-

Sharma: JSPL was declared the second biggest wealth creator during 2005-09

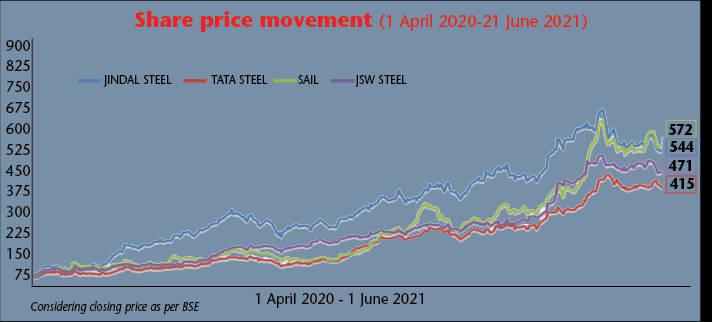

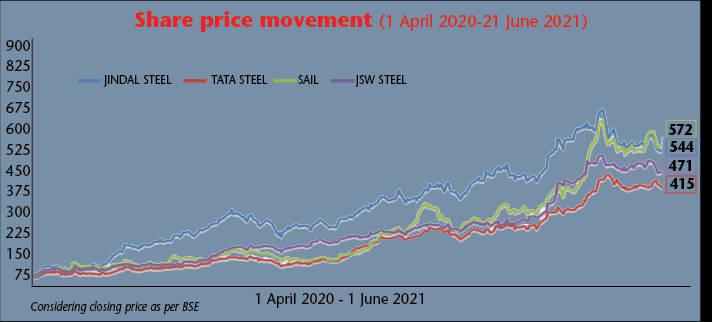

“We witnessed correction in steel stocks from mid-April, when China tried to restrict the sharp move in Chinese steel prices,” says Ashish Kejriwal, SVP, Centrum Finance. “However, that could not change the world ex-China demand-supply dynamics, and prices remained firm globally (world, ex-China). With Chinese steel prices stabilising at lower levels by May 2021-end (corrected 16 per cent from recent highs to $874/ tonne, though still higher by 16 per cent from March 2021), and world steel fundamentals (China to reduce steel exports in 2H 2021, stimulus provided by the US, firm demand and supply constraint in Europe, etc) remaining intact, we believe stock correction provides a good buying opportunity. We believe that valuing companies at P/B is a conservative approach, especially if one is comfortable even on 2022-23 earnings. We continue to value the stocks on 2022-23E EV/EBIDTA basis and see a 25-45 per cent upside in stocks like Tata Steel, SAIL and JSPL.”

