-

Mehta: well-prepared for the next growth phase

In the mining chemical business, with a total installed capacity of 486,900 tpa, the company is the largest TAN producer in India, with a leading market share of 42 per cent. It caters to sectors like explosives, mining, infrastructure and healthcare and is the only producer of solid grade of TAN (low density ammonium nitrite or LDAN and high density ammonium nitrite or HDAN) in India. The company is the only producer of explosive grade ammonium nitrate solids in India and also makes medical grade ammonium nitrate, widely used in the production of medical grade nitrous oxide for use as an anaesthetic/analgesic. DFPCL is ranked amongst the top five producers of TAN in the world, catering to international markets such as the Middle East, Africa, Australia and South East Asia.

Backed by 2,000-odd employees, it has earmarked a major capex programme across its businesses to maintain its leadership position in the market. The company is looking to further carry out expansion across its multiple capacities, located in Taloja, Maharashtra; Dahej, Gujarat; Panipat, Haryana; and Srikakulam, Andhra Pradesh. It is also going in for major backward integration to ensure consistent supply of its key raw material like ammonia. Apart from catering to agriculture, pharmaceuticals, mining, chemicals and infrastructure sectors in India, its products are also exported to 29 countries across six continents.

The whole process of transition started when the company management appointed the global consulting firm McKinsey & Co in September 2016, which put up a comprehensive roadmap for the way forward. The consulting firm enumerated multiple measures towards the company’s transformation journey, and it was decided that it couldn’t remain a mere commodity player in the changing marketplace.

Adding value to businesses

Instead, to sustain its leadership and improve its overall margins, it was decided the company would have to move up in the value chain with specialty products. Moreover, it was also felt that it would have to proactively offer closure to its consumers not just with products but with the solutions that can add value to businesses in a consistent manner. With these measures getting implemented in the last three to four years, the company is now gradually reaping the benefits of this change.

“We have commenced our transformation journey on a positive note,” affirms Sailesh Mehta, 60, chairman & managing director, DFPCL. “In the last few years, we have taken multiple measures to prepare ourselves for the next growth phase. As a company, we are almost there and are now prepared to carry out the necessary changes that will take us to where we want to see ourselves in the next decade or so. While we have undertaken a whole lot of structural changes within our organisation, with new systems and processes in place, our offerings are today more differentiated and aimed at providing a distinct value proposition to our consumers.”

Under its changed approach, DFPCL has reworked its strategy and the overall business model and has shifted its approach from merely manufacturing products to providing end-to-end solutions to its consumers. It has tried to move up the value chain, offering more speciality products rather than just being in the commodity space. While doing so, the company has brought about desired changes within the organisational structure as well and as a result it is now looking more efficient and agile. It has also adopted an array of new initiatives, including new-age technologies and processes.

-

From commodities to speciality: launching NPK fertilisers under Smartek brand

In most of its businesses, the company has moved up the value chain with differentiated products, offering closure to consumers with not just products but solutions too. The objective has been to not only expand the business, but also do so in a more profitable manner and, hence, to face the competition in a more effective manner.

To enable this shift, McKinsey suggested a corporate rejig, following which the company’s fertiliser and TAN businesses have been moved into a separate entity called Smartchem Technologies Ltd, a wholly-owned subsidiary of DFPCL. The two businesses have been housed under a single entity, since they have common raw material requirements and select manufacturing processes. The parent company continues to house the remaining businesses, (industrial chemicals and real estate) in Pune where it owns a lifestyle retail centre called Creaticity (formerly Ishanya).

Separating the business under two entities has helped in sharpening the focus of each vertical. The new structure has also helped DFPCL rope in a strategic investor. Endorsing its transformation journey towards creating a robust business model, International Finance Corporation (IFC), the private-sector investment arm of the World Bank, recently invested $60 million in DFPCL in the form of foreign currency convertible bonds (FCCBs) and compulsory convertible debentures (CCDs). The company has also successfully raised Rs178 crore through a rights issue (oversubscribed) in October 2020 from existing and new institutional shareholders.

“Our partnership with the International Finance Corporation, a member of the World Bank Group, is a strong endorsement of our strategic direction,” observes Mehta. “We will continue our business transformation, from products to solutions, and from commodities to brands.”

