-

Following stringent parameters for IKEA production

“BSL’s biggest strength is its presence in the entire value chain. Its distinctive strategy to become an IKEA partner paid off. The story would have been different for BSL without IKEA,” says Pankaj Singhania, Founder Lakewater Advisors, an equity research firm in Kolkata.

Over the last few years BSL slowly increased its business through efficiency, capacity enhancement and emphasis on new growth areas. The company is now foraying into cotton spinning for the first time. The greenfield project, expected to have a capacity of 6,000 tonnes per annum, will be commissioned at the company’s existing campus in Bhilwara next year at a cost of Rs100 crore. The project is primarily for export but also for the domestic market.

During the last five years, the country has seen a huge growth in cotton textiles. Justifying setting up the cotton spinning unit Nivedan explains: “China is the biggest cotton producer but post Covid, there is a psychological barrier with China. So, western buyers have shifted to India. This is helping the Indian market to excel in cotton yarn and fabric.” In 2020, the revenue share of cotton textiles was close to 40 per cent.

The story of BSL started in 1971, when NLJ Bhilwara Group partners, the late PN Churiwal and LN Jhunjhunwala had foreseen that the demand for polyester suiting would be on the rise. They decided to venture into fabric weaving from synthetic yarn and BSL was founded in the desert state of Rajasthan. “Initially BSL had started as pilot plant with eight indigenous shuttle looms. Subsequently, with the improved demand, we had grown the capacity to 50,000 metres per month,” remembers Arun Churiwal, son of P.N. Churiwal, who joined the company and was involved in its expansion.

High speed shuttle-less looms

In 1977, BSL’s processing unit was the first in Rajasthan with a capacity of 1.25 lakh metres per month. This helped the company to be cost competitive among its peers. Always inclined towards new technology, in 1980, the company imported eight high-speed shuttle-less looms from Switzerland, which increased production by three times. It was the first in Rajasthan to have a shuttle-less loom for synthetic weaving.

At that time, shuttle-looms were used for weaving. Only some large players in the cotton industry had shuttle-less looms. Progressively, Bhilwara emerged as a textile city. Mushrooms of organised and unorganised textile looms grew around the town, which today produces six-seven crore metres per month of fabric, including denim.

“We were the first company from India to participate as a synthetic producer in various international textile exhibitions. Many cotton yarn manufacturers from India taunted us for this,” claims Churiwal. “The first overseas order came from an exhibition and we did not look back thereafter.” Churiwal, 71, is the chairman of the company. Jhunjhunwala is still on the board of BSL, but the management control is with Churiwal’s family. Churiwal’s son, Nivedan, 46, is now the driving force of the company’s future.

-

The domestic textile and apparel market is estimated at $75 billion in FY21. It has dropped almost 30 per cent, from $105 billion in FY20. And the export market stood at $30 billion. The demand is now on the rise. The market is expected to recover and grow at 8-10 per cent CAGR to reach $190 billion by 2025-26.

Fabric manufacturers were unhappy with the GST structure of 12 per cent on yarn and only 5 per cent on fabric. As a result, fabric manufacturers pay more duty for buying yarn but collect only 5 per cent for making fabric from that yarn. “The finance ministry has confirmed it will rectify the structure from January next year,” Churiwal says.

BSL has now rolled out the future growth strategy of the company. Besides the cotton spinning unit, it also plans to focus on the domestic market and expand the furnishing business. “We will invest Rs125 crore towards this new growth strategy and also for some machinery upgradation,” says Jain.

BSL is expanding its domestic business with three brands. It has also introduced a new direct to retail premium brand – Geoffrey Hammonds Insignia, which has a range of suits and trousers. The existing two brands – Geoffrey Hammonds and BSL – are also being revamped.

The company has set a target to double the dealer base pan-India from 75 to 150 and will increase retailer base to 2,000 from 800 within next one year. Typically for BSL, the south and west markets are strong. The management’s vision is to have a uniform share across India. Bengaluru based BSL dealer, Vim Tex has been associated with the company for the last 35 years. Dhiraj Lunawat, the owner of the dealership, says: “BSL is a reputed brand in the mass product category. It is a quality driven company. The management is transparent and always reachable to solve any issues which may arise with the dealerships.”

“During the last seven to eight years, the furnishing business has been the growth driver for us. The IKEA tag opened doors for us in general exports. Both will help us to grow,” Nivedan says. The company expects the furnishing business, which contributes 25 per cent of its turnover, to double over the next two to three years.

