-

Rawal: the solution is to correct the ground situation

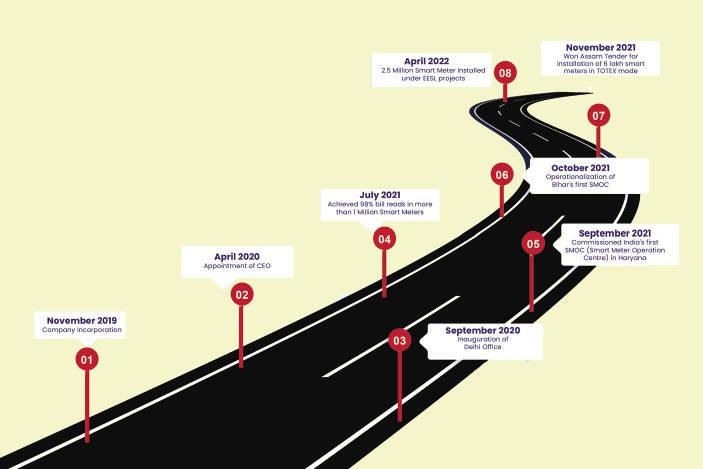

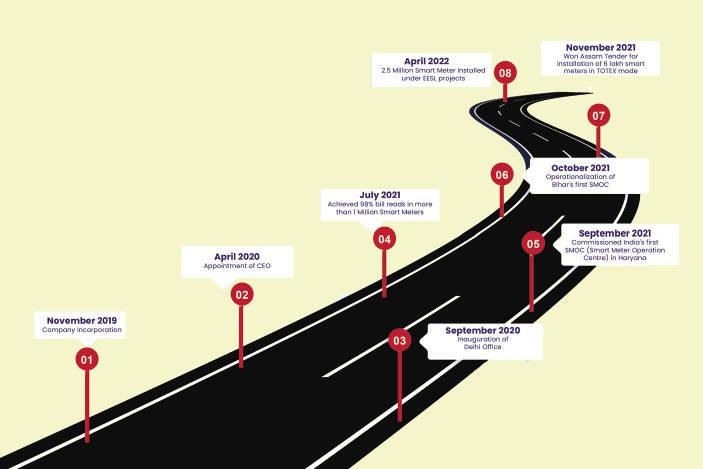

According to Rawal, IntelliSmart, since inception, has enabled the large-scale deployment of smart meters providing a range of services. These include installation, ownership, operation, meeting the SLAs (Service Level Agreements) during the contract period and transferring the entire AMI system to the discoms at the end of the tenure. The company claims to have significantly contributed by adopting the TOTEX model and the development of the Standard Bidding Document.

Under this model, the developer takes care of all expenses with discoms paying them back on the basis of their savings. “If the utility has to pay upfront, it becomes very costly for them because they don’t have money. Somebody can do this for them and once they start earning, they can pay it back. As a service provider, companies like IntelliSmart would take care of maintenance for an agreed period and then hand over to the utility. This is a holistic or pay as you save approach. This is the TOTEX model,” he elaborates.

IntelliSmart’s MD says that while spearheading a base of nearly 2.5 crore meters (EESL’s previous contracts plus IntelliSmart’s own combine) in half a dozen states in the country, the company, during its preliminary years, noticed improvement in discom savings really coming into play rather than just being a theory. For the AIML driven system which facilitates a two-way communication system (in the case of prepaid meters, this even means providing similar services as a mobile firm where connection will be suspended if the recharge reminders are not responded to), the company has joined hands with technology partners.

“The leading players in the segment are not just trying to bring a technological transformation. They are rather bringing about a social-technological transformation which makes the endeavour more challenging,” says Shalu Agarwal, Senior Programme Lead (Power Sector). Council on Energy, Environment and Water (CEEW).

