-

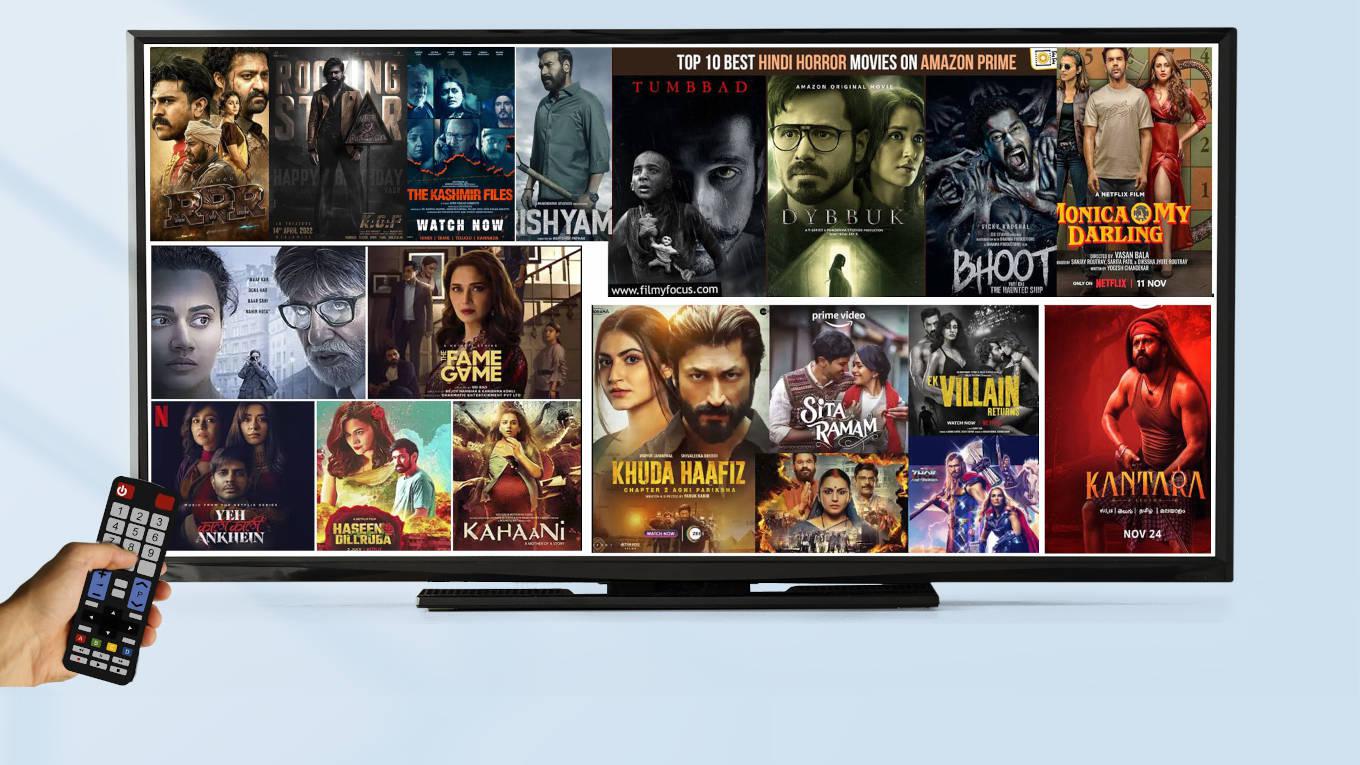

Over the last 3 years, regional language OTT has recorded around 124 per cent growth in India

Pritish Nandy, Founder, Promoter and non-executive Chairman, Pritish Nandy Communications

In fact, Indian entertainment industry producers anticipate a quantum leap in the consumption of OTT entertainment content in India in the years to come as leading telecom operators compete with each other in rolling out 5G services across the country. It is estimated that India will have 1 billion smartphone users by 2026. It is estimated there will a minimum of 150 million 5G customers within the next 2 years and 100 per cent coverage for 5G services by the end of December 2024.

