-

Nath: adding wings to U GRO

However, some observers who have monitored the rise and fall of Religare in the past feel that even as Nath had played a major role in the growth in the business of the company, he may have acted quite late. But then, the kind of financial backing he got in creating a new entity almost from scratch and has brought it to the current functional state is reflective of the fact that the market continued to see him in positive light.

“He has been a smart professional, no doubt about it. Despite Religare fiasco, a bunch of noted investors have backed him and that is quite credible. And his new venture seems to be on a roll as it is now part of big banks and government agencies’ lending system,” says a credit industry veteran requesting not to be named.

Incidentally, last year U GRO had made an attempt to buy out Religare’s NBFC division (it is waiting for clearance of its debt restructuring plan to resume lending exercise again) making a bid to the board currently entrusted with the responsibility of reviving the company (See ‘Rising from the ashes,’ Business India, 6 September, 2021). But it did not work out. According to an official currently part of Religare core team, it did not fructify because the board decided not to hand over the reins of the unit to a former employee who was present when the rot had begun setting in.

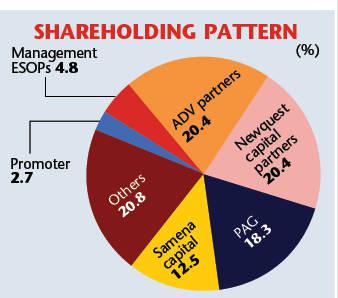

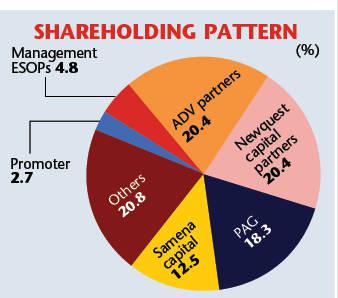

But away from Religare, Nath, as his peers broadly testify, has created a show which is holding promises galore in a fast growing environment. And this is not typically of a start-up mould where cash burning is inevitable to swiftly gain scale. Nath had raised around Rs950 crore from global private equity funds such as NewQuest, ADV Partners, and others and bought an enlisted NBFC Chokhani Securities which was re-branded as U GRO in a new avatar.

“We had bought it for Rs48 crore and has developed it as a platform that’s driven by the combination of knowledge and technology,” explains Nath, who is spearheading the ship as Executive Chairman and MD with a small stake of around 2.7 per cent (see Shareholding Pattern). He has, however, cobbled up a team of industry veterans both at the functional as well as board level.

“Like the consumer segment, MSMEs credit too will offer a staggering opportunity to the new lenders in the coming years,” points out A M Karthik, VP and Sector Head (Financial Sector Ratings), ICRA. He adds that the leaders in the game will be determined by their ability to scale up, mostly on the basis of their technology base. And this is what U GRO seems to be getting ready for in order to make a larger splash in the segment in the coming years.

Technological base

The platform has been built on the principals of OCEN (Open Credit Enablement Network) that promises to put in place a set of protocols leading to credit democratisation. The platform is also using what is popularly known as account aggregation (AA) model and in a cumulative sense, these systems are capable of changing the composition of the lending business by promoting embedded credit, buy now/pay later and flow based credit system.

“Technology underpins every aspect of U GRO’s lending process, from API integrations, machine learning, OCR technology, scorecards and rule engine, automated policy approvals, disbursals and repayments. All of this culminates in the delivery of an industry first 60 minute in-principle decisioning process to the customer based on complex cash flow modelling,” points out Rishab Garg, Chief Technology Officer of the company.

-

The difference this high end technological application can make is best reflected in the GeM (government e-marketplace)-Sahay programme, the first use case of OCEN, where U GRO Capital is providing purchase order financing to small enterprises across nearly 130 locations. The process takes only a few minutes and does not require any physical interface with the customer.

“When the MSME credit offtake reaches to a matured stage, raising credit on the basis of work-orders would be a normal practice for the smaller enterprises. But it is an exception now and we are in the forefront of changing the scene,” Nath says.

A salient feature of its technological architecture is data tripod system which is used for judging the credit worthiness of the loan seekers based on his GST statement, bank statement and bureau statement analysis. “Since inception, U Gro has used statistical predictive modelling as a core element of underwriting, and currently uses the second-generation model Gro Score 2.0. The best way to understand every MSME is through the combination of bureau, banking, and GST; our strong analytics expertise helps unlock deep insights from this data and use it to drive product innovation for the full spectrum of MSMEs,” points out Subrata Das, Chief Innovation Officer.