Meanwhile, making its first major breakthrough as an independent entity, IntelliSmart won its maiden order to install more than six lakh pre-paid smart meters in 19 circles of Assam late last year. This was incidentally, the first smart meter tendering in the country under the TOTEX model (capex + opex). While IntelliSmart has been created to give a major push to the smart metering drive, analysts are of the unanimous view that the pace of putting up smart meters leaves a lot to be desired.

“The pace has been pathetically slow. We have almost lost more than five years in creating a robust base for this mechanism which indeed has its merits,” says Vinayak Chatterjee, former Chairman, Feedback Infra. “Considering the financial benefits and technological capabilities that smart meters can provide discoms, it is hard to understand why installations have not been fast-tracked. India’s smart meter coverage is just over one per cent compared to over 50 per cent in Europe and over 75 per cent in the US,” says Raj Prabhu, CEO of Mercom Capital Group (an energy research firm).

Industry observers underline that since 2013, there has been a spate of policy interventions to pave the way for creating a strong base of smart grids and smart meters. The Smart Grid Pilot Project Roadmap, 2013 had envisaged smart meters made available to all consumers by 2027. The following year, Integrated Power Development Scheme (IPDS) was announced which focussed more on the smart metering of urban pockets.

-

The National Smart Grid Mission, 2015, promised supporting deployment of smart meters under projects outside IPDS’s scope. The National Tariff Policy, announced in 2016, had two major cornerstones: install smart meters for all consumers with more than 500 kWh monthly consumption by December 2017 and installation of smart meters for consumers with monthly consumption between 200 and 500 kWh by December 2019. The Smart Meter National Programme, 2018 underlined replacing all conventional meters with smart meters (no target date defined). Budget 2020 further talked about replacing all conventional meters with pre-paid smart meters by March 2023.

These interventions, however, did not help in delivering the numbers the government had envisaged. As per a submission by the union minister of power and new & renewable energy, RK Singh in the Lok Sabha early this year, about 37.33 lakh smart electricity meters have been installed across the country so far under various schemes of the Government of India and discoms.

Meanwhile, in order to give a fresh impetus to the programme, the union government launched the Revamped Distribution Sector Scheme (RDSS) in July last year which targets the deployment of 25 crore smart prepaid meters for all domestic consumers by March 2025. The Centre is providing funding to the states for the implementation of smart metering under the National Smart Grid Mission (NSGM) and Integrated Power Development Scheme (IPDS).

Unfolding scene

India’s report card in initiating effective power sector reforms vis-à-vis smart grids and smart meters certainly lacks brownie points as of today. “If you want to create a robust network, you need smart grids which can facilitate two-way communication and consistent monitoring of consumption patterns. But not much headway has been made in the area of smart grids,” says Vinay Rustagi, CEO, Bridge to India, a Gurgaon headquartered power sector thinktank.

Quite interestingly, in the last four-five years, while India has been struggling to lay a base for the adoption of smart meters, countries like China (with 350 million smart meters) have seen the ushering in of the third generation of smart meter devices while the UK has upgraded to the second generation.

There has been a spate of recent studies confirming that smart metering is likely to become effective in India too. A report by Bridge to India released in 2020 had underlined an average revenue increase of 19.5 per cent (Rs294) per meter per month due to a reduction in power theft, meter reading costs and billing errors in Uttar Pradesh. Haryana and NDMC (a Delhi discom) realised an increase in revenues of 5.3 per cent (Rs112 per meter per month) and 16.1 per cent respectively.

Similarly, Bihar reported an increase of 169 per cent (Rs370) in monthly revenue per connection after the installation of prepaid smart meters in the state. A more recent study undertaken by IntelliSmart also shows similar trends. States such as Uttar Pradesh, which has installed 11.5 lakh smart meters so far and has been leading the pack of states in the forefront of smart meter adoption, saw billing performance improving to 99.5 per cent.