The company’s credit rating has also been reaffirmed by ICRA at A+ stable for long-term bank facilities and at A1 for short-term bank facilities. The net debt of the company has declined from sR2,665 crore at the end of March 2020 to Rs1,826 crore in Marcg 2021. As a result, the net debt-to-equity ratio improved considerably from 1.20x to 0.65x.

Positive results

“The ratings continue to take into account the company’s diversified business product portfolio, comprising fertilisers and industrial chemicals, and the strong market position it holds in the industrial chemicals business, with leadership in TAN, nitric acid and IPA,” says the ICRA report. “The ratings also factor in the company’s high financial flexibility, as is evident from the competitive cost of debt and healthy refinancing ability demonstrated in the past. The company has reduced its short-term borrowings in the current fiscal by reducing its trading business in chemicals, which was capital-intensive. The stable outlook takes into account its established position in both the chemicals and fertilisers segments and the stable demand outlook for both the sectors in the long term.”

With all this, the company’s transformation journey is showing positive results. In the fertiliser business, there has already been a significant turnaround. In line with the strategy to move from commodity to speciality, value-added and innovative products, the company has introduced ‘enhanced efficiency’ NPK fertilisers under the ‘Smartek’ brand. It is promoting sulphur, an essential nutrient for crop productivity, through Bensulf, which comprises 90 per cent sulphur. The company also focusses on growing high-margin, crop-specific, water soluble fertilisers. It recently launched a crop-specific water-soluble product, addressed to the crop needs of grapes, tomato and sugarcane.

-

Pursuing its strategy-to-execution journey and to come closer to the farming community, the company has created a strong team of 300-odd agriculture graduates, who are constantly in touch with farmers, helping them with the right prescriptions and solutions. Towards this end, it has rolled out more than 25,000 demonstration plots for different crops across geographies, even as the marketing team has connected with more than 2.5 million farmers and over 4,000 focussed retailers, strengthening communication and conviction around an improved farm yield of 12-15 per cent.

DPPCL has made similar attempts to bring in the desired vibrancy in other businesses as well. In the case of TAN, the company is increasingly connecting with end customers directly and introducing new value-added products. Besides, it has recently introduced on-the-ground services for the delivery of explosives to mine sites. The company’s strategic tie-ups to provide value-added products, deeper associations with the growing private coal mining segment and down-the-hole (DTH) last mile delivery systems have commenced in earnest.

The company, in its TAN business, has established long-term partnerships with key customers like Coal India, Adani, Tata steel, Balco, and Hindustan Zinc, ACC, UltraTech and Ambuja Cement in the mining and cement sector. It also supplies TAN to explosives makers like Solar Industries, IDL, GOCL and Salvo Explosives. Following the Covid-19 outbreak, it swiftly commenced IPA supplies to hand sanitiser manufacturers, besides launching its own brand of hand sanitisers, IPA wipes and rubbing alcohol.

In nitric acid, Deepak Nitrite, Aarti Industries, Kutch Chemical Industries, Ordnance Factory Board, Jindal Steel, Rudraksh Chemicals and Nuclear Fuel Complex are some of DFPCL’s key customers. Similarly, Dr Reddy’s Laboratories, Aurobindo Pharma, Mylan Laboratories, Hetero Drugs, Divis Laboratories and Asian Paints are its main consumers for IPA.