Structural highlights

While superior technological architecture is one element of its operations, another critical component of the three-year-old entity is its decision to keep its operations restricted to specific domains rather than taking a shot at everything that is the part of the gigantic MSMEs universe. According to Nath, the company had shortlisted these sectors on the basis of extensive study of macro and micro economic parameters carried out in conjunction with market experts like CRISIL. “We choose sectors on the basis of parameters like regulatory certainty and their positioning in consumption economy. Furthermore, these sectors do not require large geographical penetration and at the same time, they are those banks that have not fully penetrated,” explains he.

With initially 180 businesses examined, the exercise was indeed extensive. This further drilled down to 20 sectors before eight were finally decided. These include – chemicals, education, auto component, health care, food processing/FMCG, light engineering, hospitality, and electrical equipment and components. And then these sectors have specific set of activities which U GRO management has agreed to finance at this stage.

For instance, its healthcare vertical has general nursing homes, eye clinics, dental clinics, diagnostic labs, radiology and pathology labs, and pharma retailers as the sub-sectors eligible to get credit from the company. “Such an approach helps as the demand trend is not uniform across all the sectors or even sub-sectors. For instance, even after Covid restrictions were lifted, we were not enthused to provide finance to banquet halls segment within the hospitality business,” Nath points out.

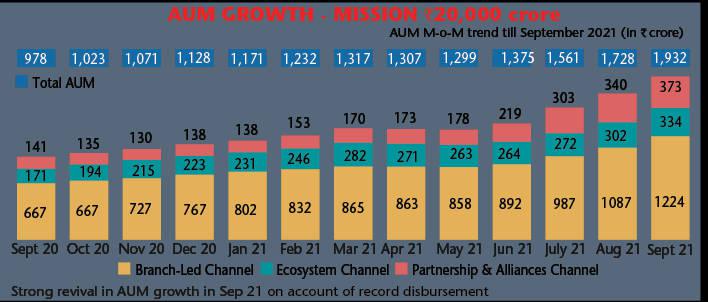

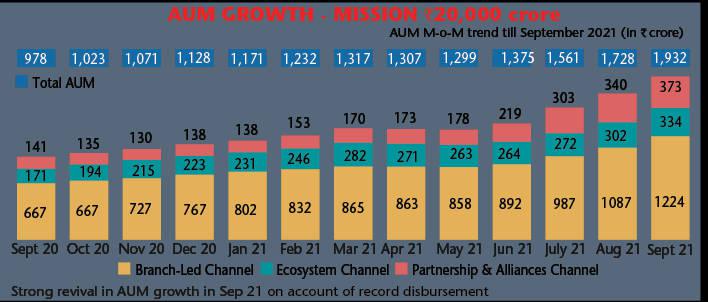

Closely integrated with this sectoral focus is the cluster approach. The company as a lending agency has embraced both online and offline capabilities to reach to its growing volume of customers with specific focus on certain geographical clusters right now (see graph) including Tier-II and III locations. It has four critical channel pillars to reach out to customers – branch-led channel (Gro Plus), ecosystem channel (gro-chain), partnership alliances (gro-xstream) and direct digital channel (gro-direct). Its branch-led channel is gradually developing an expansive portfolio with nearly 34 units in place now but is contributing to over 60 per cent of the company’s business.

-

Gupta: disbursal is hitting new high

“A large segment of Indian MSME market is still not digitised. It brings more confidence to both sides. Till time we have a track record of new bunch of credit seekers, offline units will have their significance,” Nath reasons. The gro-chain channels are for supply chain and machinery financing on secured basis. And its partnership with banks and NBFCs are probably the most strategic channel for its growth and its direct digital channel, slated to become operational in a full-fledged manner early next year, will allow MSMEs to directly apply for credit.

The credit offering is available in different packages called Pratham, Sanjeevani, Saathi and Gro Micro and ticket size varies from Rs1 lakh to Rs3 crore, mostly in secured form. A major element of its operation, however, is working in close association with big banks and other fintechs trying to make the most of co-lending opportunities which is now assuming a concrete shape in the financial market. “Last decade, NBFCs felt they can compete with banks. But now the trend is to align with them and become their co-lending partners. MSME is 70 per cent requirement of the priority sector lending of the banks and they can’t serve them directly. We can make a difference here,” Nath says.

