-

Sameer and Sundeep Gupta: right business strategy defined its success; Photo: Sajal Bose

The existing unit produces 70 MW highly efficient solar PV modules, with imported robotic production lines. It is capable of producing both mono- and poly-crystalline modules in the 10 WP-325 WP range. It has an annual capacity to make 8,000 tonnes of module-mounting structures for ground and rooftops.

Similarly, Jakson has decided to go ahead with one GW solar cell manufacturing plant at a cost of Rs450 crore as part of backward integration. The entire production of this greenfield project will be used for its module manufacturing. “The solar cell plant will give us 5-6 per cent of additional cost advantage in module manufacturing,” says Sameer. The management will select the location soon in either Gujarat, UP or Rajasthan. “We have a strong balance sheet. The capex is met through internal accruals and bank loans. When all the plants are up and running, it will add about R2,000 crore to our topline. The breakeven point will be reached in less than two years by each plant,” says group chief financial officer, Nandalal Gundecha.

“The government’s projection for solar power is 100 GW by 2022,” argues Sundeep, justifying its investment in solar modules and cells. “There are 35 GW already in the pipeline. In addition, the cabinet approved performance-based incentive (PLI) to solar manufacturers will boost the segment. So, our timing is perfect and we will take advantage of the benefits and grow in the segment.”

Jakson has created channel partners in every state who take small orders from the market, source them from Jakson and supply them to customers – be they rooftops, modules, module mounting structures or complete solar kits. Punjab-based channel partner Dasmesh Solar Energy has been associated with Jakson since 2018. “Jakson is a known quality brand,” acknowledges Rahul Sachar, owner, Dasmesh Solar.

PLI scheme

The solar industry has been passive for the past few years, as the government had not clarified its long-term policy on the subject. Manufacturers deferred their expansion plans. Now, things are set to change. The recent China issue has also helped domestic solar product manufacturers.

A focussed PLI scheme for solar PV modules will incentivise domestic and global players to build large-scale solar PV capacity in India and help India leapfrog in capturing the global value chains for solar PV manufacturing’, said the cabinet decision on the scheme. The cabinet approved Rs4,500 crore for ‘high-efficiency solar PV modules’ to the nodal Ministry for New and Renewable Energy (MNRE).

-

Besides, MNRE has also proposed 40 per cent basic customs duty (BCD) on solar cell and 25-40 per cent on modules on imports. At the same time the Directorate General of Trade Remedies (DGTR), in a recent order, extended the safeguard duty of 15 per cent on solar imports from China for one more year. The industry is hopeful that the finance ministry will announce a basic custom duty in the budget. The guesstimated solar market is R30,000 crore. “Our aim is to have 5 per cent of the total market,” says Sameer.

Jakson had a remarkable beginning that is worth recounting. Jaikishan Gupta had worked with Multan Electric Supply Co at Lahore. However, he was forced to abandon his home and an electrical-goods shop in Lahore when he left that city with his wife and children and fled to India five days before Independence in 1947. After struggling among the millions of refugees from Pakistan, he restarted his electrical shop in Delhi selling electric motors, pump-sets and the associated switchgear. By the late 1960s, he and young son Satish Kumar Gupta (who, at 85, is now chairman emeritus of Jakson group), had grown the business into a large distributorship for leading multinational brands like L&T, Siemens and the then Kirloskar-Cummins.

The Guptas’ big change began when they set up a small generator set manufacturing unit in Delhi in 1982, anticipating power shortages. They started assembling gensets and sold 60 sets in the very first year. The initiative did not go unnoticed. Cummins picked up Jakson as one of its OEMs. Jakson then slowly moved up the assembly chain and worked towards backward integration like control panels, switchgear and other value-added items for genset manufacturing. Later, his elder son Sameer, an electronics engineer (now chairman & managing director) and younger son Sundeep, a computer engineer (vice-chairman and managing director) took the business to new heights. The group today employs 2,200 people.

The relationship with Cummins strengthened over the decades. Jakson is now one of the three OEMs of Cummins India for gensets – the others being Sudhir Genset of Delhi and Powerica of Mumbai. Jakson, the market leader, controls 42 per cent in its operating regions. “Cummins India and Jakson have been true business partners and have powered the nation for over three decades,” acknowledges Ashwath Ram, managing director, Cummins India. “As industries and consumer needs have evolved over time, the partnership too has transformed to deliver market-leading, emission-compliant products.”

Jakson gensets have been the silent partners of many a large establishment for decades now. It serves a wide range of industries, which includes infrastructure & realty, IT & ITeS, healthcare, hospitality, automobile manufacturing and aqua. The company was the first to introduce acoustic enclosures for diesel gensets in India, which is now mandatory under the noise pollution law.

-

Demand will stay in high voltage capacity genset

“The growth of the genset business has invariably been flat. Last year, it took a further hit due to Covid-19. The market is now worth merely Rs4,500 crore. The investments on improvement of the power grid, stringent pollution norms and the focus on renewables have hit the genset industry. But, with high voltage capacity, gensets will continue to be in good demand,” clarifies Gagan Chanana, COO, Distributed Energy. Jakson has two genset manufacturing facilities in Gujarat and Jammu and the range varies from 7.5 kVa to 3,750 kVa.