“The 5G telecom network infrastructure in India will undoubtedly rejuvenate OTT entertainment consumption which has witnessed phenomenal growth over the last few years in our country,” says Asit Modi, founder of Neela Telefilms and producer & creator of ‘Taarak Mehta Ka Ooltah Chashmah (TMKOC)’ – an extremely popular and top-rated television show.

Modi says his TV show, TMKOC, is regularly watched by millions of viewers worldwide on OTT platforms too. “Any Indian TV show that can garner huge viewership in the OTT space as well will continue to top the charts in the years to come as personalised viewing of entertainment content is gaining prominence by the day in our country,” he says.

Modi added that as OTT viewing allows for immense flexibility and does not require all family members in a household to consume entertainment content together, the relatable content of popular TV shows like TMKOC has resonated with viewers of all ages.

It is believed that the regional language entertainment industry will also thrive in India in the OTT space due to the presence of robust telecom infrastructure across urban and rural parts of the country and the easy availability of bandwidth at economical prices. “Over the last 3 years, regional language OTT has recorded around 124 per cent growth in India,” says Pritish Nandy, Founder, Promoter and non-executive Chairman of Pritish Nandy Communications. The company’s blockbuster show, ‘Four More Shots Please’ has won many international awards including recognition at The Busan International Film Festival in South Korea.

Nandy said the popularity of OTT entertainment content in India is solely dependent on the quality of scripts as Indian OTT viewers are extremely mature. “Although many well-known Indian actors have started working in OTT shows, the Indian OTT entertainment space is, fortunately, totally script-driven,” he said.

According to him, good quality entertainment OTT content will continue to mesmerise the Indian viewer for years to come. Less than 2 per cent of OTT entertainment content in India has any nudity or inappropriate language. “Which is why, I am of the view that the entertainment content in the Indian OTT space should not be subjected to censorship guidelines. If required the Government could assign classifications to OTT shows, films, documentaries, etc,” suggested Nandy.

-

This is a great time for creators and storytellers. Due to the advent of OTT in India, all kinds of stories can find a home. Characters do not need to necessarily follow a certain moral code

Arjya Patnaik, Producer and co-promoter, Full Focus Entertainment

Rural India drives the growth

Regional OTT players in India are growing rapidly, because of the deep understanding of their region’s tradition, culture, geographies, nuances & consumption patterns. With the metros and mini metros reaching a saturation point the real growth in OTT has been driven by rural India. Marathi is only one among the other prominent languages like Bengali, Malayalam, Gujarati, Odia, Punjabi, Kannada (among others) that are witnessing phenomenal growth.

As per the latest Ormax OTT Audience Report, just 30 per cent of India has access to OTT platforms. Indian OTT audience universe comprises 42.38 crore people. Out of which the top 6 metros combined contribute to only 10 per cent of the overall OTT audience base in India.

According to the 2022 FICCI-EY report, the share of regional languages in overall OTT video content in India will double from 27 per cent in 2020 to 54 per cent in 2024. In 2021 alone, 47 per cent of OTT originals and 69 per cent of films released on platforms were not in Hindi and English.

Regional OTTs do not need a large content budget to make an impact – they just need to strategically convey realistic and original tales with quality production from the heartland to be profitable. India has 121 languages and 19,500 dialects and Hindi is just one of them.

“Our country is a diverse kaleidoscope. We have multi-regional, multicultural icons, stories, languages & narratives which are yet to be fully explored. There has been a huge growth of regional OTT players in India. They have been providing them with engaging content in their preferred local languages, hence forging a deeper emotional connection with those audiences”, says the FICCI-EY report.

According to the EY Report, there is space for 25 regional OTTs. Around 50-60 per cent of new shows produced today are regional. This number was not more than 20 per cent 3 years ago. Regional OTT platforms have not only increased their spends on upgrading content, technology and user interface, but have also added new genres and concepts to tell viewers local stories in their native languages.

Prominent stars and talent across languages have partnered for big ticket projects on regional OTTs. It has also boosted the dubbing, subtitling and formatting sector, and this content is not only watched by the target natives but even by people who speak other languages.

