-

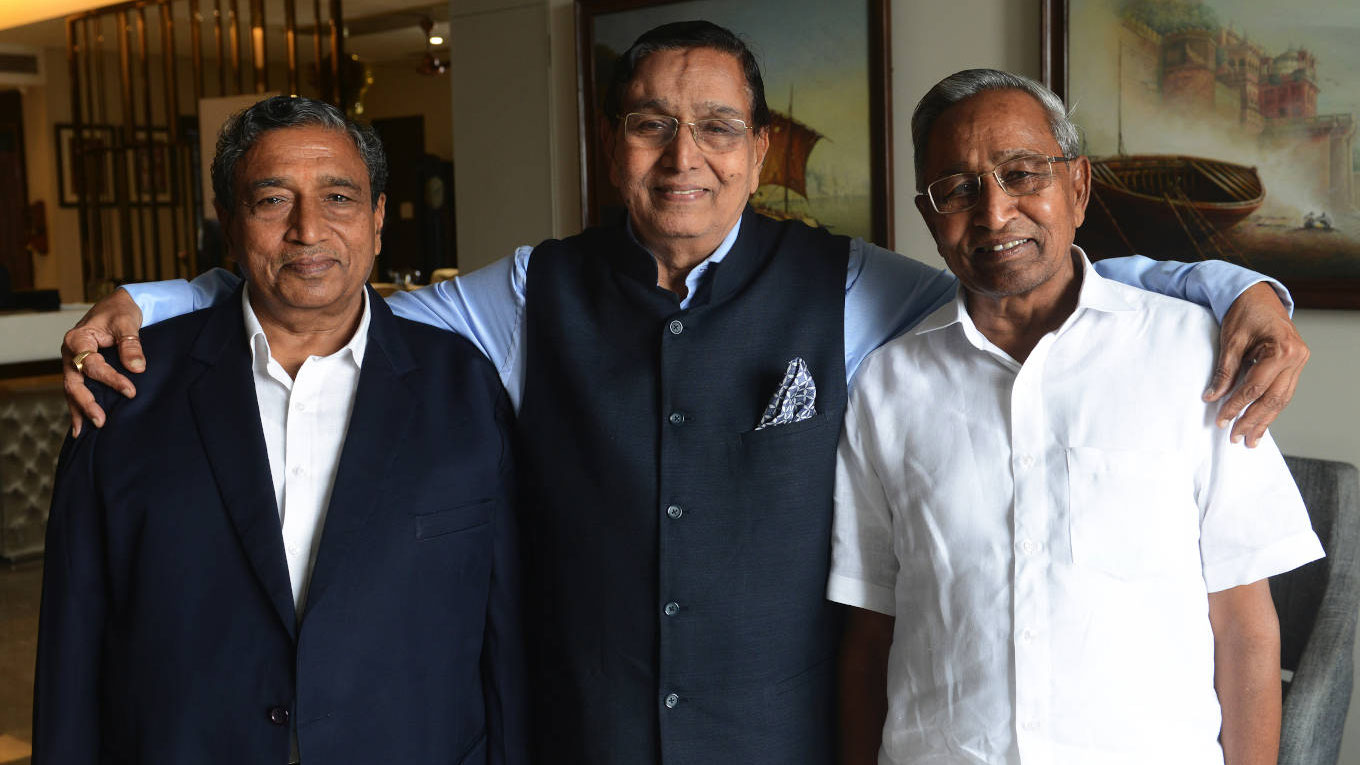

Vikash: emphasis on premium segment; Photo: Sajal Bose

Significant player

There are about a dozen categories of cotton hosiery goods in India – the vest, hosiery briefs, bras, panties, warm thermals, socks and a growing segment of knitted, lounge wear, tees and crew shirts. Over 65 per cent of sales in the sector come from vests, briefs and trunks.

“We are among the significant players in the mid and mass segment, which constitute 65 per cent of our revenue,” says Vikash. “At present, over 50 per cent of the company’s sales comes from non-urban and rural market”.

P.R. Agarwala set up Rupa in 1968, when he was 28, after learning the trade tricks from his father’s hosiery goods shop in Burrabazar area. The name of his brand Rupa is derived from rupo (silver) in Bengali. Agarwala’s business acumen and product innovation helped Rupa to make impact in the market.

In the 1970s, the company launched elastic strap underwear for men – a first in the mass market. PR was later joined by his younger brothers G.P. and K.B. Agarwala. PR then took over the business of Binod Hosiery and converted into public limited company.

Calcutta used to be the centre for the hosiery business, producing almost 95 per cent of the nation’s output. However, the hosiery business in the city declined dramatically in the 1970s, due to the infamous labour militancy, which forced the industry to develop a new manufacturing base in Tirupur, Tamil Nadu. The weather in Tirupur had the right humidity; the water allowed good dye quality; textile machinery was easily available; and a favourable work culture prevailed there. Even today, the biggest players in Tirupur have their origins in Kolkata.

And, despite all odds, Rupa continues to run its units in Calcutta though, like other players, it has also set up production facilities in Tirupur. The three brothers have knitted the business well and turned Rupa into a leading innerwear manufacturer in the country. Now, the second and third generations of the family have entered the business and are successfully nurturing the growth of the company.

Today, Rupa has diversified its product portfolio in the segment to include men, women and kids’ wear in its range. It has over 7,000 SKUs and 18 sub-brands catering to diverse socio-economic classes. Frontline, Macroman, Euro, Macrowoman, Softline, Femmora, Bumchums and Torrido are some of the prominent brands of the company. But Frontline is Rupa’s highest selling brand, with a 30 per cent sale record.