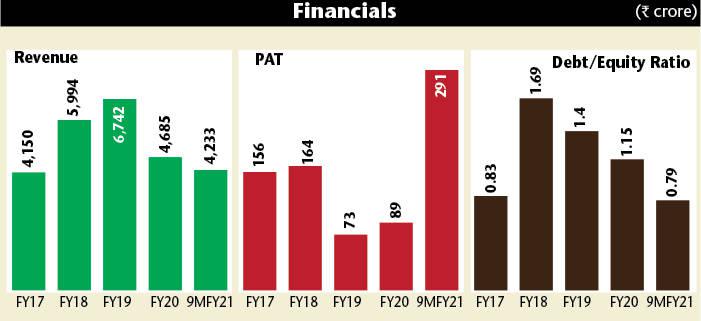

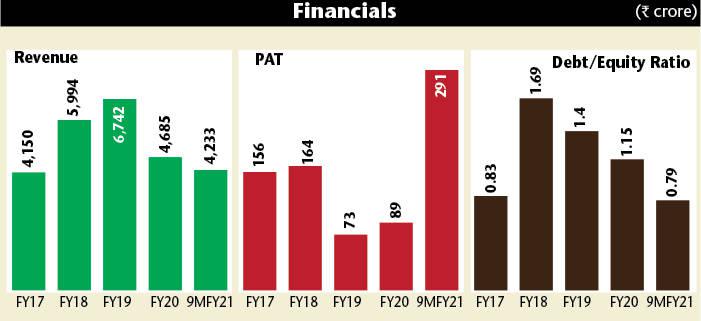

The company recently recorded one of its best performances, despite various challenges imposed by Covid-19. During 2020-21, the revenue grew 24 per cent to Rs5,808 crore. Most importantly, the company’s net profit surged 357 per cent to Rs406 crore (the highest ever profit achieved by the company since inception), and net profit margins grew from 1.9 per cent to 7.0 per cent. The Board has recommended the highest ever dividend rate of 75 per cent (FY20: 30 per cent).

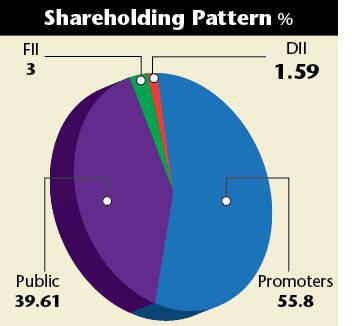

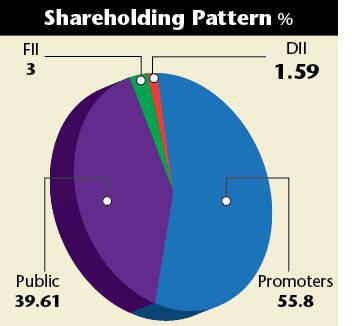

The company’s stock has also responded quite favourably. The stock price moved from about Rs78 on 28 May 2020 to Rs309 on 28 May 2021. Meanwhile, the promoters have increased their holding up from 51.50 per cent in March 2019 to 55.80 per cent in March 2021.

“Despite the Covid-related challenges, we have made a major turnaround in most of our businesses and that is something now strongly reflected in our financials,” says Amitabh Bhargava, president & CFO, DFPCL. “While our topline has improved, we have also recorded a massive surge in our profitability. This definitely validates our efforts and initiatives towards the transformational journey we have commenced.”

Ramping up capacities

As part of this entire shift, DFPCL is ramping up its capacities across various products and solutions to gain the desired scale, while also strengthening its raw material sourcing. Apart from diversifying raw material sourcing, the company is also undertaking backward integration, where it is significantly expanding its in-house assets for the production of its key raw material – ammonia. It is also trying to debottleneck the existing capacities across its product portfolio.

-

The Ammonia plant will meet the company's raw material needs

In fertilisers, the company carried out a capex of R800 crore to set up a 600,000-tpa greenfield facility (commercial production started in February 2017) for multiple grade NPK (nitrogen phosphorus potassium) fertilisers at Taloja, Raigad, Maharashtra. In Taloja, the company already has a production capacity of 300,000 tpa of nitro phosphate fertilisers at its existing NP plant. Going ahead, it also plans to put up another 200,000-tpa NPK facility at Taloja. With all this, its total fertiliser capacity (crop nutrition business) now stands at 957,000 tpa, which also includes a combined 57,000 tpa capacity (Taloja & Panipat) of bentonite sulphur, which meets the plant’s sulphur requirements.

In another significant capex programme, DFPCL started the commercial production of its nitric acid complex at Dahej, Gujarat, in April 2019. The new facility, which has come up at a project cost of about R550 crore, has a capacity of about 92,000 tpa for concentrated nitric acid and about 148,000 tpa for diluted nitric acid. With this newly-built capacity at Dahej now running at over 90 per cent capacity utilisation (despite teething troubles initially), DFPCL has now emerged as the second largest manufacturer of nitric acid in Asia. The company has the largest integrated nitric acid plants, with a combined capacity of about 1.11 million tpa at Taloja (Maharashtra), Dahej (Gujarat) and Srikakulam (AP). With this expansion, the company, the largest player in the space, has increased its market share in concentrated nitric acid to over 70 per cent now, while also making its foray into the Gujarat region (one of the largest chemical belts in the country). It serves customers in the north and east of India too.