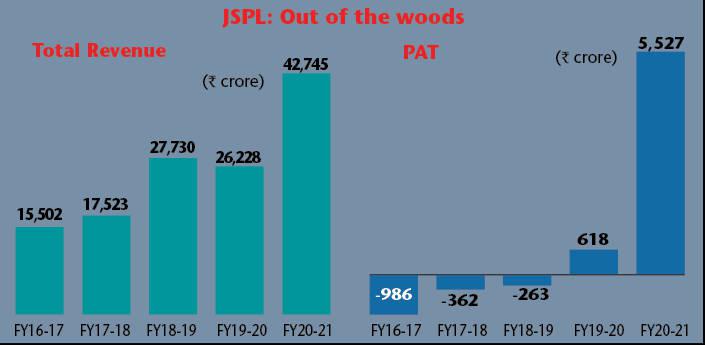

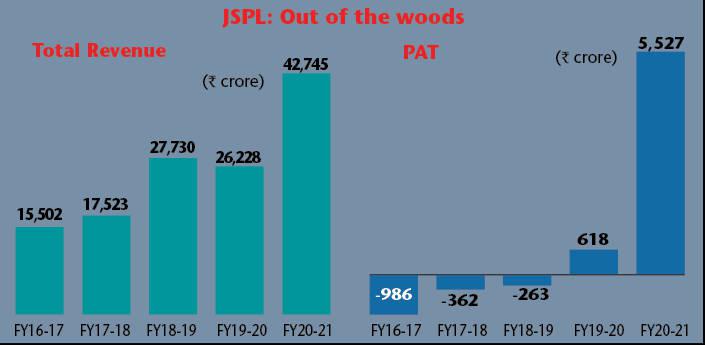

The common sentiment among analysts currently covering the metals market is that Indian steel manufacturers will continue to report improvement in profitability and had recommended JSPL as a preferable stock pick prior to their latest earnings. JSPL announced its financial results and reported its highest ever consolidated EBIDTA of Rs5,287 crore in 4Q 2020-21. The company is also driven by a record standalone EBIDTA of Rs4,884 crore in 4Q 2020-21 and the highest ever consolidated EBIDTA of Rs14,444 crore and profit after tax (PAT) of Rs5,527 crore in 2020-21. Also, JSPL’s standalone net debt reduced further by Rs4,643 crore in 2020-21. Additionally, the consolidated net debt reduced by Rs13,773 crore in 2020-21.

According to a CARE report, the second half of Covid-struck 2020-21 saw an unprecedented rally in domestic steel prices, which seems unstoppable even in the current 2021-22. Domestic flat steel & hot rolled coil (HRC) prices are up 40 per cent since April 2020 and prices of long steel-TMT are nearly 30 per cent higher than they were on March 2021.

Steel prices continue to set new record highs month after month. In April 2021, domestic steel players announced further price hikes by up to Rs1,000-2,000 per tonne in HRC and about Rs3,000 per tonne in CRC. HRC are offered at Rs59,700-60,000 per tonne in April 2021, as against Rs36,950 per tonne in April 2020. This is the highest level seen since 2008, the year of the financial crisis.

Rollercoaster ride

“The up-cycle in domestic steel prices is supported by the bullish trend in global steel prices and a revival in domestic demand,” says the CARE report. “The rally in global steel prices was initially driven single-handedly by China until other large economies like the US and Europe came roaring back to the market, armed with stimulus checks, which resulted in demand outpacing supply. Sellers, who kept capacities idle due to the pandemic earlier, have been slow to ramp up post lockdowns.”

JSPL’s journey has been a roller-coaster ride over the last decade and a half. “It was declared the second biggest wealth creator during 2005-09 by the Boston Consulting group. Then the company went through a rough patch with high debt levels. There was a time until a few years ago when JSPL was saddled with a debt owing to external policy regulations and performance of the steel industry that impacted operations,” says Vidya Rattan Sharma, MD, JSPL, who has more than 37 years of experience in the steel, power, cement and mining industry.

If one looks at the balance sheet, JSPL’s profit after tax (PAT) for 2012 was Rs2,200 crore; however, from 2015, it started making losses. This haemorrhaging continued till 2018-19. And, in 2020, it earned a marginal PAT of Rs475 crore, before making Rs7,500 crore in 2020-21.

-

“The story goes as follows: in 2012-15, we were busy making investments and incurred capex of about Rs28,000-30,000 crore,” says Sharma. “The equipment we acquired with the new capex was not performing well due to a variety of reasons. We gave an impetus in 2019 on how to sweat out existing equipment.”

JSPL had a capacity of 3 million tonnes per annum (mtpa) in 2012, and installed an additional capacity of 6 mtpa in end of 2015. “Then, the next three years, 2016-18, were challenging. In 2016-17, we had a total debt of Rs45,000 crore, which we were worried about bringing down; in fact, we were on the verge of not meeting our obligations. That’s when we formulated the right strategy and found that the first and foremost thing to do is to utilise our capacities,” adds Sharma.

So, in 2018-19, JSPL made 5.5 million tonnes of steel. “The growth was 36 per cent, without adding any capacity or capex or any sort of modifications. Then, we decided to utilise the existing facilities fully and, thus reached a capacity of 7.5 million tonnes in 2020. We are trying to exceed the 8.5 million tonnes capacity now. This has changed our perceptions, and has brought the true value of the economy of scales, the overall cost, the variable cost and the fixed cost, which has allowed us to export 35 per cent of our produce,” points out Sharma, who re-joined JSPL in June 2019.

Incidentally, the turnaround was internal. “This time we did not deal with any consultants. We found that the consultants were not that good; their knowledge of the subject was not enough for them to advice, guide or strategise. So, we made core teams – one for international business and another for domestic,” observes Sharma. From 2014 to 2017, the company’s export was in single digits – 4-7 per cent.