“Rupa is one of the oldest players in the segment,” says Vinod Gupta, managing director, Dollar Industries. “Its products are good and have wide acceptance in the market. We are in close completion with them”.

Innerwear industry suffered last year due to the lockdown. Rupa’s sales too declined from Rs1,150 crore in 2018-19 to Rs975 crore in 2019-20. The net profit too fell from Rs74 crore to Rs62 crore during the same period. But, for the nine month period ended September 2020, the overall performance and profitability of the industry have improved. Rupa’s revenue has risen from Rs795 crore in September 2019 to Rs860 crore in September 2020, with the PAT for the period too growing significantly from Rs66 crore in September 2019 to Rs109 crore in September 2020 – a growth of 65 per cent.

“Our performance is an indication of the company successfully building a resilient business capable of performing even in the most adverse conditions,” says Dinesh Lodha, CEO, Rupa. The management expects the revenue to increase at a CAGR a 30 per cent in the next three years. The company has also seen good traction in winter wear sales, with strong pent-up demand surfacing in Tier II and Tier III cities.

-

Lodha: strengthening the markets; Photo: Sajal Bose

Rupa’s promoters hold 73.3 per cent of the company’s stock, while DIIs have 1.5 per cent. The remaining 25.2 per cent is with the public. The promoters are open for more dilution, if needed. Rupa’s shares are trading at Rs295 today, contributing to a market cap of Rs2,380 crore.

The volume of business in the mass segment is mind-boggling, with premium and super premium segments covering 15 per cent of it, driven by the value and higher margin. “About 15 per cent of our products are in the premium and super premium ranges,” explains Vikash. “It is catering to the brand-sensitive Indian youth, aspiring towards super premium product categories. Our target is to increase the share to 20 per cent in the next 2-3 years time”. Rupa had acquired licence from FCUK of the UK and Fruit of the Loom from the US to produce and market these brands in India.

The company now has four manufacturing bases – in Domjur near Kolkata, Tirupur, Bengaluru and Ghaziabad – and produces 1 million pieces per day innerwear and outerwear for men, women and children. The unit in Ghaziabad and Bengaluru are for lingeries. Domjur is the main manufacturing base for Rupa and produces 50 per cent of the company’s total output. It has large integrated operations, which consist of knitting, dyeing and cutting. The unit does fabric bleaching and dyeing of as much as 25 tonnes of yarn. T

he Domjur facility can knit for specifications of 13-42 inches diameter. The four Italian high-speed, computer-numerical cutters have the capacity to cut 320,000 pieces per day, which is highest in the industry, claims Rajendra Kumar Singh, GM, production. But what Domjur facility needs most is suitable house-keeping.

Rupa is setting up a sewing line in Domjur, with the capacity of 400,000 pieces per month, at a cost of Rs50 crore – to be commissioned by next year. The company-controlled sewing line is largely for export production.

Rupa’s army of experienced and skilled workers produce high-precision, zero-waste designs, which are shipped out to thousands of units with sewing machines in Kolaghat. The stitching cluster at Kolaghat has over 1,000 sewing vendors dedicatedly working for Rupa. “We organise training for them in association with the local government and also help them to get bank loan to buy sewing machine,” Singh says. Domjur produces the flagship brands like Frontline vests, Jon and Macroman, while the Tirupur facility produces the company’s Euro and Bumchums brands.

Fine products, trendy designs

The company employs over 500 people directly, with 30,000 more involved indirectly, through contract manufacturing. “Our products are made from fine fabrics with trendy designs and are price friendly,” says K.B. Agarwala. The finished goods are inspected, packed and sent out through its network of over 1,200 dealers and 125,000 retailers and 11 exclusive stores across the country. “We also sell through big retail chains and large e-commerce platforms like Amazon, Flipkart and Paytm, as well as our own website,” adds Agarwala.

-

Domjur: the main facility; Photo: Sajal Bose

Moksh, an exclusive distributor for Rupa in Bengaluru, has been associated with the company for the last seven years. “Rupa has a strong brand recall in the segment,” says Shantinath Gandhi, who owns the dealership. “Its large product basket, across all price ranges, meets the customer’s requirements.

Rupa, which was in the leadership position in the mass segment, has lost its position to Lux. P.R. Agarwala admits that it is due to lack of right planning but he quickly adds that the company is working to regain it. Rupa has charted few growth strategies – expand new markets, focus on high-margin business, increase outerwear products, drive on the exports revenue, grow thermal wear business and build strong distribution and expansion of exclusive showrooms.

‘The company’s 17-18 EBOs will go up to 100 in the next two years,” says Lodha. “This will help us to grow premium products”. Women’s innerwear segment is ruling 64 per cent of the total market, where Rupa is set to increase its share. Export is another area the company has a strong focus on. Currently, exports to the Middle East, Africa and Russia bring in only 2 per cent of its turnover. The company has now taken a challenge to double it in the next two years’ time.

“Rupa has strong bouquet of brands,” says Nikhil Saboo, senior analyst, SKP Research. “With its product portfolio and extensive distribution reach, it is well-positioned to benefit from changing customer preferences towards quality-branded products, particularly amongst the growing and affluent mass. But the company should focus on improving its working capital. It is a bit stretched at the moment”.

The Agarwala brothers have grown the company with almost native intelligence. The new generation believes that their network and brands must be extended into larger basket of allied goods. They realise that, with increasing competition, they need to seriously study their brand strategies; and are therefore shopping around for marketing consultants. However, the challenge now for the extended new generation in the business is to keep the family business united.