DFPCL has also planned a major capex of about Rs3,000-4,000 crore, putting up a greenfield project in Taloja for the production of ammonia (capacity: 500,000 tpa), its key raw material. The ammonia capacity, which is likely to be commercialised in the next 24 months, will add substantially to its existing Taloja capacity of 128,700 tpa and will help the company in adequately managing its raw material supplies.

Scripting a success story

On the raw material side, to ensure adequate and consistent supply, the company has also diversified the sourcing of its other key raw material – phosphoric acid – for fertilisers. A couple of years ago, it had faced severe disruption in fertiliser production as its only supplier of phosphoric acid had production-related issues.

The company has also earmarked a new TAN capacity of 376,000 tpa in Gopalpur, Odisha. Estimated to cost about Rs1,800 crore, the project is likely to roll out in the next 24-36 months and will further strengthen its leadership position in the TAN market, where it already has an installed capacity of 486,900 tpa at its Taloja complex.

“With all these activities and initiatives in place, we are in the process of scripting a major success story for ourselves,” says Mehta. “We started the whole process some time back, to be closer to our consumers across our various verticals and to add value to our consumers’ businesses. We are consciously trying to get into high-value products and solutions, which will not only help sustain our leadership, but also do so in a more profitable manner. All these measures and efforts have started bearing fruit for us now. Last year, despite challenges, we pulled off one of our best performances; now, the momentum will be maintained, going ahead as well.” He believes that, in the company’s transformation shift, all its sectors now seem to be nicely aligned with the country’s growth story.

-

Mehta joined his father’s company in 1991 and took over as its managing director in 2002. He was appointed vice-chairman in 2005 and was elevated to chairman in October 2012. His son Yeshil, 34, holds a master’s degree from Harvard Business School, while his daughter, Rajvee, 30, has a master’s degree from the London Business School. Both of them are deeply entrenched in the company’s transformative journey.

“Our fertiliser business is well-aligned with the mid-income group growth in foods and vegetables, horticulture and crop requirements,” explains Mehta. “Our industrial chemicals are connected with the country’s pharmaceuticals and fine chemicals sectors and, now, the hygiene need for hand sanitisers. Our mining chemicals are also aligned with the country’s need for power (for which it needs coal) or cement (which needs limestone) or infrastructure for roads. One key thing we are seeing at the macro level is that the DFPCL businesses have beautifully linked to the country’s growth story, even as macro-economic factors are getting more favourable.”

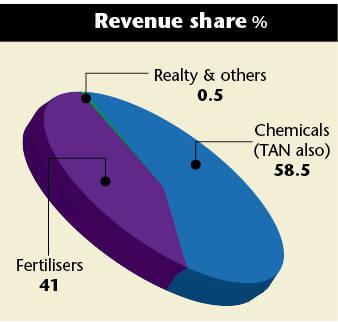

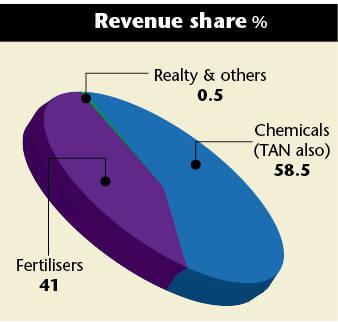

Mehta feels the current product mix of the company is more balanced, with a significant portion of the revenue coming from the chemical business, while less than 30 per cent is from the fertiliser segment. With the company’s business well-linked to the segments it caters to, DFPCL should derive the desired traction, going ahead. Further, the company enjoys enough headroom since its newly-implemented capacities are yet to achieve the optimal capacity utilisation levels.