-

Adoption of smart meter improves billing performance

One reason smart metering did not gain momentum in the past has been that only a clutch of discoms in a handful of states have responded to this programme. EESL, which commands 65 per cent share of smart meter installations along with IntelliSmart, had earlier signed MoUs for smart meters with the states of Andhra Pradesh, Uttar Pradesh, Haryana, Bihar, NDMC-Delhi, Rajasthan, Telangana and for prepaid meters with the states of Uttar Pradesh and Tripura. Analysts, however, believe that the scene is poised for change considering the imperatives attached to the mission.

“It is time for discoms to come out of the dark ages and go digital to cut losses and add new revenue streams. Smart meter installations need to become an urgent priority in the country,” says Prabhu of Mercom Capital. Vinayak Chatterjee believes large scale qualitative changes may also unfold in the not-too-distant future. “The next five years would be critical as it is a proven fact that smart metering is critical to bring down discoms’ losses. There would be better use of technology to ensure two-way communication, more services generating from the smart meter would be attached and there could even be introduction of variable pricing structures like time-of-day pricing,” says he.

As per the definition, the Time-of-Day Pricing Plan which has come into effect in many developed markets rewards the end user with a discount for helping to spread the demand for electricity more evenly over each 24-hour period cycle. Although you’ll earn a discount for using electricity during off-peak hours, you will pay a premium rate for the electricity you use during on-peak hours. The CEEW is currently conducting a survey (to be released shortly) in a clutch of states examining the broader trends in smart meter adoption by consumers.

“Consumers have begun appreciating its benefits, like improvement in supply quality. In some pockets in Rajasthan and Madhya Pradesh, the billing cycle has been successfully brought down to 15 days. A positive feeling is evolving around it,” says Shalu. In the past, there have been numerous complaints from consumers of smart meters overcharging them.

Vendors galore

With these positive indicators, the IntelliSmart chief is convinced of a tremendous surge in the tendering process in the near run which would give the firm an opportunity to expand its wings quickly. He points at the growing volume of vendors in the fray as more projects go live in the market. “There were six vendors in Assam. Going ahead, there will be 8-10 players,” says he. And the serious financial push provided by the Centre is expected to help as the new programme does not put any pressure on discoms.

The Revamped Distribution RDSS scheme has an outlay of Rs3,03,758 crore over five years which includes an estimated Government Budgetary Support (GBS) of Rs97,631 crore. “The Ministry has come out with this RDSS scheme which actually intends to contribute from the grant of the Centre. For smart prepaid meters, there will be a grant of Rs900. Plus, there would be an incentive of Rs450/meter if it is commissioned in time. The remaining expenses will be borne by the developers with utilities paying nothing upfront. The change in business model to TOTEX has given wings to the programme. It has become largely a TOTEX play,” he says.

-

Consumers have begun appreciating the benefits of smart meters

Considering the present equation, the company is looking at the next two years as a period of rapid-fire expansion. “We are geared up to contribute as much as possible. We have commissioned 2.5 million. Along with EESL, we have a combined pipeline of 8.6 million units. We are targeting 20 million in the next two years,” Rawal explains.

Meanwhile, smart meters as devices are meant to provide a series of services, as efficient global examples show. The same meter and digital ecosystem can help in water metering, gas metering, EV station metering, etc. IntelliSmart does have plans to eventually move in this direction and it successfully conducted a pilot in Haryana recently.

However, Rawal cites the serious renewable integration issue (rapid inflow fluctuation from the source) as a major hurdle for all stakeholders involved in transforming the power sector by using advanced technology.

However, from the sole perspective of IntelliSmart, what is unlikely to be a challenge in the near run is raising finances to fund its meter installations expansion drive. In recent months, there has been speculation in the marketplace as to whether IntelliSmart would generate funds via the debt route. A report had suggested the company is close to raising Rs10,000 crore of loans.

Ask Rawal to respond to this and he will tell you with a straight face that this concern does not worry him. “Our promoters have promised us reasonable funding with reasonable returns. In every infrastructure company, some kind of capital infusion by promoters is required to draw lenders from outside. I don’t think financing would be an issue. We have good backing,” he says. Confidence, after all, is counted as one of the key advantages that an impressive pedigree can bestow on one.