-

OTT shows are mostly watched alone by the consumer in our country, and hence a lot of niche content and stories related to taboo subjects can easily be addressed in the OTT space

Priya Mishra, TV Producer

So, to increase their reach to deeper native locations, Regional OTTs are partnering with local cable and broadband distributors to make their content more accessible. For eg OHO Gujarati has been breaking the clutter by offering bite-sized content, which can be watched over a cup of tea like 5 to 6 episodes of 18-30 minutes or even smaller, at 10-12 minutes.

India is one of the top 5 markets globally in terms of time spent on online video consumption. It has been the largest earning segment with a contribution of 29 per cent to Digital AdEX (Advertising Execution) in 2021. Not to be left behind, major players like Amazon Prime Video have tied up with Hoichoi and ManoramaMAX to show their content on its platform. Smartphones and Internet are reaching deeper into India to cover rural and smaller areas where vernacular content is preferred.

Original attraction

The regional OTT game is all about creating originals. There will be a demand of at least 500 originals per year with each original being uploaded within 7 to 10 days, as new sets of viewers will be coming on the platform every week. They need to create a strong differentiation factor in terms of content slate, scale and distribution. Players will also have to tactically use SVOD, AVOD & Pay Per View Models for different markets.

The swift development of internet infrastructure in India has heavily influenced the increasing prevalence of OTT platforms. This has enabled them to deliver content directly to the viewers, circumventing the need for traditional distribution channels and media outlets. People are increasingly turning to OTT platforms for fresh and high-quality content, as they become increasingly tired of the routine Indian TV serials. Additionally, OTT has provided a platform for creators and artists to reclaim their status in the entertainment industry, which may have otherwise been overshadowed by a shift in the cinema or other forms of entertainment.

Producer-director and promoter of a highly successful regional language OTT platform, ‘Oho Gujarati’, Abhishek Jain too echoed similar sentiments and said the regional language OTT entertainment content’s consumption in rural India would get a major boost due to the imminent rollout of 5G. However, Jain added that going forward, the core challenge will be appealing content creation in various languages for OTT players. “Finding the right mix of content, making it price-sensitive and offering convenient technology is going to be extremely challenging for OTT players. And, the biggest challenge lies in making the audience pay for OTT subscriptions or getting the revenues for OTT ventures through advertisements.”

-

OTT content writers, directors and producers enjoy working in a space where freedom to experiment with a variety of story ideas is welcomed and appreciated

Himanshoo Pathak, Producer-director, Elixir Production

Entertainment industry stalwarts believe that TV has a loyal audience in India and that its biggest advantage is its enormous reach. “This is a great time for creators and storytellers. Due to the advent of OTT in India, all kinds of stories can find a home. Characters do not need to necessarily follow a certain moral code,” said well-known producer and co-promoter of Full Focus Entertainment, Arjya Patnaik.

She said the major challenges TV producers face today include the lack of clarity of vision on TV shows in comparison to films and OTT shows. Also, the daily ratings of TV shows make for impatient stakeholders and time is not devoted to creating believable characters or storylines. The Indian TV audience is fragmented due to the existence of multiple channels and players.

Many Indian TV producers are looking at OTT as a viable option to showcase novel storylines and also depict plots which are relatable to rural audiences. “Moreover, the episode-wise budgets of Hindi TV shows have reduced by around 30 per cent over the past few years. Hence, many television producers have got no option but to operate at lower profit margins in the cutthroat competitive scenario in the post Covid phase,” said award-winning television director Anshuman Kishore Singh.

According to him, the Indian satellite TV industry needs to change its way of thinking, especially regarding the execution aspect of TV shows. “Interestingly, Pakistani TV shows are more ‘grounded’ and far more realistic in comparison to the Indian TV shows airing currently. Satellite television channel companies operating in India should support realistic and knowledgeable execution of TV shows in order to compete with the OTT platforms to sustain competition in India,” said Singh.

