managing director and the driving force of the company. Anand joined the company after finishing school. He worked on the shop floor and learned the fundamentals of the logistics business the hard way before securing his place on the board. Anand is now taking the company to the next level of growth.

The company’s goods transport business is a B2B business which contributes 92 per cent of the revenue and owns 4,816 vehicles, comprising small, light and heavy commercial vehicles (as on March 2022). The rest comes from the passenger bus services. In goods transport, it serves almost 8 lakh customers for Less Than Truckload (LTL), Full Truckload (FTL) and Courier services. VRL has a large and experienced pool of drivers on its payroll.

General Parcel forms the core of VRL’s business and involves the pan-Indian movement of consignments of varying size and weight across the country on a Less than Truck Load godown to godown Basis. LTL involves transportation of consignments belonging to multiple customers in single vehicle. The company also provides the option of door collection and door delivery to customers at a cost.

The Priority Cargo business involves door-to-door delivery. A wider reach and adequate infrastructure help in aggregating less than truckload consignments from various clients and sending them to the desired destinations.

VRL has continuously evolved, with an extended network of branches and its own fleet. The company serves 23 states and four Union Territories, covering all major cities and towns in India. It has 761 branches and 47 strategically placed hubs. LTL is the major revenue earner of the company – almost 89 per cent.

-

Jahagirdar: Gowdavalli transshipment hub volume has increased

Full Truckload service is typically used by manufacturers that have large quantities of goods to be transported and is offered at a pre-determined price. In general, VRL provides FTL services to optimise capacity utilisation of vehicles or to those customers who offer attractive margins. This service earns 10 per cent of the business.

On the other hand, courier services and others contribute only 1 per cent to the business – this caters to walk-in customers, as also to the pick-up of commercial documents and packages directly from customers which are then delivered in a time-bound manner on a door-to-door basis.

Good service

Automotive Axles, an FTL customer, uses five-six trucks daily for its axle shipments. “Their trucks with the long chassis are suitable for loading the maximum numbers of axles. Their service is good, with on-time delivery and easy tracking,” says Ranganathan Sankaran, CFO of Automotive Axles. But he thinks VRL’s cost is on the higher side.

“LTL’s logistics” business is a very straightforward business with immense market potential. We have already identified and set our growth goals and have started working towards these,” Anand explains. “We have opened up more than 150 new offices across India within the last year and will monitor and nurture these new markets to garner higher freight volumes for our company. The company has decided to focus on its core LTL business and will not focus on other logistics verticals over the near medium term.”

VRL’s focus is on increasing its presence in UP, Bihar and West Bengal. The emphasis is also on the north-eastern states where logistic service is inadequate. All these would lead to the addition of many new customers and help service existing customers business in the new areas.

VRL will continue to pay attention to SME customers to achieve volume growth. There is an immense business potential in India; the consumption pattern of goods is changing fast and becoming dynamic across the urban as also rural markets, necessitating the existence and gradual thriving of a robust surface logistics network. The company’s focus is to look at this opportunity. However, Sankeshwar’s aim is to serve only the right kind of customers.

The company rarely outsources vehicles, while most of the organised sector operates primarily on outsourced vehicles. “Owned vehicles always have cost advantages. It also helps faster and safer movement of consignments, with the lowest incidences of theft, pilferage and damage. Using one’s own vehicles gives us 10 per cent cost advantages,” argues Sankeshwar.

VRL’s transhipment hub at Gowdavalli near Hyderabad is the largest in Telangana state and was set up in 2020. The hub is spread across 20 acres of land with a built-up area of 4 lakh sq ft. This modern mechanised hub can handle 1,800 tonnes of load per day from its 21 loading and un-loading bays. The manual handling is minimal. From this hub the company mainly caters to Telangana, Andhra, Karnataka, Tamil Nadu, Maharashtra, Gujarat and Delhi.

“Our volume has increased significantly in the last two years. We handle textile, industrial goods, agricultural products, food and fertilizer. Textile contributes 40 per cent of the total volume,” says Dhruvaraj Jahagirdar, Vice President, VRL. The hub generates 10 per cent of the company’s revenue. It covers 120 branches of the company.

-

State-of-the-art vehicle workshop facility at Hubballi

“VRL is a key partner. We have been associated with VRL over two decades and use VRL’s service pan-India for our supply chain. Their service is excellent. It follows basic trade ethics, system and process. VRL management’s regular interaction with customers to improve the services is appreciated,” says Balgond Chougula, Sr VP CSS and Procurement Head, D-Link.