At the micro level, the company’s move to ramp up capacities, as also its efforts to derive more value propositions from the existing businesses by moving closer to consumers and actively participating in their business models, have given DFPCL exceptional results. “The most critical one is that our strategic drive from customers to consumers and climbing up the value chain from products to solutions is really bearing fruit now and all this going to fundamentally give us positive traction,” says the DFPCL chief.

As part of the whole transformation process, while the company, a well-diversified ammonia downstream player, is now well-aligned to the country’s growth story, serving critical sectors of the economy, such as agriculture, pharmaceuticals, mining, infrastructure and health & hygiene, it is also addressing the emerging needs of markets through differentiated value-added consumer-centric products and innovative solutions on the micro front.

In the crop nutrition business, the company has undertaken a major shift and, instead of focussing on products, it has started concentrating on a crop-specific strategy. There has been a significant turnaround in the entire fertiliser business. In line with its strategy to move away from commodities to speciality, value-added and innovative products, it had introduced ‘enhanced efficiency’ NPK fertilisers under the brand name ‘Smartek’, which is a unique product, established by the proprietary manufacturing process of the company.

It enhances nutrient bio-availability and efficiency, as also crop performance through profuse root growth, increases plant height, number of branches, number of fruit and yield, etc, which results in a 10-15 per cent increase in the yield and increased farmer income. It has also established its value proposition across various focus crops. The company is promoting sulphur, an essential nutrient for crop productivity, through Bensulf, which comprises 90 per cent sulphur.

-

Change initiatives

DFPCL has one of the largest manufacturing capacities of Bensulf in India and is a market leader in this product. The company recently introduced a differentiated Bensulf product called ‘Bensulf Super Fast’, which was developed within the company. It also focusses on growing high margin crop-specific, water-soluble fertilisers.

The company’s team of agriculture graduates has supported the strategy-to-execution journey, from the commodity NPK fertilisers being sold to dealers, to the crop-specific and value-added NPK fertilisers being marketed to farmers. Towards this end, it has carried out a huge basket of change initiatives, encompassing organisational structure, manufacturing processes, applied R&D, channel reselection, farmer-focused marketing as well as the systems and processes to monitor these initiatives.

“Our CNB business has made a remarkable turnaround,” acknowledges Bhargava. “Even as the overall market remained subdued, the company has remained focussed on demand generation. The fertiliser segment has continued its strong performance for the sixth consecutive quarter, led by higher sales volumes and supported by good rains in the core command area and demand for the recently launched Superfast Bensulf. Overall, the margins have improved significantly due to high proportions of differentiated Smartek NPK in our product mix.”

“Similarly, for our TAN project, we are focussing on our customers’ industrial explosives firms,” says Mehta. “We have now begun to strongly focus on the mines level; so this strategic drive is certainly something that has helped. Besides, we have increased cost efficiencies, introduced system controls digitalisation and each of these now reflect into better tracking and much better cost optimisation.”

The production facilities for TAN are located at Taloja and Srikakulam. The company caters to the mining, infrastructure and pharmaceutical sectors under the brand names of Optiform/Vertex Norma (HDAN), Optimex/Vertex Super (LDAN), Optispan/Vertex Supreme (medical grade), strengthening recall and customer loyalty. Through the strategic proximity of 10 warehouses at key mining regions, it also provides ready material availability, low delivery turnaround time and a low delivered cost.

The company’s strategically-located plants near key mining operations and customers, have built on its unique position in the LDAN segment with customer transformation initiatives to drive the market from conventional explosives to ammonium nitrate fuel oil (ANFO).

-

“We believe that DFPCL is at the cusp of a major re-rating story, given the strong outlook for its chemical products business. NPK and differentiated NPK (branded as Smartek) will be the drivers in the near term, led by price realisation and volume growth. Fresh capex will ramp up its leadership TAN business capacity by over 75 per cent and thus should cater to medium to long term growth,” says a Ventura Securities report.

DFPCL has now positioned itself well in the market. It has so far carried out its transformational journey efficiently and appears to be sustaining its leadership position across its product portfolio. With consistently improving business performance from its industrial chemical and fertiliser segments, the company now has a relatively balanced product portfolio mix.