-

The 5G telecom network infrastructure in India will undoubtedly rejuvenate OTT entertainment consumption which has witnessed phenomenal growth over the last few years in our country

Asit Modi, Founder, Neela Telefilms

OTT shows also enjoy a clear and distinct advantage over TV shows produced in India as OTT platforms offer more freedom to content creators to express their ideas. Moreover, OTT has also become a highly personalised medium for consumers. “OTT shows are mostly watched alone by the consumer in our country, and hence a lot of niche content and stories related to taboo subjects can easily be addressed in the OTT space. This factor is fuelling the growth of the OTT industry as Indian TV shows are subject to censorship guidelines,” said well-known TV producer Priya Mishra, adding that the audience of daily TV shows is shrinking all the time and that, interestingly, most TV viewers in India have a short attention span.

‘Time Spent Viewing’

Also, with the OTT platform opening its doors to showcase varied and realistic stories, there has been a paradigm shift in its content. Himanshoo Pathak, producer-director, Elixir Production, said: “OTT content writers, directors and producers enjoy working in a space where freedom to experiment with a variety of story ideas is welcomed and appreciated. Young people have largely given up watching TV shows, but they now receive interesting and appealing OTT content.

The popularity of television shows was earlier driven by ‘Television Rating Points’. Nowadays, the ‘Time Spent Viewing’ rating decides the popularity of a show. These are dark days for the entertainment television industry. Many shows get axed by the TV channels within a few weeks of their launch if ‘Time Spent Viewing’ ratings are found to be not up to the mark. In such a scenario, TV producers tend to incur huge losses as they are usually asked by the TV channels to invest more in the quality of a show during the initial phase post its launch,” said Pathak.

-

Marathi OTTs such as Ultra Jhakaas were launched with the latest updated technology & plans of investing Rs250 crore over the next 5 years

Venkat Garapati, Business Head, Ultra Jhakaas, Marathi OTT App

Producer Payal Saxena believes that many talented producers do not get the opportunity to showcase their creativity. “Everything nowadays is so micro-managed by Indian TV channels, that a producer loses a lot of his or her creative freedom in this process. The end result rides entirely on a producer’s shoulders. Budget constraints and strict channel inputs do not allow control of the end product. It is a tough business. Moreover, the Television Ratings Point system is outdated and algorithms do not make sense. General entertainment channels in India need better ways to figure out the popularity of shows and viewership. There are some good producer-friendly Channels like ‘Dangal’, which give their producers an opportunity to make good content,” she said. Saxena added that as a result, OTT is a far better option for Indian producers but cautioned against OTT platforms working only with a few renowned names.

Incidentally, Indian OTT is now perceived as a burgeoning multi-crore industry almost threatening the very existence of cinema halls or multiplexes as entertainment content retailed on the Internet promises multiple as well as economical options for the price savvy Indian consumer.

Lastly, India is a land of great cultural and demographic diversity, presenting multiple chances for OTT players to reach out to a wide variety of viewers. As the OTT space continues to develop, it’ll be intriguing to observe how these platforms adjust to fluctuating consumer behaviour and preferences.

-

Hitting a six: Nearly 25 million downloads of Jio Cinema app are recorded in a single day

Reliance group set to ride the IPL wave

The Jio Cinema app is one of the prime beneficiaries of the current IPL cricket season. Several records were broken by Jio. The number of digital viewers in the first weekend of the game surpassed that of the entire season last year. Nearly 25 million downloads were recorded in a single day. What also helped were the new innovations done by Jio Cinema like 12-language coverage, multi-cam setups and 16 unique feeds.

Earlier, the final match of the Women’s Premier League, saw as many as 10 million new viewers, the highest for a women’s event globally. The average clock time was as high as 50 minutes just behind IPL which saw viewers staying on for 57 minutes.

Consumption of sports in any form contributes to the largest viewership of content across any medium of distribution. Globally, around 20 per cent of OTT revenues come from sports. Many more watch satellite TV but OTT platforms are catching up. Currently there are an estimated 40 OTT platforms in India.

Reliance Industries scores over the others as it has both distribution and broadcasting strengths, besides content. Content can be viewed either on the internet, Wi-Fi, TV or its Jio fibre initiatives. It is, according to one astute Reliance company observer, putting the building blocks in place.

