-

Shiv Ratan: carving out his food business

Packaging was essential to ensure a longer shelf life as compared to the paper and plastic bags used extensively during that period. Pouch packing, now very popular, was introduced by Shiv Ratan. Considerable time was spent in customising machines for which he even took a trip to Australia to determine how the machines could be adapted for making bhujias. Besides the production of bhujias it was also necessary to set up packaging lines to ensure quality and hygienic packing. “We were the first in Bikaner to have packaging machines,” the founder says proudly, reminiscing about his early days. Currently, the company has 2,000 employees.

Building blocks for converting to organised sector

Operating in a largely unorganised sector, Shiv Ratan’s motto was simple: ‘To scale up fast, without compromising on quality, come what may’. Shivdeep, which was till then selling its products under Haldiram’s brand, decided on its own brand to differentiate the products made by the brothers and cousins in Delhi, West Bengal and Nagpur. Shiv Ratan chose the name of the founder of Bikaner – Bika – and added ‘ji’ as a mark of respect.

The firm, which sold Haldiram branded products till 1993, was converted into a limited company in 1995 and was also renamed Bikaji Foods International Ltd. The packaged food of the firm found a good market outside Rajasthan, in the North-East and Bihar. “We knew the local taste of the people of different regions and refined our products to meet their tastes,” says Shiv Ratan, 69, who even today diligently attends one of his three factories daily, without fail. His wife and Deepak’s wife also help in running the business. So, different types of bhujias are marketed to cater to different palates.

From bhujias to other namkeen foods was a natural extension. Today, ethnic snacks form around 75 per cent of the turnover, Bikaner, being in a cow belt, has an abundant supply of milk and they therefore made milk-based sweets like rasgoola, gulab jamun, rasbahari, soan papdi, amongst others. Bikaner is also famous for papads and Shiv Ratan, who believes in women empowerment, ensured papads were made by women within the locality.

-

Bikaner, being in a cow belt, has an abundant supply of milk and they therefore made milk-based sweets

To ensure quality, a batch of dough mixed with different spices was prepared and given to the women folk who came with the dried papads the very next day. Currently nearly 5,000 women are engaged in making papads for Bikaji, ensuring its emergence as one of the biggest papad makers. Papads form 8 per cent of its total turnover. Sweets account for 12 per cent. Ethnic snacks are the major contributor, accounting for three-fourths of the turnover. Western snacks form the balance.

From a one-man enterprise in the late '80s, Bikaji has grown, manufacturing several ethnic savouries, papads and sweets, with sales in Rajasthan reduced to 60 per cent of the turnover. The turnover has gone up from Rs6 crore in FY92 to Rs1,074 crore in FY20. From a city-specific brand to a regional brand, Bikaji is now rapidly expanding to become a well-known national and international brand. Shiv Ratan’s son Deepak, 39, formally joined the company in 2001. He is executive director and CEO and holds a post-graduate degree from SP Jain & Research Institute in family management. He has, over the last two decades, taken charge of the expansion of the market and diversification of the product portfolio.

Deepak Agarwal believes: “Our biggest differentiator is our quality. Despite an increase in raw materials which include lentils, spices, oil and milk in the case of sweets, we have not comprised on quality in any way. Our products, marketed in small packets, are affordably priced and, catering to regional tastes, have done well in the markets with consumers looking to buy branded packaged products.” This was one reason why even during the Covid-19 pandemic, sales of packaged foods have gone up on an average by 25 per cent during April-August. Deepak, who believes that real ethnic snacks are all fried, has been responsible for taking brand Bikaji to nearly 40 countries. Exports contribute to around Rs50 crore.

-

Deepak: taking brand Bikaji global

Deepak was also responsible for launching two eating joints, Bikaji Junxon, in Mumbai and Thane, and starting a heritage hotel in Bikaner. He is making forays in western snacks like chips and extruded snacks, frozen food as also ready-to-eat foods. Deepak, who travels frequently to interact with his stockists and distributors, also participates in food exhibitions.

Marwari acumen in managing finance

Like all Marwari family-run enterprises, where managing finance comes naturally, Bikaji has managed its finance well. The capital expenses, including the three factories set up in Bikaner, have mainly been funded through internal accruals. Save for a very few stockists, most of the material sent is on a cash on delivery basis. Brickwork has given the company, which has long-term debts of Rs129 crore and short-term debts of R20 crore (funded and non-funded), a BWR AA-stable rating.