“So, we started growing the export market. During that time, the lockdown was declared, which made it a challenging time for us, with the share price coming down to Rs63. We had a marathon meeting in March 2020 and came up with a solid plan; now, that plan has to be implemented,” points out Sharma.

During the pandemic, the government had allowed steel mills to run as essential services. So, the JSPL team started booking orders day and night and, in April, May and June 2020, when the world was under lockdown and most steel mills were shut, “we started exporting; and this was the turning point. Sometimes, opportunities surface during bad times and we have to grab them. We exported 85 per cent of our production, continuing it even to the third quarter. And, in Q1 2021, we also outperformed the market. We found the gaps and we figured out how to fill them. This has led us to performing well. We did not hire any outside consultants. We just got an excellent team. We sat together and made short-term plans and then they also became our long-term plans, since they helped us achieve 95 per cent of our targets.”

“In fact, in December 2019, we started finding a great amount of export opportunities. We started moving out to the international markets, which we realised was the best strategy during the pandemic, since it helps to sustain and survive. During the last quarter (October, November and December) of 2019, when the whole of Europe and China were affected by the pandemic, we saw an opportunity,” adds Sharma.

Then 2020 came and the wave came with it. And, China reduced its production. During December 2019-March 2020, the Jindal team saw a V-shaped recovery. They discussed with some of the trading houses and non-industry people about what was happening. “We came to know that China declared they are all out to spend more and more money and to keep their growth and overall potential by brand.” That has made China the highest, undisputed consumer of steel after the pandemic. In January 2020, China produced about 75 million tonnes; in the next month, the production went up to about 85 million tonnes and, in March, it touched 90 million tonnes.

-

JSPL’s product portfolio spans across the steel value chain from the widest flat products to a whole range of long products and rails

India declared its lockdown in March 2020. “We got a report that China was short of 20 million tonnes of steel. That helped us and we formulated a different strategy; we identified who the customers of China were. It was exporting materials to Denmark, the Philippines, Europe, Italy, Germany, France, Switzerland, Saudi Arabia, the UAE, Cambodia, as also Australia. So, what we did was to play a two-pronged strategy; we planned to give China enough steel to make up the shortage it had, while we also reached out to all the customers who were banking on China. When we offered materials to these countries, they were just thrilled. We told them we could replace China’s steel with Indian steel and that really worked for us in terms of business,” says Sharma.

China is still busy figuring out its own requirements; so, there is a vacuum. JSPL has moved to South East Asia, Malaysia, Cambodia, the Philippines, Thailand and also Australia and exports from JSPL are increasing. “We got busy supplying 10-15 per cent to China and the balance 85 per cent to customers of China, as China is still not supplying to them,” adds Sharma. China used to consume about 900 million tonnes of steel a year. This year, it has consumed 1,050 million. So, the growth in Chinese consumption is 15-17 per cent, which has made the international market dry.

In India, JSPL touched Rs65,000 crore as GST collection during pandemic; it had reached as high as Rs1 lakh crore in GST earlier; and Rs1.27 lakh crore as GST collection in March. Now, it stands at Rs95,000 crore. “I am sure, in June 2021, we will cross Rs1.10 lakh crore and, when the pandemic ends, India will have the potential to get a GST collection of Rs1.50 lakh crore, with the vaccination drive gathering momentum. More money will flow to the states, more projects will come, and that means more funds for the steel industry, the infra, building and earth-moving industries, besides ship building,” says Sharma.

Mixed feeling

India needs to re-structure the defence industry and this will bring about changes in the fortunes of a number of Indian MSMEs and larger organisations, which deal with steel in the country. During Sharma’s tenure, JSPL has undertaken several steps to transform itself and shown excellent performance on all fronts. “This includes an impressive higher production and sales turnover during the Covid-19-induced economically challenging period.

Post pandemic, the country has been given stimulus packages: in these packages, major growth has been seen in basic infrastructure, railway, power lines, manufacturing industry, and we get fit into each and every product needed by this audience in a proper way. We have exploited the potential fully in the last 18 months and that has turned us into a profit-making organisation,” says Sharma, under whose leadership, JSPL recorded its highest ever consolidated EBIDTA in 2020-21. Prior to joining JSPL, Sharma had worked with the Abul Khair group of Bangladesh as MD. He also worked in the UAE and Africa for five years.