“Co-lending is at a nascent stage. But these fintechs are playing an important role now acting as the bridge between big banks and under-served or un-served customers,” avers Karthik of ICRA. And U GRO seems to be taking this route to the hilt with partnerhip with three large banks – IDBI, SBI and Bank of Baroda. “When RBI had sanctioned Rs50,000 crore financing line for Covid affected businesses, we were the first NBFC which got credit line from three public sector banks to give loans under this scheme because they realised we have a special sector healthcare with nine sub-sectors – small nursing home, pharmacy etc,” says Nath.

U GRO additionally has 20 fintechs as part of its co-lending ecosystem. Only last week, ZipLoan, an RBI registered fintech firm announced onboarding its lending marketplace GRO X – Stream by committing R50 crore towards the programme. “The partnership is in sync with ZipLoan’s long-term growth strategy of strengthening its foothold in India’s growing fintech market by bolstering its leadership ranks. U GRO Capital has consistently been building an ecosystem of fintech players who can benefit from its API driven technology and data driven underwriting,” ZioLoan maintained in a formal communiqué.

Top gear projections

Having set up a base in the last three years and Corona triggered economic nervousness probably behind, the company is now envisaging putting its growth vehicle in top gear. And this would be much in alignment with strong tailwinds projected for the MSME credit market as a whole. In fact, the latest edition of the Sidbi – TransUnion Cibil MSME Pulse Report has underlined buoyancy returning in the market with lenders disbursing loans worth Rs9.5 lakh crore to micro, small and medium enterprises in FY21. This is substantially higher (40 per cent) than Rs6.8 lakh crore doled out in the form of credit in the previous year. The total credit exposure to MSMEs had stood at Rs20.21 lakh crore at the end of FY21.

“The key highlight which signals the revival is credit to new-to-bank (customers) which has returned back to pre-Covid levels, while credit to existing-to-bank (customers) remains buoyant. The recent additional relief measures by the government, especially in healthcare, travel and tourism, are expected to improve credit offtake in the MSME sector,” Sivasubramanian Ramann, CMD of Sidbi commented. The ECLGS (emergency credit line guarantee scheme) scheme of the government is believed to have made a big difference in turning the tides in credit offtake business for MSMEs.

There is an overall positive mood stakeholders broadly believe fintechs will increasingly becoming more prominent in the ecosystem. “I feel that at least 50 per cent of the loans under retail and MSME segments will move to the digital lending platforms, right from sourcing to documentation level, in two to three years,” Rajkiran Rai, managing director and CEO, Union Bank of India recently maintained while speaking in an industry seminar. And it’s a comment which has brought cheers in the new age lenders’ quarters.

“These businesses are the backbone of the Indian economy and need capital as they bounce back post Covid. We believe next three-four years will see a rapid growth in the MSME segment and we intend using a digital first approach to address their needs,” adds Kshitij Puri, Co-Founder and CEO, Ziploan.

-

And with these favourable equations in place, U GRO has now set for itself the target of over Rs20,000 crore of asset under management (AUM) by 2025 from the current base of around Rs2,000 crore. On this parameter, the company has seen a swift jump with AUM rising from Rs978 crore to Rs1,932 crore between September last year and this year. A similar trend is witnessed in the loan disbursement which has reached close to Rs300 crore monthly trajectory. “September 21 has been the best month for us with our disbursal figure touching Rs270 crore. We expect to hit Rs350 crore average monthly disbursal figure soon,” says Amit Gupta, CFO. The branch-led channel is driving its business (64 per cent share) with partnership model also showing signs of consistent ascendancy.

Its vision 2025 plan meanwhile contains specific milestones which include having one million customers as part of its MSME credit system and 1 per cent market share. It is eyeing to take up its branch numbers to 270, 45 intermediated branches from 9 currently and 225 micro-branches from the present count of 25. It is expecting also its disbursal numbers to grow by a healthy 68 per cent CAGR between 20-25 period and intends to develop its Go-Xstream as a robust marketplace for MSMEs lending.

On the financial front, the company is claiming to be in fine fettle earning small profit and income with the judicious use of its resources. Its income had stood at Rs153 crore with a profit before tax of over Rs12 crore. “We have been focusing on profitability since beginning and that is why our emphasis is on secured loans. We are leveraging on our balance sheet in 3.8x ratio and do not intend to exceed that. There is science behind our business model,” Gupta emphasises.

As per the company’s annual report, 73 per cent of the credit it has doled out till date is in the form of secured loans. “We are sufficiently funded for next 18-24 months. In 2023, we will need to generate another Rs1,000 crore to expand our operations in sync with our 2025 projections. Our ultimate aim is to become the country’s leading LaaS (lending as a service platform),” Nath adds. The statement certainly carries the promise of making U GRO’s own growth story more exciting.