Rationalising its rating, it says: ‘Rating draws its strength from experienced promoters, brands, consistent improvement in turnover, infusion of equity in FY19 and healthy turnover. Of the total sanction debt, the usage was well below the maximum limits and by July 2020 virtually all debt has been paid off.’ “Effectively we are a debt-free company,” says Rishabh Jain, vice-president, finance.

Getting private equity in the business, in FY14 was another turning point in the history of the company. Lighthouse Fund took a 12.5 per cent stake for Rs90 crore. Sachin Bhartiya, the face of Lighthouse Fund, who has been on the board of directors, has helped the company take a further leap of faith. Says Deepak: “Bhartiya has a global perspective and has helped in furthering our vision. He had brought good practices into the business. Bhartiya was also instrumental in roping in Amitabh Bachchan as the brand ambassador.”

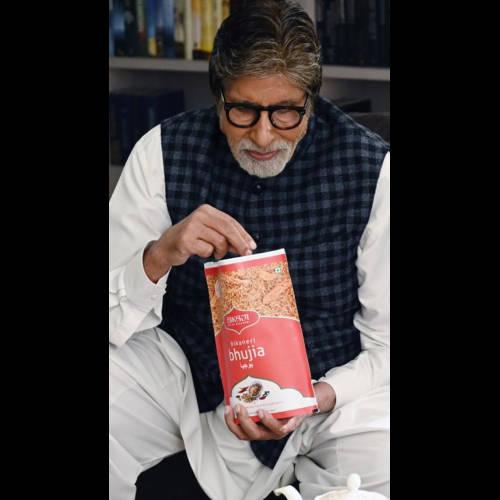

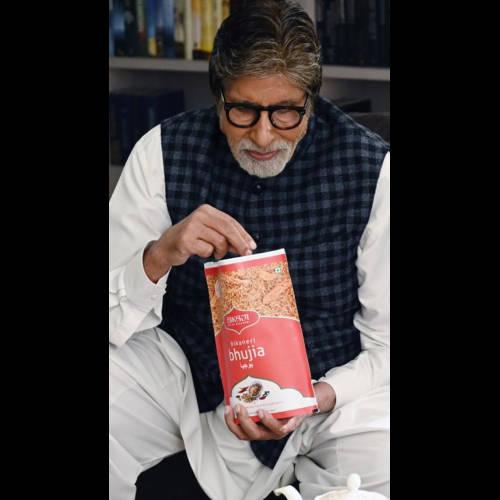

-

Bikaji's brand ambassador Amitabh Bachchan

Earlier, he had done a similar exercise for another of his investee companies, Dhanuka Agritech, where the celebrity ambassador had helped the company grow its market cap multiple times from Rs300 crore to Rs4,500 crore. While there may not be a direct correlation between having a celebrity endorsement and volume growth, the fact is that it does make a discernible change in the perception of the brand. Distributors and other channel partners do look at the brand with a sense of pride. Bhartiya claims: “The promoters’ obsession with maintaining quality and the unquenching quest for growth made us invest money in this company.” His dream is to see the company become a truly pan-India one.

Expansion moves

A dream shared by Deepak too. He feels that the way ahead is to ensure Bikaji becomes a true pan-India brand. He has already started making forays into frozen foods, Western snacks and ready-to-eat food packages. The capacity has expanded to 480 mt per day from the earlier 380 mt per day. A contract manufacturing unit has been set up in Kolkata for manufacturing chips and western snacks as well as modern snacks like corn rings and lentil chips. New facilities are also being planned in the eastern and southern regions. Inorganic growth is also being planned, confides an insider.

“Most of the foreseeable capex will be done through internal cash generation,” says Rishabh Jain. In any case, with a net worth exceeding Rs550 crore and cash generation of Rs175 crore, there is enough scope to fund new projects. Borrowing is also an option. With promoters still holding 80 per cent equity, even a small dilution through IPO or through sale to another private equity firm will give it the necessary finances to fund projects. At an estimated valuation of Rs5,000 crore even a 10 per cent dilution will get Rs500 crore for the company.

The company has a well-established brand and vision to become a truly pan-India player. The new product lines will also enable it to improve profit margins. Production in different states will also give it the flexibility to make swift changes in its product portfolio. For investors, it is definitely a company worth watching. ♦