-

Also read: JSPL propels ESG

“In fact, many trade pundits had written off JSPL. Its stocks were viewed as low-value, with no great future. Both top and bottom lines also weren’t promising enough to bring confidence to the investors on the company’s ability to trim high total outstanding debt. However, JSPL worked on a turnaround strategy, with a focus on increasing the production, aided by the good demand for steel and alignment with the government initiatives. This focussed strategy enabled JSPL to stage a spectacular turnaround,” observes Sharma who also had an earlier stint with JSPL, as deputy MD & CEO (steel). A mechanical engineer with an MBA from the UK, in the steel sector, he has also worked with Ispat Industries, Bhushan Steel group and Socialist Steel Libya, in senior positions.

“Despite the pandemic situation across India, JSPL’s operations have displayed resilience. We continued operations at 90-100 per cent capacity utilisation even when many other steel manufactures were holding off. Also, JSPL put in efforts to export its products through virtual meetings which bode well for our production and sales,” explains Sharma, speaking about the efforts that led to JSPL posting the highest ever production and sales in 2020- 21 of 7.51 lakh tonnes – up 19 per cent growth year on year (y-o-y) and 8.5 lakh tonnes (20 per cent growth y-o-y), respectively.

JSPL has placed a singular focus on sweating its assets, improving capacity utilisations and deleveraging. From a loss-making company to making a PAT of Rs7,500 crore is a big story. “To achieve this, JSPL adopted a 15:15:50 model – planning to achieve an operating profit (EBIDTA) of Rs15,000 crore; net debt of Rs15,000 crore; and a gross turnover Rs50,000 crore by 2022. This has now become the slogan at JSPL,” says Jindal, who has prepaid Rs2,462 crore to its term lenders. This is in continuation of its long-stated financial strategy of debt reduction and building a balance sheet with an optimal capital mix. In 2016, JSPL’s peak debt stood at about Rs46,000 crore, which has come down to Rs19,300 crore as of today. This year, the company has plans to bring it down in four figures – to around Rs9,500 crore.

“We are sure this will shape up as planned and we will become one of the most vibrant companies. Top 10 in every ratio – be it debt to EBIDTA, debt to sales, EBIDTA to sales, or turnover ratio, etc. We are not talking about GAIL or Oil India or Indian Oil, or any other government entity. We are talking about the private sector; we want to reach the top 10 and be one of the most vibrant and healthiest companies in the country,” hopes Sharma.

JSPL is now embarking upon its next stage of growth cycle, with sharper focus on its core business of steel-making and an enhanced product portfolio to support the massive infrastructure push planned by the government in the next few years. The company has also forayed into the construction solutions business. Their product profile consists of a wide variety of structural steel products ranging from basic €250 and €350 grade fabricated structures, along with special engineered products like high tensile strength €550 and €450 MPA fabricated steel structures.

-

Jindal Power receives positive feedback from investors

In addition, JSPL also has a hot rolled (HR) section for various structural steel requirements for bigger and clear span structures, ensuring optimum steel consumption and reducing the project gestation period and cost. The company has produced and fabricated €550 grade steel plates and even introduced smart and innovative construction solutions – like speed floor, cut & bend, weld-mesh etc, to tackle the need for faster construction.

Over the years, JSPL has invested capital in building and enhancing utilities within the country, as also internationally. “We are adding 4.5 million tonnes capacity and, by 2024, we aim to invest Rs18,000 crore in capex, all the funding coming through internal accruals; we will not be taking any loans or assistance from any bank. And, we will achieve all this in 2025,” assures Sharma.

Talking about the near-term outlook for steel in 2021-22, crude steel production is expected to reach 112-114 million tonnes, which would be a growth of 8-9 per cent year-on-year (y-o-y), estimates the CARE report. The crude steel production is expected to be marginally higher than 2018-19, when India produced nearly 111 million tonnes of crude steel. Steel demand will be supported by economic recovery, government spending and enhanced liquidity. The Union Budget for 2021-22 had a sharp 34.5 per cent y-o-y increase in allocation for capex at 5.54 lakh crore.