While DFPCL has carried out the changes to move up in the value chain with differentiated products, it has also proactively tried to move closer to its customers who are now more discerning and demanding in nature. To achieve scale and leverage the same, the company has ramped up its capacities significantly. Besides, it is also getting into backward integration and setting up its own ammonia capacity – something that will help it manage its raw material supply in a more efficient manner, without being prone to the vagaries of external sources.

To effectively leverage the outcome of these initiatives, the company has carried out much needed structural changes within the organisation as well. Moreover, its ability to suitably modify its product mix in response to changes in market conditions partially mitigates the risks associated with cyclicality. With all these changes and measures, the company looks well prepared to commence its next growth phase in a more determined fashion.

-

A man with a mission

Sailesh Mehta, who joined the company in 1991 and became its managing director in 2002, getting elevated thereafter to the present position as chairman & managing director in 2012, normally keeps a low profile. An astute entrepreneur, Mehta, 60, came into the limelight, when DFPCL attempted to acquire MCFL in 013-14, buying a chunk of shares from another investor. MCIFL was a parrt of the beleaguered former liquor baron Vijay Mallya’s UB group.

But Mehta’s competitor, Zuari Fertilisers and Chemicals, part of the Kolkata-based Adventz group, held the upper hand in the fight for control of MCF. In the ensuing rounds of price war, Zuari, led by Saroj Poddar, who enjoyed Mallya’s support, finally outbid Mehta. Having lost the war, DFPCL sold off its entire 31.25 per cent holding in MCF by 2015.

Be it the failed takeover attempt, or the abruption in gas supply to his firm’s Taloja facility (a factor critical for DFPCL’s operations), Mehta has emerged stronger from each crisis. DFPCL’s fertiliser manufacturing operations had completely stalled at its Taloja plant between May 2014 and June 2015, following the Union government’s instructions to GAIL and Reliance Industries to stop the supply of domestic natural gas to the company, arguing that domestic cheap gas couldn’t be used for manufacturing non-subsidised fertilisers and crop nutrients. DFPCL had to move the High Court against this order. The company resumed production subsequently using imported re-gassified liquid natural gas (RLNG) as feedstock.

Even a single phase of adversity can spell an entrepreneur’s doom. Mehta had faced it in multitude. Earlier, in the 1990s, when the prices of non-urea fertilisers like NPK were decontrolled by the government, urea-based fertilisers continued to enjoy subsidy support, leading to soaring prices of NPK and a demand shift in favour of urea. Later another catastrophe struck, when, in 2005, DFPCL’s fertiliser manufacturing facility in Taloja was completely submerged in flood.

But each of these challenges only made Mehta stronger and more determined. His involvement with DFPCL extends to over three decades, since he first started work on the brand’s manufacturing operations, after studies in the US. He then spearheaded the expansion of the company from only an ammonia manufacturer to a multi-product market leader, with products spanning fertilisers, mining chemicals, petrochemicals and value-added real estate. Focus on growth and confidence in his business model prompted Mehta to embark now upon the next phase of growth journey with a whole lot of initiatives and measures.

-

DFPCL: fact file

The journey of DFPCL began in 1979, when the visionary Chimanlal K. Mehta founded the company, as an ammonia-making entity initially. A first generation entrepreneur from a Jain family in Gujarat, CKM had, in fact, started its entrepreneurial journey in the chemical business in 1970, when he founded Deepak Nitrite (the company and the group are celebrating their 50th anniversary this year). The Rs2,400-crore Deepak Nitrite, another listed entity, now run by Chimanlal’s oldest son Deepak, is today one of India's fastest-growing chemical intermediates companies with a diversified business of basic chemicals, fine & speciality and performance products. Chimanlal Mehta who is now the chairman emeritus, had drawn up a succession plan some time in 2003-04, through which Deepak was given Deepak Nitrite, while the youngest son Sailesh took charge of DFPCL. The second sibling Ajay was weaned away through a financial consideration.

Today, both the Deepak group, led by flagship Deepak Nitrite and its associate companies, and DFPCL are two separate entities. DFPCL is headed by Sailesh Mehta, whereas the Deepak group of companies/SBUs is headed by Deepak Mehta. Both companies are managed independently by distinct and separate management teams and stand as independent corporate entities, with no cross shareholdings or common directors.