The organised logistics industry faced challenges for a few years after GST was abruptly introduced. “Initially there were a lot of glitches in the system. The government was busy with the formulation of the law rather than compliance,” says Sankeshwar.

Things started improving from 2012 onwards. The implementation of the e-waybill provisions is being monitored and regulated meticulously across India by the enforcement authorities and the gradual reduction of thresholds for e-invoicing is expected to further bring more and more small and mid-size businesses into the GST compliant fold.

The system also shifted customers from unorganised to organised players like VRL. “We have now started getting significant volumes of commodities such as leather goods, betel nut, coconut products, incense products, which were earlier not being moved by us, and were the exclusive domain of the unorganised sector,” Sankeshwar adds.

Using composite material

VRL makes constant efforts to gain efficiency that has cost benefits in its operations. The company has state-of-the-art vehicle workshop facilities, with performance-enhancing technological innovations. In addition, inventory of spare parts and in-house software & technology capabilities makes it cost-efficient. GPS tracking, SMS alerts, consignment tracking, schedule alerts and predictive analyses are part of its vehicles system.

The company’s in-house vehicle body design unit fabricates lighter and longer bodies, thereby reducing the overall weight of the vehicles, and ensuring a higher payload within the prescribed limits. “We use composite material for making a vehicle’s cabin, instead of steel. This is lighter, rust-proof and strong,” says Bapu U Makkannavar, general manager of the workshop. It has introduced a Centralised Lubricating System, which lubricates all the points automatically in the vehicles – that reduces the maintenance cost. Through the use of PTF based grease, the interval of grease change in wheel-bearings has been increased to 150,000 km from an average of 40,000 km. “The in-house vehicle maintenance expertise developed by us over the years is making us competitive,” proclaims Anand.

“VRL is a well-recognised company in the logistics segment and has been growing aggressively under its able management team. Owning a large fleet of trucks certainly gives them the edge over the competition. They also follow good HR practices in the industry,” says Pawan Jain, Chairman of the Gurugram-based logistics player Safex.

-

VRL has kept its balance sheet healthy. “We have good cash flow. The margin is a little under pressure due to the high diesel price but the growth in volume will improve the margin. We are expecting around 20-25 per cent growth in next 3 years,” says Nalavadi.

VRL has touched an annual revenue of Rs2,410.10 crore in the year ended March 2022, as against Rs1,775.78 crore during the previous year. The net profit is reported to be Rs160.11 crore in 2022, as against Rs45.06 crore in 2021. “The company’s EBITA margin is 19.71 per cent (Q4FY22) – amongst the best in the industry. Our return on capital employed is 30 per cent as against industry average of 15-16 per cent,” claims Nalavadi.

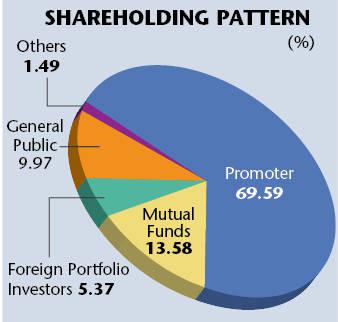

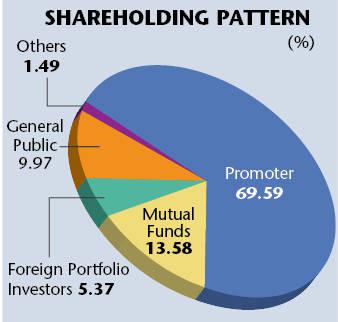

The market cap of the company is Rs5,776 crore with a current stock price of Rs657 a share. The promoter owns 69.59 per cent of the company.

VRL has achieved a gross turnover of Rs717 crore for the three months ended June 2022 as against Rs665 in the previous quarter. The net profit for the three months till June 2022 was Rs49.37 crore against Rs56.19 crore in the last quarter ended March 2022.

Talking about EV for goods, Sankeshwar believes that cost and the weight of the battery to carry high tonnage truck will be the biggest challenge. “It will not be an easy transition. But we will be the first to adopt the changes in the segment,” he asserts.

VRL has shown its ability to remain a significant player in the segment. With the expected growth opportunity in logistics, the company has set a target to achieve a top line growth of Rs6,000 crore in the next 4-5 years.