The budget’s thrust is on infrastructure creation and manufacturing to propel the economy. Therefore, enhanced outlays for key sectors like defence services, railways, and roads, transport and highways will provide impetus to steel consumption, which is expected to grow by 10-12 per cent in 2021-22 to cross 100 million tonnes for the first time ever.

“An up-cycle in steel prices is expected to continue in 2021-22. Stimulus packages, unveiled by various countries, will keep demand for steel high. The absence of China from the world export market and higher import of steel from China is one of the major factors keeping steel prices elevated. Continued higher demand from China on the back of the stimulus package and the country’s desire to bring down production levels in 2021 to reduce carbon levels will be an important factor that will strengthen steel prices. The cost push from iron ore prices will remain. Demand-supply imbalance in the global market will also continue to present export opportunities to domestic players,” states the CARE report.

Stimulus package

Moving forward, more than $17 trillion worth of stimulus packages have been given by different countries in the world. India’s finance minister has declared Rs15 lakh crore. If one goes out of India, the largest money distributor is the US. Former President Trump had declared $2.5 trillion during his tenure and President Biden has declared $5 trillion. So, $7.5 trillion has been declared by the US alone in the last eight to nine months. Europe (France, Italy, Germany, Spain and Denmark) has planned for €4.2 trillion. China too had declared $1.7 trillion and then $2.7 trillion, which makes its offer about $4.4 trillion. Over and above these, there are other countries contributing in smaller ways, with Saudi Arabia, the UAE, Qatar, Oman, etc, putting together about $500 billion and Australia coming up with AU$ 1 trillion.

“We lost $50 trillion in the last 18 months. The world economy, which is recorded by the developed and under-developed countries, is about $100 trillion, and $50 trillion was a major loss, so it is to be recovered. I am sure that, with this $21 trillion, which is coming into the market, each dollar will bring $3.5 dollars as part of the value chain; so, the $21 trillion will bring $70-72 trillion in terms of value chain,” estimates Sharma.

-

We are optimistic that we will continue to maintain our strong momentum as we recover as a country from the Covid-19 pandemic. We expect demand to recover and increase with a more significant number of projects coming through. Our ability to consistently pare down our debt levels is a key element of our turnaround story

Naveen Jindal

On the power front, JSPL has proposed a hive-off. Several companies were approached and among them, Worldone, a private entity owned by Naveen Jindal and his family, showed interest. Worldone was to pay JSPL an equity value of Rs3,015 crore for a 96.42 per cent stake in Jindal Power Ltd (JPL). “While it received positive feedback from investors on the sale, there were requests to simplify certain terms of the transaction that the company is in the process of addressing. If there is another company that shows interest, it will be taken into consideration before making a decision on the sale,” says Sharma, evaluating the deal.

We have mixed feelings about the proposed sale of JPL by JSPL. While we find the enterprise value (EV) of Rs95 billion, implying 5x 2021-22E EV/EBIDTA, for the asset a bit underwhelming, it does improve the growth outlook for the steel business by freeing up both the balance sheet and management bandwidth. JSPL has already announced its intent to double capacity at Angul to 12 million tpa.

Moreover, by hiving off thermal power plants and reducing its carbon footprint, access to global capital should improve for JSPL. The deal should also aid in better value discovery for the steel business, which is still under-valued at 4.5x 2021-22E EV/EBIDTA,” says a Motilal Oswal report suggesting a ‘buy’ at Rs450 and targeting a 20 per cent appreciation to Rs539.

So, what does the minority shareholder of JSPL get? “Subject to successful closure, JSP’s net debt would reduce by $50 billion (factoring equity, debt on books, inter-company loan), core steel making operations should stack up better on carbon footprint, and a deleveraging of the balance sheet would enable growth in steel making,” says Ritesh Shah of Investec.

“We are optimistic that we will continue to maintain our strong momentum as we recover as a country from the Covid-19 pandemic. We expect demand to recover and increase with a more significant number of projects coming through. Our ability to consistently pare down our debt levels is a key element of our turnaround story,” sums up Jindal.