Distributed Energy business comprises genset manufacturing & maintenance, including spares. It also covers execution of solar rooftop plants, energy storage, hybrids energy solutions and specialised energy solution for defence. It has a wide network of channel partners. “We have leveraged our 60,000-strong genset customers’ base. Many of them are willing to look at alternate energy or complete energy solution. In the last six months, we have received Rs30 crore worth of rooftop orders from UP alone,” says Chanana. The division has achieved revenues of R1,126 crore, of which gensets continue to have a lion’s share.

The group’s five core values are customer-centricity, innovation, teamwork, care and integrity. “To create a sustainable organisation, we look at ourselves through the customer’s lens,” says Sameer. “This helps us to know what our flaws are and work towards improvement. Also, innovation is a continuous process for us in order to stay in the forefront in technology.”

Turnkey services

EPC is the major growth driver of the company. Jakson provides turnkey services for land-based solar power plants, rural and urban electrification, electrical sub-stations and transmission and railway electrification, with highly skilled engineering professionals. It has executed over one GW of solar EPC projects so far in India and overseas. And, its electric EPC business has executed numerous projects under various schemes.

Lately, Jackson also won two EPC contracts for Kolkata and Bengaluru Metrorail projects, valued at Rs260 crore. The Kolkata metro order is for engineering, supply, erection, testing and commissioning of electrical and mechanical works of 11 stations, to be executed in 30 months. The Bengaluru metro EPC is for electrical and mechanical works and products, comprising LT panels, LT cable distribution, lighting hydraulics, fire safety system, UPS, DG dets, HVAC and BMS for 32 elevated stations.

The solar and electrical EPC business, at Rs843 crore, is also expanding geographically in Africa, the Middle East, Nepal and Bangladesh. At the current ongoing project at Togo in Africa, Jakson was appointed by AMEA Power as EPC to construct a 50 MW monocrystalline-based solar power plant at Blitta. Once completed, this will be the first utility scale solar powerplant in Togo and one of the biggest in West Africa. And, Jakson will operate and maintain it for two years. “We will participate in many such projects; the opportunity in Africa is unlimited,” says Sundeep.

-

To create a sustainable organisation, we look at ourselves through the customer’s lens

The proactive management strategy of Jakson to increase its integrated energy portfolio has given the group an edge. The company has executed landmark projects in India and overseas – such as India’s first solar power railway coach; repowering of armoured recovery and repair vehicles for defence; the first solar-powered highway project on the Delhi-Meerut expressway; the solar plant in Africa and the diesel power project for the Eden Garden stadium in Kolkata.

The solar IPP (independent power purchase) business division sells power to state utilities and private organisations under long-term power purchase agreements (PPA). The company had commissioned its first project of 20 MW in Rajasthan for NTPC. The portfolio of IPP has now expanded to 200 MW. Recently, the company set up two IPP projects of 120 MW in Assam and UP, valued at Rs590 crore.

The 70 MW in Assam at Amguri Solar Park is the first solar project in the state. Jakson has entered into a PPA with the state and is expected to commission the Rs350 crore project by July 2021. The 50 MW Rs240 crore solar IPP for the Uttar Pradesh Power Corporation in Agra is to go on stream by March 2021, with a 25-year PPA. Sameer says the company’s aim is to add 100 MW of solar IPP every year.

Jakson made its foray into the solar business only a few years ago. And, in a short span of time, the company has reaffirmed its age-old reputation of being a customer-centric company, with a focus on quality. “Its commitment is commendable,” says Ashish Khanna president, renewables, Tata Power.

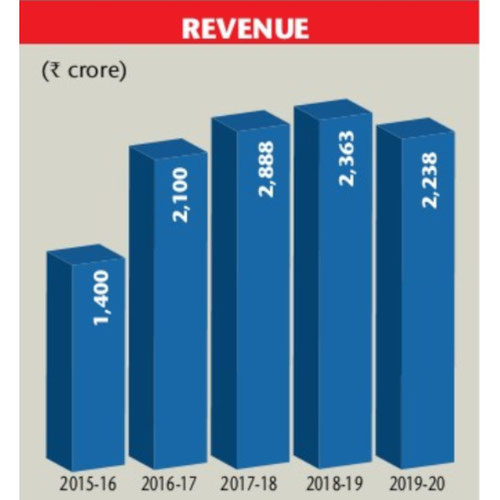

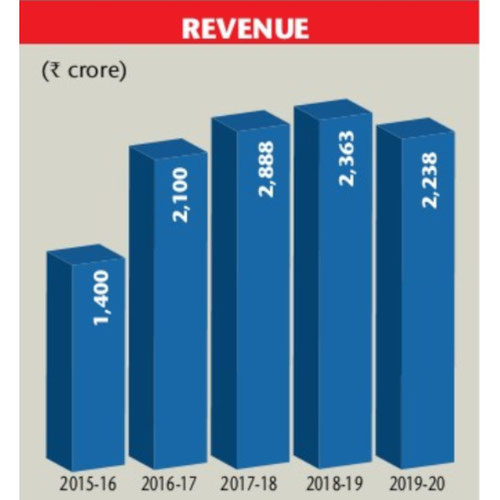

The Jakson group achieved a turnover of Rs2,238 crore in 2019-20, as against Rs2,363 crore in 2018-19. For the nine months ended December 2020, the group reported revenues of Rs1,613 crore, as against Rs1,603 crore during the previous corresponding period.

Built on a solid foundation, Jakson is now cautiously looking at the option of going public. “If all goes as planned, we may hit the market in mid-2022,” says Sameer.