Even as the fine-tuning of Zee-Sony merger is being done, one of Reliance company’s biggest competitors (Amazon and Netflix do not have their own channels) Reliance is consolidating its hold across production, broadcasting and distribution rights. Towards this end it has increased its controlling stake in Viacom 18.

Jio Cinema, a part of Viacom 18 Pvt Ltd is now a subsidiary of Reliance Industries-owned TV 18 Broadcast, which is a part of Network 18 Group. Clearly Viacom is all set to scale up it digital and sports verticals as also other segments of the media and entertainment segment. It is already a big disrupter in the segment and aggressively pursues new customers.

Viacom recently announced the completion of its transaction involving a strategic partnership with Reliance Industries, Paramount Group, and Bodhi Tree Systems, an initiative of James Murdoch and Uday Shankar, credited with building Star TV (now branded as Disney Star). Qatar Investment Authority, the sovereign fund of Qatar is also an investor in Bodhi Tree Systems.

Viacom 18 will get an infusion of Rs15,145 crore. Earlier in 2022 it was envisaged that the bulk of the $2 billion funds would be contributed by Bodhi Tree Systems. However as per the arrangement now worked out R10,839 crore will be contributed by RIL group entities and Rs4,306 crore by Bodhi Tree Systems. Jio Cinema will also be integrated with Viacom 18.

The funds will be used to scale up Viacom’s offerings across various segments – news, entertainment, and digital. Currently, its OTT app offer both subscription-based videos on demand (SVOD) as also advertising-based videos on demand (AVOD). One of its popular programmes, Big Boss, delivered 25 billion minutes of watch time – nearly 47 per cent above the last season. T

he current equity structure of Viacom will comprise of TV 18 holding a little under 51 per cent, Paramount group 48.99 per cent and Bodhi Tree 0.011 per cent. This will change once the compulsory convertible preference shares are converted. On a fully diluted basis, Reliance group will become the largest owner with the TV 18 group holding 13.54 per cent equity and Reliance Industries group companies holding 60.37 per cent. Bodhi Group and Paramount Global will hold 13.08 and 13.01 per cent respectively.

Uday Shankar is on the board of Viacom 18, and James Murdoch will provide strategic guidance. Getting good talent on-board will help Reliance to beef up its production content. Reliance has already been on a buying spree over the last few years and going forward it will continue to acquire smaller production houses.

-

Growing digital influence is increasingly driving people’s viewing preferences

Seeing the big picture

Media & Entertainment (M&E) players around the world have embraced digital-forward practices to become future-ready. They recognise the power of digital to influence every stage of the consumer’s media consumption journey, from discovery to interest to engagement. Yet Indian players have been hesitant to embrace digital. BCG and Meta have come together to present a view on how digital can drive growth for M&E organisations in India.

BCG and Meta connected with 30+ industry leaders from LTV, OTT and Movie Studios to get the complete industry perspective. BCG and Meta complemented this with a quantitative survey of ~2,600 consumers and in-depth discussions with 50+ viewers, for a holistic customer perspective. Here is a summary of the report:

With the meteoric growth in online content and on-demand streaming platforms in India, the media and entertainment landscape in the country has transformed dramatically over the last few years. The report unravels key consumer trends around how India is consuming content while busting prevailing myths and highlighting the growing digital influence that is increasingly driving people’s viewing preferences. Digital influence implies the role of digital in content discovery, sharing, and engagement both before and after viewing content.

‘Seeing the BIG Picture - Harnessing digital to drive M&E growth’ a Meta-commissioned report by BCG was done with over 2,600 consumers across 15 towns and cities. The study also includes in-depth interviews with consumers and industry leaders from Linear TV (LTV), OTT platforms, and Movie Studios. Among the most significant findings of the report is that contrary to industry perception women, and small-town residents, and people over 35 years of age have significant digital influence driving their content consumption discovery and choices.

Similarly, before watching something on OTT, more people from smaller towns (81 per cent) use digital for content discovery than people from large towns (74 per cent). Moreover, contrary to popular belief, digital discovery is on the upswing, even for linear TV, with linear TV viewers increasingly seeking information and engagement online for the content they watch.

(From a report released recently by Boston Consulting Group)