BSL is also launching home textile made-ups such as ready curtains, towels, bed linen, etc and this will focus on the e-commerce and large format stores on a pan-India basis. “The market size for this segment is about Rs40,000 crore and has been growing 8-10 per cent,” says Sanan who is now project consultant for BSL.

“BSL was a pioneer in India’s textile evolution. Bhilwara town is known globally because of BSL. It has a good management team which focuses on quality. The company has created a large integrated facility and that will make the difference in the future,” says S.N. Modai, managing director & CEO of Sangam Group, a large PV yarn and fabric manufacturer in Bhilwara.

Exports continue to be the major revenue earner of the company. “In the suiting export market, we are one of the largest players,” claims Nivedan. The market cap of BSL is Rs97 crore with the current share price at Rs94.25. The company exports its products to over 60 countries. The biggest are Latin America, Middle East and North America.

-

During the last seven to eight years, the furnishing business has been the growth driver for us. The IKEA tag opened doors for us in general exports

“All our capex will be funded through internal generation and bank loans,” says Jain. BSL reported annual gross sales of Rs321.42 crore in March 2021 as against Rs390.04 crore in March 2020. The profit after tax was Rs1.36 crore in 2021 as against Rs1.66 crore in March 2020. The dip in revenue and profit is a reflection of the Covid pandemic.

For the six months ended September 2021, the company clocked a revenue of Rs202.80 crore as against Rs140.98 crore in the six months ended September 2020. The net profit reported was Rs6.41 crore in September 2021 as against Rs (-) 3.29 in September 2020.

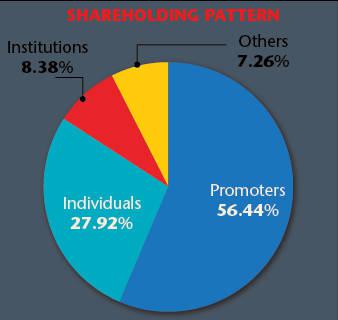

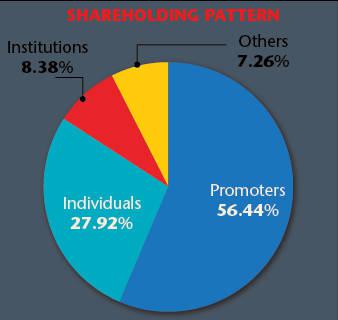

“Our business grew across all our segments both in the domestic and export markets and we have delivered good results in the first six months of this year. We are confident of presenting a credible report card in the coming years,” says Nivedan. The promoter holds 56.44 per cent of the company; 27.92 per cent is held by individuals; institutions have 8.38 per cent and the rest (7.26 per cent) is with others.

Product innovation and aggressive marketing are the key factors in the segment to stay ahead of the competition. BSL has set a target of achieving a turnover of Rs700 crore in the next two years.

-

Exports contribute 60 per cent of the company’s revenues

Friends, forever

That LN Jhunjhunwala and the late PN Churiwal shared a close friendship is well known in the textile industry. It all began in Maheswari Vidyalaya School near Burrabazar in Calcutta where both were classmates in the 1930s. Later in life, they got involved in their respective businesses. Churiwal was into the rice mill and pesticides business, while Jhunjhunwala was involved in jute trading. In 1961, Jhunjhunwala moved to Rajasthan and set up the LNJ Group’s first yarn (cotton) unit called RSWM Limited, later adding polyester yarn.

When the polyester market started growing the duo teamed up in 1971 and started BSL Limited (Formerly Bhilwara Synthetic Limited) which would manufacture poly viscose fabric. Churiwal’s son, Arun and later his grandson Nivedan also joined the business.

The relationship between Jhunjhunwala and Churiwal’s family strengthened further. Both families would routinely travel together for holidays in India and overseas. P.N. Churiwal’s death in 2006 was an emotional setback for Jhunjhunwala, now 93. “After my father’s demise, Jhunjhunwala has not been for a holiday, these past 15 years,” recalls Arun Churiwal.

Over the years, the NLJ Bhilwara group, which started as a textile group, diversified into graphite electrodes, power, IT services and skill development. Both Churiwals and Jhunjhunwalas are on each other’s boards. The group companies have been informally separated. While the BSL management is with the Churiwals, the rest is with the Jhunjhunwalas.